BlogWednesday, June 30 2021

Florida Governor Ron DeSantis has vetoed a measure intended to replace auto insurance personal injury protection (PIP) coverage with bodily injury coverage limits and a requirement that insurers offer medical payments coverage. In a letter time-stamped at 9:12 pm last night, DeSantis wrote that he was vetoing the bill (SB54) because it may have “unintended consequences.” The bill received widespread support from Florida lawmakers but faced scrutiny from critics including insurers arguing that the repeal would raise rates and lead to a higher number of uninsured drivers. DeSantis seemed to have listened to the critics. “While the PIP system has flaws and Florida law regarding bad faith is deficient, CS/CS/SB 54 does not adequately address the current issues facing Florida drivers and may have unintended consequences that would negatively impact both the market and consumers,” DeSantis wrote in his veto letter. SB 54 would have repealed the state’s no-fault PIP system and instead required mandatory bodily injury coverage of at least $25,000 for all Florida drivers. The passed version of the bill also provides the option of a $5,000 medical payment coverage (MedPay) death benefit. Bill sponsor Danny Burgess, a Republican, pointed to a 2016 Office of Insurance Regulation study that showed rates would decrease if PIP was repealed. Opponents of the repeal said it would have the opposite effect. Insurer trade group American Property Casualty Insurance Association argued the cost of an average auto insurance policy could increase by as much as 23%, or $344. Drivers with low coverage levels could see an increase as high as $805 annually. “Moving forward, we hope any proposals to reform or eliminate Florida’s no-fault auto insurance system will reduce consumer costs, combat rampant lawsuit abuse by implementing meaningful bad faith reforms, and prevent or minimize fraud,” APCIA said in a statement applauding the veto. Monday, June 21 2021

Florida Gov. Ron DeSantis on Friday officially signed into law reform legislation on property insurance and roofing contractor practices, a measure some say is having a positive impact even before it goes into effect. DeSantis signed the measure during a morning roundtable with sponsors and business groups in Sarasota. The measure – known as SB 76— will officially go into effect July 1. But, according to several participants at the roundtable, including Insurance Commissioner David Altmaier, some effects are already being realized. “Already there is a lot of positive as a result of this bill,” Altmaier said. He said insurers and reinsurers have both reacted positively and that he has seen that private carriers are beginning to pick up more homeowners policies across the state. Rep. Bob Rommel, who worked on the House version of the bill, also said insurance carriers are already showing a willingness to again invest and come into the state since the bill passed. DeSantis said Florida is “uniquely susceptible to having to respond to natural disasters and that naturally” has an impact on insurance. He said the bill is a response to many problems that he and the sponsors of the bill saw in the system. “Many of you know over the last decades, there’s been a lot of ups and downs in this property insurance market in Florida,” he said. “We saw a lot of problems. You’ve seen major premium increases and you even see some homeowners, their policies get canceled. They get dumped onto Citizens. So, we wanted to do something to stabilize that.” DeSantis said the state wants to encourage more private sector involvement and give homeowners policies that are more affordable and that will “protect them from whatever mother nature throws our way.” “I think we were able to do that,” the Republican governor added. Supporters hope SB 76 will begin to reduce litigation and control home insurance premiums. Sen. Jim Boyd, also owner of Boyd Insurance & Investments in Bradenton, said his insureds have been seeing rate increases of 20, 30 and 50%. “So we needed to do something,” he said. Boyd said it may take a year to 18 months for rates to come down but he is confident it will happen. DeSantis revealed his intentions to sign the measure during a meeting of the Enterprise Florida board of directors Wednesday. He said then that he thinks the legislature did a “pretty good job” addressing the insurance market but that the state is probably going to have to do more, according to the Orlando Sentinel. Some stakeholders agree with DeSantis that more needs to be done to lower costs and reduce litigation, citing the omission of two provisions the insurance industry said were essential. The legislation, which passed on the last day of the legislative session, includes changes to the state’s one-way attorney fee statute, the eligibility and glidepath of Citizens, and the deadline to file claims. It also places new requirements and restrictions on roofing contractors. But two provisions the industry and experts identified as critical to addressing cost drivers and stabilizing the market were left out of the final bill — the elimination of the state’s attorney fee multiplier and a provision allowing insurers to implement policy language to mitigate roof replacement costs. The provisions were sticking points in both legislative chambers. Industry groups in Florida applauded the signing of SB 76. “When Florida accounts for only 8 percent of the nation’s property insurance claims but 76 percent of national property insurance litigation, you know there is a problem,” said Mark Wilson, president and CEO, Florida Chamber of Commerce. Wilson said the measure “addresses some of the root causes that are rapidly increasing homeowner’s insurance rates.. He cited specifically attorney fee reform and roofing solicitation practices that he said have been were driving lawsuits. “As Governor DeSantis has said before, Florida’s legal system should resolve real disputes and not be used as a game,” said William Large, president of the Florida Justice Reform Institute (FJRI), a legal reform lobbying group. Large also cited the reform of the attorney fee formula. FJRI believes the new attorney fee formula will encourage more reasonable settlement offers by all parties and discourage non-meritorious claims, and we look forward to seeing the positive impact of this new approach in practice,” said Large In its key provisions, the legislation signed by DeSantis:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation, including making it illegal for roofing contractors or any person acting on their behalf to make a “prohibited advertisement,” including an electronic communication, phone call or document that solicits a claim. Offering anything of value for performing a roof inspection, an offer to interpret an insurance policy or file a claim or adjust the claim on the insured’s behalf will also be prohibited. Additionally, contractors are prohibited from providing repairs for an insured without a contract that includes a detailed cost estimate of the labor and materials required to complete the repairs. Violations could result in fines of $10,000. Monday, June 21 2021

AM Best’s composite of Florida property insurance companies hit five-year performance and surplus lows in 2020, and given persisting and significant market hurdles, companies will find sustaining current surplus levels a challenge, according to a new commentary from the ratings firm. In its Best’s Commentary, “Florida’s Difficult Market Continues to Challenge Insurers,” AM Best states that despite no hurricanes making landfall in 2019-2020, Florida property insurance writers still posted a combined ratio of 131.5 in 2020, an 18.2 percentage-point deterioration from 2019. Both years reported greater volatility compared to 2017-2018 due to social inflation pressures, which has increased the severity of claims and litigation costs; more-frequent severe convective storms; and an increase in roof replacements, Best said. Insurers have requested material rate increases, often in the double digits, to offset elevated pressure on profitability, and have revised their risk appetite for select pockets of Florida business. “However, rate increases have not kept pace, leading to declines in underwriting profitability,” the commentary states. Over the last five years, the mounting pressures also have led to a 9.7% decline in surplus, with aggregate losses reported each year. These actions have led to an increase of in-force policies at Florida’s residual insurer, Citizens Property Insurance Corp. Beginning in 2019 through the first quarter of 2021, Citizen’s personal residential policies in force increased by 29.3%. In addition, the reinsurance market has hardened, resulting in higher costs for reinsurance protection. Expectations for a more-active storm season also may influence reinsurance purchase decisions. Hurricanes over the last five years have largely been considered earnings events, given that reinsurance programs acted as intended, limiting the impact to the balance sheet. However, given the added challenges, pressure has started reaching past operating performance and eroding balance sheet strength. Primary insurers are nearing the close of the midyear reinsurance renewal season, which will provide insights to specific shifts in price and its impact. Thursday, June 10 2021

Florida Gov. Ron DeSantis said that he will sign recently-passed legislation addressing property insurance costs and roofing contractor practices while adding that he believes that the state needs to do more to curb excess litigation and improve the insurance market. The measure he said he will sign attempts to solve some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion last year. Consumers are facing double-digit rate increases, restricted coverage, or having to turn to the state’s insurer of last resort, Citizens Property Insurance. DeSantis revealed his intentions to sign the measure during a meeting of the Enterprise Florida board of directors. He said that he wants to see “manageable premiums” and a “stronger private insurance market,” according to the Orlando Sentinel. He said he thinks the legislature did a “pretty good job” addressing the insurance market but that the state is probably going to have to do more. The governor’s office told Insurance Journal DeSantis had not yet signed the bill as of late morning. Some stakeholders agree with DeSantis that more needs to be done to lower costs and reduce litigation, citing the omission of two provisions the insurance industry said were essential. Other policymakers are optimistic that the measure as passed will still have a positive effect. The legislation, Senate Bill 76, which passed on the last day of the legislative session session, includes changes to the state’s one-way attorney fee statute, the eligibility and glidepath of Citizens, and the deadline to file claims. It also places new requirements and restrictions on roofing contractors. But two provisions the industry and experts identified as critical to addressing cost drivers and stabilizing the market were left out of the final bill — the elimination of the state’s attorney fee multiplier and a provision allowing insurers to implement policy language to mitigate roof replacement costs. The provisions were sticking points in both legislative chambers. Sen. Jim Boyd, also an insurance broker and owner of Boyd Insurance & Investments in Bradenton, Fla., acknowledged that what passed didn’t have everything he or the industry wanted, but he is confident what did pass will make a difference. “Rates aren’t going to go down tomorrow, of course,” Boyd said. “But I firmly believe this will have a definite downward impact on what has been continually rising homeowners rates in Florida … I really, truly believe we have done a lot of good toward getting at the root causes of the problem.” Sen. Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve. Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his Senate colleagues. “In my view, the most important provisions are the ones that didn’t get in it,” said Joseph Petrelli, president and founder of ratings analysis firm Demotech, which rates more than 40 Florida domestic insurers “It’s a watered-down bill that won’t restore market stability. It will not curb rate increases,” agreed American Integrity CEO Robert Ritchie. “Everybody is set up for these expectations and everybody’s going to be mad at each other.” The insurance measure was one of 13 bills sent to DeSantis yesterday for signing. After signing by the governor, the legislation would take effect July 1. In its key provisions, the legislation:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation, including making it illegal for roofing contractors or any person acting on their behalf to make a “prohibited advertisement,” including an electronic communication, phone call or document that solicits a claim. Offering anything of value for performing a roof inspection, an offer to interpret an insurance policy or file a claim or adjust the claim on the insured’s behalf will also be prohibited. Additionally, contractors are prohibited from providing repairs for an insured without a contract that includes a detailed cost estimate of the labor and materials required to complete the repairs. Violations could result in fines of $10,000. Monday, June 07 2021

More than 50,000 Florida policyholders will soon be looking for a new carrier for their homeowners insurance after three Florida-based companies were approved by the state regulator to drop the policies. The moves come just a few weeks before the official start of hurricane season and as legislation designed to target the state’s insurance market issues awaits the governor’s signature. In consent orders signed by Florida Insurance Commissioner David Altmaier, Universal Insurance Co. of North America (UICNA) was approved to drop 13,294 personal residential policies and Gulfstream Property & Casualty was approved to cancel about 20,311 personal residential policies. Both insurers will remove the policies over the next 45 days. Southern Fidelity Insurance Co. was approved to nonrenew approximately 19,600 personal residential policies over the next 14 months, with approximately 2,300 receiving less than the required statutory written notice of nonrenewal. The early cancellation and nonrenewals of policies is “an extraordinary statutory remedy reserved to address insurers which are or may be in hazardous financial condition,” the Florida Office of Insurance Regulation stated in the orders, which also require the insurers to take other steps to stay solvent. The regulator’s actions are the most recent indicators of Florida’s stressed insurance marketplace that has been described as “spiraling towards collapse.” Altmaier and others have previously warned of problems for Florida’s domestic companies thanks to spiking litigation, dishonest contracting practices, catastrophe events and high reinsurance costs. Florida insurers were reported to have lost a combined $1.7 billion in 2020. “OIR remains focused on the protection of consumers and fostering stability in Florida’s insurance marketplace,” OIR said in a statement to Insurance Journal. “Allowing for the early cancellation or nonrenewal of policies is not a decision made lightly, and requires a finding that such action is necessary to protect the best interests of the public or policyholders.” The respective orders outline what “hazardous” financial conditions led to the approval of the policy cancellations and nonrenewals: Universal Insurance Co. of North America (UICNA)UICNA’s cancellation of 13,294 of its 57,000 Florida policies will occur as part of a financial restructuring plan that includes a merger with and into Universal North America Insurance Co., a Texas domestic company. UICNA reported net losses of $4.1 million in 2019 and $22.5 million in 2020, and had decreased its surplus by more than $9 million as of Dec. 31, 2020, OIR stated in the order approving the policy cancellations. UICNA’s surplus deterioration came despite the company receiving capital contributions of $13.5 million, without which it would have been considered an impaired insurer as it would have fallen below Florida’s minimum required surplus of $10 million. OIR said UICNA provided financial projections that show without the cancellation of the approximately 9,341 homeowners policies and 3,953 dwelling policies, the company’s financial condition would further deteriorate to an unsustainable level by the end of 2021. Given UICNA’s catastrophe loss experience, higher reinsurance costs, and significantly increased litigation, the identified policies for cancellation would “provide an immediate impact to the company’s financial position and facilitate the completion of a financial restructuring plan to protect its policyholders and the public,” the order says. The policy cancellations are also a condition of the company’s merger plan, OIR said, which is still subject to approval by the Texas regulator. If the merger plan is not approved, or if Universal North America Insurance Co. is unsuccessful in becoming licensed in Florida, “UICNA agrees it will consent to immediate administrative supervision, for the purpose of conserving assets while UICNA develops a fully funded plan,” the OIR order states. UICNA must file its plan of merger with OIR and the Texas Department of Insurance no later than May 14, 2021, and must provide at least 45 days’ notice of cancellation to the affected policyholders. UICNA must also continue to file monthly financial statements with OIR until further notice and submit an updated business plan to the regulator by Aug. 1, 2021 for the period of July 1, 2021 through Dec. 31, 2024. The plan must include the company’s ability to generate “successful operation results by the implementation of underwriting changes, rate adjustments, operational savings, capital management, and other significant modifications to its current business model.” No policies from the block of cancelled policies can be rewritten on a different UICNA policy form or an affiliated insurer for a period of three years from the date of cancellation. Southern Fidelity Insurance Co.Southern Fidelity’s order, signed April 28, is the latest in a series of moves by OIR designed to “remediate the financial condition” of the company and to facilitate a long-term financial restructuring plan. OIR said it previously approved a rate increase, a merger with its sister company Capitol Preferred Insurance Co., the cancellation of an identified block of policies, and a capital contribution plan developed by Southern Fidelity’s new indirect owners, HSCM Bermuda. The 19,600 policies Southern Fidelity is seeking to nonrenew are generating significant losses, and OIR found after evaluation that dropping the policies is “necessary to protect the best interest of its policyholders and the public.” “Information filed by the company in support of its request demonstrates that without the approval of this plan of nonrenewal, the company would not be able to satisfy the surplus requirements of [Florida law], nor complete its long-term restructuring plan,” the order states. Southern Fidelity is required to actively facilitate the placement of the policies to be nonrenewed through “robust” communication with its agents and by providing data to other insurers expressing interest in offering replacement coverage under a confidentiality agreement. Southern Fidelity must also provide OIR with an actuarial review of its homeowners programs to “properly position its rates so as to avoid adverse selection and improve future loss ratios,” as well as adhere to file and use rate filings on a prescribed schedule. The company wrote more than 133,000 policies in Florida as of Dec. 31, 2020, making it among the top five insurers in the state. Gulfstream Property & Casualty Co.The financial condition of personal residential insurer Gulfstream, which has 56,000 policies in Florida, will deteriorate to an unsustainable level by mid-2021 without action, the May 6 consent order from OIR states. As such, the company has been approved to early cancel approximately 20,311 personal residential policies. Gulfstream has also signed a letter of intent with a new investor that stipulates the policy cancellations as a condition of its investment. The company also reported that it will no longer have risk on any policies outside of Florida, except for about 90 policies in Texas that will non-renew by June 20, 2021, as part of an ongoing renewal rights transaction and withdrawal from the state of Texas. Gulfstream reported a decrease in surplus of more than $5.2 million as of Dec. 31, 2020 compared with the same date in 2019, the order states. Its surplus included a net loss of $22.6 million, a net underwriting loss of $34.9 million and capital contributions of $17.1 million, without which its surplus would have fallen below the required $10 million. If Gulfstream is unable to complete its obligations in the investor letter of intent or the move is not approved by OIR, Gulfstream will consent to immediate administrative supervision for the purpose of conserving assets while it develops a fully funded plan, the OIR order states. Gulfstream has voluntarily ceased writing new business, OIR said, and may only resume doing so if its revised business plan is filed and approved by the regulator. Gulfstream must submit an updated business plan to OIR by July 1, 2021. Demotech President Joseph Petrelli said Florida companies are taking action to nonrenew and cancel policies to lower their exposure in particular geographic areas and their reinsurance costs. Demotech requires “rigorous” reinsurance programs from the Florida insurers it rates, and advised in March that several companies may need to remove certain policies from their books “whose underwriting characteristics generate a disproportionate cost of reinsurance,” to sustain their ratings. “Between the geographical issues and the disproportionate reinsurance cost issues, we think that’s a smart move on behalf of companies,” Petrelli told Insurance Journal in response to the recent orders. For consumers, the actions make a tough market even tougher. Florida Insurance Consumer Advocate Tasha Carter said she has been assisting homeowners daily who are facing challenging consequences because their policies have been cancelled or nonrenewed. As insurers offset sustained losses with rate increases and coverage restrictions, homeowners are left to pay higher rates with fewer options and less coverage, she said. “In addition to raising rates, the cancellation of high-risk policies is another step insurers are taking to reduce their exposure and mitigate their risk in an effort to improve their overall financial stability to ensure financial protection for policyholders,” Carter said in a statement to Insurance Journal. “I am hopeful that the implementation of the [property insurance] legislation will lead to a reduction of rates and increased coverage and capacity.” In the meantime, OIR encouraged consumers who receive a cancellation notice from their insurer to immediately contact their agent to obtain replacement coverage, and noted the companies will also contact their appointed agents to facilitate the placement of policies with other insurers. “OIR’s priority is to ensure consumers have access to coverage and will make every effort to help consumers find replacement coverage,” the regulator said. Monday, June 07 2021

A bill passed by the Florida Legislature to address the state’s property insurance crisis has created optimism among some stakeholders, while others say it will not reduce rates over the next 18 to 24 months or stop the state’s out-of-control claims litigation. This year’s effort to pass property insurance reforms came down to the wire with the passage of Senate Bill 76 on the last day of session. The bill attempts to solve some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion last year. Consumers are facing double-digit rate increases, restricted coverage, or having to turn to the state’s insurer of last resort, Citizens Property Insurance. Shortly after the bill passed, the state regulator approved three Florida insurers’ requests to drop more than 50,000 homeowners policies as the state heads into hurricane season. The passed bill includes changes to the state’s one-way attorney fee statute, the eligibility and glidepath of Citizens, and the deadline to file claims. It also places new requirements and restrictions on roofing contractors. But two pieces the industry and experts identified as critical to addressing cost drivers and stabilizing the market were left out of the final bill — the elimination of the state’s attorney fee multiplier and a provision allowing insurers to implement policy language to mitigate roof replacement costs. The provisions were sticking points in both legislative chambers. “It’s a watered-down bill that won’t restore market stability. It will not curb rate increases,” said American Integrity CEO Robert Ritchie. “Everybody is set up for these expectations and everybody’s going to be mad at each other.” “In my view, the most important provisions are the ones that didn’t get in it,” said Joseph Petrelli, president and founder of ratings analysis firm Demotech, which rates more than 40 Florida domestic insurers. Petrelli previously warned that it will be harder for several companies to enhance their financial results, and sustain their ‘A’ ratings, if the Florida Legislature did not pass “meaningful” reform this year. Sen. Jim Boyd, also an insurance broker and owner of Boyd Insurance & Investments in Bradenton, Fla., acknowledged that what passed didn’t have everything he — or the industry — wanted, but he is confident what did pass will make a difference in stabilizing the market, encourage the return of insurance investment capital into the state, and cut down on contractor and litigation abuse in the system. “Rates aren’t going to go down tomorrow, of course,” Boyd said. “But I firmly believe this will have a definite downward impact on what has been continually rising homeowners rates in Florida … I really, truly believe we have done a lot of good toward getting at the root causes of the problem.” Sen. Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve.” “Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his Senate colleagues. If signed by the governor, the legislation would take effect July 1 and includes:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation, including making it illegal for roofing contractors or any person acting on their behalf to make a “prohibited advertisement,” including an electronic communication, phone call or document that solicits a claim. Offering anything of value for performing a roof inspection, an offer to interpret an insurance policy or file a claim or adjust the claim on the insured’s behalf will also be prohibited. Additionally, contractors are prohibited from providing repairs for an insured without a contract that includes a detailed cost estimate of the labor and materials required to complete the repairs. Violations could result in fines of $10,000. Florida’s insurance regulator is optimistic the new reforms will have a positive effect on the state’s marketplace over the longer term. “I think it’s a pretty meaningful step forward, in terms of stabilization, but certainly as with most things, there’s no quick fix, and this is going to take some time to implement,” said Insurance Commissioner David Altmaier. “We’re going to be very carefully monitoring a lot of different data points — most importantly, the impact to consumer rates.” Locke Burt, chairman and CEO of Florida-based insurance company Security First, said the bill will ultimately change “the way that roofers do business, the way public adjusters do business, the way plaintiff’s attorneys do business, and the way that insurance companies do business,” which is “significant.” But “it is not going to cause rates to go down [now]; the best that can happen is it will flatten the curve in 2023 or 2024,” he said. “It’s not going to make agents’ life easier in the foreseeable future.” Litigation Reform Altmaier called the reforms to the one-way attorney fee statute one of the more impactful features of the bill. The new statute stipulates that if a claimant recovers at least 50% of the disputed amount (the difference between the pre-suit demand excluding attorney fees and costs and the indemnity award obtained at trial), full attorney fees would be awarded to the plaintiff attorney. If the indemnity award obtained is less than 20% of the amount in dispute, then no attorney fees are awarded to the plaintiff attorney. Indemnity awards between 20% and 50% of the disputed amount would merit the same proportional award of attorney fee and costs as the percentage of the disputed amount obtained at trial. The fee reforms were modeled after the assignment of benefit legislation that passed in 2019, Altmaier said, which appears to be having a “meaningful impact in reducing the incentive for some of the excessive litigation that we were seeing with AOB.” The Florida Office of Insurance Regulation sent a report to lawmakers during session that found while Florida homeowners insurance claims accounted for just over 8% of all homeowners claims opened by U.S. insurers in 2019, homeowners insurance lawsuits in Florida accounted for more than 76% of all litigation against insurers nationwide. “Litigation trends in Florida have been consistently many times higher than any other state,” the report stated, citing data from the National Association of Insurance Commissioners (NAIC) showing that Florida lawsuits rose steadily from 64.4% of all nationwide homeowners lawsuits in 2016, to 68% in 2017, to 79.9% in 2018 and 76.4% in 2019. “I really think that [attorney fee reform] is going to go a long way in helping to disincentivize some of the excessive litigation, while still allowing the opportunity for consumers to pursue civil remedies against their insurance companies if they feel as if they’ve run out of other options,” Altmaier said. Burt said changes to the one-way attorney fee statute, which has been in place for 125 years, are a “big deal,” but noted it is hard to quantify at this point what litigation savings companies will see. The pre-suit demand requirement will also be “very significant” for insurers. “It is usually very difficult to extract that information from plaintiff attorneys,” he said. “Now we will know what we are dealing with in terms of a demand.” Roofing Claims Abuse Many in the industry, like American Integrity’s Ritchie, said addressing roofing claims was a critical element left out. “Seventy percent of my lawsuits are for uncovered roof claims. Will this curb the lawsuits for roofs? I say no,” Ritchie said. Sen. Boyd said roofing claims are “one of the biggest drivers of rate increases” for Florida homeowners, but the House rejected provisions in the passed Senate bill aimed at stemming these losses by allowing insurers to only offer homeowners policies that adjust roof claims to actual cash value if the roof is older than 10 years. Also rejected was allowing property insurers to offer homeowners to purchase a stated value limit for roof coverage and implement a reimbursement schedule for total losses to a primary structure. OIR did not support the roof ACV provisions, Altmaier said. He expects carriers will see positive results from the combination of curbing roof claims solicitations and the one-way attorney fee reforms. “I think those two things combined are going to make the absence of those other two items much less significant in the overall impact of the bill,” he said. State agencies will be responsible for enforcement of the roofing provisions in the law. The Florida Department of Professional Regulation will handle licensing and the Florida Department of Financial Services will investigate and work to prosecute insurance fraud related to roofing solicitations and claims. “As we await the Governor’s signature on consumer protection legislation passed this session, the Department is preparing to implement measures to curb unlicensed adjusting by holding anyone accountable who looks to profit off of a business model of improperly soliciting insurance consumers and coming between them and their insurance claims,” DFS Communications Director Devin Galetta said in a statement to Insurance Journal. Today’s Market For the insurers that are struggling now, there isn’t time to wait and see if the bill goes far enough. Demotech’s Petrelli said Florida companies are taking action to nonrenew and cancel policies to lower their exposure in particular geographic areas and their reinsurance costs. Southern Fidelity Insurance, Universal Insurance Co. of North America and Gulfstream Property & Casualty were recently approved by OIR to drop more than 50,000 policies because of hazardous financial conditions. “Between the geographical issues and the disproportionate reinsurance cost issues, we think that’s a smart move on behalf of companies,” Petrelli said. Without addressing the other major cost drivers for insurers going forward, Petrelli said the passed legislation is merely “nibbling around the edges.” He does not expect more investment capital or competition in the state and said there soon could be less. Demotech is waiting to review the first quarter results and final reinsurance programs of the companies it rates, but Petrelli noted about five companies could be downgraded. The ratings firm would have been more lenient if Florida had passed “meaningful” reforms, and “there was a true light at end of a litigation tunnel,” Petrelli said. “What would have saved companies, in terms of their rating, is reforms that had immediate teeth. I don’t see these as being immediate nor having the sharpest of teeth.” Florida Association of Insurance Agents (FAIA) President and CEO Kyle Ulrich said while the association is encouraged and supportive of the reforms that passed and thinks it will have a positive impact on the market, significant changes aren’t likely for at least 18 to 24 months. FAIA is advising agents to become comfortable with placing business with Citizens, if they aren’t already, as it is likely more policies are headed that way. “Unfortunately, as much as agents don’t want to have to do it, there are going to be some relying on Citizens in ways that they either never have, or haven’t had to in probably 10 years,” Ulrich said. “The good news is, at least from our perspective, is that Citizens is in a much better place right now to handle that and are easier to do business with than they have been in the past.” Monday, May 24 2021

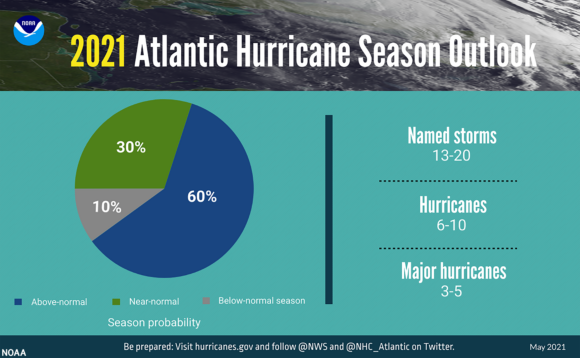

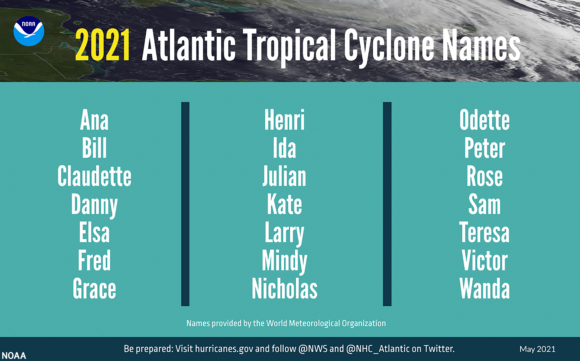

Just days after weather forecasters predicted another above-normal Atlantic hurricane season in 2021, Ana launched the season by forming off of Bermuda. Ana reached Tropical Storm status early on Sunday northeast of Bermuda, but then weakened to a Tropical Depression. The National Weather Service said Ana is expected to dissipate by Monday. The National Oceanic and Atmospheric Administration’ (NOAA) Climate Prediction Center is predicting a 60% chance of an above-normal season this year, a 30% chance of a near-normal season, and a 10% chance of a below-normal season. However, NOAA does not anticipate the historic level of storm activity seen in 2020. Ana was the first “named storm” in the Atlantic this year even though the hurricane season does not officially start until June 1. The season runs through November 30. For 2021, a likely range of 13 to 20 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 5 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher) is expected. NOAA provides these ranges with a 70% confidence. Last month, NOAA updated the statistics used to determine when hurricane seasons are above-, near-, or below-average relative to the latest climate record. Based on this update an average hurricane season produces 14 named storms, of which 7 become hurricanes, including 3 major hurricanes. El Nino Southern Oscillation (ENSO) conditions are currently in the neutral phase, with the possibility of the return of La Nina later in the hurricane season. However, these phases support the conditions associated with the ongoing high-activity era, according to Matthew Rosencrans, lead seasonal hurricane forecaster at NOAA’s Climate Prediction Center.

Forecasters at the National Hurricane Center are now using an upgraded probabilistic storm surge model — known as P-Surge — which includes improved tropical cyclone wind structure and storm size information that offers better predictability and accuracy. This upgrade extends the lead time of P-Surge forecast guidance from 48 to 60 hours in situations where there is high confidence.

Thursday, May 13 2021

Make sure your home is insured before hurricane seasonPublished:May 12, 2021 2:50 PM EDT Updated:May 12, 2021 9:18 PM EDT Insuring your home against a hurricane is more expensive than ever. We look into what you can do to make sure you have enough coverage for a worst-case scenario and save some money on your policy. Summertime in Southwest Florida just isn’t the same for Hope Daley and her husband Matthew Dykes. Hurricane Irma changed everything, damaging their Naples home so much it had to be torn down. “Hurricane season definitely raises our level of anxiety,” Daley said. “I grew up here and never worried about them, and it just takes one really bad one to kind of trash your life and turn everything upside down, and then you’re never the same.” And the full payout of their insurance policy didn’t cover the cost to rebuild, so they had to start over. “My advice, from having gone through it, is to absolutely… do not take any shortcuts on insurance, do not do it, it’s not worth it,” Daley said. But homeowners take shortcuts to save money because policy renewals are at an all-time high. “I heard the other day in a meeting that the average hurricane premium is headed towards $5,000,” said insurance agent Kagen Cookesly. “If we don’t make some meaningful change to help the industry, the rates are going to continue to climb.” Cookesly says the rate increases are out-of-control for homeowners. “At the end of the day, a lot of folks that had these increases, there’s not another market for them—they have to pay,” Cookesly said. “And some of them I’m even telling, ‘You’re lucky to get a policy right now.'” While there’s not a magic bullet to significantly cut your insurance price, there are some simple things you can do around your home to help cut those costs and keep you safer during storm season. To qualify for discounts, you have to hire a licensed home inspector. Home inspector Coty Lawrence walked Hope Daley and Matthew Dykes around their house and checked every opening from the garage door to the windows to see if they are impact-rated. Many of their windows are not impact-rated; if they don’t want to replace them, they can get shutters. “If you don’t have hurricane shutters, you can call your insurance agent and say ‘How much is it going to save me to get hurricane shutters installed?'” Cookesly said. “If it’s a 2002 or newer home, you may already be getting the credit because of the year built. But if your home is built in 2001 or older, those discounts are a lot more meaningful than they were five, six years ago.” And if you have an older home, you could get significant savings with a simple fix in your attic: Install a third nail into the hurricane clips on your roof trusses. And if you got your roof replaced recently, let your insurance company know. “So if you have a roof that’s five years [old] or newer, you’re going to have a gamut of options,” Cookesly said. More options make it easier to shop for a better rate and better coverage. “Get every possible coverage you can and get as much as you can, because you don’t need it until you absolutely need it,” Daley said. Monday, May 03 2021

Florida lawmakers passed two bills on the last day of their 2021 legislative session that make major changes to the state’s auto and property insurance markets. The actions follow weeks of back-and-forth debate on the proposals between the House and Senate chambers. Stakeholders say neither of the potential new laws will do enough to accomplish lawmakers’ goals of reducing rates or weeding out fraud in their respective insurance industries. Both bills are now headed to Governor Ron DeSantis, who will have to sign them before they can become law. Senate Bill 76The bill attempts to address some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion in last year. It passed Friday in the Senate by a vote of 35 to 5 and 75 to 41 in the House. The legislation was revised significantly from its original form at the start of the session and includes:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation. Specifically, SB 76:

Removed from the final legislation was the elimination of the state’s attorney fee multiplier and allowing insurers to include policy language that offers actual cash value instead of full replacement cost on roofs. The industry had urged lawmakers to include these provisions to address cost drivers, but it became a sticking point in both chambers. An amendment passed Friday also eliminated offers of judgment for the insured or the insurer. Senator Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve.” “Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his colleagues. Locke Burt, chairman and CEO of Florida-based insurance company Security First, said he was disappointed lawmakers didn’t take up reforms to the effects of two Florida Supreme Court cases – Joyce vs. FedNat (2017), and Sebo vs. American Home Assurance (2016) – that are said to be partly to blame for perpetuating litigation in the state, as noted in a recent report from Florida Insurance Commissioner David Altmaier. But, Burt said, the legislation that passed makes some much needed changes and is a “step in the right direction.” “I would characterize this a single step,” he told Insurance Journal. “But I would also tell consumers that their rates are going to continue to go up.” Senator Jim Boyd, who is also an insurance broker, acknowledged that the bill is far from perfect and that no one, including the insurance industry and the trial bar, are happy with the result. However, he noted, “we have got to do something. We cannot wait until next year to solve what is an incredibly large problem for our constituents.” Representative Bob Rommel, who worked on the House version of the bill, said the legislation would provide oversight on insurance companies, help attract new carriers to the state of Florida and “make sure homeowners will have a competitive market and have the right to choose the right insurance for themselves.” The Florida Office of Insurance Regulation (OIR) said in a statement that it “appreciates the tireless work of the Florida Legislature to pass meaningful property insurance reform. SB 76 protects consumer’s rights and addresses the current challenges in the property insurance market.” If signed by DeSantis, the new law will take effect July 1, 2021. Senate Bill 54Florida’s passage of this bill will repeal the state’s no-fault personal injury protection (PIP) system and instead require mandatory bodily injury coverage starting at $25,000 for all drivers in the state of Florida. Earlier versions of the legislation required insurers to offer medical payments coverage (MedPay) in the amount of $5,000 or $10,000, but the passed version makes the offering optional and includes an optional $5,000 MedPay death benefit. The bill will also create a new framework to govern motor vehicle claims handling and third-party bad faith failure to settle actions against motor vehicle insurance carriers. A House amendment passed this week added a statement that the statute governing these bad faith actions is not intended to expand or diminish any cause of action currently available against insurance agents who sell motor vehicle liability insurance policies in this state. Brandes, one of three senators to vote against the bill, said its sponsors had not done enough to study how the bill would affect rates. “Florida already has some of the highest rates in the country and unfortunately if you are just struggling to make it… [and] buying just PIP today, rates will go up 40%,” Brandes said. But bill sponsor Danny Burgess, a Republican, argued that a 2016 study from OIR showed rates would go down if the state repealed PIP. He said the provisions addressing bad faith will also help stop fraud that has been rampant with PIP and lead to further rate reductions. “It’s hard to predict market forces, but overwhelmingly the data shows we will see a [rate] reduction,” he said. “Certainly not a steep reduction, but I do believe we will see a reduction.” However, many in the industry and stakeholders have countered that assessment. Insurer trade group the American Property Casualty Insurance Association (APCIA) opposed the bill’s passage, saying it could increase rates on Florida drivers and increase the state’s current uninsured rate of 20%. It worked on an actuarial study to assess the impact of the bill and said its analysis shows it could increase the cost of the average auto insurance policy by as much as 23% or $344. Drivers who carry the lowest levels of coverage could see increases as high as $805 a year. APCIA said more than 28,000 letters from Floridians were sent to lawmakers opposing the bill. The group is encouraging the governor to veto the legislation. “As SB 54 heads to Governor DeSantis’ desk, he has the opportunity to protect Florida drivers from higher auto insurance costs and help keep our roads safer by vetoing this legislation,” APCIA said. Also encouraging the governor to veto the bill is the Personal Insurance Federation of Florida (PIFF) and the Consumer Protection Coalition (CPC). “We are extremely concerned that this bill would substantially increase rates for our customers and Florida residents who can least afford an increase, while forcing hundreds of thousands of Floridians already struggling to pay current premiums to drive without insurance,” said Michael Carlson, president and CEO of PIFF. “On behalf of Florida consumers, the CPC urges Governor Ron DeSantis to examine the potential cost impact this legislation will pose on Florida consumers and consider vetoing the bill if it is found to raise rates and not decrease litigation,” the group said. If signed by DeSantis, the new law will take effect Jan. 1, 2022. Monday, April 26 2021

Florida’s property-insurance market is headed toward a crisis, as mounting carrier losses and rising premiums threaten the state’s booming real-estate market, according to insurance executives and industry analysts. Longtime homeowners are getting socked with double-digit rate increases or notices that their policies won’t be renewed. Out-of-state home buyers who have flocked to Florida during the pandemic are experiencing sticker shock. Insurers that are swimming in red ink are cutting back coverage in certain geographic areas to shore up their finances. Various factors are at play, insurance executives and analysts say. Two hurricanes that slammed the state—Irma in 2017 and Michael in 2018—generated claims with an estimated cost of about $30 billion. The cost of reinsurance, which insurers take out to cover some of the risk in the policies they sell, is swelling. Of particular concern, executives say, are excessive litigation over insurance claims and a proliferation of what insurers see as sham roof-related claims. A large group of Florida homeowner insurers tracked by Marsh McLennan’s Guy Carpenter business had $1.58 billion in underwriting losses in 2020, more than double the $664 million loss in 2019. “The industry is in a panic because it is losing so much,” said Barry Gilway, chief executive of Citizens Property Insurance Corp., a state-backed insurer of last resort that is growing rapidly as private-sector insurers retrench. Barring changes, he said, “rates will continue to skyrocket and it absolutely will have an impact on the real-estate market.” Eric Firestone, a 37-year-old teacher who lives with his wife in the Miami area, received a letter from their insurance company in February saying their policy wouldn’t be renewed because the carrier was no longer servicing their area. When their insurance agent shopped for an alternative, the cheapest one she could find had a $9,644 annual premium—an 85% increase over their most recent premium of $5,205. “Where am I going to get the extra $4,000?” Mr. Firestone said. “Worst-case scenario, I will have to go into credit-card debt.” Florida is the most expensive state in the U.S. for home insurance. Residents are projected to pay on average $2,380 in premiums this year, a 21% increase over the $1,960 paid in 2018, according to estimates by trade group Insurance Information Institute. By contrast, the average American homeowner is expected to pay $1,297 this year, up 4% from $1,249 in 2018. Out of 105 rate increases for multi-peril homeowners policies approved by the Florida Office of Insurance Regulation last year, more than half exceeded 10%, compared with six of 64 in 2016, state Insurance Commissioner David Altmaier informed lawmakers. Ana Regina Myrrha, an insurance agent in the Orlando area, said she hired three more employees because clients’ policies that used to automatically renew now require “re-quoting,” or finding cheaper alternatives. Her office used to tell clients to expect a single-digit rate increase upon renewal, she said, but “we now tell them that a 20% increase is a gift.” Florida lawmakers are considering bills that supporters say would help curb premium increases. Among the provisions of a Senate measure backed by the insurance industry and passed by the Republican-led chamber are limits on attorney fees and roof coverage that proponents say would reduce incentives for frivolous lawsuits and claims. A measure in the GOP-led House that industry representatives consider weaker is expected to come up for a vote in the next few days. If it passes, lawmakers will have until the end of the session on April 30 to negotiate a compromise. Many Democrats and plaintiff lawyers oppose the bills, saying they would hurt consumers by limiting legal recourse against insurance companies. Opponents say the insurance industry is exaggerating the role of fraud in its deteriorating finances and playing down the significance of losses from natural disasters and rising reinsurance rates. While Florida made up 8% of all homeowner insurance claims in the U.S. in 2019, it accounted for 76% of homeowners’ insurance lawsuits, according to an analysis by Mr. Altmaier’s office. A survey by his office of Florida insurers representing about 60% of the market showed they received 90,950 roof claims in 2020, up from 56,657 in 2019. Questionable claims often involve alleged roof damage from hail or wind that the carriers’ adjusters and engineers conclude was due instead to normal wear and tear, which isn’t insured, according to industry executives. In Florida, as in other states, policyholders with disputed claims can sue their insurers. Critics say that Florida law currently allows too-easy access to insurer-paid legal fees, encouraging contractors to drum up business and lawyers to file frivolous lawsuits over claims, seeking the legal fees. “Let me help you get a new roof through insurance!” reads one door hanger that Mr. Altmaier shared with lawmakers. Mandy Wells, 40, a real-estate agent in Cape Coral, met with a representative of roofing company Marlin Construction in 2019 regarding storm damage. The representative guided her on filing a claim and said she would get a new roof, according to Ms. Wells. She signed an agreement authorizing Marlin to receive payment directly from the insurer. But Ms. Wells said Marlin, which has generated numerous complaints to the Better Business Bureau, never performed any work, and broke off contact when she refused to sign additional documents. Scott Hertz, a Marlin attorney, said Ms. Wells cut off Marlin after receiving an insurance payment, and the parties are now locked in litigation, partly over that money. He said the complaints against Marlin are mostly tied to the employee who met with Ms. Wells, who is no longer at the company. Though Florida’s real-estate market remains strong, spiraling insurance premiums could hobble it, real-estate agents say. Some out-of-state buyers streaming into Florida say they are stunned by their insurance bills. Ricardo Calina, 45, a former Wisconsin resident who closed on a house in Winter Garden, near Orlando, in January, said he was upset to learn he and his wife would pay roughly 25% more in homeowners insurance, even though the 4,500-square-foot Florida property is 500 square feet smaller than their Wisconsin residence. “It is frustrating that we are paying more for less,” Mr. Calina said. Meanwhile, in Davie, near Fort Lauderdale, Alexander Barr is worried about getting priced out of the house where he grew up and is now raising his two children with his wife. Earlier this month, they received a renewal notice from their insurance company advising that their premium was increasing to $4,006, a 63% jump from the $2,451 they paid last year. “I can only imagine what’s going to happen next year,” Mr. Barr said. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.