BlogMonday, September 23 2024

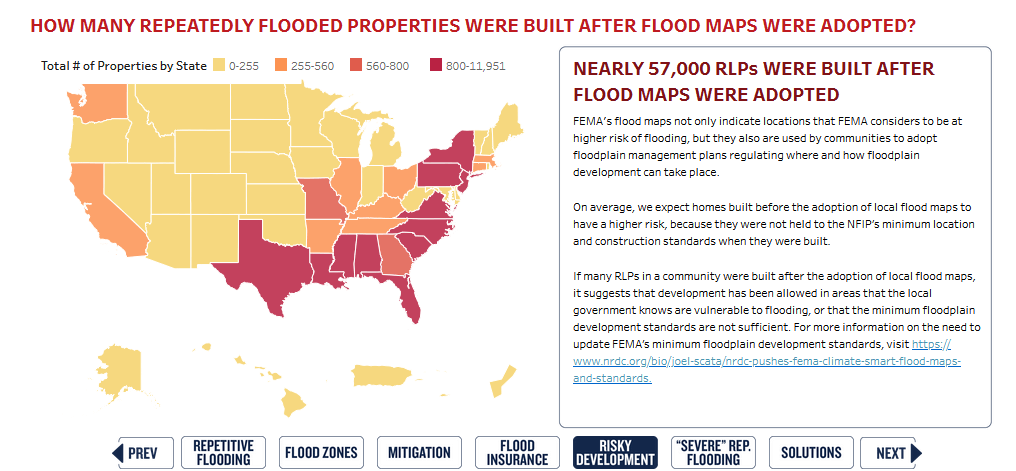

More than a quarter million U.S. properties have repeated claims for federal flood insurance, costing the National Flood Insurance Program billions of dollars in claims, according to new federal data compiled by the National Resources Defense Council. Four states account for more than half of repetitive loss properties (RLPs), led by Louisiana with more than 43,000. Texas has the next highest with over 41,000, followed by Florida (26,700) and New York (20,400). Information on properties with repeated claims for federal flood insurance was hard to come until this year, when FEMA published data on properties with two or more NFIP claims. NRDC, an environmental advocacy, used FEMA’s data to create a new mapping dashboard, Flooded Again, which provides data visualization of RLPs. While all 50 states have properties with repeated federal flood insurance claims, the bulk of RLPs are located in states along the East Coast and Gulf Coast.

Anna Weber, a senior policy analyst at NRDC, said more homes are being damaged by floods because of climate change combined with risky development and out-of-date infrastructure. “Stronger hurricanes, more intense rainstorms and rising seas are all enacting a toll on people’s lives. We need changes at all levels of government to make communities safer,” Weber said. Fewer than one in four RLPs have had risk mitigation action, like building elevation or floodproofing the first floor, NRDC said. Only 13% of single-family homes are covered by federal flood insurance, according to estimates by the Society of Actuaries. NRDC recommends FEMA should enact the following steps to protect those with, and without flood insurance:

|

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.