Thursday, September 28 2017

Anti-fraud strike teams comprised of investigators working for the Department of Financial Services’ Division of Investigative and Forensic Services will soon be deployed across the state in an effort to to protect Floridians from post-storm fraud, according to a statement from the Florida Department of Financial Services.

CFO Patronis announced the formation of three teams that will work in areas heavily impacted by Hurricane Irma: South Florida, including Miami-Dade and Monroe counties; Southwest Florida, including Lee and Collier counties; and Central Florida, including Polk and Orange counties.

Patronis is working directly with prosecutors housed within each of the respective State Attorney’s Office, to “ensure that law-breakers are prosecuted to the fullest extent of Florida law,” the statement says.

“The unfortunate truth is that some individuals will attempt to take advantage of consumers during this high-stress time,” Patronis said. “To combat fraudsters attempts to swindle Floridians, we’re putting boots on the ground to ward off fraud and swiftly address any scams that may arise.”

These strike teams are trained insurance fraud investigators with specialized knowledge of property & casualty fraud and workers’ compensation fraud. In addition to identifying active fraud operations in the field, investigators will work with each community to educate homeowners, homeowners’ associations and local law enforcement about the red flags of fraud.

Floridians can report suspicious behavior by calling the Department’s anti-fraud hotline at 1-800-378-0445, or by contacting one of the Department’s regional insurance fraud offices. To find a map of the Department’s insurance fraud offices in Florida, click here. Callers are asked to provide as many details as possible, and callers may request to remain anonymous.

More information on the the Department of Financial Services’ anti-fraud efforts is available on its website.

Wednesday, September 27 2017

Hurricane Deductibles

From June 1st to November 30th, the Gulf of Mexico and eastern coast of the United States is on alert for Hurricane Season. Eyes turn to the National Hurricane Center during this season to watch and prepare for any storm threats.

According to the Florida Office of Insurance Regulation, wind damage is considered hurricane damage if the damage occurred DURING a hurricane named by the National Hurricane Center of the National Weather Service. The duration of a hurricane is defined by the following:

- Begins when a hurricane Watch or Warning is issued for any part of Florida by the National Hurricane Center;

- While hurricane conditions continue to exist in Florida; and

- Ends 72 hours after the hurricane watches and warnings are lifted in Florida.

The National Hurricane Center declared Hurricane Irma’s duration for the state of Florida to be from 11 a.m. on September 7, 2017 to 5 a.m. on September 14, 2017. Any wind-related damages occurring within this time frame would be subject to your hurricane deductible.

So just how much is a hurricane deductible and when does it apply?

Hurricane deductibles are a percentage of your Coverage A – Dwelling amount. In Florida, a typical homeowners insurance policy hurricane deductible is 2% of Coverage A – Dwelling amount.

For example, if your Coverage A amount is $200,000, then your hurricane deductible would be $4,000.

Your deductible is subtracted from your claims loss amount as you are required to cover the deductible amount BEFORE your insurance kicks in. After this amount is met, any other hurricane related damage is covered by your insurance for the remainder of the calendar year. Since hurricane deductibles are a calendar year deductible (January 1 – December 31), if you do not meet your hurricane deductible amount and experience a second hurricane loss, the deductible will be either the remainder of the hurricane deductible or the AOP (All Other Perils) deductible, whichever is greater. If you did meet your hurricane deductible, then the AOP deductible will apply for any subsequent hurricane loss.

It is important to keep ALL of your receipts and a running tally of your out-of-pocket expenses. This way when a storm strikes, you’re prepared to show how much of your deductible you’ve met after filing a claim.

Monday, September 25 2017

Although insured losses as a result of Hurricane Irma will not be as severe as originally forecast, the storm still represents a sizeable catastrophe event that will test the infrastructure and potentially strain the financial wherewithal of some local and regional carriers in Florida, particularly those that are geographically concentrated, according to a new briefing from A.M. Best.

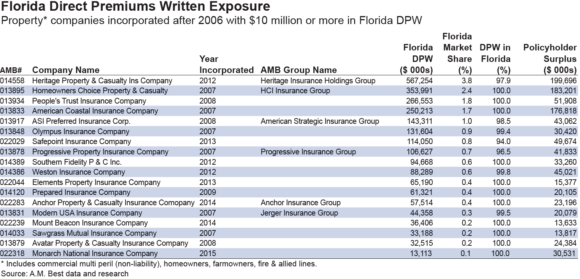

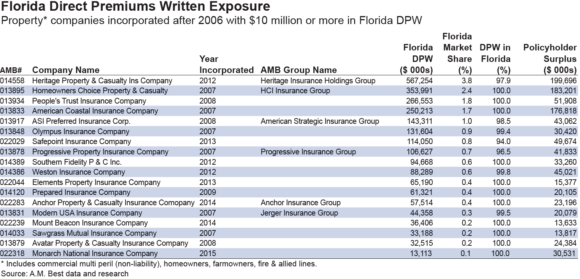

The Best’s Briefing, titled, “Hurricane Irma Tests Newer Participants in Florida Market,” notes that over the past decade, the number of more concentrated local/regional writers in Florida’s insurance market has increased as national writers pulled back on the state.

The state-formed Citizens Property Casualty Insurance Corporation took on much of that risk exposure, and as a result, experienced significant financial pressure. This led to a fairly successful depopulation program, whereby private insurers were given incentives to assume policies from Citizens. This, along with other factors that included benign weather in Florida and favorable reinsurance pricing, prompted many new insurance companies to form.

According to the report, a number of new insurance companies were formed since 2007, writing nearly a fifth of the property market lines: homeowners, farmowners, fire and allied, and commercial multiperil (non-liability). Hurricane Irma represents the first severe event to test the strength of these business models, particularly with regard to risk selection, loss mitigation and potentially their reinsurance programs.

The report also states that with Hurricane Irma occurring in such close proximity to Hurricane Harvey, the demand for independent catastrophe claim adjusters has increased. A.M. Best-rated entities had already started strengthening their claims processes in response to the state’s Assignment of Benefit issues. Newer companies may face additional pressure from a lack of experience as well as limitations due to scale.

The report warns that Hurricane Irma has the potential to amplify the AOB issue, which had already led to performance constraints in the Florida market from an increase in the frequency and severity of litigated water claims. A.M. Best said insurer performance had deteriorated in recent years in large part due to the AOB issue.

“A.M. Best expects that Hurricane Irma and AOB losses will have a much greater impact on operating results for the concentrated insurers, and will continue to monitor the effects of risk-adjusted capitalization,” the report states.

A.M. Best does not expect a significant number of rating actions on its rated insurers to result solely from Hurricane Irma, but reinsurance programs that respond differently from what is anticipated could increase ratings pressure.

A.M. Best said that ultimately, although the aftermath of Hurricane Irma may be bleak for some regional and local carriers, particularly overexposed companies with earnings and potential capital concerns, it believes opportunities will emerge for others.

“An insurer that can effectively navigate through the storm and potentially others during this hurricane season may attract displaced insureds,” the briefing states.

Insurers also may need to rethink their risk selection, risk tolerances and reinsurance purchases, and some may consider diversifying outside of Florida or revamping products. Smaller or struggling companies in the Florida insurance market also could become merger and acquisition targets, the ratings agency said.

A full copy of the special report is available through A.M. Best.

Friday, September 22 2017

With two Florida landfalls in the same day, Hurricane Irma‘s destructive wind and flood damage could cost up to $65 billion for both insured and uninsured losses, according to a recent estimate by CoreLogic.

Residential property flood loss is estimated at up to $38 billion, CoreLogic reported, noting that includes storm surge, inland and flash flooding in five states – Florida, Alabama, Georgia, North Carolina and South Carolina.

80 percent of the flood damage is uninsured, the company said.

Reported insured flood loss for commercial properties could top out at $8 billion.

AIR Worldwide estimated insured losses for the U.S. States resulting from Irma will range between $25 billion – $35 billion.

The catastrophe modeling firm noted the hurricane-force winds extended 80 miles from the eye and tropical storm–force winds extended more than 400 miles, covering the entire state and driving storm surge into both the Atlantic and Gulf coasts.

Downed trees, signs and utility poles and flooded or debris-strewn streets could be seen in the southern regions of the state, AIR Worldwide reported.

Karen Clark & Company estimated losses in the U.S and Caribbean at $25 billion. Of the $18 billion insured loss in the U.S., the majority is in Florida, followed by Georgia, South Carolina and Alabama, KCC reported.

As of Thursday, Sept. 21, the Florida Office of Insurance Regulation reported more than 397,000 residential property claims and just over 17,000 commercial property claims had been filed. Including all types of losses, total estimated insured losses thus far had passed the $3 billion mark. OIR has been updating claims data daily.

According to A.M. Best, the top five homeowners’ insurers in Florida are: Universal Insurance Holdings Group, Tower Hill Group, State Farm, Federated National Insurance Co., and Citizens Property Insurance Corp.

In response to the storm, Universal Property & Casualty Insurance Company reported it has more than $300 million in surplus, as well as a catastrophe reinsurance program that provides $2.65 billion in coverage to cover an event like Hurricane Irma. The insurer stated its projected losses from the hurricane are considerably lower than the limits of its catastrophe reinsurance program. UPCIC has not reported on the claims it has received to date.

As of September 18, Tower Hill reported receiving 20,000 claims resulting from Irma. The company has 300 catastrophe adjusters stationed in Florida. The insurer commented that many of its customers reported light to moderate damage, with most claims not requiring a visit from an adjuster before settlement.

As of September 14, State Farm reported it had received 26,700 homeowner and 7,700 auto claims from Irma.

Federated National Insurance Company and Monarch National Insurance Company (partially owned by Federated National) both write homeowners’ insurance in Florida, according to a press release issued after Irma. Each company purchases its own separate reinsurance program. Federated National’s single event pre-tax retention for a catastrophic event in Florida is $18 million. Monarch National’s reinsurance program covers Florida exposures and all private layers of protection have prepaid automatic reinstatement protection which affords Monarch National additional coverage for subsequent events. Neither company reported the claims it received resulting from Irma to date.

Citizens Property Insurance began opening catastrophe response centers across Florida to handle Irma claims. The state-run insurer has not released claims figures to date.

Texas-based Interstate Restoration, a disaster restoration firm, reported it had 90 employees stationed in Florida prior to the storm, with another 60 new hires ready to go.

CEO Stacy Mazur said the firm’s workers face the same challenges Florida residents are experiencing.

“Those challenges include lodging, power outages and scarcity of fuel,” said Mazur.

An additional 500 subcontractors in the southeast U.S. will join the Florida crew, he said.

Thursday, August 31 2017

Insurance scammers have already started preying on homeowners impacted by Hurricane Harvey.

The Federal Trade Commission has issued a warning that scammers are making robocalls in areas affected by the storm, tell homeowners that their flood insurance is overdue and must be paid immediately in order to maintain coverage.

But the Federal Emergency Management Agency, which oversees the National Flood Insurance Program, generally provides extended grace periods during natural disasters, according to a CBS News report. During the flooding in Louisiana last year, FEMA extended its usual 30-day grace period for renewals to 120 days in affected areas. So even if a homeowner’s premium payment was due at month’s end, his flood insurance wouldn’t be cancelled during the storm.

“Every time there is a natural disaster, scammers jump in,” Lois Greisman, associate director for the FTC’s marketing practices division, told CBS News. “No one should be calling you about paying premiums right now. Everybody knows what is going on.”

Greisman also warned that FEMA representatives would never show up at your door to hand out financial aid. Some scammers go door-to-door and tell homeowners that they’re there to help – the homeowner just needs to pay an upfront “application” fee.

“That’s not the government’s method of doing business,” Greisman said.

According to the FTC, hurricane victims are much more likely to receive money from FEMA than to have to make a payment. The FTC is currently helping displaced hurricane victims cover temporary living costs, according to CBS News. The agency asks that flood victims make their initial claim online at www.disasterassistance.gov or call 1-800-621-3362.

And if you suspect someone is trying to scam you, call the FEMA Disaster Fraud Hotline at 1-866-720-5721.

Monday, August 28 2017

Hurricane Harvey’s second act across southern Texas is turning into an economic catastrophe -- with damages likely to stretch into tens of billions of dollars and an unusually large share of victims lacking adequate insurance, according to early estimates.

Harvey’s cost could mount to $24 billion when including the impact of relentless flooding on the labor force, power grid, transportation and other elements that support the region’s energy sector, Chuck Watson, a disaster modeler with Enki Research, said by phone on Sunday. That would place it among the top eight hurricanes to ever strike the U.S.

“A historic event is currently unfolding in Texas,” Aon Plc wrote in an alert to clients. “It will take weeks until the full scope and magnitude of the damage is realized,” and already it’s clear that “an abnormally high portion of economic damage caused by flooding will not be covered,” the insurance broker said.

Many forecasters were hesitant over the weekend to make preliminary estimates for how much insurers might pay, potentially speeding recovery. Researchers were shifting from examining Harvey’s landfall Friday as a roof-lifting category 4 hurricane to the havoc it later created inland as a tropical storm. Typical insurance policies cover wind but not flooding, which often proves costlier. Blaming one or the other takes time.

In the Houston area, rainfall already has surpassed that of tropical storm Allison in 2001, which wreaked roughly $12 billion of damage in current dollars. In that case, only about $5 billion was covered by insurance, according to Aon.

Those storms are dwarfed by Hurricane Katrina, which struck in 2005 and devastated New Orleans. By some estimates, it inflicted $160 billion in total economic damage.

Most people with flood insurance buy policies backed by the federal government’s National Flood Insurance Program. As of April, less than one-sixth of homes in Houston’s Harris County had federal coverage, according to Aon. That would leave more than 1 million homes unprotected in the county. Coverage rates are similar in neighboring areas. Many cars also will be totaled.

“A lot of these people are going to be in very serious financial situations,” said Loretta Worters, a spokeswoman for the Insurance Information Institute. “Most people who are living in these areas do not have flood insurance. They may be able to collect some grants from the government, but there are not a lot, usually they’re very limited. There are no-interest to low-interest loans, but you have to pay them back.”

The federal program itself is already struggling with $25 billion of debt. The existing program is set to expire on Sept. 30 and is up for review in Congress, which ends its recess Sept. 5.

Investors Brace

Costs still will likely soar for insurance companies and their reinsurers, biting into earnings. As Harvey bore down on the coastline Friday, William Blair & Co., a securities firm that tracks the industry, said the storm could theoretically inflict $25 billion of insured losses if it landed as a “large category 3 hurricane.”

Policyholder-owned State Farm Mutual Automobile Insurance Co. has the largest share in the market for home coverage in Texas, followed by Allstate Corp., which is publicly traded. William Blair estimated that, in that scenario, Allstate could incur $500 million of pretax catastrophe losses, shaving 89 cents off of earnings per share.

Investors began bracing for losses last week. But many didn’t believe that Harvey could wipe out bonds that were issued to protect insurers against storm damage in the region, according to Brett Houghton, a managing principal at Fermat Capital Management. His firm manages more than $5 billion, with allocations to catastrophe bonds.

The Swiss Re Cat Bond Price Return Index dropped 0.44 percent in the week ended Aug. 25, the steepest decline since January. The benchmark is recalculated every Friday, so it’s unclear how the debt performed as the storm continued through Sunday. Reinsurers, which provide a backstop for primary carriers, also may get burned. That group include Bermuda-based companies Arch Capital Group Ltd., Axis Capital Holdings Ltd. and RenaissanceRe Holdings Ltd., according to a note last week from Meyer Shields, an analyst at Keefe, Bruyette & Woods.

Interrupting Business

Businesses are probably better covered than individuals. Companies across the retailing, manufacturing, health-care and hospitality industries will be seeking reimbursements from insurers for lost revenue during the storm and subsequent repairs, said Aon’s Jill Dalton, who helps manage claims.

But for Texas’s massive energy industry, it’s still too early to project how badly the storm will disrupt supply and distribution. That’s because the devastation keeps spreading.

“If it continues to rain, I just don’t think the situation is going to get better any time soon,” said Rick Miller, who leads Aon’s U.S. property practice. “In fact, it could get a lot worse.”

Thursday, August 24 2017

Just a day after being downgraded by ratings agency Demotech, Florida-based insurer Sawgrass Mutual Insurance Company has revealed it is under administrative supervision by the Florida Office of Insurance Regulation.

According to an amended consent order for administrative supervision dated Aug. 22, 2017, Sawgrass notified OIR of a plan for “orderly wind-down of the company’s operations” on Aug. 18, through a confidential consent order. The amended consent order said that plan is no longer feasible and that the move for administrative supervision should be made public “in order to facilitate the consideration of other plans for the orderly transition of Sawgrass’s business.”

Under Florida Law, administrative supervision is confidential unless otherwise specified. OIR may open the proceedings or hearings or make public the information.

The amended order states that “The Office finds and Sawgrass agrees, that it is in the best interest of its policyholders and the public to make this Consent Order public…” The order was signed by Sawgrass CEO Daniel O’Neal.

In a statement, OIR said “Under an Order of Administrative Supervision, the Office is working with Sawgrass Mutual Insurance Company and interested parties to develop a wind-down plan for the company, which includes the orderly transition of policies from Sawgrass to another insurer. Coverage for current Sawgrass policyholders remains in force until a plan is implemented. In the interim, policyholders may contact the Florida Market Assistance Plan to explore other options. Consumers may also research homeowners insurance companies through the Office’s CHOICES homeowners rate comparison tool via our website at www.floir.com.”

Sawgrass first became licensed in Florida in 2009 and currently has about 20,000 policies throughout the state with $35 million in premium written in the first quarter of 2017. The mutual insurer wrote voluntary homeowners through a network of independent agents. It bound just 222 new policies in Q1 of 2017, and had more than $39 million in exposure for policies in force that exclude wind coverage, according to OIR’s Quarterly Supplemental Report – Market Share Report system.

Sawgrass notified its agencies of the administrative supervision in an Aug. 22 email that was obtained by Insurance Journal. The email said the move is necessary “to allow Sawgrass and interested parties to develop a run-off plan for the company which includes the orderly transition of policies from Sawgrass to another insurer.”

The email further stated the plan could include the cancellation of all Sawgrass policies with at least 45 days’ notice and a guaranteed offer of coverage for those policies from another licensed insurer.

It appears Sawgrass’s problems began to brew after its second quarter earnings report, based on a downgrade in its Financial Stability Rating (FSR) of A (Exceptional) to L (licensed) from ratings agency Demotech on Aug. 21. Demotech released a statement saying the action was necessary despite a number of potential transactions in negotiation by the company.

“The company filed its initial year-end 2016 financial statement, reporting surplus in excess of $20 million, in a timely manner,” said Joseph Petrelli, Demotech president. “The company secured an effective reinsurance program prior to storm season. The focus of the company was to identify suitors and negotiate a transaction that was favorable to their policyholders rather than write additional new business.”

Demotech added the Sawgrass missed the deadline to report to Demotech the results of an independent audit and its second quarter 2017 financial statement, presented to Demotech on Aug. 16, as well as a revised year-end 2016 financial statement, “present surplus and other financial metrics at levels that no longer support the current FSR.”

Wednesday, August 23 2017

It has been 25 years since Hurricane Andrew swept through South Florida leaving $26.5 billion (1992 USD) of economic damage in its deadly wake. Of that astonishing figure, only $15.5 billion was insured, dumping the remaining $11 billion economic loss on American society.

But what impact would Hurricane Andrew have if it struck today?

A new report from global reinsurer Swiss Re reveals that a similar event today would totally dwarf the losses experienced a quarter of a century ago. The company modelled the outcome of the exact same storm in 2017 and found that economic losses would be estimated at $80-100 billion in current US dollars, of which only $50-60 billion would be covered by insurance.

Celebrate excellence in insurance. Nominate a worthy colleague for the Insurance Business Awards!

Swiss Re also studied a scenario in which Andrew’s track shifted 20 miles north today, to directly strike Miami. Losses in this case would range from $100-300 billion, making it the costliest natural disaster ever in the US. Again, just over 50% of the damage would be covered by insurance, leaving a huge shortfall to be made up by taxpayers and the government.

“The results serve as a wake-up call to the insurance industry, homeowners, small businesses, public officials and the private sector,” said Marla Schwartz, atmospheric perils specialist, Swiss Re. “A common response is ‘sticker shock,’ as some of the numbers are hard to fathom and rather unsettling. Although it is certainly difficult to wrap your mind around an economic loss in the range of USD 300 billion, it is critical in order to truly address present-day hurricane risk.”

The levels of underinsurance are some of the most shocking statistics in the Swiss Re report. For lower-income residents or smaller enterprises in Florida, underinsurance can be blamed on the cost of coverage (premiums and deductibles), according to Schwartz.

“In emerging and developing markets, there seems to be a rather low level of risk awareness and risk culture,” she added. “Some people in these markets have never had insurance before or are not familiar with insurance products, so it is difficult to penetrate these markets with traditional products. This highlights the need to develop innovative products that address the unique needs of underinsured communities or those with historically poor risk awareness.

“Additionally, the US has not experienced a major (Category 3 or greater) hurricane landfall since Wilma in 2005. This extended quiet period can lead to complacency, and insurance take up rates begin to drop as memories of hurricanes fade. However, it is critical to point out that this quiet period does not translate to decreased risk: it’s not a matter of if a major hurricane will barrel through South Florida, but when.”

Preparing Florida for Andrew’s second strike requires team work, communication and education, according to Schwartz. Brokers need to share this “profound protection gap” with clients so that they fully understand their risk and have as much mitigation and protection in place as possible.

“Overall, our findings have the same take-away message for primary insurers, consumers and brokers,” Schwartz commented. “It is more important than ever to better understand hurricane risk, to learn about new solutions that address the protection gap, and to consider if insurance instruments are sufficient to cover financial needs in the event of a significant loss, like an Andrew.”

Wednesday, August 23 2017

It has been 25 years since Hurricane Andrew swept through South Florida leaving $26.5 billion (1992 USD) of economic damage in its deadly wake. Of that astonishing figure, only $15.5 billion was insured, dumping the remaining $11 billion economic loss on American society.

But what impact would Hurricane Andrew have if it struck today?

A new report from global reinsurer Swiss Re reveals that a similar event today would totally dwarf the losses experienced a quarter of a century ago. The company modelled the outcome of the exact same storm in 2017 and found that economic losses would be estimated at $80-100 billion in current US dollars, of which only $50-60 billion would be covered by insurance.

Celebrate excellence in insurance. Nominate a worthy colleague for the Insurance Business Awards!

Swiss Re also studied a scenario in which Andrew’s track shifted 20 miles north today, to directly strike Miami. Losses in this case would range from $100-300 billion, making it the costliest natural disaster ever in the US. Again, just over 50% of the damage would be covered by insurance, leaving a huge shortfall to be made up by taxpayers and the government.

“The results serve as a wake-up call to the insurance industry, homeowners, small businesses, public officials and the private sector,” said Marla Schwartz, atmospheric perils specialist, Swiss Re. “A common response is ‘sticker shock,’ as some of the numbers are hard to fathom and rather unsettling. Although it is certainly difficult to wrap your mind around an economic loss in the range of USD 300 billion, it is critical in order to truly address present-day hurricane risk.”

The levels of underinsurance are some of the most shocking statistics in the Swiss Re report. For lower-income residents or smaller enterprises in Florida, underinsurance can be blamed on the cost of coverage (premiums and deductibles), according to Schwartz.

“In emerging and developing markets, there seems to be a rather low level of risk awareness and risk culture,” she added. “Some people in these markets have never had insurance before or are not familiar with insurance products, so it is difficult to penetrate these markets with traditional products. This highlights the need to develop innovative products that address the unique needs of underinsured communities or those with historically poor risk awareness.

“Additionally, the US has not experienced a major (Category 3 or greater) hurricane landfall since Wilma in 2005. This extended quiet period can lead to complacency, and insurance take up rates begin to drop as memories of hurricanes fade. However, it is critical to point out that this quiet period does not translate to decreased risk: it’s not a matter of if a major hurricane will barrel through South Florida, but when.”

Preparing Florida for Andrew’s second strike requires team work, communication and education, according to Schwartz. Brokers need to share this “profound protection gap” with clients so that they fully understand their risk and have as much mitigation and protection in place as possible.

“Overall, our findings have the same take-away message for primary insurers, consumers and brokers,” Schwartz commented. “It is more important than ever to better understand hurricane risk, to learn about new solutions that address the protection gap, and to consider if insurance instruments are sufficient to cover financial needs in the event of a significant loss, like an Andrew.”

Tuesday, August 22 2017

The majority of homeowners do not view internal water leak damage as the most concerning home threat, despite the fact that water leaks are a more frequent risk than fire and theft, a new Chubb survey revealed.

“The time between when a leak occurs and when it is discovered is the single greatest factor in determining the amount of damage,” said Fran O’Brien, division president of Chubb North America Personal Risk Services. “As a result, leaks that occur while you’re away result in greater amounts of damage, in terms of both cost and severity.”

Instances of water damage have been rising dramatically. In the past 10 years, the frequency of sudden pipe bursts has nearly doubled. In 2015, water damage accounted for nearly half of all property damage, according to the Insurance Information Institute. Chubb’s new Homeowners’ Water Risk Survey measures homeowners’ attitudes toward home protection, the risks they’re most concerned about and what they are overlooking. The online survey of 1,200 homeowners finds that just 8 percent of homeowners correctly identify August as the month with the most water leak events, and when subsequently heading out on a late-summer vacation, just 22 percent shut off the water main (despite 88 percent knowing where it is located within their home).

While homeowners are particularly vulnerable during the summer travel season, the study finds many face year-round water exposures. For instance, despite the fact that 91 percent of homeowners rate themselves as “vigilant” or “doing an okay job” at preventative home maintenance, and that close to half (45 percent) have or know someone who has experienced a water leak in the past two years, only 18 percent have installed a water leak detection device.

|