Monday, September 23 2024

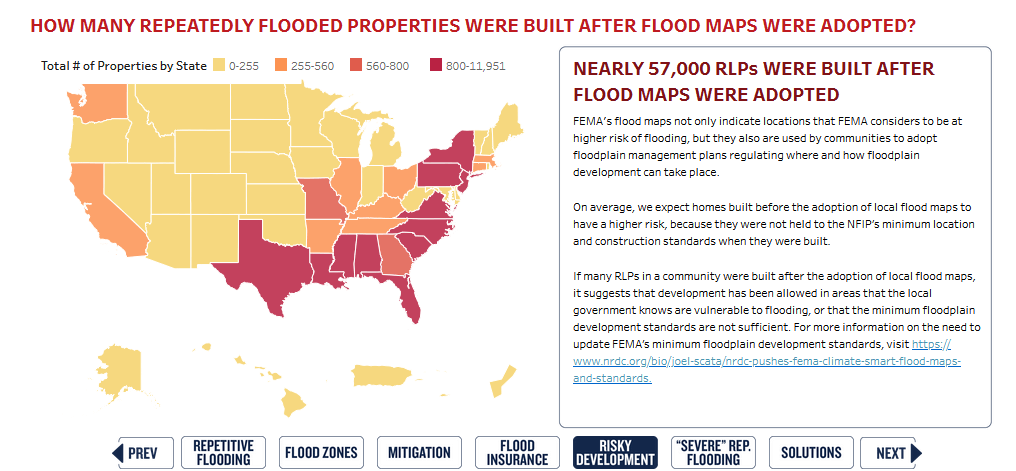

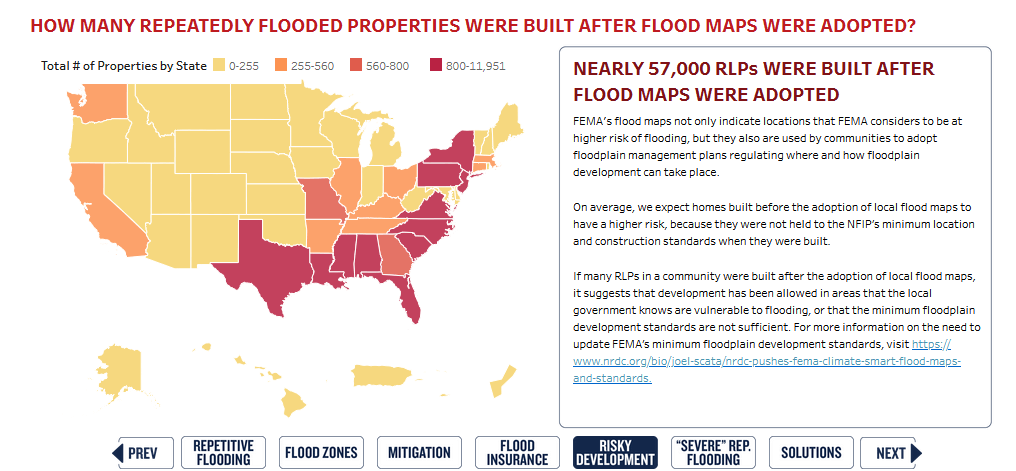

More than a quarter million U.S. properties have repeated claims for federal flood insurance, costing the National Flood Insurance Program billions of dollars in claims, according to new federal data compiled by the National Resources Defense Council.

Four states account for more than half of repetitive loss properties (RLPs), led by Louisiana with more than 43,000. Texas has the next highest with over 41,000, followed by Florida (26,700) and New York (20,400).

Information on properties with repeated claims for federal flood insurance was hard to come until this year, when FEMA published data on properties with two or more NFIP claims.

NRDC, an environmental advocacy, used FEMA’s data to create a new mapping dashboard, Flooded Again, which provides data visualization of RLPs. While all 50 states have properties with repeated federal flood insurance claims, the bulk of RLPs are located in states along the East Coast and Gulf Coast.

Anna Weber, a senior policy analyst at NRDC, said more homes are being damaged by floods because of climate change combined with risky development and out-of-date infrastructure.

“Stronger hurricanes, more intense rainstorms and rising seas are all enacting a toll on people’s lives. We need changes at all levels of government to make communities safer,” Weber said.

Fewer than one in four RLPs have had risk mitigation action, like building elevation or floodproofing the first floor, NRDC said.

Only 13% of single-family homes are covered by federal flood insurance, according to estimates by the Society of Actuaries.

NRDC recommends FEMA should enact the following steps to protect those with, and without flood insurance:

- update the NFIP’s national floodplain development standards to account for worsening floods and put the brakes on risky development;

- ensure that flood-risk maps are up to date and account for climate change;

- be granted authority to make flood insurance more affordable for low- and middle-income households;

- ensure home buyers and renters the right to know their new home’s flood risk

Monday, July 01 2024

After spiking premiums, nonrenewals and complaints about unpaid claims, more than 115,000 property owners in southwest Florida are now facing a new slap in the face after 2022’s Hurricane Ian: 25% higher flood insurance rates because local officials reportedly allowed subpar rebuilding for flood-damaged homes.

Governments in Lee County, Florida, which took the brunt of Ian’s storm surge in September 2022, said in a news release last week that the action from the Federal Emergency Management Agency is a “devastating blow” that came with no warning.

“Without any prior notice, FEMA verbally informed Lee County and some of its municipalities late Thursday that it was altering discounts on National Flood Insurance Program (NFIP) premiums that allow residents to save up to 25%, delivering a blow to the community as it continues to recover from the devastation of Hurricane Ian,” reads the statement from Lee County officials.

FEMA has long allowed the flood insurance premium discounts for communities that enforce the agency’s rebuilding requirements and take other measures to reduce flood losses. These include requiring rebuilding – and in many cases elevating – homes that were more than 50% damaged in a flood event.

But the federal agency said last week that the county and several municipalities had loosened the rules after the storm, allowing many policyholders to stay below the 50% mark and avoid a total rebuild and elevation, The Miami Herald, the Fort Myers News-Press and other Florida news outlets reported.

The move means that the cities and the county will lose the NFIP’s community-wide discounts on flood insurance. Some communities could be booted out of the NFIP altogether, a FEMA official said in a letter, the Herald reported.

Nobody wanted to reach this point, but the federal agency had little choice, and had sent local officials multiple letters requesting correct information on rebuilt properties, Robert Samaan, a regional administrator for FEMA, told the Herald.

FEMA inspectors said they found problems soon after Hurricane Ian slammed through the area in 2022, including much unpermitted rebuilds and a lack of documentation.

Local officials called the move “punitive.”

“Ian was the third costliest hurricane to hit the United States, and many of our residents are still reeling financially from its impacts,” Lee County Commission Chairman Mike Greenwell said in the press release.

“Make no mistake – FEMA is the villain in this nightmare,” Cape Coral Mayor John Gunter said in the statement.

The local leaders said they had undertaken many efforts in recent years to comply with the discount system. But FEMA contends the most important measures were not followed.

The average flood premium will rise by about $300 a year, starting Oct. 1.

Ironically, some critics of the NFIP have warned for years that the program had done little to enforce its Community Rating System parameters, allowing communities nationwide to claim discounts even when homes were not rebuilt to newer code requirements. It’s unclear if the Lee County action marks a new approach by FEMA leadership.

The idea behind the CRS was to encourage communities to keep more buildings out of flood zones and take other steps to prevent flood damage, thus reducing losses to NFIP. Some jurisdictions that gain the highest rating can see discounts as much as 40%.

The CRS is flawed, though, because it undercuts FEMA’s newly established Risk Rating 2.0, which aims to base flood insurance rates more on the risk of individual properties, not area-wide and outdated flood maps, Craig Poulton, head of Poulton Associates, a private company that writes flood and catastrophe insurance, said last year.

Southwest Florida communities may have a chance to rejoin the CRS discount program – but not until 2026.

Monday, July 01 2024

Many more properties, including hundreds of thousands of homes across Florida and other parts of the Southeast, will be required to purchase flood insurance after July 31, due to revisions in federal flood maps.

For some of the most exposed and populous parts of the region, in south Florida, the changes means about 138,800 more structures in Miami-Dade, Palm Beach and Broward counties are now considered to be in the special flood hazard area, a significant increase from previous flood maps, according to the Federal Emergency Management Agency. For properties with mortgages, most owners will be required to buy flood coverage, bringing opportunity to insurance agents and private flood insurers, but more costs for insureds.

“The maps for some parts of Florida have not been updated in 20 years,” said Trevor Burgess, president and CEO of St. Petersburg-based Neptune Flood, one of the largest private flood insurance providers in the country.

Neptune now writes more than 191,000 policies, and Burgess expects that number to grow with the Federal Emergency Management Agency’s flood map revisions.

“The water levels are much higher now, the population has grown, and there have been a lot of changes to the landscape,” Burgess said.

The map revisions put about 252,015 structures in Miami-Dade County into the special hazard area, an increase of 45,420 structures from previous maps, FEMA data show. In Palm Beach County, some 34,154 properties are now in the flood zone, an increase of 5,800.

In Broward County, home of Fort Lauderdale, almost 89,000 parcels that were previously in a low-risk area are now in a higher-risk flood zone, the South Florida Sun Sentinel reported.

An agency official did not provide an estimate of the number of properties nationwide or across the Southeast, but people familiar with the maps said many parts of the region will be affected.

The FEMA map revisions came out this month, just as a tropical disturbance dumped as much as 20 inches of rain on parts of Miami-Dade and Broward counties. The flooding is expected to trigger thousands of claims on cars, homes and businesses, with insured losses in the hundreds of millions of dollars, Aon reported last week.

The changes also come at a time when many vulnerable residents and businesses in parts of the Southeastern United States have backed away from flood insurance. In Texas, the number of National Flood Insurance Program policies has dropped by 6% in the last 12 months, according to Neptune, which analyzed the NFIP data. Louisiana, which has 440,000 flood policies, also has seen the number of policies shrink by 6% in the last year.

Burgess pointed out that while FEMA has revised its maps, it’s partly up to communities to enforce the rules and disallow rebuilding in flood hazard areas. Many local jurisdictions have failed to do that.

In Lee County, Florida, where Hurricane Ian brought heavy storm surge and flooding in 2022, FEMA this spring stripped local governments of community-wide flood insurance discounts after the federal agency determined that many structures were allowed to rebuild without elevating or taking other flood-damage prevention measures. Local officials are continuing to work with FEMA on lightening the penalties.

Wednesday, May 22 2024

The Florida Office of Insurance Regulation (OIR) has noted that it continues to see overall market stabilisation following the “historic” legislative reforms of 2022/2023 that have reportedly enhanced consumer protections, strengthened Citizens Property Insurance Corporation, and encouraged investment by re/insurers.

This news follows the signing of House Bill 1611 by Governor DeSantis, aimed at ensuring the OIR has the tools and authority necessary to maintain accountability within the market.

According to the OIR, rate filings for 2024 show a slight downward trend for the first time in years, which indicates a stabilisation of the property insurance market.

“Ten companies have filed a zero % increase and at least eight companies have filed a rate decrease to take effect in 2024,” the state’s regulator said.

As Reinsurance News understands, rate decreases are being announced by some Florida specialist property insurance carriers, and in some cases, the regulator is pushing carriers to reduce rates after they reported better-than-anticipated underwriting income in 2023 after years of consecutive underwriting losses.

While this is all a sign of an improving marketplace in Florida, some are asking whether rate decreases are too early given the forecasts for a very active hurricane season.

Nonetheless, early signs from the 2024 reinsurance purchasing season are showing further positive indications. The OIR observed that reinsurance is a direct and significant cost to consumers, and relief in this area is “a significant sign” that the reforms are working.

As of Q4 2023, the regulator has noted there are approximately 7.45 million residential insurance policies in force in the Florida property market.

81% of those policies are written by admitted insurers, as opposed to Surplus Lines companies or Citizens.

Eight new companies have also been approved to write homeowners policies in Florida since the reforms, and an additional company was acquired to expand its footprint in the state. Meanwhile, approximately 389k policies have been taken out of Citizens from January 2023 through March 2024.

Monday, April 08 2024

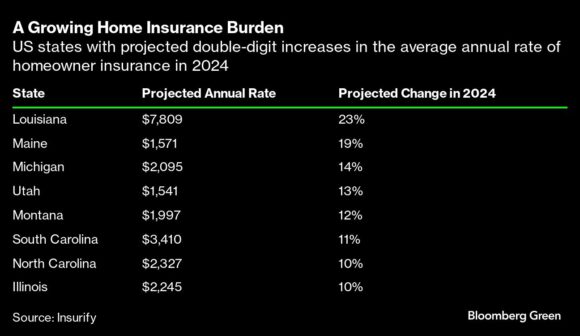

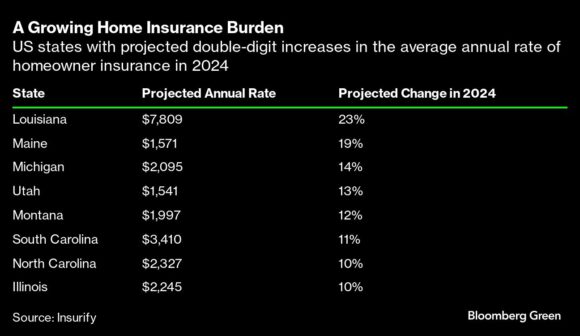

US home insurance rates are expected to reach a record high this year, with the biggest increases occurring in states prone to severe weather events, according to a new analysis.

The average premium for homeowners insurance in the US is expected to hit $2,522 by the end of the year, driven largely by intensifying natural disasters, rising reinsurance costs and higher fees for home repair, according to Insurify, a Massachusetts-based insurance-comparison platform. That figure would represent a 6% increase over the average US premium at the end of 2023, and follows a roughly 20% increase over the past two years.

“Many Americans are motivated to buy a home because they think their housing costs will remain fixed or stable when compared to renting,” says Cassie Sheets at Insurify, who co-authored the analysis. “But this trend of significant insurance rate hikes makes housing costs more unpredictable.”

Home insurance is becoming a flashpoint in the US as damage from thunderstorms picks up and as climate change increases the frequency and severity of natural disasters. In the 1980s, the country experienced about three disasters a year that caused damages of at least $1 billion each. In the 2010s, that climbed to 13 per year, according to the National Oceanic and Atmospheric Administration. Last year, the US endured a record 28 weather and climate disasters that caused at least $1 billion in damages each.

Responding to climate-induced threats, a growing number of insurance companies are pulling out of California and Florida, where those impacts are frequently felt. To fill the gap, state “insurers of last resort” are absorbing trillions of dollars in risk.

“It’s possible that the highest-risk areas will become uninsurable,” says Betsy Stella, vice president of carrier management and operations at Insurify. “However, where there’s demand, typically a supplier will appear. The question will be, at what cost?”

For Insurify’s analysis, researchers collected real-time quotes from the platform and combined them with aggregate rate filings from a third-party data provider. They then analyzed how often and by how much insurers implemented rate increases during the second half of 2023 and the beginning of 2024 and applied that pattern to the rest of this year. Insurify only looked at data for single-family frame houses that met a list of criteria around insurance type, coverage limits and homeowners’ credit score and claim history.

The steepest premiums are expected for states that also have the highest risk of natural disasters. Homeowners in Florida, who already pay the highest rates of home insurance in the country, are expected to see another 7% increase this year — bringing the state average to $11,759, more than four times the national average.

Six states, including Texas and Washington, will see their premiums remain almost flat this year, according to the analysis, which cited a healthier insurance market and the stabilizing effect of local legislation. South Dakota is the only state likely to see a meaningful drop in premiums: Its average is expected to fall about 3% to $2,488.

For states with rising premiums, Insurify’s researchers largely point the finger at the increase in natural catastrophes. According to AccuWeather, the US can expect an “explosive” hurricane season this year, with the potential for as many as 25 named storms between June and November, compared with about 14 on average. Meanwhile, sea-level rise and other adverse climate impacts are catching up with historically low-risk states like Maine.

The rising cost of reinsurance — through which insurers can hedge their risk by buying protection from other insurers — is also playing a role in higher premiums, as are the growing costs associated with home reconstruction. Insurance fraud and legal disputes also contribute to higher rates, the analysis notes. That problem is particularly acute in Florida, which accounts for 9% of home insurance claims but 79% of lawsuits over filed claims, according to a 2022 statement from Governor Ron DeSantis.

Friday, March 22 2024

In 2023, Florida’s domestic insurers turned a net profit for the first time in seven years, a new report by marketing intelligence company S&P Global said.

The study of “around 50” Florida-based insurers credited the turnaround to investment income, a mild hurricane year, and tort reforms that took effect in March 2023.

The group reported $147.3 million in net income for 2023, according to the analysis by Jason Woleben of S&P Global Market Intelligence that was released on Wednesday. That compares to net losses of more than $1 billion in each of the previous two years.

The results are likely to renew hopes that insurers might soon begin to reduce property insurer rates for Florida’s homeowners.

The report quoted Universal Insurance Holdings CEO Stephen Donaghy as telling investors during the company’s third-quarter earnings report last year that future rate reductions in Florida might be possible.

Yet Universal Property & Casualty, the flagship company of Universal Insurance Holdings, was among just four of Florida’s top 22 private-market insurers, as ranked by direct premiums written, to post a net loss in 2023.

The company lost $99.6 million last year, compared to $141.2 million in 2022, the report said.

State-owned Citizens Property Insurance Corp. posted a $746.5 million net profit last year after reporting a $2.24 billion net loss the year before, Woleben wrote.

Citizens’ results were not counted among the totals in the report.

Other companies that made money last year were State Farm Florida ($52.2 million), First Protective ($16.2 million), Slide ($15.5 million), American Integrity ($16.6 million), American Coastal ($105.9 million), ASI Preferred ($13.5 million), Edison ($42.0 million), Security First ($13.6 million), Heritage Property & Casualty ($20.2 million), Homeowner’s Choice ($12.9 million), Florida Peninsula ($46.8 million) and Auto Club Insurance Co. of Florida ($40.9 million).

Companies that posted losses included Tower Hill Insurance Exchange (-$86.9 million), Kin Interinsurance Network (-$59.5 million), and Privilege Underwriters Reciprocal Exchange (-$29.7 million).

While the top 50 companies also posted an underwriting loss for the eighth straight year, the combined loss of $190.8 million was “considerably better” than losses of nearly $1.8 billion in 2022 and $1.52 billion in 2021, the report said.

The 2021 and 2022 loss totals included nine residential insurers that have since become insolvent or merged into other companies.

Rate reductions soon?

The improved income result fuels confidence “that you will either see rate reductions or stability of rates over the next six to 24 months,” said Stacey Giulianti, chief legal officer for Boca Raton-based Florida Peninsula. “My understanding is that the industry is beginning to see the positive effects of legislative action, and loss ratios (insurers’ expenses compared to revenue) are in sharp decline.”

Mark Friedlander, spokesman for the industry-funded Insurance Information Institute, was less optimistic, stating that the U.S. property insurance industry posted its worst underwriting result in a decade last year, with a $38 billion underwriting loss due to $100 billion in storm losses, replacement cost inflation, and reinsurance pricing.

“Net income improvements were driven by exceptional investment results in the financial markets, not because of rising premiums,” Friedlander wrote.

While forecasts for the upcoming hurricane season have not yet been released, Friedlander said “early indications are this is going to be a very active year with the potential of significant impacts on Florida.”

Some scientists have forecast a La Niña by summer. That’s a pattern of cooler waters along the equator in the Pacific Ocean that often leads to more active hurricane seasons in the Atlantic Ocean.

Projections of an active storm season would increase costs that Florida insurers would have to pay for reinsurance, and those increases would be recovered by raising prices for homeowners coverage in the state, Friedlander said.

Reduced litigation levels in Florida will hopefully keep rate increases “moderate” in Florida compared to recent years, he said. “However, declining rates are not a realistic scenario in 2024 based on the macro factors impacting the industry.”

Defense costs still high in Florida

S&P Global’s report states that property insurers in Florida are optimistic about the long-term benefits of tort reforms that were enacted in 2022 and 2023.

Effects of tort reforms could be seen in the firm’s tallies of Defense and Cost Containment Expenses — costs related to investigating or litigating specific claims.

DCCE costs can include legal fees, court costs, expert witnesses, investigation costs, costs of records duplications, expert witnesses, and trial preparations.

In Florida, DCCE costs among property insurers fell to $739.2 million after hitting $1.6 billion in 2022, thanks largely to Hurricane Ian. It’s the lowest total since 2019, a year no hurricane struck Florida, Woleben wrote.

A majority of the incurred defense costs came from the homeowners business line. They fell to $593.5 million in 2023, compared with $1.23 billion in 2022 and $571.1 million in 2021.

Even at $739.2 million, Florida insurers spend much more on defense costs than any other state in the nation, S&P Global said. States with the next highest defense spending totals were California ($401.6 million) and Texas ($284.7 million).

While plaintiffs’ attorneys would say the high number is caused by insurers failing to pay or underpaying, Giulianti blamed the “one-way attorneys fee statute” that encouraged plaintiffs lawyers to file suit over what he called relatively small fee disputes.

A state law in effect for more than a century required insurers to pay plaintiffs’ legal fees if litigation resulted in a judgment or settlement that exceeded an insurer’s original offer by any amount. But the tort reforms narrowed the types of cases that require insurers to pay plaintiffs’ legal fees, making attorneys less likely to file them, Giulianti said.

“With an attorney fee provision, you take any case at all, because all you have to do is get a settlement, and 99.9% of the cases settle, and you tack exorbitant fees onto it,” he said. “Now, if a lawyer is going to take a case, they have to believe in it strongly. It has to be extremely meritorious and serious.”

Giulianti added that claims have declined as well, because many were previously “either trumped up or manufactured by public adjusters and trial lawyers.”

Thursday, February 29 2024

The legislative reforms aimed at improving the property insurance market in Florida are increasingly seen as having a positive effect, with carriers increasing their appetite for writing in the state and analysts suggesting the benefits of the reforms could be significant over time.

As we reported earlier this year, data released on homeowners’ property insurance lawsuits had already showed a decline in litigation.

The CEO of insurer Universal had said last year that he felt the situation was improving thanks to the reforms, which he reiterated again in the firm’s latest earnings call saying that property insurance claims trends are definitely looking better in Florida.

At the same time, while the Florida property insurance market is seen as improving and recent legislative reforms are expected to ultimately drive more capital to support reinsurance for the Florida marketplace, some in the insurance-linked securities (ILS) industry have rightly highlighted that there is still likely to be a premium charged for capacity deployed to the state.

That’s a given, until we really see the full effects of the already enacted legislative reforms, as well as any additional property insurance or reinsurance measures taken in the still ongoing Florida session this year.

But, the underlying sentiment seems to be that Florida’s marketplace for insurance is getting healthier all the time and this is now even encouraging some carriers to write more business there again.

Case in point American Integrity, which we have learned is to begin offering more capacity by starting to write DP-1 Owner-Occupied policies, in all Florida counties the insurer is active in, again.

Yes, this will be restricted to policyholders with no lapse in coverage and no prior losses, but it is going to be available statewide, except in Broward, Miami-Dade, and Monroe counties we understand.

American Integrity has also expanded availability of HO-3, DP-3 and its Integrity Select policies in certain areas and zip codes in Florida, while also expanding short-term rental coverage statewide and making its flood endorsement more widely available.

But, most importantly, is how American Integrity explained its capacity updates, saying, “Recent legislative reforms aimed at both tackling abusive litigation practices in Florida’s property insurance market and increasing long-term certainty in Florida’s business climate have helped make this decision possible.”

Which is a glowing review for the lawmakers and will hopefully spur them on to make further improvements in the ongoing session.

We’ve heard similar stories of increased appetites at other primary carriers in Florida, although it seems the national companies are in the main still waiting for more evidence and perhaps to see what additional reforms the current legislative session may bring.

Another signal of improving conditions in comes out of insurer Progressive, which has also said that the Florida insurance reforms are benefiting the company.

The management of Progressive have said that recent reserve releases were specifically related to Florida and that the recent reforms are a positive for them and other insurance carriers operating in the state.

It’s worth noting that the equity analyst team at BMO Capital Markets estimates that the Florida insurance reforms could be worth at least a 5 point loss ratio improvement in 2024 for Florida portfolios of risk.

That’s a meaningful improvement and just the kind of buffer that might encourage more insurance and reinsurance capacity to the state of Florida this year.

The BMO Capital Markets analyst team said that some lawyers they have spoken with believe the benefit of the reforms could be even greater over time, as many of the reforms tackle litigation which has a long-tail.

But, for the benefits to already be so clearly showing that carriers are encouraged to deploy more of their capital into the state, shows that the Florida property market environment may have turned the corner and be on a steady path back towards becoming a much more functional marketplace.

Of course, no amount of legal reform can reduce the threat of loss, hurricane seasons and severe weather will continue to erode re/insurance capital in Florida over time.

But, there are some other signals of improvement, such as where it is being said that building codes in Florida are seen as a significant factor in reducing the potential insurance industry loss from hurricanes there.

All of which adds up to some interesting inputs for reinsurance capital providers decision-making, as to how much exposure to take on in Florida this year.

Should the evidence of improving conditions persist through the coming months, or become increasingly apparent, it does have the potential to elevate the appetite of capital providers for Florida risk and perhaps elevate the levels of competition at the June reinsurance renewals.

Wednesday, October 11 2023

One of the biggest sources of confusion for customers after Hurricane Ian was the difference between “wind-created openings” and “wind-driven rain.” This is an important distinction that often determines whether the damage is covered or not.

In general, if water enters through an area of the home in which the exterior materials are ripped, torn, broken or smashed as a result of the storm, allowing rain to enter the dwelling, the damage caused by that wind-created opening would generally be covered under the policy unless an exclusion applies.

However, if water seeps into a home during a storm through a window pane, flashing point, material transition, around sealants, through seams and natural openings like a door jamb, and the exterior materials were not ripped, torn, broken or smashed creating an opening, that would be considered wind-driven rain. That damage is typically not covered by a base policy (though American Integrity offers an endorsement that covers this damage).

Fast fact: many windows are designed with weep holes and other design elements to allow water to escape the tracts when heavy rain is pelting them. The windows will allow water through in some instances, but does not mean they are damaged. It is a safety and design feature, so customers should consider adding an endorsement to their policy to ensure this coverage.

Monday, July 17 2023

Trouble in raising rates may be among the reasons for the retreat

Insurers are trapped in a riddle: In a world where the risk of costly disasters is rising but high premiums are squeezing policyholders and angering state regulators, how can they continue to make money?

That question was at the center of the decision by Farmers Insurance last week to stop renewing almost one-third of the policies it has written in Florida, becoming the latest insurer to pull business from a state as the industry grapples with the rising costs of covering damage tied to floods, hurricanes, wildfires and other climate-related disasters.

Farmers, one of America’s biggest home insurers, didn’t say what specifically led to its decision. Was the cost of payouts too high in recent years, which saw record-setting numbers of billion-dollar disasters, just as rates charged by reinsurers, which sell insurance to insurers, were rising? Was it too many lawsuits from policyholders? Or is Farmers playing a game of chicken with state regulators, hoping that walking away now will give it leverage to charge customers more in the future?

“A lot of insurers have been losing a lot of money in Florida and they’ve been threatening to leave for years,” said Daniel Schwarcz, a professor at the University of Minnesota Law School who specializes in insurance.

In most states, insurers have to behave like electrical utilities: If they want to increase the rates they’re charging their customers, they have to apply for regulatory approval from the state government to do so.

Insurers’ trouble in raising rates may be among the reasons they are retreating in places like Florida and California, where climate change is causing the costs of paying claims — which insurers refer to as “losses” — to soar. When it’s hard toraise rates as companies have done in certain places, the best business decision is to leave.

In May, State Farm, the country’s largest insurance company, said it would stop selling homeowners’ coverage in California. Last month, Allstate said it would stop selling new home and commercial policies in the state, citing the worsening climate and rising building costs. Farmers said this month that it would limit new homeowners insurance policies in California, citing rising inflation and risks from worsening climate disasters as among the reasons.

Florida law lets regulators deny rate increases or even force insurers to return money to customers if the rates they’re charging or hoping to charge are “excessive,” meaning they could generate a profit regulators consider “unreasonably high in relation to the risk involved.” Floridians already pay more than the national average for homeowners insurance. Insurance on a $250,000 home in Florida cost an average of $1,981 this year, while the national average was $1,428.

Some experts, like Schwarcz, say state regulators have too much control over how insurers set rates, keeping them artificially low even as the cost of paying out claims after devastating and more frequent storms continues to rise.

Other experts say it’s not less regulation that is needed, but more of it — specifically, better management of so-called reinsurance companies that operate out of the sight of consumers and sell insurance to home and auto insurers to help them manage their risk. These companies have raised their rates sharply in recent years. State regulators have less authority over reinsurers, allowing those companies more freedom to charge insurers rates as they see fit.

Industry lobbyists say that it’s neither of those things and that insurers are folding parts of their business to reduce the number of claims-related lawsuits from policyholders.

“This business decision was necessary to effectively manage risk exposure,” Trevor Chapman, a spokesperson for Farmers, said in an email.

Chapman added that Farmers was not totally pulling out of the state, just ending its home, auto and umbrella policies sold under the Farmers brand. Any damage that occurs to policyholders’ properties before their yearlong policies end will still be covered. The company sells policies under several other brands, which it plans to keep running.

A spokesperson from the Office of Insurance Regulation said the written notice the company sent to the regulatory agency Wednesday was marked as a “trade secret.”

Schwarcz said Florida’s politicians and regulators should have seen this coming.

The Florida insurance industry has also seen smaller insurers vanish. Over the past two years, eight small insurers have gone bankrupt in the state. The string of retreats and bankruptcies has left many homeowners with few options other than a nonprofit, state-backed carrier.

According to the Insurance Information Institute, an industry trade group, property and casualty insurers have not, as a whole, earned profits on underwriting — or as a result of their overall business activities — in Florida since 2016. The industry’s cumulative underwriting losses have topped $1 billion for the last three years. Last year, the institute said, insurers’ cumulative net income losses in the state totaled $900 million.

“While some states have very bad years financially, like Louisiana in 2020 and 2021 due to the record level of hurricanes, no other state has reported sustained losses for property insurers like Florida has since its last profitable year in 2016,” said Mark Friedlander, a spokesperson for the institute, which represents consumer insurance companies.

“The problem is that there’s denial among folks that live in Florida and folks that live in California — and, frankly, the American population — about the dangers that we’re facing,” Schwarcz said.

His proposed solution: Let insurers charge whatever they want to for policies in disaster-prone areas. Eventually, that would lead people to stop building homes and businesses that were very likely to be destroyed by natural disasters. “That would actually result in a more resilient infrastructure, more adaptive to climate change.”

Birny Birnbaum, an insurance expert who is the executive director of the Center for Economic Justice, a nonprofit working toward equal access to economic opportunity, said Schwarcz’s idea — letting market forces dictate how homeowners respond to climate change risks — would not fly.

“That’s like saying, ‘As long as I can keep paying more and more each year, I don’t care if my house burns down because there will always be more to pay for it,’” Birnbaum said. “That’s insane.”

Insurers in Florida and other states where the disaster threats are higher, like California, are struggling because the reinsurance companies they’re turning to for help managing their risks are charging too much, and no one is regulating them, Birnbaum said.

Reinsurers offer insurance companies a guarantee that if something huge goes wrong like a giant hurricane hitting southwest Florida, they’ll be able to find the cash to pay for it. The reinsurance market, although large, tends to be volatile, with prices spiking quickly just when insurers are least prepared to handle the increases.

Birnbaum, who sits on a committee that advises the Treasury Department on insurance matters, said reinsurers should have their rates regulated more like consumer insurance companies do. He also argued that the federal government should create a national reinsurance backstop similar to its terrorism insurance program, which guarantees that the government will step in and help cover catastrophic losses once they reach a certain dollar amount.

The Reinsurance Association of America, a leading traade group representing dozens of reinsurers doing business in the United States, did not respond to requests for comment about the role of the industry or debates about more stringent regulation.

The cost of reinsurance in Florida jumped 40% to 70% this year over last year, according to the Insurance Information Institute. But Friedlander said reinsurance rates were higher in Florida than in other storm-prone states because of insurer losses tied to lawsuits.

“Legal system abuse and claim fraud are the man-made factors that have generated Florida’s property insurance crisis, not catastrophe losses,” Friedlander said. In Florida, insurance companies feel it’s too easy for people to sue them, he said. More than 100,000 lawsuits have been filed each year against insurers in Florida for the past several years, he added.

Tuesday, May 30 2023

With the June 1 reinsurance renewals a week away, the outlook for Florida-based property insurers may not be quite as dire as many had predicted earlier this year, at least according to a top official with one of the world’s largest reinsurance brokers.

“So far, what we’re seeing is a much more orderly renewal process than what we saw in 2022,” Rhandahl Fuller, managing director and Florida practice lead for Guy Carpenter & Co. He spoke this week at an online Florida market briefing hosted by the AM Best financial rating firm.

While some in the industry have warned that reinsurance renewal costs could rise another 40% next month, along with tightened availability, Fuller suggested the feeling now is more of “cautious optimism.”

“We saw a bit more overall appetite as some of the reinsurers that had stepped back last year either reentered or they increased their participations this year,” he said.

And one big reason for the measured sanguinity is that recent Florida legislative reforms, which have limited assignments of benefits and one-way attorney fees, already appear to be having an impact on many carriers’ long-suffering bottom lines.

Claims litigation and defense containment costs in Florida rose steadily from 2014 to 2018, dipped a bit in 2019, then rose again, explained Chris Draghi, AM Best’s associate director, who also spoke at the webinar. Since 2013, defense costs have increased more than six-fold and since 2018, Florida insurers have spent $2.6 billion in that category for homeowners, allied lines and fire insurance claims. Draghi called that “a material amount.”

Looked at another way, the direct defense and cost-containment expenses for Florida carriers were about 8% of direct premiums earned in 2022, compared to 2% for most other states. The next-closest state was Louisiana, with about a 4% cost number.

But since late 2022, those defense costs have started to drop in the Sunshine State, after May and December legislative changes, the AM Best-compiled data show.

“We really started to see the impact pretty quickly,” Fuller said. “We’re already starting to see companies observing pretty significant decreases in reported claims and frequency of AOB, and frequency of litigation. So a lot of that stuff is kind of happening behind the scenes and not all of it’s going to be reflected in operating results right away.” “We really started to see the impact pretty quickly,” Fuller said. “We’re already starting to see companies observing pretty significant decreases in reported claims and frequency of AOB, and frequency of litigation. So a lot of that stuff is kind of happening behind the scenes and not all of it’s going to be reflected in operating results right away.”

Combined ratio for Florida carriers, excluding major national companies and Citizens Property Insurance Corp., also has dropped since 2020, after rising steadily for six years, Draghi pointed out. In 2014, those carriers enjoyed a luxurious combined ratio in the high 70s. But by 2020, that had almost doubled before sliding back slightly. For many insurers, though, the bellwether measure of profit is still well above 100, he noted.

Direct-loss ratios also are improving, Fuller said. For the first quarter of this year, the Florida domestic industry saw the ratio drop 5 points from the same time in 2022. The average ratio is now 15 points lower than the five-year average for Q1 – “pretty meaningful movement there,” Fuller said.

“We saw that more than 75% of the companies were reporting improvements year-on-year on that direct-loss ratio,” he noted. “So that’s really, really encouraging.”

But the Florida market is not out of the woods yet, Fuller and Draghi said. Capital contributions since 2018 for those Florida carriers, excluding Citizens and major nationals, have increased significantly, totaling $1.8 billion. But in that time, surplus amounts have risen just $158 million, or about 7.6%, Draghi’s data show.

“So what this indicates is that there has been a substantial amount of capital that has been flowed into these primary insurance carriers that is almost needed in order to keep them afloat,” he said. “And you have to wonder how long that can continue, if there’s any concerns in that kind of dynamic.”

|