Nearly one in eight U.S. motorists is driving around uninsured and putting insured drivers at greater risk in the event of an auto accident, according to a study.

The study, directed by the Insurance Research Council (IRC) and co-sponsored by The Hanover Insurance Group, found that 13 percent of all U.S. motorists were uninsured in 2015, up from 12.3 percent in 2010, following a seven-year decline from a high of 14.9 percent in 2003.

When an uninsured driver is at fault in an accident, insured drivers or their insurance companies often are left to pay for the resulting physical damage and health costs. Similarly, an underinsured driver may not have high enough policy limits to cover all costs of damage.

“The results of the survey sound an alarm,” said Daniel Halsey, president, personal lines, at The Hanover. “Uninsured motorists represent a significant risk to insured drivers.”

Halsey said the average cost of an uninsured motorist claim is about $20,000, excluding any physical damage to the vehicle.

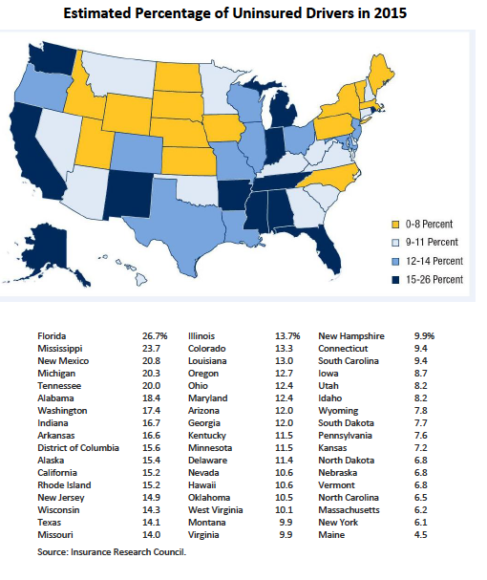

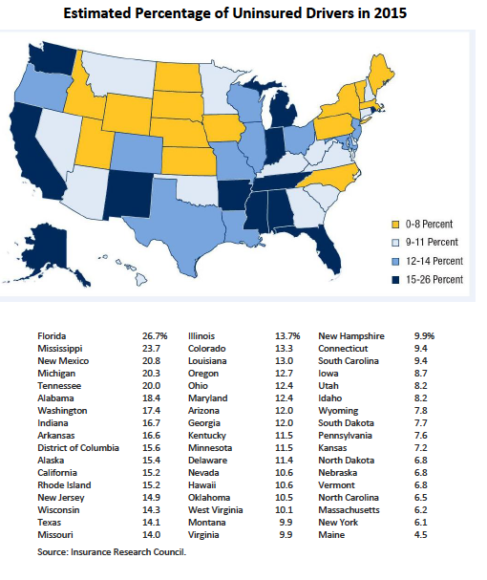

Despite the fact that 49 states require car insurance, some drivers choose to drive without coverage. The number of uninsured motorists varies by state, ranging from a low of 4.5 percent of all drivers in Maine to a high of 26.7 percent in Florida, according to the IRC.

Mississippi, New Mexico, Michigan and Tennessee are with Florida in the top five states based on rate of uninsured motorists, while North Carolina, Massachusetts, New York, and Maine have the lowest rates.

Despite the recent increase in the countrywide rate, several states experienced significant declines. Oklahoma’s UM rate in 2015 was 10.5 percent—15.4 percentage points lower than in 2012. New Mexico’s fell from 29.8 percent in 2006 to 20.8 percent in 2015.

However, twice as many states saw their UM rate increase as decrease from 2010 to 2015.

“While some states saw significant drops in their uninsured motorists rates, overall, the rate is increasing nationwide,” said Elizabeth A. Sprinkel, senior vice president of the IRC. “This can mean added risk for all motorists.”

The Hanover used the results to urge drivers to discuss uninsured/underinsured motorist coverage with their independent agents. Generally, it is a good idea for motorists to have the same amount of uninsured and underinsured motorist coverage as bodily injury coverage, according to the insurer.

Th IRC study, Uninsured Motorists, 2017 Edition, examined data collected from 14 insurers representing approximately 60 percent of the private passenger auto insurance market in 2015.