BlogThursday, October 19 2017

Jennifer Smith doesn’t like the term “accident.” It implies too much chance and too little culpability. A “crash” killed her mother in 2008, she insists, when her car was broadsided by another vehicle while on her way to pick up cat food. The other driver, a 20-year-old college student, ran a red light while talking on his mobile phone, a distraction that he immediately admitted and cited as the catalyst of the fatal event. “He was remorseful,” Smith, now 43, said. “He never changed his story.” Yet in federal records, the death isn’t attributed to distraction or mobile-phone use. It’s just another line item on the grim annual toll taken by the National Highway Transportation Safety Administration [NHTSA]—one of 37,262 that year. Three months later, Smith quit her job as a realtor and formed Stopdistractions.org, a nonprofit lobbying and support group. Her intent was to make the tragic loss of her mother an anomaly. To that end, she has been wildly unsuccessful. Nine years later, the problem of death-by-distraction has gotten much worse. Over the past two years, after decades of declining deaths on the road, U.S. traffic fatalities surged by 14.4 percent. In 2016 alone, more than 100 people died every day in or near vehicles in America, the first time the country has passed that grim toll in a decade. Regulators, meanwhile, still have no good idea why crash-related deaths are spiking: People are driving longer distances but not tremendously so; total miles were up just 2.2 percent last year. Collectively, we seemed to be speeding and drinking a little more, but not much more than usual. Together, experts say these upticks don’t explain the surge in road deaths. Three Big CluesThere are however three big clues, and they don’t rest along the highway. One, as you may have guessed, is the substantial increase in smartphone use by U.S. drivers as they drive. From 2014 to 2016, the share of Americans who owned an iPhone, Android phone, or something comparable rose from 75 percent to 81 percent. The second is the changing way in which Americans use their phones while they drive. These days, we’re pretty much done talking. Texting, Twitter, Facebook, and Instagram are the order of the day—all activities that require far more attention than simply holding a gadget to your ear or responding to a disembodied voice. By 2015, almost 70 percent of Americans were using their phones to share photos and follow news events via social media. In just two additional years, that figure has jumped to 80 percent. Finally, the increase in fatalities has been largely among bicyclists, motorcyclists, and pedestrians—all of whom are easier to miss from the driver’s seat than, say, a 4,000-pound SUV—especially if you’re glancing up from your phone rather than concentrating on the road. Last year, 5,987 pedestrians were killed by cars in the U.S., almost 1,100 more than in 2014—that’s a 22 percent increase in just two years. Safety regulators and law enforcement officials certainly understand the danger of taking—or making—a phone call while operating a piece of heavy machinery. They still, however, have no idea just how dangerous it is, because the data just isn’t easily obtained. And as mobile phone traffic continues to shift away from simple voice calls and texts to encrypted social networks, officials increasingly have less of a clue than ever before. Out of NHTSA’s full 2015 dataset, only 448 deaths were linked to mobile phones—that’s just 1.4 percent of all traffic fatalities. By that measure, drunk driving is 23 times more deadly than using a phone while driving, though studies have shown that both activities behind the wheel constitute (on average) a similar level of impairment. NHTSA has yet to fully crunch its 2016 data, but the agency said deaths tied to distraction actually declined last year. Deadlier Than Data ShowsThere are many reasons to believe mobile phones are far deadlier than NHTSA spreadsheets suggest. Some of the biggest indicators are within the data itself. In more than half of 2015 fatal crashes, motorists were simply going straight down the road—no crossing traffic, rainstorms, or blowouts. Meanwhile, drivers involved in accidents increasingly mowed down things smaller than a Honda Accord, such as pedestrians or cyclists, many of whom occupy the side of the road or the sidewalk next to it. Fatalities increased inordinately among motorcyclists (up 6.2 percent in 2016) and pedestrians (up 9 percent). “Honestly, I think the real number of fatalities tied to cell phones is at least three times the federal figure,” Jennifer Smith said. “We’re all addicted and the scale of this is unheard of.” In a recent study, the nonprofit National Safety Council found only about half of fatal crashes tied to known mobile phone use were coded as such in NHTSA databases. In other words, according to the NSC, NHTSA’s figures for distraction-related death are too low. Perhaps more telling are the findings of Zendrive Inc., a San Francisco startup that analyzes smartphone data to help insurers of commercial fleets assess safety risks. In a study of 3 million people, it found drivers using their mobile phone during 88 percent of trips. The true number is probably even higher because Zendrive didn’t capture instances when phones were mounted in a fixed position—so-called hands free technology, which is also considered dangerous. “It’s definitely frightening,” said Jonathan Matus, Zendrive’s co-founder and chief executive officer. “Pretty much everybody is using their phone while driving.” There are, by now, myriad technological nannies that freeze smartphone activity. Most notably, a recent version of Apple’s iOS operating system can be configured to keep a phone asleep when its owner is driving and to send an automated text response to incoming messages. However, the “Do Not Disturb” function can be overridden by the person trying to get in touch. More critically, safety advocates note that such systems require an opt-in from the same users who have difficulty ignoring their phones in the first place. State Data CollectionIn NHTSA’s defense, its tally of mobile phone-related deaths is only as good as the data it gets from individual states, each of which has its own methods for diagnosing and detailing the cause of a crash. Each state in turn relies on its various municipalities to compile crash metrics—and they often do things differently, too. The data from each state is compiled from accident reports filed by local police, most of which don’t prompt officers to consider mobile phone distraction as an underlying cause. Only 11 states use reporting forms that contain a field for police to tick-off mobile-phone distraction, while 27 have a space to note distraction in general as a potential cause of the accident. The fine print seems to make a difference. Tennessee, for example, has one of the most thorough accident report forms in the country, a document that asks police to evaluate both distractions in general and mobile phones in particular. Of the 448 accidents involving a phone in 2015 as reported by NHTSA, 84 occurred in Tennessee. That means, a state with 2 percent of the country’s population accounted for 19 percent of its phone-related driving deaths. As in polling, it really depends on how you ask the question. “Crash investigators are told to catch up with this technology phenomenon” Massachusetts State Police Sergeant Christopher Sanchez, a national expert on distracted driving, said many police departments still focus on drinking or drug use when investigating a crash. Also, figuring out whether a mobile phone was in use at the time of a crash is usually is getting trickier every day—proving that it precipitated the event can be even harder to do. Prosecutors have a similar bias. Currently, it’s illegal for drivers to use a handheld phone at all in 15 states, and texting while driving is specifically barred in 47 states. But getting mobile phone records after a crash typically involves a court order and, and even then, the records may not show much activity beyond a call or text. If police provide solid evidence of speeding, drinking, drugs or some other violation, lawyers won’t bother pursuing distraction as a cause. “Crash investigators are told to catch up with this technology phenomenon—and it’s hard,” Sanchez said. “Every year new apps are developed that make it even more difficult.” Officers in Arizona and Montana, meanwhile, don’t have to bother, since they allow mobile phone use while you drive. And in Missouri, police only have to monitor drivers under age 21 who pick up their phone while driving. Like Smith, Emily Stein, 36, lost a parent to the streets. Ever since her father was killed by a distracted driver in 2011, she sometimes finds herself doing unscientific surveys. She’ll sit in front of her home in the suburbs west of Boston and watch how many passing drivers glance down at their phones. “I tell my local police department: ‘If you come here, sit on my stoop and hand out tickets. You’d generate a lot of revenue,'” she said. Since forming the Safe Roads Alliance five years ago, Stein talks to the police regularly. “A lot of them say it surpasses drunk driving at this point,” she said. Meanwhile, grieving families and safety advocates such as her are still struggling to pass legislation mandating hands-free-only use of phones while driving—Iowa and Texas just got around to banning texting behind the wheel. “The argument is always that it’s big government,” said Jonathan Adkins, executive director of the Governors Highway Safety Association. “The other issue is that … it’s hard to ban something that we all do, and we know that we want to do.” “We all know what’s going on, but we don’t have a breathalyzer for a phone” Safety advocates such as Smith say lawmakers, investigators and prosecutors won’t prioritize the danger of mobile phones in vehicles until they are seen as a sizable problem—as big as drinking, say. Yet, it won’t be measured as such until it’s a priority for lawmakers, investigators and prosecutors. “That’s the catch-22 here,” Smith said. “We all know what’s going on, but we don’t have a breathalyzer for a phone.” Perhaps the lawmakers who vote against curbing phone use in cars should watch the heart-wrenching 36-minute documentary filmmaker Werner Herzog made on the subject. Laudably, the piece, From One Second to the Next, was bankrolled by the country’s major cellular companies. “It’s not just an accident,” Herzog said of the fatalities. “It’s a new form of culture coming at us, and it’s coming with great vehemence.” Adkins has watched smartphone culture overtake much of his work in 10 years at the helm of the GHSA, growing increasingly frustrated with the mounting death toll and what he calls clear underreporting of mobile phone fatalities. But he doesn’t think the numbers will come down until a backlash takes hold, one where it’s viewed as shameful to drive while using a phone. Herzog’s documentary, it appears, has had little effect in its four years on YouTube.com. At this point, Adkins is simply holding out for gains in autonomous driving technology. “I use the cocktail party example,” he explained. “If you’re at a cocktail party and say, ‘I was so hammered the other day, and I got behind the wheel,’ people will be outraged. But if you say the same thing about using a cell phone, it won’t be a big deal. It is still acceptable, and that’s the problem.” Monday, October 16 2017

Florida’s famous oranges are still falling from trees and rotting on the ground weeks after Hurricane Irma, and the state’s agriculture commissioner said Thursday there will be fewer Florida vegetables on Thanksgiving tables and a shortage of poinsettias at Christmas. Agriculture Commissioner Adam Putnam and Florida farmers updated the state Senate Agriculture Committee that the storm damaged crops of all kinds, with losses topping $2.5 billion. Losses are reported to peanuts, avocadoes, sugar, strawberries, cotton and tomatoes. The storm also affected timber, milk production and lobster and stone crab fishing. “The fresh winter vegetables that are on people’s Thanksgiving tables won’t be there this year because of Hurricane Irma,” Putnam said. “The losses are staggering; in many cases, the tale of those losses will be multiple years … This is more than just damage contained in just one crop year.” He said Irma’s path couldn’t have been “more lethal” for Florida agriculture, with few crops spared. The citrus industry was particularly hard hit, with some estimates of more than half the orange crop lost. The U.S. Department of Agriculture released its Florida citrus forecast Thursday, estimating that Florida will produce 54 million boxes of oranges, down 21 percent from last year. But the Florida Citrus Mutual said the federal government should have delayed the forecast because it’s still too early to tell just how hard hit the industry was after the storm. It said production would be closer to 31 million boxes of oranges, or a 55 percent drop from the 68.7 million boxes produced in the 2016-2017 season. “Irma hit us just a month ago and although we respect the skill and professionalism of the USDA, there is no way they can put out a reliable number in that short time period,” said Michael W. Sparks, CEO of the Florida Citrus Mutual. The agricultural losses are expected to affect consumers, but how much so is still to be determined. “I would expect prices to rise as a result of the winter vegetable capital of America being put out of the production going into the holiday season,” Putnam said, but he added that there could be a flood of foreign fruit and produce entering the market that could keep prices from rising – something he said could further hurt Florida farmers. “That could, over time, replace market share that should be going to Florida’s farmers,” he said. Committee Chairwoman Sen. Denise Grimsley talked about the damage she’s seen in her family’s orange groves. “The fruit on the ground was so thick it was hard to walk through, and the smell is now bad because of the rotting fruit,” she said. Putnam’s family also farms orange groves. He told reporters they’ve lost about half the crop. “It’s not good,” he said. “You can stand in the grove and continue to hear fruit fall. It’s a double kick in the gut because this was the best crop we’ve set in years. We had better crop, better crop size, more fruit on the trees than I’ve seen in years. It was finally a crop to be proud of and now it’s laying on the ground.” Thursday, October 12 2017

House lawmakers unveiled a bill Tuesday night that would provide $36.5 billion in emergency funding for hurricane and wildfire relief requested by the Trump administration. With Congress under pressure to provide urgent help to storm victims in Texas, Florida and Puerto Rico, the House measure includes $18.7 billion for the Federal Emergency Management Agency’s disaster relief fund, as well as $16 billion to replenish the nation’s flood insurance program. The FEMA funding includes a provision that would give Puerto Rico and the U.S. Virgin Islands access to $4.9 billion in low-interest Treasury loans so they doesn’t run out of cash as the islands recovers. That funding is needed to help the territory pay government salaries and other expenses after Oct. 31. House Speaker Paul Ryan said the bill will be on the House floor Thursday for a vote, after which it could taken up by the Senate when that chamber returns next week. “Harvey, Irma, Maria, they’ve been devastating for Texas, Florida, Puerto Rico,” Ryan said at a news conference Wednesday. “This is a time when we here in Congress need to respond because that is our responsibility.” House Appropriations Chairman Rodney Frelinghuysen of New Jersey said, “You have a lot of people in pain,” adding that he expects the next tranche of aid to be passed before December. “I think there is some momentum to get some money out the door as quickly as possible.” Congress needs to act quickly, particularly when it comes to flood insurance. The National Flood Insurance Program needs additional funding to cover claims from all the recent storms. The bill will be brought to a vote as soon as Thursday under a fast-track procedure that will require Democratic votes to pass. Minority Leader Nancy Pelosi of California praised the measure. An aide to Pelosi said she fought for two items included in the bill: loans for Puerto Rico and the U.S. Virgin Islands, also suffering from hurricane damage, and $1 billion in disaster funds over the White House request in light of California wildfires. The bill includes no flood insurance policy changes, which the aide said is a victory, after Republicans had discussed revisions to the program. Representative Mark Walker of North Carolina, who heads the conservative Republican Study Committee, said he is disappointed the measure doesn’t include any spending cuts to offset the disaster funding and still trying to decide whether to vote for it. “This is a very frustrating place,” he said Wednesday. Jim Jordan, an Ohio Republican and member of the conservative Freedom Caucus, said he won’t support the bill because there aren’t plans to offset the costs and because there aren’t changes to the flood insurance program. Several other lawmakers, from both parties, said they’d support the legislation. Texas Republican Blake Farenthold said: “They don’t have to sell me on that one.” Nita Lowey, a New York Democrat, said disaster victims deserve help from the federal government. “This package provides critical public and individual disaster assistance, flood insurance aid, liquidity for Puerto Rico’s government, and help for communities devastated by wildfires,” she said in a statement. The loan authority for Puerto Rico is also a needed financial lifeline for the U.S. territory of 3.4 million people that’s been operating in bankruptcy since May, which makes it difficult — if not impossible — for the government to borrow on its own. With the island still recovering from the storm, much of the economy there has ground to a halt, radically curtailing the government’s tax collections. Puerto Rico’s treasury secretary, Raul Maldonado, said last week that the territory faces a government shutdown on Oct. 31 that would halt its hurricane recovery efforts if Congress doesn’t intervene. The package includes a $150 million advance to cover a matching-funds requirement from the commonwealth, an administration official said. It would be available for easing short-term expenses such as payroll and pension payments, though not for debt service on bonds. The devastation wrought by Hurricane Maria is threatening to exacerbate the financial crisis that had already pushed the island into a series of record-setting defaults on its $74 billion of debt. The scale of the damage, which has left most of the island without electricity almost three weeks after the storm, has caused Puerto Rico bond prices to tumble as investors speculate they’re likely to recoup even less of their investments. Puerto Rico’s delegate to Congress, Jenniffer Gonzalez Colon, said at a news conference with House Republican leaders Wednesday that she was pleased that the aid plan will help the island deal with the “humanitarian crisis.” “We still have a dire situation on the island,” Gonzalez said. “It’s not easy when you’re used to living in an American way of life and then somebody tells you that you’re going to be without power for six or eight months.” “We’re still counting the fatalities,” she said, with 45 dead as of Wednesday. More than 86 percent of the population still lacks electricity and more than 44 percent is without running water, Gonzalez said. One notable omission from the broader funding measure is additional funding for the Community Development Block Grant Program at the Department of Housing and Urban Development, which a bipartisan group of Texas lawmakers had asked to be included in this measure. “I am counting on the next supplemental having the extra funds for Texas” Representative John Carter of Texas, the chairman of the House Homeland Security Appropriations subcommittee said. Thursday, September 28 2017

Anti-fraud strike teams comprised of investigators working for the Department of Financial Services’ Division of Investigative and Forensic Services will soon be deployed across the state in an effort to to protect Floridians from post-storm fraud, according to a statement from the Florida Department of Financial Services. CFO Patronis announced the formation of three teams that will work in areas heavily impacted by Hurricane Irma: South Florida, including Miami-Dade and Monroe counties; Southwest Florida, including Lee and Collier counties; and Central Florida, including Polk and Orange counties. Patronis is working directly with prosecutors housed within each of the respective State Attorney’s Office, to “ensure that law-breakers are prosecuted to the fullest extent of Florida law,” the statement says. “The unfortunate truth is that some individuals will attempt to take advantage of consumers during this high-stress time,” Patronis said. “To combat fraudsters attempts to swindle Floridians, we’re putting boots on the ground to ward off fraud and swiftly address any scams that may arise.” These strike teams are trained insurance fraud investigators with specialized knowledge of property & casualty fraud and workers’ compensation fraud. In addition to identifying active fraud operations in the field, investigators will work with each community to educate homeowners, homeowners’ associations and local law enforcement about the red flags of fraud. Floridians can report suspicious behavior by calling the Department’s anti-fraud hotline at 1-800-378-0445, or by contacting one of the Department’s regional insurance fraud offices. To find a map of the Department’s insurance fraud offices in Florida, click here. Callers are asked to provide as many details as possible, and callers may request to remain anonymous. More information on the the Department of Financial Services’ anti-fraud efforts is available on its website. Wednesday, September 27 2017

Hurricane Deductibles From June 1st to November 30th, the Gulf of Mexico and eastern coast of the United States is on alert for Hurricane Season. Eyes turn to the National Hurricane Center during this season to watch and prepare for any storm threats. According to the Florida Office of Insurance Regulation, wind damage is considered hurricane damage if the damage occurred DURING a hurricane named by the National Hurricane Center of the National Weather Service. The duration of a hurricane is defined by the following:

The National Hurricane Center declared Hurricane Irma’s duration for the state of Florida to be from 11 a.m. on September 7, 2017 to 5 a.m. on September 14, 2017. Any wind-related damages occurring within this time frame would be subject to your hurricane deductible. So just how much is a hurricane deductible and when does it apply? Hurricane deductibles are a percentage of your Coverage A – Dwelling amount. In Florida, a typical homeowners insurance policy hurricane deductible is 2% of Coverage A – Dwelling amount. For example, if your Coverage A amount is $200,000, then your hurricane deductible would be $4,000. Your deductible is subtracted from your claims loss amount as you are required to cover the deductible amount BEFORE your insurance kicks in. After this amount is met, any other hurricane related damage is covered by your insurance for the remainder of the calendar year. Since hurricane deductibles are a calendar year deductible (January 1 – December 31), if you do not meet your hurricane deductible amount and experience a second hurricane loss, the deductible will be either the remainder of the hurricane deductible or the AOP (All Other Perils) deductible, whichever is greater. If you did meet your hurricane deductible, then the AOP deductible will apply for any subsequent hurricane loss. It is important to keep ALL of your receipts and a running tally of your out-of-pocket expenses. This way when a storm strikes, you’re prepared to show how much of your deductible you’ve met after filing a claim. Monday, September 25 2017

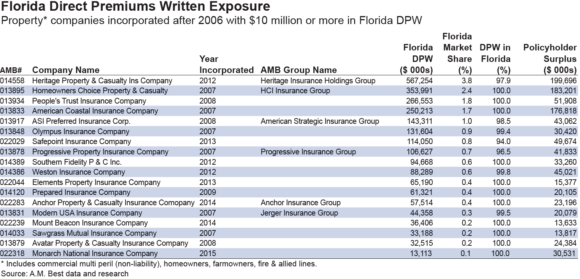

Although insured losses as a result of Hurricane Irma will not be as severe as originally forecast, the storm still represents a sizeable catastrophe event that will test the infrastructure and potentially strain the financial wherewithal of some local and regional carriers in Florida, particularly those that are geographically concentrated, according to a new briefing from A.M. Best. The Best’s Briefing, titled, “Hurricane Irma Tests Newer Participants in Florida Market,” notes that over the past decade, the number of more concentrated local/regional writers in Florida’s insurance market has increased as national writers pulled back on the state. The state-formed Citizens Property Casualty Insurance Corporation took on much of that risk exposure, and as a result, experienced significant financial pressure. This led to a fairly successful depopulation program, whereby private insurers were given incentives to assume policies from Citizens. This, along with other factors that included benign weather in Florida and favorable reinsurance pricing, prompted many new insurance companies to form. According to the report, a number of new insurance companies were formed since 2007, writing nearly a fifth of the property market lines: homeowners, farmowners, fire and allied, and commercial multiperil (non-liability). Hurricane Irma represents the first severe event to test the strength of these business models, particularly with regard to risk selection, loss mitigation and potentially their reinsurance programs.

The report also states that with Hurricane Irma occurring in such close proximity to Hurricane Harvey, the demand for independent catastrophe claim adjusters has increased. A.M. Best-rated entities had already started strengthening their claims processes in response to the state’s Assignment of Benefit issues. Newer companies may face additional pressure from a lack of experience as well as limitations due to scale. The report warns that Hurricane Irma has the potential to amplify the AOB issue, which had already led to performance constraints in the Florida market from an increase in the frequency and severity of litigated water claims. A.M. Best said insurer performance had deteriorated in recent years in large part due to the AOB issue. “A.M. Best expects that Hurricane Irma and AOB losses will have a much greater impact on operating results for the concentrated insurers, and will continue to monitor the effects of risk-adjusted capitalization,” the report states. A.M. Best does not expect a significant number of rating actions on its rated insurers to result solely from Hurricane Irma, but reinsurance programs that respond differently from what is anticipated could increase ratings pressure. A.M. Best said that ultimately, although the aftermath of Hurricane Irma may be bleak for some regional and local carriers, particularly overexposed companies with earnings and potential capital concerns, it believes opportunities will emerge for others. “An insurer that can effectively navigate through the storm and potentially others during this hurricane season may attract displaced insureds,” the briefing states. Insurers also may need to rethink their risk selection, risk tolerances and reinsurance purchases, and some may consider diversifying outside of Florida or revamping products. Smaller or struggling companies in the Florida insurance market also could become merger and acquisition targets, the ratings agency said. A full copy of the special report is available through A.M. Best. Friday, September 22 2017

With two Florida landfalls in the same day, Hurricane Irma‘s destructive wind and flood damage could cost up to $65 billion for both insured and uninsured losses, according to a recent estimate by CoreLogic. Residential property flood loss is estimated at up to $38 billion, CoreLogic reported, noting that includes storm surge, inland and flash flooding in five states – Florida, Alabama, Georgia, North Carolina and South Carolina. 80 percent of the flood damage is uninsured, the company said. Reported insured flood loss for commercial properties could top out at $8 billion. AIR Worldwide estimated insured losses for the U.S. States resulting from Irma will range between $25 billion – $35 billion. The catastrophe modeling firm noted the hurricane-force winds extended 80 miles from the eye and tropical storm–force winds extended more than 400 miles, covering the entire state and driving storm surge into both the Atlantic and Gulf coasts. Downed trees, signs and utility poles and flooded or debris-strewn streets could be seen in the southern regions of the state, AIR Worldwide reported. Karen Clark & Company estimated losses in the U.S and Caribbean at $25 billion. Of the $18 billion insured loss in the U.S., the majority is in Florida, followed by Georgia, South Carolina and Alabama, KCC reported. As of Thursday, Sept. 21, the Florida Office of Insurance Regulation reported more than 397,000 residential property claims and just over 17,000 commercial property claims had been filed. Including all types of losses, total estimated insured losses thus far had passed the $3 billion mark. OIR has been updating claims data daily.

According to A.M. Best, the top five homeowners’ insurers in Florida are: Universal Insurance Holdings Group, Tower Hill Group, State Farm, Federated National Insurance Co., and Citizens Property Insurance Corp. In response to the storm, Universal Property & Casualty Insurance Company reported it has more than $300 million in surplus, as well as a catastrophe reinsurance program that provides $2.65 billion in coverage to cover an event like Hurricane Irma. The insurer stated its projected losses from the hurricane are considerably lower than the limits of its catastrophe reinsurance program. UPCIC has not reported on the claims it has received to date. As of September 18, Tower Hill reported receiving 20,000 claims resulting from Irma. The company has 300 catastrophe adjusters stationed in Florida. The insurer commented that many of its customers reported light to moderate damage, with most claims not requiring a visit from an adjuster before settlement. As of September 14, State Farm reported it had received 26,700 homeowner and 7,700 auto claims from Irma. Federated National Insurance Company and Monarch National Insurance Company (partially owned by Federated National) both write homeowners’ insurance in Florida, according to a press release issued after Irma. Each company purchases its own separate reinsurance program. Federated National’s single event pre-tax retention for a catastrophic event in Florida is $18 million. Monarch National’s reinsurance program covers Florida exposures and all private layers of protection have prepaid automatic reinstatement protection which affords Monarch National additional coverage for subsequent events. Neither company reported the claims it received resulting from Irma to date. Citizens Property Insurance began opening catastrophe response centers across Florida to handle Irma claims. The state-run insurer has not released claims figures to date. Texas-based Interstate Restoration, a disaster restoration firm, reported it had 90 employees stationed in Florida prior to the storm, with another 60 new hires ready to go. CEO Stacy Mazur said the firm’s workers face the same challenges Florida residents are experiencing. “Those challenges include lodging, power outages and scarcity of fuel,” said Mazur. An additional 500 subcontractors in the southeast U.S. will join the Florida crew, he said. Thursday, August 31 2017

Insurance scammers have already started preying on homeowners impacted by Hurricane Harvey. Monday, August 28 2017

Hurricane Harvey’s second act across southern Texas is turning into an economic catastrophe -- with damages likely to stretch into tens of billions of dollars and an unusually large share of victims lacking adequate insurance, according to early estimates. Thursday, August 24 2017

Just a day after being downgraded by ratings agency Demotech, Florida-based insurer Sawgrass Mutual Insurance Company has revealed it is under administrative supervision by the Florida Office of Insurance Regulation. According to an amended consent order for administrative supervision dated Aug. 22, 2017, Sawgrass notified OIR of a plan for “orderly wind-down of the company’s operations” on Aug. 18, through a confidential consent order. The amended consent order said that plan is no longer feasible and that the move for administrative supervision should be made public “in order to facilitate the consideration of other plans for the orderly transition of Sawgrass’s business.” Under Florida Law, administrative supervision is confidential unless otherwise specified. OIR may open the proceedings or hearings or make public the information. The amended order states that “The Office finds and Sawgrass agrees, that it is in the best interest of its policyholders and the public to make this Consent Order public…” The order was signed by Sawgrass CEO Daniel O’Neal. In a statement, OIR said “Under an Order of Administrative Supervision, the Office is working with Sawgrass Mutual Insurance Company and interested parties to develop a wind-down plan for the company, which includes the orderly transition of policies from Sawgrass to another insurer. Coverage for current Sawgrass policyholders remains in force until a plan is implemented. In the interim, policyholders may contact the Florida Market Assistance Plan to explore other options. Consumers may also research homeowners insurance companies through the Office’s CHOICES homeowners rate comparison tool via our website at www.floir.com.” Sawgrass first became licensed in Florida in 2009 and currently has about 20,000 policies throughout the state with $35 million in premium written in the first quarter of 2017. The mutual insurer wrote voluntary homeowners through a network of independent agents. It bound just 222 new policies in Q1 of 2017, and had more than $39 million in exposure for policies in force that exclude wind coverage, according to OIR’s Quarterly Supplemental Report – Market Share Report system. Sawgrass notified its agencies of the administrative supervision in an Aug. 22 email that was obtained by Insurance Journal. The email said the move is necessary “to allow Sawgrass and interested parties to develop a run-off plan for the company which includes the orderly transition of policies from Sawgrass to another insurer.” The email further stated the plan could include the cancellation of all Sawgrass policies with at least 45 days’ notice and a guaranteed offer of coverage for those policies from another licensed insurer. It appears Sawgrass’s problems began to brew after its second quarter earnings report, based on a downgrade in its Financial Stability Rating (FSR) of A (Exceptional) to L (licensed) from ratings agency Demotech on Aug. 21. Demotech released a statement saying the action was necessary despite a number of potential transactions in negotiation by the company. “The company filed its initial year-end 2016 financial statement, reporting surplus in excess of $20 million, in a timely manner,” said Joseph Petrelli, Demotech president. “The company secured an effective reinsurance program prior to storm season. The focus of the company was to identify suitors and negotiate a transaction that was favorable to their policyholders rather than write additional new business.” Demotech added the Sawgrass missed the deadline to report to Demotech the results of an independent audit and its second quarter 2017 financial statement, presented to Demotech on Aug. 16, as well as a revised year-end 2016 financial statement, “present surplus and other financial metrics at levels that no longer support the current FSR.” |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.