BlogThursday, September 28 2017

Anti-fraud strike teams comprised of investigators working for the Department of Financial Services’ Division of Investigative and Forensic Services will soon be deployed across the state in an effort to to protect Floridians from post-storm fraud, according to a statement from the Florida Department of Financial Services. CFO Patronis announced the formation of three teams that will work in areas heavily impacted by Hurricane Irma: South Florida, including Miami-Dade and Monroe counties; Southwest Florida, including Lee and Collier counties; and Central Florida, including Polk and Orange counties. Patronis is working directly with prosecutors housed within each of the respective State Attorney’s Office, to “ensure that law-breakers are prosecuted to the fullest extent of Florida law,” the statement says. “The unfortunate truth is that some individuals will attempt to take advantage of consumers during this high-stress time,” Patronis said. “To combat fraudsters attempts to swindle Floridians, we’re putting boots on the ground to ward off fraud and swiftly address any scams that may arise.” These strike teams are trained insurance fraud investigators with specialized knowledge of property & casualty fraud and workers’ compensation fraud. In addition to identifying active fraud operations in the field, investigators will work with each community to educate homeowners, homeowners’ associations and local law enforcement about the red flags of fraud. Floridians can report suspicious behavior by calling the Department’s anti-fraud hotline at 1-800-378-0445, or by contacting one of the Department’s regional insurance fraud offices. To find a map of the Department’s insurance fraud offices in Florida, click here. Callers are asked to provide as many details as possible, and callers may request to remain anonymous. More information on the the Department of Financial Services’ anti-fraud efforts is available on its website. Wednesday, September 27 2017

Hurricane Deductibles From June 1st to November 30th, the Gulf of Mexico and eastern coast of the United States is on alert for Hurricane Season. Eyes turn to the National Hurricane Center during this season to watch and prepare for any storm threats. According to the Florida Office of Insurance Regulation, wind damage is considered hurricane damage if the damage occurred DURING a hurricane named by the National Hurricane Center of the National Weather Service. The duration of a hurricane is defined by the following:

The National Hurricane Center declared Hurricane Irma’s duration for the state of Florida to be from 11 a.m. on September 7, 2017 to 5 a.m. on September 14, 2017. Any wind-related damages occurring within this time frame would be subject to your hurricane deductible. So just how much is a hurricane deductible and when does it apply? Hurricane deductibles are a percentage of your Coverage A – Dwelling amount. In Florida, a typical homeowners insurance policy hurricane deductible is 2% of Coverage A – Dwelling amount. For example, if your Coverage A amount is $200,000, then your hurricane deductible would be $4,000. Your deductible is subtracted from your claims loss amount as you are required to cover the deductible amount BEFORE your insurance kicks in. After this amount is met, any other hurricane related damage is covered by your insurance for the remainder of the calendar year. Since hurricane deductibles are a calendar year deductible (January 1 – December 31), if you do not meet your hurricane deductible amount and experience a second hurricane loss, the deductible will be either the remainder of the hurricane deductible or the AOP (All Other Perils) deductible, whichever is greater. If you did meet your hurricane deductible, then the AOP deductible will apply for any subsequent hurricane loss. It is important to keep ALL of your receipts and a running tally of your out-of-pocket expenses. This way when a storm strikes, you’re prepared to show how much of your deductible you’ve met after filing a claim. Monday, September 25 2017

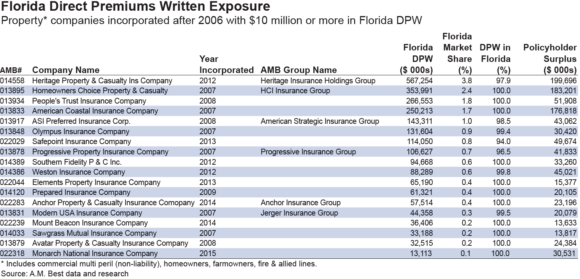

Although insured losses as a result of Hurricane Irma will not be as severe as originally forecast, the storm still represents a sizeable catastrophe event that will test the infrastructure and potentially strain the financial wherewithal of some local and regional carriers in Florida, particularly those that are geographically concentrated, according to a new briefing from A.M. Best. The Best’s Briefing, titled, “Hurricane Irma Tests Newer Participants in Florida Market,” notes that over the past decade, the number of more concentrated local/regional writers in Florida’s insurance market has increased as national writers pulled back on the state. The state-formed Citizens Property Casualty Insurance Corporation took on much of that risk exposure, and as a result, experienced significant financial pressure. This led to a fairly successful depopulation program, whereby private insurers were given incentives to assume policies from Citizens. This, along with other factors that included benign weather in Florida and favorable reinsurance pricing, prompted many new insurance companies to form. According to the report, a number of new insurance companies were formed since 2007, writing nearly a fifth of the property market lines: homeowners, farmowners, fire and allied, and commercial multiperil (non-liability). Hurricane Irma represents the first severe event to test the strength of these business models, particularly with regard to risk selection, loss mitigation and potentially their reinsurance programs.

The report also states that with Hurricane Irma occurring in such close proximity to Hurricane Harvey, the demand for independent catastrophe claim adjusters has increased. A.M. Best-rated entities had already started strengthening their claims processes in response to the state’s Assignment of Benefit issues. Newer companies may face additional pressure from a lack of experience as well as limitations due to scale. The report warns that Hurricane Irma has the potential to amplify the AOB issue, which had already led to performance constraints in the Florida market from an increase in the frequency and severity of litigated water claims. A.M. Best said insurer performance had deteriorated in recent years in large part due to the AOB issue. “A.M. Best expects that Hurricane Irma and AOB losses will have a much greater impact on operating results for the concentrated insurers, and will continue to monitor the effects of risk-adjusted capitalization,” the report states. A.M. Best does not expect a significant number of rating actions on its rated insurers to result solely from Hurricane Irma, but reinsurance programs that respond differently from what is anticipated could increase ratings pressure. A.M. Best said that ultimately, although the aftermath of Hurricane Irma may be bleak for some regional and local carriers, particularly overexposed companies with earnings and potential capital concerns, it believes opportunities will emerge for others. “An insurer that can effectively navigate through the storm and potentially others during this hurricane season may attract displaced insureds,” the briefing states. Insurers also may need to rethink their risk selection, risk tolerances and reinsurance purchases, and some may consider diversifying outside of Florida or revamping products. Smaller or struggling companies in the Florida insurance market also could become merger and acquisition targets, the ratings agency said. A full copy of the special report is available through A.M. Best. Friday, September 22 2017

With two Florida landfalls in the same day, Hurricane Irma‘s destructive wind and flood damage could cost up to $65 billion for both insured and uninsured losses, according to a recent estimate by CoreLogic. Residential property flood loss is estimated at up to $38 billion, CoreLogic reported, noting that includes storm surge, inland and flash flooding in five states – Florida, Alabama, Georgia, North Carolina and South Carolina. 80 percent of the flood damage is uninsured, the company said. Reported insured flood loss for commercial properties could top out at $8 billion. AIR Worldwide estimated insured losses for the U.S. States resulting from Irma will range between $25 billion – $35 billion. The catastrophe modeling firm noted the hurricane-force winds extended 80 miles from the eye and tropical storm–force winds extended more than 400 miles, covering the entire state and driving storm surge into both the Atlantic and Gulf coasts. Downed trees, signs and utility poles and flooded or debris-strewn streets could be seen in the southern regions of the state, AIR Worldwide reported. Karen Clark & Company estimated losses in the U.S and Caribbean at $25 billion. Of the $18 billion insured loss in the U.S., the majority is in Florida, followed by Georgia, South Carolina and Alabama, KCC reported. As of Thursday, Sept. 21, the Florida Office of Insurance Regulation reported more than 397,000 residential property claims and just over 17,000 commercial property claims had been filed. Including all types of losses, total estimated insured losses thus far had passed the $3 billion mark. OIR has been updating claims data daily.

According to A.M. Best, the top five homeowners’ insurers in Florida are: Universal Insurance Holdings Group, Tower Hill Group, State Farm, Federated National Insurance Co., and Citizens Property Insurance Corp. In response to the storm, Universal Property & Casualty Insurance Company reported it has more than $300 million in surplus, as well as a catastrophe reinsurance program that provides $2.65 billion in coverage to cover an event like Hurricane Irma. The insurer stated its projected losses from the hurricane are considerably lower than the limits of its catastrophe reinsurance program. UPCIC has not reported on the claims it has received to date. As of September 18, Tower Hill reported receiving 20,000 claims resulting from Irma. The company has 300 catastrophe adjusters stationed in Florida. The insurer commented that many of its customers reported light to moderate damage, with most claims not requiring a visit from an adjuster before settlement. As of September 14, State Farm reported it had received 26,700 homeowner and 7,700 auto claims from Irma. Federated National Insurance Company and Monarch National Insurance Company (partially owned by Federated National) both write homeowners’ insurance in Florida, according to a press release issued after Irma. Each company purchases its own separate reinsurance program. Federated National’s single event pre-tax retention for a catastrophic event in Florida is $18 million. Monarch National’s reinsurance program covers Florida exposures and all private layers of protection have prepaid automatic reinstatement protection which affords Monarch National additional coverage for subsequent events. Neither company reported the claims it received resulting from Irma to date. Citizens Property Insurance began opening catastrophe response centers across Florida to handle Irma claims. The state-run insurer has not released claims figures to date. Texas-based Interstate Restoration, a disaster restoration firm, reported it had 90 employees stationed in Florida prior to the storm, with another 60 new hires ready to go. CEO Stacy Mazur said the firm’s workers face the same challenges Florida residents are experiencing. “Those challenges include lodging, power outages and scarcity of fuel,” said Mazur. An additional 500 subcontractors in the southeast U.S. will join the Florida crew, he said. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.