Wednesday, December 20 2017

Citizens Property Insurance Corp., the Florida state-run insurer of last resort, is anticipating its policyholder count will increase in 2018 for the first time since its efforts to shed policies through depopulation began several years ago.

As it moves on from a tumultuous 2017 that included a major hurricane and ongoing assignment of benefits (AOB) abuse, Citizens executives said at its board of governors meeting last week that it anticipates more than 60,000 policyholders from private insurance companies will return to the state-run insurer of last resort.

Citizens President, CEO and Executive Director Barry Gilway told the board at the Dec. 13 meeting that the Florida domestic insurance market’s combined ratio and surplus have declined, and the majority of Florida insurers experienced negative net income for the first time in five years.

While the active 2017 storm season is one factor contributing to deteriorating insurer results, the biggest factor is increasing costs from nonweather-related losses and AOB abuse fueled by attorneys and contractors. The industry has started taking steps to limit losses from AOB, with some insurers not writing in certain areas of the state where it is the rampant.

Citizens, which is statutorily obligated to offer coverage when the private market will not, will have to pick up these policies. Gilway said he expects Citizens will see significantly less depopulation next year.

“When the market is healthy, and companies are making money, depopulation soars; when it becomes negative, depopulation drops. We are not expecting a lot of depopulation next year,” Gilway said.

Instead, Gilway said, Citizens is expecting its overall policy count of 442,000 – the lowest it has been since the company was formed in 2002 – to climb back up to around 500,000. Citizens policy count reached a high of 1.4 million before the depopulation program began in 2012.

Gilway said the insurer’s personal lines accounts (PLA), where AOB is having the biggest impact, will grow by about 66,000 policies. The company expects its commercial lines policy count to continue to decline because the commercial market is so competitive.

Gilway said Citizens overall premium will likely grow by about $100 million primarily because of the growth in PLA, but he added that “the unfortunate thing is we are growing in unprofitable lines and losing business in profitable lines. It’s the nature of the beast.” Gilway said that brings more pressure to focus on finding solutions for the personal lines account segment.

Citizens took several steps in 2017 to mitigate nonweather-related losses and AOB abuse, in addition to an unsuccessful push for legislative reform. Over the summer, Florida regulators approved Citizens request for a $10,000 sublimit on nonweather-related water claims for policyholders who opt not to use the new Citizens managed repair and preferred vendor program. Citizens will also require that contractors and other third parties adhere to the same disclosure responsibilities as policyholders when they accept an assignment of benefit.

The policy changes go into effect for new and renewal policies on May 1, 2018, to coincide with the implementation of Citizens 2018 rates.

Gilway said Citizens’ other efforts to curb AOB abuse have been successful at stabilizing the overall cost of water damage claims, but added nonweather-related water claims remain double the cost of a non-litigated water damage claim in the Tri-County region of Miami-Dade, Palm Beach and Broward.

“The last couple years, at least we are maintaining the same level of severity,” he said.

Still, Citizens’ percentage of operating expenses relative to claims and litigation is increasing. The company expects AOB and litigation costs will account for about 23 percent of its 2018 operating expenses, up from 16 percent in 2017 – an increase of $17 million.

“The scam – and that’s what it is – continues. And until legislative changes are made, it will continue,” Gilway said.

Christine Ashburn, chief Communications, Legislative & External Affairs officer, told the board that the bill the industry supported last year to address AOB abuse and reform the one-way attorney statute blamed for the abuse was reintroduced by Florida Sen. Dorothy Hukill for the upcoming 2018 Florida legislative session, but she is not optimistic it will be passed next session as it has yet to have a hearing. The same bill passed by the Florida House in 2017 was also filed again this year.

“Our legislative priority remains unchanged from 2017 with our primary focus being meaningful assignment of benefits reform,” she said.

Hurricane Irma Response, New Claims System

Citizens has closed nearly 80 percent of the 63,600 Hurricane Irma claims and the company said it is continuing to work with policyholders whose claims remain open or whose closed claims need to be adjusted further. It reported about 1,476 of its total claims filed had an AOB attached, and 6,312 claims had representation. The total number of claims in the tri-county region was 58.4 percent.

Despite a projected $1.1 billion in Irma losses, Chris Gardner, chairman of Citizens Board of Governors, said the company maintains a $6.4 billion surplus and substantial reinsurance coverage following the payout of Irma claims.

Gilway told the board that Citizens is making improvements to its claims processing in the aftermath of Irma to help with efficiency and communication with its policyholders.

“There are lessons learned with every event, and we what we learned very quickly with Irma is that we did not have an online claims capability,” he said.

Gilway said Citizens was not prepared for the magnitude of calls that came in for Irma and the subsequent follow-up calls from customers requesting status updates on their claims. To meet this need after future events, Citizens is upgrading its claims system and implementing a customer portal. The new system will allow insureds and claimants to view the progress of their claims and, once fully implemented, report them online.

“From a consumer standpoint, it clearly will be a huge benefit,” he said.

Citizens will also upgrade its existing Guidewire software and storage platform, the first update since the system was implemented five years ago.

Thursday, December 07 2017

The Florida Office of Insurance Regulation (OIR) has approved statewide rate increases on 2018 personal and commercial property insurance rates for Citizens Property Insurance Corp.

OIR approved a statewide increase of 6.6 percent for homeowners multi-peril policies, but held rates steady for Monroe County policyholders until Citizens completes analyses and review of Hurricane Irma, which devastated the Florida Keys in September. Citizens’ 2018 request called for homeowners wind-only rates in the Keys to climb by 3.9 percent.

Chris Gardner, chairman of Citizens Board of Governors, said OIR’s rate order “balances the needs of policyholders facing challenges from Irma with its responsibility to maintain a healthy property insurance market.”

Under the approved rates, homeowners along the coast would see wind-only rates climb by an average of 0.9 percent. Rates for condominium unit owners would rise by a statewide average of 4.6 percent.

Citizens’ commercial property residential multi-peril rates will increase by 4.8 percent, while commercial property non-residential will increase by 8.1 percent. Wind-only commercial property residential will increase 10.3 percent.

The effective date for both new and renewal rates is no earlier than May 1, 2018.

Still, despite statewide increases, thousands of Citizens customers will see rate reductions.

OIR said the rate decision was as a result of its review of Citizens filings and the 200 comments and testimony received from policyholders and other interested parties, both by email and during a public rate hearing held on August 23, 2017, in Miami.

State insurance regulators postponed the rate filing review process, usually reached in September, on Citizens 2018 rate request to focus attention on response efforts following Hurricane Irma, a Category 4 hurricane that made landfall in the Keys on September 10, 2017.

OIR issued an emergency order to assist consumers recovering from this storm. That order expired on Dec. 3, 2017.

Industry-wide as of December 4, Hurricane Irma had resulted in more than 850,000 claims with insured losses of nearly $6.3 billion. Citizens said it expects to receive about 70,000 claims, including more than 9,000 from Monroe County. Statewide Citizens losses are expected to exceed $1.2 billion.

OIR’s new order calls on Citizens to review rating territories throughout Monroe County and analyze wind mitigation credits while working with local officials to review building codes for possible revision.

“The residents of the Florida Keys have withstood challenges and will continue to do so as they rebuild in the wake of Hurricane Irma,” said Barry Gilway, Citizens president, CEO and executive director. “We look forward to working with all stakeholders going forward to address issues discovered as a result of the storm.”

Thursday, November 30 2017

The hurricane season is officially over, but it didn’t go by without leaving a major mark on Florida and its insurance industry.

Hurricane Irma, a name most in the state won’t soon forget, first hit the Florida Keys as a category 4 storm on Sunday, Sept. 10, with 130-mile per hour winds. It then worked its way north passing over the east and west coasts.

Loss estimates from Hurricane Irma have ranged between $25 billion to $65 billion by catastrophe modelers. The Florida Office of Insurance Regulation (OIR) reported total estimated insured losses at more than $5.8 billion as of Nov. 13, with more than 689,000 residential property claims and 51,396 commercial property claims. Business interruption claims reached more than 3,700 as of Nov. 3.

In the immediate aftermath of the storm, 6.7 million homes and businesses — about 65 percent of the state — were without power.

The Florida Hurricane Catastrophe Fund said the state fund that provides backing to private insurers would pay about $5.1 billion in claims. Florida estimated it had spent nearly $650 million on emergency resources and clean up from the storm.

Florida’s state-run insurer of last resort, Citizens, expects $1.2 billion in insured losses and 70,000 Hurricane Irma claims over the next 18-24 months. The carrier said Nov. 29 it had closed nearly two-thirds of the 62,000 claims it had seen so far, including more than 42,400 claims in Miami-Dade, Broward and Monroe counties.

The damage to Florida crops was also epic. According to The Associated Press, Florida Agriculture Commissioner Adam Putnam said Irma’s path couldn’t have been “more lethal” for Florida agriculture, with few crops spared. More than half of the state’s iconic orange crop is estimated to be lost.

Could Have Been Worse

Hurricane Irma will go down as one of the top hurricanes in Florida history, but experts say it could have been worse.

As the storm tracked towards Florida in early September, some estimates put the cost of damage from Irma as high as $200 billion. But something called the “Bermuda High,” threw the hurricane slightly off course, sparing the most populated area of South Florida from the brunt of the storm. Bloomberg reported that the circular system hovering over Bermuda “jostled Irma onto Northern Cuba … where being over land sapped it of some power.”

Florida escaped the worst because “Irma’s powerful eye shifted westward, away from the biggest population center of Miami-Dade County,” Bloomberg said.

“The fact that it took a left turn at the last minute and didn’t give Miami a punch in the nose was a blessing,” said Marsh US Property Practice Leader Duncan Ellis.

Recovery Ongoing

Still, Irma did pack a powerful punch and the recovery will go on for some time. Companies are now working on getting insureds back on their feet.

One of the biggest issues in the aftermath of Irma has been a shortage of claims adjusters. The storm came just two weeks after Hurricane Harvey hit Texas and the industry has scrambled to bring in adjusters, leading to delays in resolving claims.

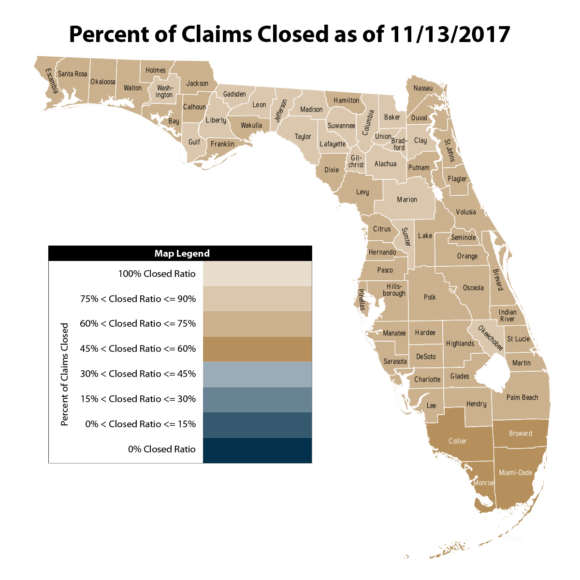

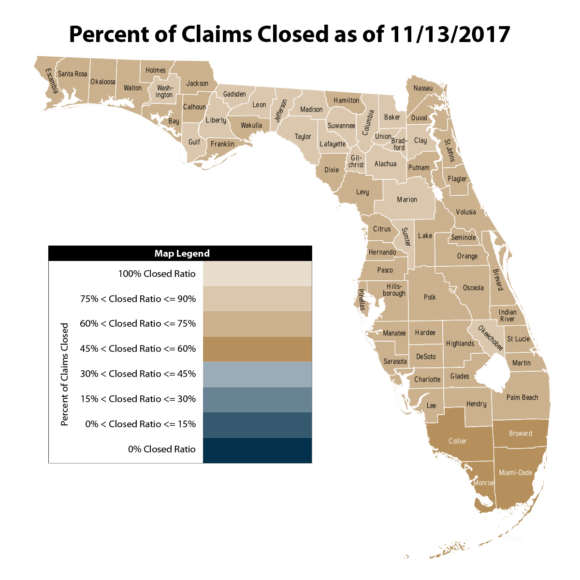

OIR reported in its Nov. 13 claims data that about 235,759 residential property claims reported to insurers remained open. The percentage of commercial property claims closed was 29.5 percent.

“The biggest challenge is you get a backlog when catastrophes hit like this. [Hurricane Harvey] was so close to what happened in Florida,” said Bobby Raymond, owner of Jacksonville, Fla.-based Brightway, The Fort Caroline Agency. “There’s a limited pool of claims adjusters in the universe. We’ve warned clients carriers are doing the best they can, but they [could] take a while to get back to you.”

Raymond himself couldn’t get a claims adjuster out for almost a month after Irma caused two trees to fall on homes he owns. “That’s just typical,” he said.

Carriers have turned to technology, such as drones, to help with assessing claims.

EagleView, an aerial imagery provider, does inspections for insurance companies, including roof and structure damage, and property damage measurements. Kenneth Cook, SVP of EagleView OnSite Solutions, said its drone technology has handled thousands of Irma claims for insurers.

“It’s a new method for them to get their work done. After any kind of a storm event — especially with two major events back to back — insurance adjusters are busy around the country, and insurance companies are always looking for faster more efficient ways to help customers,” Cook said.

EagleView contracts with drone hobbyists and provides them with insurance certification training, including how to inspect a home for claims purposes. In some areas of Florida that were impacted by Irma, Cook said drones were not a good solution because of structural damage, but in other areas drones can capture detailed images of damage like missing shingles, fences blown down, or missing roof tiles.

“There are thousands of claims that drones are perfect for because in just 25 minutes the pictures are taken and uploaded, saving the carrier a lot of time,” he said.

New hurricane policies were also put to the test in the aftermath of Hurricane Irma. Policyholders of the new StormPeace product from Assured Risk Concepts (ARC) and California-based Topa Insurance Co. were reimbursed right away for hurricane expenses ranging from $1,000 to $15,000.

Alok Jha, CEO and founder of ARC, said as of mid-October about 90 percent of its customers had been paid for Irma losses.

The StormPeace product uses mobile technology to alert costumers in declared storm areas so they be paid right away for evacuation costs or damage to their homes.

“This product has no exclusions and pays promptly after a hurricane,” Jha said.

A contractor shortage has also delayed recovery efforts. Jake Morin, president of Construction for ProSight Specialty Insurance, said demand has surged for contractors in hurricane-hit areas, and so has demand for coverage. The company is working quickly to get contractors insured so they can help with rebuilding.

“Homeowners and businesses want to make sure they are working with a licensed and reputable contractor,” he said. “There is a flood of contractors trying to capitalize; make sure the work they are doing is the work they need to be doing.”

Lessons Learned

Experts are already looking at whether the state was adequately prepared for Irma and what should be done differently next time.

“Much hard work and preparation over the last few years has paid off during Citizens initial response to Hurricane Irma,” said Chris Gardner, chairman of Citizens’ board of governors, shortly after the storm. “However, given the magnitude of reported claims, we are sure to encounter unforeseen challenges. We will continue to learn, prepare and improve our response capabilities with each storm situation.”

Agency owner Raymond said despite the adjuster shortage, he’s been impressed with how carriers have improved their cat response and capabilities to process large claims volumes since Hurricane Matthew.

“We had less complaints from customers this year about not being able to get through to their carrier,” he said.

Marsh’s Ellis says Irma is a reminder of the importance of adequate insurance coverage, and that agents should take the time now to sit down with their clients and evaluate their coverage needs.

“People forget how significant these events are. It’s an eyeopener for people, especially in the residential space where flood isn’t covered,” Ellis said.

ProSight’s Morin agrees.

“Insurance is one of those items that you buy, but you don’t know what you have until you need it. Customers truly rely on their insurance agent to be their counsel and point them in the right direction and make sure they are covered,” he said.

Doug Wiles, president of Herbie Wiles Insurance Agency in St. Augustine, Fla., said Irma’s aftermath has highlighted the important work that insurance agents do. For instance, he has spent countless hours keeping information flowing between carriers and customers since the storm.

“It can be tough to get through to insurance companies and you are speaking to a different representative each time — it’s not like talking to an old friend or neighbor. The value of an agent at a time like this is incredible,” he said.

He added that the increasing frequency of catastrophes should not be overlooked.

“With the change in our climate, I am concerned we are going to see more of this activity and I am concerned about what that is going to do to the insurance industry, especially for those companies who have focused their business in Florida,” he said. “I think we need to take a careful look at how we spread that risk — and whatever that means to the companies involved.”

Wednesday, November 22 2017

A Florida nursing home under investigation for the deaths of 13 patients after Hurricane Irma says in a letter to Congress that staff members did everything possible but couldn’t overcome a lack of power to the central air conditioner.

In a letter released Monday, Rehabilitation Center at Hollywood Hills attorney Geoffrey D. Smith told the House Energy and Commerce Committee that employees followed proper procedures between the air conditioner losing power on Sept. 10 and when the deaths began Sept. 13. The committee is investigating the deaths as are local police detectives and the state.

Smith said managers made repeated calls to Florida Power & Light, the state health care administration and Gov. Rick Scott in an effort to get the air conditioning power restored but got nowhere. Meanwhile, he says the facility’s main power never went out and employees used portable air conditioners and fans to cool the patients and kept them hydrated. There was no state law requiring nursing homes to have backup generators for their central air conditioners.

He said staff had been closely monitoring patients for two days when the deaths began without warning. He said the temperature inside the facility never exceeded 81 degrees, which would be within standards.

“We believe that there were multiple system failures that need to be considered and investigated before casting blame on persons who risked their own well-being to care for others during this natural disaster,” Smith wrote.

Scott’s office issued a statement Monday saying, “This facility had a responsibility to its patients to protect life during emergencies. We must learn why this facility chose not to evacuate their patients to the hospital across the street or call 911.”

Florida Power & Light says it followed the priority list for restoration as agreed to by Broward County.

Smith wrote in his letter that from Sept. 10 to 12, the staff monitored the facility’s 150 patients and none exhibited any sign of heat exhaustion.

He said about 3 a.m. on Sept. 13, several patients began showing signs of respiratory and cardiac distress. He said the staff summoned paramedics for each patient and followed proper protocols.

“The onset of heat stroke is impossible to predict and can occur in 10 to 15 minutes,” he said. He said the elderly are susceptible at 81 degrees (27 degrees Celsius).

He said about 6 a.m., Hollywood police officers and staff from Memorial Regional Hospital, the trauma center across the street, declared a mass casualty situation. Officers and hospital staff members have said the facility seemed excessively hot. Detectives took a temperature reading but that has not been released.

All patients were evacuated to Memorial over the next three hours. Three patients died at the nursing home, five later that day at Memorial and five in subsequent days at the hospital. A 14th death was later determined not to be related. The dead ranged in age from 57 to 99, with most from their 70s to 90s.

Smith rejected criticism that the center should have evacuated its patients to Memorial earlier, saying that would violate established emergency procedures.

“Hospitals are critical facilities that are supposed to be used for individual cases,” not as mass evacuation centers, he wrote.

Shortly after the evacuation, an FPL crew arrived and restored the air conditioning’s power in 20 minutes, he wrote.

He said 242 other Florida nursing homes lost power. He said he is seeking information on deaths at other facilities to see if they spiked during the blackout.

Thursday, November 09 2017

More than 63,000 recreational boats were damaged or destroyed as a result of Hurricane Harvey and Hurricane Irma, with a combined dollar damage estimate of $655 million, according to the Boat Owners Association of the United States (BoatUS).

BoatUS, a national service group for recreational boaters, noted that these numbers are strikingly close to 2012’s Hurricane Sandy, which remains the single-largest industry loss with more than 65,000 boats damaged and more than $650 million in estimated losses.

This year’s Hurricane Irma damaged or destroyed 50,000 vessels with approximately $500 million in recreational boat damage, while Hurricane Harvey inflicted a damage toll of $155 million on a toll on about 13,500 boats.

“These two storms were as different as night and day,” said BoatUS Marine Insurance Program Vice President of Claims Rick Wilson. “The boats that were hit the hardest by Harvey were located on a relatively small slice of Texas coast, while we saw damage to recreational vessels from Irma in every corner of Florida.”

BoatUS said its catastrophe team recently completed two months of field operations arranging for repairs, salvage or wreck removals for BoatUS Marine Insurance program members and GEICO Marine Insurance customers.

“While Hurricane Irma’s losses are significant, it could have been much worse,” added Wilson. “Irma ultimately traveled up Florida’s West Coast and not the East, which was initially forecast. And while locations in the right front quadrant of the storm such as Big Pine Key and Marathon were hit hard with a Category 4 storm, Irma lost strength as it approached the mainland and swept up Florida. As the storm passed east of Tampa Bay, waters receded and came back gradually, also lessening surge damage.”

Wednesday, November 08 2017

The National Flood Insurance Program (NFIP) has come under intense scrutiny in the past few months after its scheduled renewal period coincided with a dramatic and costly hurricane season.

Houston faced one of the worst US flood disasters in recent history as a result of Hurricane Harvey battering the Gulf Coast – and the majority of homes didn’t have flood insurance.

The hurricanes caused projected losses of $16 billion, meaning the NFIP would completely drain its financial resources according to a letter from Office of Management and Budget Director Mick Mulvaney sent to Congress on October 04.

Last month, the US House of Representatives passed a $36.5 billion disaster relief bill that would forgive $16 billion in debt owed by the NFIP. But there are still serious issues Congress needs to address, according to Nat Wienecke, senior vice president, Federal Government Relations, PCI.

“Congress has never failed to meet the obligations in the NFIP program for consumers. The consensus is that promises made to consumers should be promises kept,” Wienecke told Insurance Business. “But the reality is, Congress has designed a program that is not actuarily sound. It would pass no inspection by any insurance regulator on the planet for solvency.

“The NFIP as a program, due to its subsidization rates, is not structurally designed to handle catastrophes. That’s part of the thought process behind not requiring the program to take on more debt [relieving the $16 billion]. If you were to add more debt to its interest payments, it would just make the NFIP even more structurally unsound that it already is.”

Following the $16 billion relief, the NFIP will still owe around $46 billion in debt to US taxpayers. One major area where taxpayers are left to pick up the slack is in guaranteed mortgages, according to Wienecke.

In Houston, around 80,000 homes suffered uninsured flood losses during Harvey. For some, the only redress would have been to get a loan to rebuild their home, which might in turn have made it unaffordable. If they abandon their homes, who’s going to cover the mortgages? The taxpayer.

“I think Congress needs to spend more time looking at the risk floods play on mortgages that are guaranteed by the taxpayer,” Wienecke commented. “What’s the real taxpayers’ exposure for people outside of the 100-year flood zone?

“They’re going to have to pay one way or another.”

Monday, November 06 2017

The owner of a Florida construction company has been arrested for allegedly obtaining a fraudulent workers’ compensation policy by underreporting the number of staff he employed, the company’s annual payroll amount and the company’s scope of work.

According to a statement from Florida Chief Financial Officer Jimmy Patronis and the Department of Financial Services (DFS) Carlos Contreras, owner of DJC Builders & Construction was arrested last month after providing false information on his insurance application and illegally avoiding paying more than $ million in premium payments for an adequate policy.

Contreras allegedly claimed his company’s annual payroll was $273,786, and thus was quoted an annual workers’ compensation policy premium of $25,311. However, between January and August 2017, DFS investigators determined that Contreras cashed at least 620 payroll checks for DJC Builders & Construction. In total, nearly $6.5 million in payroll was cashed using various money service businesses located across the state. DFS said if Contreras had accurately reported the company’s total payroll, number of employees and correct work description, the company’s proper workers’ compensation premium would have been more than $1.2 million.

Contreras was arrested on Oct. 19 and transported to the Duval County jail. He has been charged with one count of knowingly concealing payroll and one count of scheme to defraud.

The case will be prosecuted by the Duval County State Attorney’s Office and if convicted, Contreras could face up to 60 years in prison.

“When companies lie to obtain cheaper, inadequate workers’ compensation policies, staff or property owners are left vulnerable to covering sky-high medical costs if a worker gets injured on the job, and free markets are disrupted by scammers who can underbid their legitimate competitors,” Patronis said.

Friday, November 03 2017

|

In the past few weeks, we have heard from a lot of our agents and policyholders regarding the things they have learned from hurricane Irma. We are evaluating all of the feedback received and how we may be able to better protect both our agents and policyholders the next time a hurricane hits our state. Those changes that would require rate and/or form filings with the Office of Insurance Regulation will be addressed in the near future. In the meantime, please see the items below that we are able to address immediately.

Wind Driven Rain Coverage

- HO 17 52 Unit-Owners Special Coverage A Endorsement will now be automatically selected on all HO6 quotes*. If the insured does not want the coverage you will need to deselect the endorsement on the Coverage tab. This endorsement broadens coverage on the HO6 policy form by changing coverage A-Dwelling loss settlement from Named Perils to All Risk subject to policy exclusions.

Amount of Hurricane Deductible

- Hurricane Deductible Options - St. Johns offers flat hurricane deductible options of $500 or $1,000. Both of these options are available on all HO3 policies regardless of Coverage A or which AOP deductible has been chosen. Please note that the hurricane deductible can only be changed at renewal.

*Existing HO6 quotes will not update automatically, you will need to select the endorsement on the coverage tab.

|

|

|

Customer Service 800-748-2030

|

|

|

|

|

|

|

|

|

St. James Insurance Group | P.O. Box 690759 , Orlando, FL 32869

|

|

|

|

|

|

|

Friday, November 03 2017

Florida Insurance Commissioner David Altmaier has ordered a statewide overall workers’ compensation rate decrease of 9.8 percent, a slightly higher decrease than the 9.6 percent decrease filed by the National Council on Compensation Insurance (NCCI) back in August.

Altmaier’s order disapproving NCCI’s 2018 rate filing was issued by the Florida Office of Insurance Regulation on Tuesday, and stated NCCI’s rate request be amended and refiled by Nov. 7, 2017.

Altmaier’s order cited NCCI’s 2 percent allowance for profit and contingencies in its rate filing as the reason for rates being disapproved. The order states that the refiling should contain a profit and contingencies provision no greater than 1.85 percent.

The rate decrease will come as a welcome surprise for many Florida businesses that were expecting additional rate increases after the Florida Supreme Court issued two decisions – Castellanos v. Next Door Company and Westphal v. City of St. Petersburg, – in 2016 that sent rates up by double digits this year.

“Using new data, this experience based filing proposes a decrease in rate level based on data from policy years 2014 and 2015 valued as of year-end 2016,” the order states. “While some of the experience used as the basis for this filing occurred before the recent Florida Supreme Court decisions, a portion of the experience period includes claims that occurred after the decisions.”

At a rate hearing in mid-October, NCCI said a decline in claims frequency due, in part, to safer workplaces, enhanced efficiencies in the workplace, increased use of automation, and innovative technologies were partly behind the recommended decrease. NCCI said this trend is not unique to Florida but countrywide, and is expected to continue in the future.

According to OIR’s order, from 2011 to 2015, the cumulative decreases in the indemnity and medical loss ratios were 19.9 percent and 12.3 percent, respectively. The primary reason for the declining loss ratios is a significant reduction in the lost-time claim frequency which declined by 45 percent from 2001 to 2015 with over 8 percent of the decline occurring in 2014 and 2015.

“Even after considering the impact of the Castellanos and Westphal decisions, other factors at work in the marketplace combined to contribute to the indicated decrease, which included reduced assessments, increases in investment income, decline in claim frequency, and lower loss adjustment expenses,” the order states.

However, the order also mandates that NCCI provide detailed analysis of the effects of the Castellanos decision by the Florida Supreme Court in future filings, which accounted for 10.1 percent of the 14.5 percent increase in Florida workers’ compensation rates this year.

“To ensure workers’ compensation rates are not excessive, inadequate or unfairly discriminatory … it is imperative that additional quantitative analysis be conducted to determine the effect the Castellanos decision is having on the Florida workers’ compensation market and the data used to support future rate filings,” the order states. “The analysis may include alternative data sources and should examine changes to the Florida workers’ compensation market that are attributed to or observed as a result of the recent court decision.”

Approval of a revised rate decrease is contingent on the amended filing being submitted with changes as stipulated within the order. If approved by OIR, the revised rate decrease would become effective on Jan. 1, 2018 for new and renewal business.

Monday, October 30 2017

Hurricane Irma’s damaging rampage through Florida may require the state fund that provides backing to private insurers to pay up to $5.1 billion in claims.

Anne Bert, chief operating officer for the Florida Hurricane Catastrophe Fund, said Thursday the fund will be able to pay claims with cash. That means the fund will not have to borrow any money.

The financial health of the fund is important because the state can impose a surcharge on most insurance policies to replenish it if money runs out. Some critics have called the surcharge a “hurricane tax.”

The fund entered storm season in good financial shape and new estimates conclude the fund could borrow up to nearly $8 billion.

The $5.1 billion claims estimate is preliminary, but actuaries said they based it on experience from previous hurricanes.

Copyright 2017 Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Tuesday, October 24 2017

An unlicensed contractor from Fort Myers, Fla., has been arrested after he was found to be conducting subpar roof repairs and operating without insurance in the wake of Hurricane Irma.

Chief Financial Officer Jimmy Patronis said Oscar M. Palma was arrested this month by the Department of Financial Services’ Disaster Fraud Action Strike Team.

Palma was reported to authorities after allegedly making subpar roof repairs to an area apartment complex following Hurricane Irma. A statement from DFS said an investigation was then launched where fraud detectives found Palma was advertising himself as a licensed and insured contractor, but held no workers’ compensation coverage and was not licensed as a contractor.

“When contractors fail to secure workers’ compensation coverage, a myriad of risks are presented, and we are sending a message that taking short cuts will not be tolerated,” Patronis said. “If any of Palma’s workers were to get injured, the property owners, who are already going through high-stress and costly times dealing with Hurricane Irma damages, or the employee themselves are forced to pay out-of-pocket for medical expenses. Our efforts are focused on ensuring our residents, consumers and employees don’t fall victim to Irma twice, and these types of uninsured activities could cause just that.”

The Department’s Bureau of Workers’ Compensation Compliance received a tip Oct. 12, 2017, alleging unlicensed, uninsured and careless roof work was being performed by Palma’s company. Investigators visited one of Palma’s current work sites and issued a stop work order upon confirming Palma failed to secure workers’ compensation insurance and Palma’s confession to having no professional license.

He was arrested Oct. 13, 2017, and transported to Lee County Jail.

This case will be prosecuted by the Lee County Office of the State Attorney, 20th Judicial Circuit. If convicted, Palma could face up to five years in prison.

DFS’s anti-fraud strike team consists of three teams working in areas heavily impacted by Hurricane Irma including South Florida, Miami-Dade and Monroe counties; Southwest Florida, including Lee and Collier counties; and Central Florida, including Polk and Orange counties. To report suspected fraud, call the Department’s toll-free Fraud Tip Hotline at 1-800-378-0445.

Thursday, October 19 2017

Jennifer Smith doesn’t like the term “accident.” It implies too much chance and too little culpability.

A “crash” killed her mother in 2008, she insists, when her car was broadsided by another vehicle while on her way to pick up cat food. The other driver, a 20-year-old college student, ran a red light while talking on his mobile phone, a distraction that he immediately admitted and cited as the catalyst of the fatal event.

“He was remorseful,” Smith, now 43, said. “He never changed his story.”

Yet in federal records, the death isn’t attributed to distraction or mobile-phone use. It’s just another line item on the grim annual toll taken by the National Highway Transportation Safety Administration [NHTSA]—one of 37,262 that year. Three months later, Smith quit her job as a realtor and formed Stopdistractions.org, a nonprofit lobbying and support group. Her intent was to make the tragic loss of her mother an anomaly.

To that end, she has been wildly unsuccessful. Nine years later, the problem of death-by-distraction has gotten much worse.

Over the past two years, after decades of declining deaths on the road, U.S. traffic fatalities surged by 14.4 percent. In 2016 alone, more than 100 people died every day in or near vehicles in America, the first time the country has passed that grim toll in a decade. Regulators, meanwhile, still have no good idea why crash-related deaths are spiking: People are driving longer distances but not tremendously so; total miles were up just 2.2 percent last year. Collectively, we seemed to be speeding and drinking a little more, but not much more than usual. Together, experts say these upticks don’t explain the surge in road deaths.

Three Big Clues

There are however three big clues, and they don’t rest along the highway. One, as you may have guessed, is the substantial increase in smartphone use by U.S. drivers as they drive. From 2014 to 2016, the share of Americans who owned an iPhone, Android phone, or something comparable rose from 75 percent to 81 percent.

The second is the changing way in which Americans use their phones while they drive. These days, we’re pretty much done talking. Texting, Twitter, Facebook, and Instagram are the order of the day—all activities that require far more attention than simply holding a gadget to your ear or responding to a disembodied voice. By 2015, almost 70 percent of Americans were using their phones to share photos and follow news events via social media. In just two additional years, that figure has jumped to 80 percent.

Finally, the increase in fatalities has been largely among bicyclists, motorcyclists, and pedestrians—all of whom are easier to miss from the driver’s seat than, say, a 4,000-pound SUV—especially if you’re glancing up from your phone rather than concentrating on the road. Last year, 5,987 pedestrians were killed by cars in the U.S., almost 1,100 more than in 2014—that’s a 22 percent increase in just two years.

Safety regulators and law enforcement officials certainly understand the danger of taking—or making—a phone call while operating a piece of heavy machinery. They still, however, have no idea just how dangerous it is, because the data just isn’t easily obtained. And as mobile phone traffic continues to shift away from simple voice calls and texts to encrypted social networks, officials increasingly have less of a clue than ever before.

Out of NHTSA’s full 2015 dataset, only 448 deaths were linked to mobile phones—that’s just 1.4 percent of all traffic fatalities. By that measure, drunk driving is 23 times more deadly than using a phone while driving, though studies have shown that both activities behind the wheel constitute (on average) a similar level of impairment. NHTSA has yet to fully crunch its 2016 data, but the agency said deaths tied to distraction actually declined last year.

Deadlier Than Data Shows

There are many reasons to believe mobile phones are far deadlier than NHTSA spreadsheets suggest. Some of the biggest indicators are within the data itself. In more than half of 2015 fatal crashes, motorists were simply going straight down the road—no crossing traffic, rainstorms, or blowouts. Meanwhile, drivers involved in accidents increasingly mowed down things smaller than a Honda Accord, such as pedestrians or cyclists, many of whom occupy the side of the road or the sidewalk next to it. Fatalities increased inordinately among motorcyclists (up 6.2 percent in 2016) and pedestrians (up 9 percent).

“Honestly, I think the real number of fatalities tied to cell phones is at least three times the federal figure,” Jennifer Smith said. “We’re all addicted and the scale of this is unheard of.”

In a recent study, the nonprofit National Safety Council found only about half of fatal crashes tied to known mobile phone use were coded as such in NHTSA databases. In other words, according to the NSC, NHTSA’s figures for distraction-related death are too low.

Perhaps more telling are the findings of Zendrive Inc., a San Francisco startup that analyzes smartphone data to help insurers of commercial fleets assess safety risks. In a study of 3 million people, it found drivers using their mobile phone during 88 percent of trips. The true number is probably even higher because Zendrive didn’t capture instances when phones were mounted in a fixed position—so-called hands free technology, which is also considered dangerous.

“It’s definitely frightening,” said Jonathan Matus, Zendrive’s co-founder and chief executive officer. “Pretty much everybody is using their phone while driving.”

There are, by now, myriad technological nannies that freeze smartphone activity. Most notably, a recent version of Apple’s iOS operating system can be configured to keep a phone asleep when its owner is driving and to send an automated text response to incoming messages. However, the “Do Not Disturb” function can be overridden by the person trying to get in touch. More critically, safety advocates note that such systems require an opt-in from the same users who have difficulty ignoring their phones in the first place.

State Data Collection

In NHTSA’s defense, its tally of mobile phone-related deaths is only as good as the data it gets from individual states, each of which has its own methods for diagnosing and detailing the cause of a crash. Each state in turn relies on its various municipalities to compile crash metrics—and they often do things differently, too.

The data from each state is compiled from accident reports filed by local police, most of which don’t prompt officers to consider mobile phone distraction as an underlying cause. Only 11 states use reporting forms that contain a field for police to tick-off mobile-phone distraction, while 27 have a space to note distraction in general as a potential cause of the accident.

The fine print seems to make a difference. Tennessee, for example, has one of the most thorough accident report forms in the country, a document that asks police to evaluate both distractions in general and mobile phones in particular. Of the 448 accidents involving a phone in 2015 as reported by NHTSA, 84 occurred in Tennessee. That means, a state with 2 percent of the country’s population accounted for 19 percent of its phone-related driving deaths. As in polling, it really depends on how you ask the question.

“Crash investigators are told to catch up with this technology phenomenon”

Massachusetts State Police Sergeant Christopher Sanchez, a national expert on distracted driving, said many police departments still focus on drinking or drug use when investigating a crash. Also, figuring out whether a mobile phone was in use at the time of a crash is usually is getting trickier every day—proving that it precipitated the event can be even harder to do.

Prosecutors have a similar bias. Currently, it’s illegal for drivers to use a handheld phone at all in 15 states, and texting while driving is specifically barred in 47 states. But getting mobile phone records after a crash typically involves a court order and, and even then, the records may not show much activity beyond a call or text. If police provide solid evidence of speeding, drinking, drugs or some other violation, lawyers won’t bother pursuing distraction as a cause.

“Crash investigators are told to catch up with this technology phenomenon—and it’s hard,” Sanchez said. “Every year new apps are developed that make it even more difficult.” Officers in Arizona and Montana, meanwhile, don’t have to bother, since they allow mobile phone use while you drive. And in Missouri, police only have to monitor drivers under age 21 who pick up their phone while driving.

Like Smith, Emily Stein, 36, lost a parent to the streets. Ever since her father was killed by a distracted driver in 2011, she sometimes finds herself doing unscientific surveys. She’ll sit in front of her home in the suburbs west of Boston and watch how many passing drivers glance down at their phones.

“I tell my local police department: ‘If you come here, sit on my stoop and hand out tickets. You’d generate a lot of revenue,'” she said.

Since forming the Safe Roads Alliance five years ago, Stein talks to the police regularly. “A lot of them say it surpasses drunk driving at this point,” she said. Meanwhile, grieving families and safety advocates such as her are still struggling to pass legislation mandating hands-free-only use of phones while driving—Iowa and Texas just got around to banning texting behind the wheel.

“The argument is always that it’s big government,” said Jonathan Adkins, executive director of the Governors Highway Safety Association. “The other issue is that … it’s hard to ban something that we all do, and we know that we want to do.”

“We all know what’s going on, but we don’t have a breathalyzer for a phone”

Safety advocates such as Smith say lawmakers, investigators and prosecutors won’t prioritize the danger of mobile phones in vehicles until they are seen as a sizable problem—as big as drinking, say. Yet, it won’t be measured as such until it’s a priority for lawmakers, investigators and prosecutors.

“That’s the catch-22 here,” Smith said. “We all know what’s going on, but we don’t have a breathalyzer for a phone.”

Perhaps the lawmakers who vote against curbing phone use in cars should watch the heart-wrenching 36-minute documentary filmmaker Werner Herzog made on the subject. Laudably, the piece, From One Second to the Next, was bankrolled by the country’s major cellular companies. “It’s not just an accident,” Herzog said of the fatalities. “It’s a new form of culture coming at us, and it’s coming with great vehemence.”

Adkins has watched smartphone culture overtake much of his work in 10 years at the helm of the GHSA, growing increasingly frustrated with the mounting death toll and what he calls clear underreporting of mobile phone fatalities. But he doesn’t think the numbers will come down until a backlash takes hold, one where it’s viewed as shameful to drive while using a phone. Herzog’s documentary, it appears, has had little effect in its four years on YouTube.com. At this point, Adkins is simply holding out for gains in autonomous driving technology.

“I use the cocktail party example,” he explained. “If you’re at a cocktail party and say, ‘I was so hammered the other day, and I got behind the wheel,’ people will be outraged. But if you say the same thing about using a cell phone, it won’t be a big deal. It is still acceptable, and that’s the problem.”

Monday, October 16 2017

Florida’s famous oranges are still falling from trees and rotting on the ground weeks after Hurricane Irma, and the state’s agriculture commissioner said Thursday there will be fewer Florida vegetables on Thanksgiving tables and a shortage of poinsettias at Christmas.

Agriculture Commissioner Adam Putnam and Florida farmers updated the state Senate Agriculture Committee that the storm damaged crops of all kinds, with losses topping $2.5 billion. Losses are reported to peanuts, avocadoes, sugar, strawberries, cotton and tomatoes. The storm also affected timber, milk production and lobster and stone crab fishing.

“The fresh winter vegetables that are on people’s Thanksgiving tables won’t be there this year because of Hurricane Irma,” Putnam said. “The losses are staggering; in many cases, the tale of those losses will be multiple years … This is more than just damage contained in just one crop year.”

He said Irma’s path couldn’t have been “more lethal” for Florida agriculture, with few crops spared. The citrus industry was particularly hard hit, with some estimates of more than half the orange crop lost.

The U.S. Department of Agriculture released its Florida citrus forecast Thursday, estimating that Florida will produce 54 million boxes of oranges, down 21 percent from last year.

But the Florida Citrus Mutual said the federal government should have delayed the forecast because it’s still too early to tell just how hard hit the industry was after the storm. It said production would be closer to 31 million boxes of oranges, or a 55 percent drop from the 68.7 million boxes produced in the 2016-2017 season.

“Irma hit us just a month ago and although we respect the skill and professionalism of the USDA, there is no way they can put out a reliable number in that short time period,” said Michael W. Sparks, CEO of the Florida Citrus Mutual.

The agricultural losses are expected to affect consumers, but how much so is still to be determined.

“I would expect prices to rise as a result of the winter vegetable capital of America being put out of the production going into the holiday season,” Putnam said, but he added that there could be a flood of foreign fruit and produce entering the market that could keep prices from rising – something he said could further hurt Florida farmers.

“That could, over time, replace market share that should be going to Florida’s farmers,” he said.

Committee Chairwoman Sen. Denise Grimsley talked about the damage she’s seen in her family’s orange groves.

“The fruit on the ground was so thick it was hard to walk through, and the smell is now bad because of the rotting fruit,” she said.

Putnam’s family also farms orange groves. He told reporters they’ve lost about half the crop.

“It’s not good,” he said. “You can stand in the grove and continue to hear fruit fall. It’s a double kick in the gut because this was the best crop we’ve set in years. We had better crop, better crop size, more fruit on the trees than I’ve seen in years. It was finally a crop to be proud of and now it’s laying on the ground.”

Thursday, October 12 2017

House lawmakers unveiled a bill Tuesday night that would provide $36.5 billion in emergency funding for hurricane and wildfire relief requested by the Trump administration.

With Congress under pressure to provide urgent help to storm victims in Texas, Florida and Puerto Rico, the House measure includes $18.7 billion for the Federal Emergency Management Agency’s disaster relief fund, as well as $16 billion to replenish the nation’s flood insurance program.

The FEMA funding includes a provision that would give Puerto Rico and the U.S. Virgin Islands access to $4.9 billion in low-interest Treasury loans so they doesn’t run out of cash as the islands recovers. That funding is needed to help the territory pay government salaries and other expenses after Oct. 31. House Speaker Paul Ryan said the bill will be on the House floor Thursday for a vote, after which it could taken up by the Senate when that chamber returns next week.

“Harvey, Irma, Maria, they’ve been devastating for Texas, Florida, Puerto Rico,” Ryan said at a news conference Wednesday. “This is a time when we here in Congress need to respond because that is our responsibility.”

House Appropriations Chairman Rodney Frelinghuysen of New Jersey said, “You have a lot of people in pain,” adding that he expects the next tranche of aid to be passed before December. “I think there is some momentum to get some money out the door as quickly as possible.”

Congress needs to act quickly, particularly when it comes to flood insurance. The National Flood Insurance Program needs additional funding to cover claims from all the recent storms.

The bill will be brought to a vote as soon as Thursday under a fast-track procedure that will require Democratic votes to pass. Minority Leader Nancy Pelosi of California praised the measure.

An aide to Pelosi said she fought for two items included in the bill: loans for Puerto Rico and the U.S. Virgin Islands, also suffering from hurricane damage, and $1 billion in disaster funds over the White House request in light of California wildfires. The bill includes no flood insurance policy changes, which the aide said is a victory, after Republicans had discussed revisions to the program.

Representative Mark Walker of North Carolina, who heads the conservative Republican Study Committee, said he is disappointed the measure doesn’t include any spending cuts to offset the disaster funding and still trying to decide whether to vote for it.

“This is a very frustrating place,” he said Wednesday.

Jim Jordan, an Ohio Republican and member of the conservative Freedom Caucus, said he won’t support the bill because there aren’t plans to offset the costs and because there aren’t changes to the flood insurance program.

Several other lawmakers, from both parties, said they’d support the legislation.

Texas Republican Blake Farenthold said: “They don’t have to sell me on that one.”

Nita Lowey, a New York Democrat, said disaster victims deserve help from the federal government. “This package provides critical public and individual disaster assistance, flood insurance aid, liquidity for Puerto Rico’s government, and help for communities devastated by wildfires,” she said in a statement.

The loan authority for Puerto Rico is also a needed financial lifeline for the U.S. territory of 3.4 million people that’s been operating in bankruptcy since May, which makes it difficult — if not impossible — for the government to borrow on its own.

With the island still recovering from the storm, much of the economy there has ground to a halt, radically curtailing the government’s tax collections. Puerto Rico’s treasury secretary, Raul Maldonado, said last week that the territory faces a government shutdown on Oct. 31 that would halt its hurricane recovery efforts if Congress doesn’t intervene.

The package includes a $150 million advance to cover a matching-funds requirement from the commonwealth, an administration official said. It would be available for easing short-term expenses such as payroll and pension payments, though not for debt service on bonds.

The devastation wrought by Hurricane Maria is threatening to exacerbate the financial crisis that had already pushed the island into a series of record-setting defaults on its $74 billion of debt. The scale of the damage, which has left most of the island without electricity almost three weeks after the storm, has caused Puerto Rico bond prices to tumble as investors speculate they’re likely to recoup even less of their investments.

Puerto Rico’s delegate to Congress, Jenniffer Gonzalez Colon, said at a news conference with House Republican leaders Wednesday that she was pleased that the aid plan will help the island deal with the “humanitarian crisis.”

“We still have a dire situation on the island,” Gonzalez said. “It’s not easy when you’re used to living in an American way of life and then somebody tells you that you’re going to be without power for six or eight months.”

“We’re still counting the fatalities,” she said, with 45 dead as of Wednesday. More than 86 percent of the population still lacks electricity and more than 44 percent is without running water, Gonzalez said.

One notable omission from the broader funding measure is additional funding for the Community Development Block Grant Program at the Department of Housing and Urban Development, which a bipartisan group of Texas lawmakers had asked to be included in this measure.

“I am counting on the next supplemental having the extra funds for Texas” Representative John Carter of Texas, the chairman of the House Homeland Security Appropriations subcommittee said.

Thursday, September 28 2017

Anti-fraud strike teams comprised of investigators working for the Department of Financial Services’ Division of Investigative and Forensic Services will soon be deployed across the state in an effort to to protect Floridians from post-storm fraud, according to a statement from the Florida Department of Financial Services.

CFO Patronis announced the formation of three teams that will work in areas heavily impacted by Hurricane Irma: South Florida, including Miami-Dade and Monroe counties; Southwest Florida, including Lee and Collier counties; and Central Florida, including Polk and Orange counties.

Patronis is working directly with prosecutors housed within each of the respective State Attorney’s Office, to “ensure that law-breakers are prosecuted to the fullest extent of Florida law,” the statement says.

“The unfortunate truth is that some individuals will attempt to take advantage of consumers during this high-stress time,” Patronis said. “To combat fraudsters attempts to swindle Floridians, we’re putting boots on the ground to ward off fraud and swiftly address any scams that may arise.”

These strike teams are trained insurance fraud investigators with specialized knowledge of property & casualty fraud and workers’ compensation fraud. In addition to identifying active fraud operations in the field, investigators will work with each community to educate homeowners, homeowners’ associations and local law enforcement about the red flags of fraud.

Floridians can report suspicious behavior by calling the Department’s anti-fraud hotline at 1-800-378-0445, or by contacting one of the Department’s regional insurance fraud offices. To find a map of the Department’s insurance fraud offices in Florida, click here. Callers are asked to provide as many details as possible, and callers may request to remain anonymous.

More information on the the Department of Financial Services’ anti-fraud efforts is available on its website.

Wednesday, September 27 2017

Hurricane Deductibles

From June 1st to November 30th, the Gulf of Mexico and eastern coast of the United States is on alert for Hurricane Season. Eyes turn to the National Hurricane Center during this season to watch and prepare for any storm threats.

According to the Florida Office of Insurance Regulation, wind damage is considered hurricane damage if the damage occurred DURING a hurricane named by the National Hurricane Center of the National Weather Service. The duration of a hurricane is defined by the following:

- Begins when a hurricane Watch or Warning is issued for any part of Florida by the National Hurricane Center;

- While hurricane conditions continue to exist in Florida; and

- Ends 72 hours after the hurricane watches and warnings are lifted in Florida.

The National Hurricane Center declared Hurricane Irma’s duration for the state of Florida to be from 11 a.m. on September 7, 2017 to 5 a.m. on September 14, 2017. Any wind-related damages occurring within this time frame would be subject to your hurricane deductible.

So just how much is a hurricane deductible and when does it apply?

Hurricane deductibles are a percentage of your Coverage A – Dwelling amount. In Florida, a typical homeowners insurance policy hurricane deductible is 2% of Coverage A – Dwelling amount.

For example, if your Coverage A amount is $200,000, then your hurricane deductible would be $4,000.

Your deductible is subtracted from your claims loss amount as you are required to cover the deductible amount BEFORE your insurance kicks in. After this amount is met, any other hurricane related damage is covered by your insurance for the remainder of the calendar year. Since hurricane deductibles are a calendar year deductible (January 1 – December 31), if you do not meet your hurricane deductible amount and experience a second hurricane loss, the deductible will be either the remainder of the hurricane deductible or the AOP (All Other Perils) deductible, whichever is greater. If you did meet your hurricane deductible, then the AOP deductible will apply for any subsequent hurricane loss.

It is important to keep ALL of your receipts and a running tally of your out-of-pocket expenses. This way when a storm strikes, you’re prepared to show how much of your deductible you’ve met after filing a claim.

Monday, September 25 2017

Although insured losses as a result of Hurricane Irma will not be as severe as originally forecast, the storm still represents a sizeable catastrophe event that will test the infrastructure and potentially strain the financial wherewithal of some local and regional carriers in Florida, particularly those that are geographically concentrated, according to a new briefing from A.M. Best.

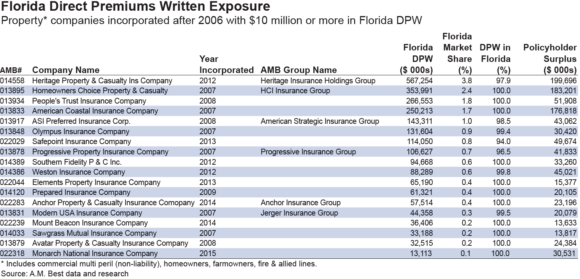

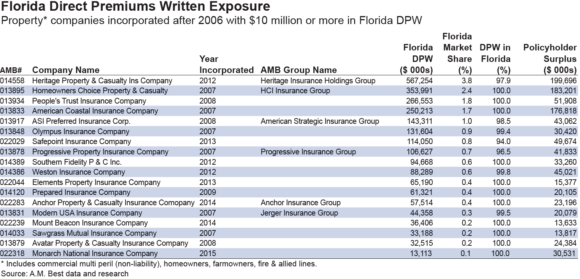

The Best’s Briefing, titled, “Hurricane Irma Tests Newer Participants in Florida Market,” notes that over the past decade, the number of more concentrated local/regional writers in Florida’s insurance market has increased as national writers pulled back on the state.

The state-formed Citizens Property Casualty Insurance Corporation took on much of that risk exposure, and as a result, experienced significant financial pressure. This led to a fairly successful depopulation program, whereby private insurers were given incentives to assume policies from Citizens. This, along with other factors that included benign weather in Florida and favorable reinsurance pricing, prompted many new insurance companies to form.

According to the report, a number of new insurance companies were formed since 2007, writing nearly a fifth of the property market lines: homeowners, farmowners, fire and allied, and commercial multiperil (non-liability). Hurricane Irma represents the first severe event to test the strength of these business models, particularly with regard to risk selection, loss mitigation and potentially their reinsurance programs.

The report also states that with Hurricane Irma occurring in such close proximity to Hurricane Harvey, the demand for independent catastrophe claim adjusters has increased. A.M. Best-rated entities had already started strengthening their claims processes in response to the state’s Assignment of Benefit issues. Newer companies may face additional pressure from a lack of experience as well as limitations due to scale.

The report warns that Hurricane Irma has the potential to amplify the AOB issue, which had already led to performance constraints in the Florida market from an increase in the frequency and severity of litigated water claims. A.M. Best said insurer performance had deteriorated in recent years in large part due to the AOB issue.

“A.M. Best expects that Hurricane Irma and AOB losses will have a much greater impact on operating results for the concentrated insurers, and will continue to monitor the effects of risk-adjusted capitalization,” the report states.

A.M. Best does not expect a significant number of rating actions on its rated insurers to result solely from Hurricane Irma, but reinsurance programs that respond differently from what is anticipated could increase ratings pressure.

A.M. Best said that ultimately, although the aftermath of Hurricane Irma may be bleak for some regional and local carriers, particularly overexposed companies with earnings and potential capital concerns, it believes opportunities will emerge for others.

“An insurer that can effectively navigate through the storm and potentially others during this hurricane season may attract displaced insureds,” the briefing states.

Insurers also may need to rethink their risk selection, risk tolerances and reinsurance purchases, and some may consider diversifying outside of Florida or revamping products. Smaller or struggling companies in the Florida insurance market also could become merger and acquisition targets, the ratings agency said.

A full copy of the special report is available through A.M. Best.

Friday, September 22 2017

With two Florida landfalls in the same day, Hurricane Irma‘s destructive wind and flood damage could cost up to $65 billion for both insured and uninsured losses, according to a recent estimate by CoreLogic.

Residential property flood loss is estimated at up to $38 billion, CoreLogic reported, noting that includes storm surge, inland and flash flooding in five states – Florida, Alabama, Georgia, North Carolina and South Carolina.

80 percent of the flood damage is uninsured, the company said.

Reported insured flood loss for commercial properties could top out at $8 billion.

AIR Worldwide estimated insured losses for the U.S. States resulting from Irma will range between $25 billion – $35 billion.

The catastrophe modeling firm noted the hurricane-force winds extended 80 miles from the eye and tropical storm–force winds extended more than 400 miles, covering the entire state and driving storm surge into both the Atlantic and Gulf coasts.

Downed trees, signs and utility poles and flooded or debris-strewn streets could be seen in the southern regions of the state, AIR Worldwide reported.

Karen Clark & Company estimated losses in the U.S and Caribbean at $25 billion. Of the $18 billion insured loss in the U.S., the majority is in Florida, followed by Georgia, South Carolina and Alabama, KCC reported.

As of Thursday, Sept. 21, the Florida Office of Insurance Regulation reported more than 397,000 residential property claims and just over 17,000 commercial property claims had been filed. Including all types of losses, total estimated insured losses thus far had passed the $3 billion mark. OIR has been updating claims data daily.

According to A.M. Best, the top five homeowners’ insurers in Florida are: Universal Insurance Holdings Group, Tower Hill Group, State Farm, Federated National Insurance Co., and Citizens Property Insurance Corp.

In response to the storm, Universal Property & Casualty Insurance Company reported it has more than $300 million in surplus, as well as a catastrophe reinsurance program that provides $2.65 billion in coverage to cover an event like Hurricane Irma. The insurer stated its projected losses from the hurricane are considerably lower than the limits of its catastrophe reinsurance program. UPCIC has not reported on the claims it has received to date.

As of September 18, Tower Hill reported receiving 20,000 claims resulting from Irma. The company has 300 catastrophe adjusters stationed in Florida. The insurer commented that many of its customers reported light to moderate damage, with most claims not requiring a visit from an adjuster before settlement.

As of September 14, State Farm reported it had received 26,700 homeowner and 7,700 auto claims from Irma.

Federated National Insurance Company and Monarch National Insurance Company (partially owned by Federated National) both write homeowners’ insurance in Florida, according to a press release issued after Irma. Each company purchases its own separate reinsurance program. Federated National’s single event pre-tax retention for a catastrophic event in Florida is $18 million. Monarch National’s reinsurance program covers Florida exposures and all private layers of protection have prepaid automatic reinstatement protection which affords Monarch National additional coverage for subsequent events. Neither company reported the claims it received resulting from Irma to date.

Citizens Property Insurance began opening catastrophe response centers across Florida to handle Irma claims. The state-run insurer has not released claims figures to date.

Texas-based Interstate Restoration, a disaster restoration firm, reported it had 90 employees stationed in Florida prior to the storm, with another 60 new hires ready to go.

CEO Stacy Mazur said the firm’s workers face the same challenges Florida residents are experiencing.

“Those challenges include lodging, power outages and scarcity of fuel,” said Mazur.

An additional 500 subcontractors in the southeast U.S. will join the Florida crew, he said.

Thursday, August 31 2017

Insurance scammers have already started preying on homeowners impacted by Hurricane Harvey.

The Federal Trade Commission has issued a warning that scammers are making robocalls in areas affected by the storm, tell homeowners that their flood insurance is overdue and must be paid immediately in order to maintain coverage.

But the Federal Emergency Management Agency, which oversees the National Flood Insurance Program, generally provides extended grace periods during natural disasters, according to a CBS News report. During the flooding in Louisiana last year, FEMA extended its usual 30-day grace period for renewals to 120 days in affected areas. So even if a homeowner’s premium payment was due at month’s end, his flood insurance wouldn’t be cancelled during the storm.

“Every time there is a natural disaster, scammers jump in,” Lois Greisman, associate director for the FTC’s marketing practices division, told CBS News. “No one should be calling you about paying premiums right now. Everybody knows what is going on.”

Greisman also warned that FEMA representatives would never show up at your door to hand out financial aid. Some scammers go door-to-door and tell homeowners that they’re there to help – the homeowner just needs to pay an upfront “application” fee.

“That’s not the government’s method of doing business,” Greisman said.

According to the FTC, hurricane victims are much more likely to receive money from FEMA than to have to make a payment. The FTC is currently helping displaced hurricane victims cover temporary living costs, according to CBS News. The agency asks that flood victims make their initial claim online at www.disasterassistance.gov or call 1-800-621-3362.

And if you suspect someone is trying to scam you, call the FEMA Disaster Fraud Hotline at 1-866-720-5721.

Monday, August 28 2017

Hurricane Harvey’s second act across southern Texas is turning into an economic catastrophe -- with damages likely to stretch into tens of billions of dollars and an unusually large share of victims lacking adequate insurance, according to early estimates.

Harvey’s cost could mount to $24 billion when including the impact of relentless flooding on the labor force, power grid, transportation and other elements that support the region’s energy sector, Chuck Watson, a disaster modeler with Enki Research, said by phone on Sunday. That would place it among the top eight hurricanes to ever strike the U.S.

“A historic event is currently unfolding in Texas,” Aon Plc wrote in an alert to clients. “It will take weeks until the full scope and magnitude of the damage is realized,” and already it’s clear that “an abnormally high portion of economic damage caused by flooding will not be covered,” the insurance broker said.

Many forecasters were hesitant over the weekend to make preliminary estimates for how much insurers might pay, potentially speeding recovery. Researchers were shifting from examining Harvey’s landfall Friday as a roof-lifting category 4 hurricane to the havoc it later created inland as a tropical storm. Typical insurance policies cover wind but not flooding, which often proves costlier. Blaming one or the other takes time.

In the Houston area, rainfall already has surpassed that of tropical storm Allison in 2001, which wreaked roughly $12 billion of damage in current dollars. In that case, only about $5 billion was covered by insurance, according to Aon.

Those storms are dwarfed by Hurricane Katrina, which struck in 2005 and devastated New Orleans. By some estimates, it inflicted $160 billion in total economic damage.

Most people with flood insurance buy policies backed by the federal government’s National Flood Insurance Program. As of April, less than one-sixth of homes in Houston’s Harris County had federal coverage, according to Aon. That would leave more than 1 million homes unprotected in the county. Coverage rates are similar in neighboring areas. Many cars also will be totaled.

“A lot of these people are going to be in very serious financial situations,” said Loretta Worters, a spokeswoman for the Insurance Information Institute. “Most people who are living in these areas do not have flood insurance. They may be able to collect some grants from the government, but there are not a lot, usually they’re very limited. There are no-interest to low-interest loans, but you have to pay them back.”

The federal program itself is already struggling with $25 billion of debt. The existing program is set to expire on Sept. 30 and is up for review in Congress, which ends its recess Sept. 5.

Investors Brace

Costs still will likely soar for insurance companies and their reinsurers, biting into earnings. As Harvey bore down on the coastline Friday, William Blair & Co., a securities firm that tracks the industry, said the storm could theoretically inflict $25 billion of insured losses if it landed as a “large category 3 hurricane.”

Policyholder-owned State Farm Mutual Automobile Insurance Co. has the largest share in the market for home coverage in Texas, followed by Allstate Corp., which is publicly traded. William Blair estimated that, in that scenario, Allstate could incur $500 million of pretax catastrophe losses, shaving 89 cents off of earnings per share.

Investors began bracing for losses last week. But many didn’t believe that Harvey could wipe out bonds that were issued to protect insurers against storm damage in the region, according to Brett Houghton, a managing principal at Fermat Capital Management. His firm manages more than $5 billion, with allocations to catastrophe bonds.

The Swiss Re Cat Bond Price Return Index dropped 0.44 percent in the week ended Aug. 25, the steepest decline since January. The benchmark is recalculated every Friday, so it’s unclear how the debt performed as the storm continued through Sunday. Reinsurers, which provide a backstop for primary carriers, also may get burned. That group include Bermuda-based companies Arch Capital Group Ltd., Axis Capital Holdings Ltd. and RenaissanceRe Holdings Ltd., according to a note last week from Meyer Shields, an analyst at Keefe, Bruyette & Woods.

Interrupting Business

Businesses are probably better covered than individuals. Companies across the retailing, manufacturing, health-care and hospitality industries will be seeking reimbursements from insurers for lost revenue during the storm and subsequent repairs, said Aon’s Jill Dalton, who helps manage claims.

But for Texas’s massive energy industry, it’s still too early to project how badly the storm will disrupt supply and distribution. That’s because the devastation keeps spreading.

“If it continues to rain, I just don’t think the situation is going to get better any time soon,” said Rick Miller, who leads Aon’s U.S. property practice. “In fact, it could get a lot worse.”

Thursday, August 24 2017

Just a day after being downgraded by ratings agency Demotech, Florida-based insurer Sawgrass Mutual Insurance Company has revealed it is under administrative supervision by the Florida Office of Insurance Regulation.

According to an amended consent order for administrative supervision dated Aug. 22, 2017, Sawgrass notified OIR of a plan for “orderly wind-down of the company’s operations” on Aug. 18, through a confidential consent order. The amended consent order said that plan is no longer feasible and that the move for administrative supervision should be made public “in order to facilitate the consideration of other plans for the orderly transition of Sawgrass’s business.”

Under Florida Law, administrative supervision is confidential unless otherwise specified. OIR may open the proceedings or hearings or make public the information.

The amended order states that “The Office finds and Sawgrass agrees, that it is in the best interest of its policyholders and the public to make this Consent Order public…” The order was signed by Sawgrass CEO Daniel O’Neal.

In a statement, OIR said “Under an Order of Administrative Supervision, the Office is working with Sawgrass Mutual Insurance Company and interested parties to develop a wind-down plan for the company, which includes the orderly transition of policies from Sawgrass to another insurer. Coverage for current Sawgrass policyholders remains in force until a plan is implemented. In the interim, policyholders may contact the Florida Market Assistance Plan to explore other options. Consumers may also research homeowners insurance companies through the Office’s CHOICES homeowners rate comparison tool via our website at www.floir.com.”

Sawgrass first became licensed in Florida in 2009 and currently has about 20,000 policies throughout the state with $35 million in premium written in the first quarter of 2017. The mutual insurer wrote voluntary homeowners through a network of independent agents. It bound just 222 new policies in Q1 of 2017, and had more than $39 million in exposure for policies in force that exclude wind coverage, according to OIR’s Quarterly Supplemental Report – Market Share Report system.

Sawgrass notified its agencies of the administrative supervision in an Aug. 22 email that was obtained by Insurance Journal. The email said the move is necessary “to allow Sawgrass and interested parties to develop a run-off plan for the company which includes the orderly transition of policies from Sawgrass to another insurer.”

The email further stated the plan could include the cancellation of all Sawgrass policies with at least 45 days’ notice and a guaranteed offer of coverage for those policies from another licensed insurer.