BlogWednesday, December 20 2017

Citizens Property Insurance Corp., the Florida state-run insurer of last resort, is anticipating its policyholder count will increase in 2018 for the first time since its efforts to shed policies through depopulation began several years ago. As it moves on from a tumultuous 2017 that included a major hurricane and ongoing assignment of benefits (AOB) abuse, Citizens executives said at its board of governors meeting last week that it anticipates more than 60,000 policyholders from private insurance companies will return to the state-run insurer of last resort. Citizens President, CEO and Executive Director Barry Gilway told the board at the Dec. 13 meeting that the Florida domestic insurance market’s combined ratio and surplus have declined, and the majority of Florida insurers experienced negative net income for the first time in five years. While the active 2017 storm season is one factor contributing to deteriorating insurer results, the biggest factor is increasing costs from nonweather-related losses and AOB abuse fueled by attorneys and contractors. The industry has started taking steps to limit losses from AOB, with some insurers not writing in certain areas of the state where it is the rampant. Citizens, which is statutorily obligated to offer coverage when the private market will not, will have to pick up these policies. Gilway said he expects Citizens will see significantly less depopulation next year. “When the market is healthy, and companies are making money, depopulation soars; when it becomes negative, depopulation drops. We are not expecting a lot of depopulation next year,” Gilway said. Instead, Gilway said, Citizens is expecting its overall policy count of 442,000 – the lowest it has been since the company was formed in 2002 – to climb back up to around 500,000. Citizens policy count reached a high of 1.4 million before the depopulation program began in 2012. Gilway said the insurer’s personal lines accounts (PLA), where AOB is having the biggest impact, will grow by about 66,000 policies. The company expects its commercial lines policy count to continue to decline because the commercial market is so competitive. Gilway said Citizens overall premium will likely grow by about $100 million primarily because of the growth in PLA, but he added that “the unfortunate thing is we are growing in unprofitable lines and losing business in profitable lines. It’s the nature of the beast.” Gilway said that brings more pressure to focus on finding solutions for the personal lines account segment. Citizens took several steps in 2017 to mitigate nonweather-related losses and AOB abuse, in addition to an unsuccessful push for legislative reform. Over the summer, Florida regulators approved Citizens request for a $10,000 sublimit on nonweather-related water claims for policyholders who opt not to use the new Citizens managed repair and preferred vendor program. Citizens will also require that contractors and other third parties adhere to the same disclosure responsibilities as policyholders when they accept an assignment of benefit. The policy changes go into effect for new and renewal policies on May 1, 2018, to coincide with the implementation of Citizens 2018 rates. Gilway said Citizens’ other efforts to curb AOB abuse have been successful at stabilizing the overall cost of water damage claims, but added nonweather-related water claims remain double the cost of a non-litigated water damage claim in the Tri-County region of Miami-Dade, Palm Beach and Broward. “The last couple years, at least we are maintaining the same level of severity,” he said. Still, Citizens’ percentage of operating expenses relative to claims and litigation is increasing. The company expects AOB and litigation costs will account for about 23 percent of its 2018 operating expenses, up from 16 percent in 2017 – an increase of $17 million. “The scam – and that’s what it is – continues. And until legislative changes are made, it will continue,” Gilway said. Christine Ashburn, chief Communications, Legislative & External Affairs officer, told the board that the bill the industry supported last year to address AOB abuse and reform the one-way attorney statute blamed for the abuse was reintroduced by Florida Sen. Dorothy Hukill for the upcoming 2018 Florida legislative session, but she is not optimistic it will be passed next session as it has yet to have a hearing. The same bill passed by the Florida House in 2017 was also filed again this year. “Our legislative priority remains unchanged from 2017 with our primary focus being meaningful assignment of benefits reform,” she said. Hurricane Irma Response, New Claims System Citizens has closed nearly 80 percent of the 63,600 Hurricane Irma claims and the company said it is continuing to work with policyholders whose claims remain open or whose closed claims need to be adjusted further. It reported about 1,476 of its total claims filed had an AOB attached, and 6,312 claims had representation. The total number of claims in the tri-county region was 58.4 percent. Despite a projected $1.1 billion in Irma losses, Chris Gardner, chairman of Citizens Board of Governors, said the company maintains a $6.4 billion surplus and substantial reinsurance coverage following the payout of Irma claims. Gilway told the board that Citizens is making improvements to its claims processing in the aftermath of Irma to help with efficiency and communication with its policyholders. “There are lessons learned with every event, and we what we learned very quickly with Irma is that we did not have an online claims capability,” he said. Gilway said Citizens was not prepared for the magnitude of calls that came in for Irma and the subsequent follow-up calls from customers requesting status updates on their claims. To meet this need after future events, Citizens is upgrading its claims system and implementing a customer portal. The new system will allow insureds and claimants to view the progress of their claims and, once fully implemented, report them online. “From a consumer standpoint, it clearly will be a huge benefit,” he said. Citizens will also upgrade its existing Guidewire software and storage platform, the first update since the system was implemented five years ago. Thursday, December 07 2017

The Florida Office of Insurance Regulation (OIR) has approved statewide rate increases on 2018 personal and commercial property insurance rates for Citizens Property Insurance Corp. OIR approved a statewide increase of 6.6 percent for homeowners multi-peril policies, but held rates steady for Monroe County policyholders until Citizens completes analyses and review of Hurricane Irma, which devastated the Florida Keys in September. Citizens’ 2018 request called for homeowners wind-only rates in the Keys to climb by 3.9 percent. Chris Gardner, chairman of Citizens Board of Governors, said OIR’s rate order “balances the needs of policyholders facing challenges from Irma with its responsibility to maintain a healthy property insurance market.” Under the approved rates, homeowners along the coast would see wind-only rates climb by an average of 0.9 percent. Rates for condominium unit owners would rise by a statewide average of 4.6 percent. The effective date for both new and renewal rates is no earlier than May 1, 2018. Still, despite statewide increases, thousands of Citizens customers will see rate reductions. OIR said the rate decision was as a result of its review of Citizens filings and the 200 comments and testimony received from policyholders and other interested parties, both by email and during a public rate hearing held on August 23, 2017, in Miami. State insurance regulators postponed the rate filing review process, usually reached in September, on Citizens 2018 rate request to focus attention on response efforts following Hurricane Irma, a Category 4 hurricane that made landfall in the Keys on September 10, 2017. OIR issued an emergency order to assist consumers recovering from this storm. That order expired on Dec. 3, 2017. Industry-wide as of December 4, Hurricane Irma had resulted in more than 850,000 claims with insured losses of nearly $6.3 billion. Citizens said it expects to receive about 70,000 claims, including more than 9,000 from Monroe County. Statewide Citizens losses are expected to exceed $1.2 billion. OIR’s new order calls on Citizens to review rating territories throughout Monroe County and analyze wind mitigation credits while working with local officials to review building codes for possible revision. “The residents of the Florida Keys have withstood challenges and will continue to do so as they rebuild in the wake of Hurricane Irma,” said Barry Gilway, Citizens president, CEO and executive director. “We look forward to working with all stakeholders going forward to address issues discovered as a result of the storm.” Thursday, November 30 2017

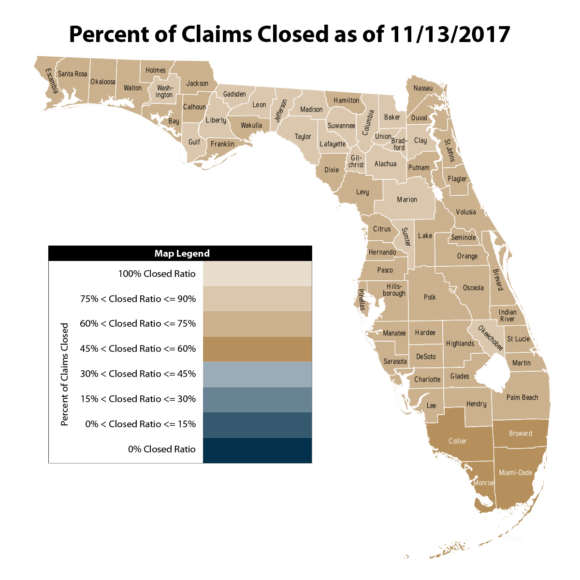

The hurricane season is officially over, but it didn’t go by without leaving a major mark on Florida and its insurance industry. Hurricane Irma, a name most in the state won’t soon forget, first hit the Florida Keys as a category 4 storm on Sunday, Sept. 10, with 130-mile per hour winds. It then worked its way north passing over the east and west coasts. Loss estimates from Hurricane Irma have ranged between $25 billion to $65 billion by catastrophe modelers. The Florida Office of Insurance Regulation (OIR) reported total estimated insured losses at more than $5.8 billion as of Nov. 13, with more than 689,000 residential property claims and 51,396 commercial property claims. Business interruption claims reached more than 3,700 as of Nov. 3. In the immediate aftermath of the storm, 6.7 million homes and businesses — about 65 percent of the state — were without power. The Florida Hurricane Catastrophe Fund said the state fund that provides backing to private insurers would pay about $5.1 billion in claims. Florida estimated it had spent nearly $650 million on emergency resources and clean up from the storm. Florida’s state-run insurer of last resort, Citizens, expects $1.2 billion in insured losses and 70,000 Hurricane Irma claims over the next 18-24 months. The carrier said Nov. 29 it had closed nearly two-thirds of the 62,000 claims it had seen so far, including more than 42,400 claims in Miami-Dade, Broward and Monroe counties. The damage to Florida crops was also epic. According to The Associated Press, Florida Agriculture Commissioner Adam Putnam said Irma’s path couldn’t have been “more lethal” for Florida agriculture, with few crops spared. More than half of the state’s iconic orange crop is estimated to be lost. Could Have Been WorseHurricane Irma will go down as one of the top hurricanes in Florida history, but experts say it could have been worse. As the storm tracked towards Florida in early September, some estimates put the cost of damage from Irma as high as $200 billion. But something called the “Bermuda High,” threw the hurricane slightly off course, sparing the most populated area of South Florida from the brunt of the storm. Bloomberg reported that the circular system hovering over Bermuda “jostled Irma onto Northern Cuba … where being over land sapped it of some power.” Florida escaped the worst because “Irma’s powerful eye shifted westward, away from the biggest population center of Miami-Dade County,” Bloomberg said. “The fact that it took a left turn at the last minute and didn’t give Miami a punch in the nose was a blessing,” said Marsh US Property Practice Leader Duncan Ellis. Recovery OngoingStill, Irma did pack a powerful punch and the recovery will go on for some time. Companies are now working on getting insureds back on their feet. One of the biggest issues in the aftermath of Irma has been a shortage of claims adjusters. The storm came just two weeks after Hurricane Harvey hit Texas and the industry has scrambled to bring in adjusters, leading to delays in resolving claims. OIR reported in its Nov. 13 claims data that about 235,759 residential property claims reported to insurers remained open. The percentage of commercial property claims closed was 29.5 percent. “The biggest challenge is you get a backlog when catastrophes hit like this. [Hurricane Harvey] was so close to what happened in Florida,” said Bobby Raymond, owner of Jacksonville, Fla.-based Brightway, The Fort Caroline Agency. “There’s a limited pool of claims adjusters in the universe. We’ve warned clients carriers are doing the best they can, but they [could] take a while to get back to you.” Raymond himself couldn’t get a claims adjuster out for almost a month after Irma caused two trees to fall on homes he owns. “That’s just typical,” he said. Carriers have turned to technology, such as drones, to help with assessing claims. EagleView, an aerial imagery provider, does inspections for insurance companies, including roof and structure damage, and property damage measurements. Kenneth Cook, SVP of EagleView OnSite Solutions, said its drone technology has handled thousands of Irma claims for insurers. “It’s a new method for them to get their work done. After any kind of a storm event — especially with two major events back to back — insurance adjusters are busy around the country, and insurance companies are always looking for faster more efficient ways to help customers,” Cook said. EagleView contracts with drone hobbyists and provides them with insurance certification training, including how to inspect a home for claims purposes. In some areas of Florida that were impacted by Irma, Cook said drones were not a good solution because of structural damage, but in other areas drones can capture detailed images of damage like missing shingles, fences blown down, or missing roof tiles. “There are thousands of claims that drones are perfect for because in just 25 minutes the pictures are taken and uploaded, saving the carrier a lot of time,” he said. New hurricane policies were also put to the test in the aftermath of Hurricane Irma. Policyholders of the new StormPeace product from Assured Risk Concepts (ARC) and California-based Topa Insurance Co. were reimbursed right away for hurricane expenses ranging from $1,000 to $15,000. Alok Jha, CEO and founder of ARC, said as of mid-October about 90 percent of its customers had been paid for Irma losses. The StormPeace product uses mobile technology to alert costumers in declared storm areas so they be paid right away for evacuation costs or damage to their homes. “This product has no exclusions and pays promptly after a hurricane,” Jha said. A contractor shortage has also delayed recovery efforts. Jake Morin, president of Construction for ProSight Specialty Insurance, said demand has surged for contractors in hurricane-hit areas, and so has demand for coverage. The company is working quickly to get contractors insured so they can help with rebuilding. “Homeowners and businesses want to make sure they are working with a licensed and reputable contractor,” he said. “There is a flood of contractors trying to capitalize; make sure the work they are doing is the work they need to be doing.” Lessons LearnedExperts are already looking at whether the state was adequately prepared for Irma and what should be done differently next time. “Much hard work and preparation over the last few years has paid off during Citizens initial response to Hurricane Irma,” said Chris Gardner, chairman of Citizens’ board of governors, shortly after the storm. “However, given the magnitude of reported claims, we are sure to encounter unforeseen challenges. We will continue to learn, prepare and improve our response capabilities with each storm situation.” Agency owner Raymond said despite the adjuster shortage, he’s been impressed with how carriers have improved their cat response and capabilities to process large claims volumes since Hurricane Matthew. “We had less complaints from customers this year about not being able to get through to their carrier,” he said. Marsh’s Ellis says Irma is a reminder of the importance of adequate insurance coverage, and that agents should take the time now to sit down with their clients and evaluate their coverage needs. “People forget how significant these events are. It’s an eyeopener for people, especially in the residential space where flood isn’t covered,” Ellis said. ProSight’s Morin agrees. “Insurance is one of those items that you buy, but you don’t know what you have until you need it. Customers truly rely on their insurance agent to be their counsel and point them in the right direction and make sure they are covered,” he said. Doug Wiles, president of Herbie Wiles Insurance Agency in St. Augustine, Fla., said Irma’s aftermath has highlighted the important work that insurance agents do. For instance, he has spent countless hours keeping information flowing between carriers and customers since the storm. “It can be tough to get through to insurance companies and you are speaking to a different representative each time — it’s not like talking to an old friend or neighbor. The value of an agent at a time like this is incredible,” he said. He added that the increasing frequency of catastrophes should not be overlooked. “With the change in our climate, I am concerned we are going to see more of this activity and I am concerned about what that is going to do to the insurance industry, especially for those companies who have focused their business in Florida,” he said. “I think we need to take a careful look at how we spread that risk — and whatever that means to the companies involved.” Wednesday, November 22 2017

A Florida nursing home under investigation for the deaths of 13 patients after Hurricane Irma says in a letter to Congress that staff members did everything possible but couldn’t overcome a lack of power to the central air conditioner. In a letter released Monday, Rehabilitation Center at Hollywood Hills attorney Geoffrey D. Smith told the House Energy and Commerce Committee that employees followed proper procedures between the air conditioner losing power on Sept. 10 and when the deaths began Sept. 13. The committee is investigating the deaths as are local police detectives and the state. Smith said managers made repeated calls to Florida Power & Light, the state health care administration and Gov. Rick Scott in an effort to get the air conditioning power restored but got nowhere. Meanwhile, he says the facility’s main power never went out and employees used portable air conditioners and fans to cool the patients and kept them hydrated. There was no state law requiring nursing homes to have backup generators for their central air conditioners. He said staff had been closely monitoring patients for two days when the deaths began without warning. He said the temperature inside the facility never exceeded 81 degrees, which would be within standards. “We believe that there were multiple system failures that need to be considered and investigated before casting blame on persons who risked their own well-being to care for others during this natural disaster,” Smith wrote. Scott’s office issued a statement Monday saying, “This facility had a responsibility to its patients to protect life during emergencies. We must learn why this facility chose not to evacuate their patients to the hospital across the street or call 911.” Florida Power & Light says it followed the priority list for restoration as agreed to by Broward County. Smith wrote in his letter that from Sept. 10 to 12, the staff monitored the facility’s 150 patients and none exhibited any sign of heat exhaustion. He said about 3 a.m. on Sept. 13, several patients began showing signs of respiratory and cardiac distress. He said the staff summoned paramedics for each patient and followed proper protocols. “The onset of heat stroke is impossible to predict and can occur in 10 to 15 minutes,” he said. He said the elderly are susceptible at 81 degrees (27 degrees Celsius). He said about 6 a.m., Hollywood police officers and staff from Memorial Regional Hospital, the trauma center across the street, declared a mass casualty situation. Officers and hospital staff members have said the facility seemed excessively hot. Detectives took a temperature reading but that has not been released. All patients were evacuated to Memorial over the next three hours. Three patients died at the nursing home, five later that day at Memorial and five in subsequent days at the hospital. A 14th death was later determined not to be related. The dead ranged in age from 57 to 99, with most from their 70s to 90s. Smith rejected criticism that the center should have evacuated its patients to Memorial earlier, saying that would violate established emergency procedures. “Hospitals are critical facilities that are supposed to be used for individual cases,” not as mass evacuation centers, he wrote. Shortly after the evacuation, an FPL crew arrived and restored the air conditioning’s power in 20 minutes, he wrote. He said 242 other Florida nursing homes lost power. He said he is seeking information on deaths at other facilities to see if they spiked during the blackout. Thursday, November 09 2017

More than 63,000 recreational boats were damaged or destroyed as a result of Hurricane Harvey and Hurricane Irma, with a combined dollar damage estimate of $655 million, according to the Boat Owners Association of the United States (BoatUS). BoatUS, a national service group for recreational boaters, noted that these numbers are strikingly close to 2012’s Hurricane Sandy, which remains the single-largest industry loss with more than 65,000 boats damaged and more than $650 million in estimated losses. This year’s Hurricane Irma damaged or destroyed 50,000 vessels with approximately $500 million in recreational boat damage, while Hurricane Harvey inflicted a damage toll of $155 million on a toll on about 13,500 boats. “These two storms were as different as night and day,” said BoatUS Marine Insurance Program Vice President of Claims Rick Wilson. “The boats that were hit the hardest by Harvey were located on a relatively small slice of Texas coast, while we saw damage to recreational vessels from Irma in every corner of Florida.” BoatUS said its catastrophe team recently completed two months of field operations arranging for repairs, salvage or wreck removals for BoatUS Marine Insurance program members and GEICO Marine Insurance customers. “While Hurricane Irma’s losses are significant, it could have been much worse,” added Wilson. “Irma ultimately traveled up Florida’s West Coast and not the East, which was initially forecast. And while locations in the right front quadrant of the storm such as Big Pine Key and Marathon were hit hard with a Category 4 storm, Irma lost strength as it approached the mainland and swept up Florida. As the storm passed east of Tampa Bay, waters receded and came back gradually, also lessening surge damage.” Wednesday, November 08 2017

The National Flood Insurance Program (NFIP) has come under intense scrutiny in the past few months after its scheduled renewal period coincided with a dramatic and costly hurricane season. Monday, November 06 2017

The owner of a Florida construction company has been arrested for allegedly obtaining a fraudulent workers’ compensation policy by underreporting the number of staff he employed, the company’s annual payroll amount and the company’s scope of work. According to a statement from Florida Chief Financial Officer Jimmy Patronis and the Department of Financial Services (DFS) Carlos Contreras, owner of DJC Builders & Construction was arrested last month after providing false information on his insurance application and illegally avoiding paying more than $ million in premium payments for an adequate policy. Contreras allegedly claimed his company’s annual payroll was $273,786, and thus was quoted an annual workers’ compensation policy premium of $25,311. However, between January and August 2017, DFS investigators determined that Contreras cashed at least 620 payroll checks for DJC Builders & Construction. In total, nearly $6.5 million in payroll was cashed using various money service businesses located across the state. DFS said if Contreras had accurately reported the company’s total payroll, number of employees and correct work description, the company’s proper workers’ compensation premium would have been more than $1.2 million. Contreras was arrested on Oct. 19 and transported to the Duval County jail. He has been charged with one count of knowingly concealing payroll and one count of scheme to defraud. The case will be prosecuted by the Duval County State Attorney’s Office and if convicted, Contreras could face up to 60 years in prison. “When companies lie to obtain cheaper, inadequate workers’ compensation policies, staff or property owners are left vulnerable to covering sky-high medical costs if a worker gets injured on the job, and free markets are disrupted by scammers who can underbid their legitimate competitors,” Patronis said. Friday, November 03 2017

Friday, November 03 2017

Florida Insurance Commissioner David Altmaier has ordered a statewide overall workers’ compensation rate decrease of 9.8 percent, a slightly higher decrease than the 9.6 percent decrease filed by the National Council on Compensation Insurance (NCCI) back in August. Altmaier’s order disapproving NCCI’s 2018 rate filing was issued by the Florida Office of Insurance Regulation on Tuesday, and stated NCCI’s rate request be amended and refiled by Nov. 7, 2017. Altmaier’s order cited NCCI’s 2 percent allowance for profit and contingencies in its rate filing as the reason for rates being disapproved. The order states that the refiling should contain a profit and contingencies provision no greater than 1.85 percent. The rate decrease will come as a welcome surprise for many Florida businesses that were expecting additional rate increases after the Florida Supreme Court issued two decisions – Castellanos v. Next Door Company and Westphal v. City of St. Petersburg, – in 2016 that sent rates up by double digits this year. “Using new data, this experience based filing proposes a decrease in rate level based on data from policy years 2014 and 2015 valued as of year-end 2016,” the order states. “While some of the experience used as the basis for this filing occurred before the recent Florida Supreme Court decisions, a portion of the experience period includes claims that occurred after the decisions.” At a rate hearing in mid-October, NCCI said a decline in claims frequency due, in part, to safer workplaces, enhanced efficiencies in the workplace, increased use of automation, and innovative technologies were partly behind the recommended decrease. NCCI said this trend is not unique to Florida but countrywide, and is expected to continue in the future. According to OIR’s order, from 2011 to 2015, the cumulative decreases in the indemnity and medical loss ratios were 19.9 percent and 12.3 percent, respectively. The primary reason for the declining loss ratios is a significant reduction in the lost-time claim frequency which declined by 45 percent from 2001 to 2015 with over 8 percent of the decline occurring in 2014 and 2015. “Even after considering the impact of the Castellanos and Westphal decisions, other factors at work in the marketplace combined to contribute to the indicated decrease, which included reduced assessments, increases in investment income, decline in claim frequency, and lower loss adjustment expenses,” the order states. However, the order also mandates that NCCI provide detailed analysis of the effects of the Castellanos decision by the Florida Supreme Court in future filings, which accounted for 10.1 percent of the 14.5 percent increase in Florida workers’ compensation rates this year. “To ensure workers’ compensation rates are not excessive, inadequate or unfairly discriminatory … it is imperative that additional quantitative analysis be conducted to determine the effect the Castellanos decision is having on the Florida workers’ compensation market and the data used to support future rate filings,” the order states. “The analysis may include alternative data sources and should examine changes to the Florida workers’ compensation market that are attributed to or observed as a result of the recent court decision.” Approval of a revised rate decrease is contingent on the amended filing being submitted with changes as stipulated within the order. If approved by OIR, the revised rate decrease would become effective on Jan. 1, 2018 for new and renewal business. Monday, October 30 2017

Hurricane Irma’s damaging rampage through Florida may require the state fund that provides backing to private insurers to pay up to $5.1 billion in claims. Anne Bert, chief operating officer for the Florida Hurricane Catastrophe Fund, said Thursday the fund will be able to pay claims with cash. That means the fund will not have to borrow any money. The financial health of the fund is important because the state can impose a surcharge on most insurance policies to replenish it if money runs out. Some critics have called the surcharge a “hurricane tax.” The fund entered storm season in good financial shape and new estimates conclude the fund could borrow up to nearly $8 billion. The $5.1 billion claims estimate is preliminary, but actuaries said they based it on experience from previous hurricanes. Copyright 2017 Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.