BlogMonday, May 24 2021

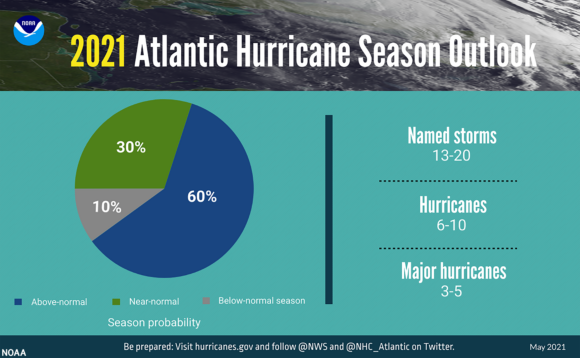

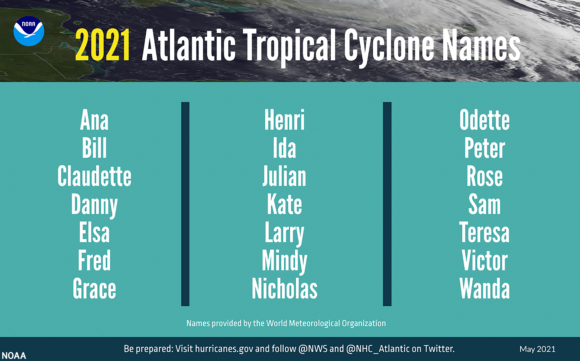

Just days after weather forecasters predicted another above-normal Atlantic hurricane season in 2021, Ana launched the season by forming off of Bermuda. Ana reached Tropical Storm status early on Sunday northeast of Bermuda, but then weakened to a Tropical Depression. The National Weather Service said Ana is expected to dissipate by Monday. The National Oceanic and Atmospheric Administration’ (NOAA) Climate Prediction Center is predicting a 60% chance of an above-normal season this year, a 30% chance of a near-normal season, and a 10% chance of a below-normal season. However, NOAA does not anticipate the historic level of storm activity seen in 2020. Ana was the first “named storm” in the Atlantic this year even though the hurricane season does not officially start until June 1. The season runs through November 30. For 2021, a likely range of 13 to 20 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 5 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher) is expected. NOAA provides these ranges with a 70% confidence. Last month, NOAA updated the statistics used to determine when hurricane seasons are above-, near-, or below-average relative to the latest climate record. Based on this update an average hurricane season produces 14 named storms, of which 7 become hurricanes, including 3 major hurricanes. El Nino Southern Oscillation (ENSO) conditions are currently in the neutral phase, with the possibility of the return of La Nina later in the hurricane season. However, these phases support the conditions associated with the ongoing high-activity era, according to Matthew Rosencrans, lead seasonal hurricane forecaster at NOAA’s Climate Prediction Center.

Forecasters at the National Hurricane Center are now using an upgraded probabilistic storm surge model — known as P-Surge — which includes improved tropical cyclone wind structure and storm size information that offers better predictability and accuracy. This upgrade extends the lead time of P-Surge forecast guidance from 48 to 60 hours in situations where there is high confidence.

Thursday, May 13 2021

Make sure your home is insured before hurricane seasonPublished:May 12, 2021 2:50 PM EDT Updated:May 12, 2021 9:18 PM EDT Insuring your home against a hurricane is more expensive than ever. We look into what you can do to make sure you have enough coverage for a worst-case scenario and save some money on your policy. Summertime in Southwest Florida just isn’t the same for Hope Daley and her husband Matthew Dykes. Hurricane Irma changed everything, damaging their Naples home so much it had to be torn down. “Hurricane season definitely raises our level of anxiety,” Daley said. “I grew up here and never worried about them, and it just takes one really bad one to kind of trash your life and turn everything upside down, and then you’re never the same.” And the full payout of their insurance policy didn’t cover the cost to rebuild, so they had to start over. “My advice, from having gone through it, is to absolutely… do not take any shortcuts on insurance, do not do it, it’s not worth it,” Daley said. But homeowners take shortcuts to save money because policy renewals are at an all-time high. “I heard the other day in a meeting that the average hurricane premium is headed towards $5,000,” said insurance agent Kagen Cookesly. “If we don’t make some meaningful change to help the industry, the rates are going to continue to climb.” Cookesly says the rate increases are out-of-control for homeowners. “At the end of the day, a lot of folks that had these increases, there’s not another market for them—they have to pay,” Cookesly said. “And some of them I’m even telling, ‘You’re lucky to get a policy right now.'” While there’s not a magic bullet to significantly cut your insurance price, there are some simple things you can do around your home to help cut those costs and keep you safer during storm season. To qualify for discounts, you have to hire a licensed home inspector. Home inspector Coty Lawrence walked Hope Daley and Matthew Dykes around their house and checked every opening from the garage door to the windows to see if they are impact-rated. Many of their windows are not impact-rated; if they don’t want to replace them, they can get shutters. “If you don’t have hurricane shutters, you can call your insurance agent and say ‘How much is it going to save me to get hurricane shutters installed?'” Cookesly said. “If it’s a 2002 or newer home, you may already be getting the credit because of the year built. But if your home is built in 2001 or older, those discounts are a lot more meaningful than they were five, six years ago.” And if you have an older home, you could get significant savings with a simple fix in your attic: Install a third nail into the hurricane clips on your roof trusses. And if you got your roof replaced recently, let your insurance company know. “So if you have a roof that’s five years [old] or newer, you’re going to have a gamut of options,” Cookesly said. More options make it easier to shop for a better rate and better coverage. “Get every possible coverage you can and get as much as you can, because you don’t need it until you absolutely need it,” Daley said. Monday, May 03 2021

Florida lawmakers passed two bills on the last day of their 2021 legislative session that make major changes to the state’s auto and property insurance markets. The actions follow weeks of back-and-forth debate on the proposals between the House and Senate chambers. Stakeholders say neither of the potential new laws will do enough to accomplish lawmakers’ goals of reducing rates or weeding out fraud in their respective insurance industries. Both bills are now headed to Governor Ron DeSantis, who will have to sign them before they can become law. Senate Bill 76The bill attempts to address some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion in last year. It passed Friday in the Senate by a vote of 35 to 5 and 75 to 41 in the House. The legislation was revised significantly from its original form at the start of the session and includes:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation. Specifically, SB 76:

Removed from the final legislation was the elimination of the state’s attorney fee multiplier and allowing insurers to include policy language that offers actual cash value instead of full replacement cost on roofs. The industry had urged lawmakers to include these provisions to address cost drivers, but it became a sticking point in both chambers. An amendment passed Friday also eliminated offers of judgment for the insured or the insurer. Senator Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve.” “Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his colleagues. Locke Burt, chairman and CEO of Florida-based insurance company Security First, said he was disappointed lawmakers didn’t take up reforms to the effects of two Florida Supreme Court cases – Joyce vs. FedNat (2017), and Sebo vs. American Home Assurance (2016) – that are said to be partly to blame for perpetuating litigation in the state, as noted in a recent report from Florida Insurance Commissioner David Altmaier. But, Burt said, the legislation that passed makes some much needed changes and is a “step in the right direction.” “I would characterize this a single step,” he told Insurance Journal. “But I would also tell consumers that their rates are going to continue to go up.” Senator Jim Boyd, who is also an insurance broker, acknowledged that the bill is far from perfect and that no one, including the insurance industry and the trial bar, are happy with the result. However, he noted, “we have got to do something. We cannot wait until next year to solve what is an incredibly large problem for our constituents.” Representative Bob Rommel, who worked on the House version of the bill, said the legislation would provide oversight on insurance companies, help attract new carriers to the state of Florida and “make sure homeowners will have a competitive market and have the right to choose the right insurance for themselves.” The Florida Office of Insurance Regulation (OIR) said in a statement that it “appreciates the tireless work of the Florida Legislature to pass meaningful property insurance reform. SB 76 protects consumer’s rights and addresses the current challenges in the property insurance market.” If signed by DeSantis, the new law will take effect July 1, 2021. Senate Bill 54Florida’s passage of this bill will repeal the state’s no-fault personal injury protection (PIP) system and instead require mandatory bodily injury coverage starting at $25,000 for all drivers in the state of Florida. Earlier versions of the legislation required insurers to offer medical payments coverage (MedPay) in the amount of $5,000 or $10,000, but the passed version makes the offering optional and includes an optional $5,000 MedPay death benefit. The bill will also create a new framework to govern motor vehicle claims handling and third-party bad faith failure to settle actions against motor vehicle insurance carriers. A House amendment passed this week added a statement that the statute governing these bad faith actions is not intended to expand or diminish any cause of action currently available against insurance agents who sell motor vehicle liability insurance policies in this state. Brandes, one of three senators to vote against the bill, said its sponsors had not done enough to study how the bill would affect rates. “Florida already has some of the highest rates in the country and unfortunately if you are just struggling to make it… [and] buying just PIP today, rates will go up 40%,” Brandes said. But bill sponsor Danny Burgess, a Republican, argued that a 2016 study from OIR showed rates would go down if the state repealed PIP. He said the provisions addressing bad faith will also help stop fraud that has been rampant with PIP and lead to further rate reductions. “It’s hard to predict market forces, but overwhelmingly the data shows we will see a [rate] reduction,” he said. “Certainly not a steep reduction, but I do believe we will see a reduction.” However, many in the industry and stakeholders have countered that assessment. Insurer trade group the American Property Casualty Insurance Association (APCIA) opposed the bill’s passage, saying it could increase rates on Florida drivers and increase the state’s current uninsured rate of 20%. It worked on an actuarial study to assess the impact of the bill and said its analysis shows it could increase the cost of the average auto insurance policy by as much as 23% or $344. Drivers who carry the lowest levels of coverage could see increases as high as $805 a year. APCIA said more than 28,000 letters from Floridians were sent to lawmakers opposing the bill. The group is encouraging the governor to veto the legislation. “As SB 54 heads to Governor DeSantis’ desk, he has the opportunity to protect Florida drivers from higher auto insurance costs and help keep our roads safer by vetoing this legislation,” APCIA said. Also encouraging the governor to veto the bill is the Personal Insurance Federation of Florida (PIFF) and the Consumer Protection Coalition (CPC). “We are extremely concerned that this bill would substantially increase rates for our customers and Florida residents who can least afford an increase, while forcing hundreds of thousands of Floridians already struggling to pay current premiums to drive without insurance,” said Michael Carlson, president and CEO of PIFF. “On behalf of Florida consumers, the CPC urges Governor Ron DeSantis to examine the potential cost impact this legislation will pose on Florida consumers and consider vetoing the bill if it is found to raise rates and not decrease litigation,” the group said. If signed by DeSantis, the new law will take effect Jan. 1, 2022. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.