BlogFriday, March 09 2018

Federal disaster officials are ending a program that paid for hotel rooms for more than 27,000 Florida households in the wake of Hurricane Irma. FEMA officials announced Tuesday that the short-term emergency sheltering program will end March 10, six months after Irma hit the Sunshine State. At the request of the state, FEMA extended the temporary hotel program five times over the last six months. More than 26,000 households have already moved out after making home repairs or finding suitable longer-term housing. FEMA has been working with survivors to help them identify resources and develop a long-term housing plan. Tuesday, February 20 2018

A Florida woman called police because she thought she heard a prowler. She actually was hearing the first of several sinkholes that have opened up in a Florida retirement community, displacing seven people. The Villages resident Doris Morrill says she heard a creaking noise at about 1 a.m. Thursday. Suspecting a prowler, she called police. Several hours later, she heard another creaking noise and noticed a crack on the floor of her home. Then she noticed the hole opening up outside. County Emergency Management Director Preston Bowlin tells the Ocala Star-Banner that five more sinkholes have opened up since Morrill’s call. Two homes have been condemned and two have been evacuated. Power has been cut to all four. Thursday, January 25 2018

Insurance agents from across Florida marched together on the state’s capitol Wednesday to deliver a message to Florida lawmakers: It’s time for assignment of benefits (AOB) reform. Carrying signs that read “STOP AOB ABUSE,” about 125 members of the Florida Association of Insurance Agents (FAIA) were accompanied by representatives from the Florida Consumer Protection Coalition (CPC) as they carried their message from downtown Tallahassee to the Florida Capitol building. “We are here with folks who see it every day,” said Jeff Grady President of FAIA, which represents about 2,000 property and casualty independent agencies in the state, in a video by CPC. “Rates are going up and coverages are becoming less. Consumers are losing because of the failure of the legislature to address AOB fraud.” Contractors and attorneys are being blamed for abuse of AOB’s by taking control of a homeowner’s policy, inflating water or roof damage claims, and then suing the insurance company when it disputes the bill. CPC, which consists of business leaders, consumer advocates, real estate agents, construction contractors, insurance agents and insurance trade groups pushing for reforms to end AOB abuse, has worked for two years to call attention to the problem. The march was the group’s latest effort to get lawmakers attention after they have failed to agree on reform in the previous five sessions. Barry Gilway, CEO of Citizens, the state-run insurer of last resort, also attended the march with a message for lawmakers. Citizens has faced the brunt of AOB abuse, particularly in South Florida. But Gilway says things are just getting worse. “Here is the scary part, this used to be Southeast Florida problem – it’s not a Southeast Florida problem anymore, its spreading across the state,” Gilway said. “The ultimate payer in this situation is the consumer – it’s that simple – they will pay the price.” Rates have already started going up for many Florida homeowners, but that’s just the tip of the iceberg, says the industry. Many insurers are also responding by refusing to write in certain zip codes or are tightening coverage offerings. Citizens raised rates last year and was approved to do so again in 2018. The company has said policyholders should expect rate increases for the foreseeable future. Citizens also blames AOB for an expected increase to its policyholder count after several years of shedding policies to the private market. Lawmakers have accused the industry of exaggerating the effect of the abuse and using it as an excuse to raise rates. But the numbers look to be on the industry’s side. A recent data call report from the Florida Office of Insurance Regulation (OIR) of water or roof damage claims from private insurers between Jan. 2015 and June 2017 found that the frequency of water claims per 1,000 policies increased 44 percent since 2015 and severity increased by 18 percent. The use of AOB’s on water claims has increased from 12.8 percent in 2015 to 17 percent in 2017, OIR said. According to the Florida Justice Reform Institute, there has been a 300 percent increase in AOB lawsuits since 2010. “This is not an emotional issue – just let the data speak for itself,” said Florida CFO Jimmy Patronis, who spoke to agents at a breakfast before Wednesday’s march and has also been vocal about the need for AOB reform. Patronis urged lawmakers to act, saying the increase in AOB lawsuits is “a total exploitation of the law.” “I hope the [legislature] will pass meaningful legislation that, at the end of the day, will keep insurance in the state of Florida as low as it can for our consumers,” he said. “It’s an issue that is going to potentially affect every insurance policy in the state of Florida if we don’t do something about it.” Grady said the industry has tried to get that message across to legislators, but for the last five years it hasn’t been received. The industry is hopeful this year will be different. “These folks are here firsthand with the experiences of their consumers to tell legislators to get this done,” Grady said. For their part, lawmakers have been weighing several bills that would address the problem since the 2018 Florida Legislative Session kicked off earlier this month. But which path lawmakers choose is a point of contention and concern for the insurance industry. So far the Florida House has passed a bill the industry supports, House Bill 7015, but the Florida Senate has yet to act on it. The industry says it would be the most effective at reforming AOB because of provisions addressing Florida’s “one-way attorney fee” statute. The statute, designed to be a policyholder protection for those suing an insurance company, has been the main source of abuse, the industry says, as an assignee can sue insurers over a claim and the insurers end up paying the attorney fees. The bill, sponsored by Rep. Jay Trumbull, would chip away at incentives for third parties to sue insurance companies by awarding fees under a formula based on the judgement obtained by the assignee and the pre-suit settlement offer. In a press release, the Consumer Protection Coalition urged the Florida Senate to take up HB 7015, which they said include “commonsense protections for consumers and modifications to one-way attorney fee rules.” The industry has also voiced support for Senate Bill 62, drafted by OIR and other stakeholders last year and reintroduced this session, but it has not had a hearing. Senate lawmakers let the current house bill die last year. “The House has understood that consumers need this loophole closed, that there is fraud going on in AOB in Florida,” said David Hart, executive vice president of the Florida Chamber of Commerce, a member of CPC and part of yesterday’s march. “Consumers are long overdue for attention to this issue and this loophole to be closed.” Senate lawmakers have called for a guarantee that property insurance rates would go down if the industry’s proposed reforms are enacted. The Florida Senate has shown preference for Senate Bill 1168 filed by Senator Greg Steube, which does not address the one-way attorney fee statute and is favored by the trial bar and water restoration contractors. CPC said in a statement that it opposes that bill “because it does not go far enough to protect consumers and would not allow insurers to include litigation costs in their rates.” The industry appears to have consumers on their side of the issue this year, at least according to a poll by the Property Casualty Insurers Association of America (PCI) that showed 60 percent of voters surveyed say the current system for using AOBs in property insurance claims needs to be reformed. “Let’s keep the consumer number one in our mind. The same homeowners that I represent as an insurance agent [lawmakers] represent as a constituent, and we all ought to be working together regardless of the issue,” said Doug Wiles, chairman of FAIA and president of Herbie Wiles Insurance Agency in St. Augustine, Fla. “But in particular now, to avoid these significant rate increases, to avoid degradation of coverage, to make sure that our homeowners insurance market remains healthy in the state of Florida.” Thursday, January 18 2018

American Integrity Insurance Group’s charitable efforts have become an integral part of the company’s culture, and not just during the holiday season. The Florida-based insurer, which formed in 2006, began asking employees four years ago what charities they would like to support. Every November, employees can submit and vote on the ones they would like to put company efforts toward the following year. According to Michael Goodman, American Integrity Human Resources manager, employees have selected three different charities to support for the last several years: Metropolitan Ministries, which provides food for needy families in three Florida counties; John Hopkins All Children’s Hospital, a pediatric hospital in St. Petersburg; and Joshua House, which offers a safe haven for abused, neglected and abandoned children aged six to 17 in Tampa Bay. With each group the insurer supports, the response from employees is overwhelming, Goodman says. From one employee collecting gift cards and loading up trucks of food during Thanksgiving for the Metropolitan Ministries food drive, to buying all of the gifts on the wish lists of children staying at Joshua House, to participating in a radiothon at the John Hopkins children’s hospital, employees at American

Integrity feel passionately about giving back. “It’s the individual passion that the employees have for the fundraisers that we do that has driven the success,” Goodman said. “It’s really extraordinary. When you give, you get.” This holiday season, American Integrity contributed 8,000 meals to Metropolitan Ministries – enough food to feed a family of four for more than 600 days. The company also ensures that each of the 30 to 40 children staying at Joshua House receive every item on their wish list at Christmas. A Christmas tree was put up at the company headquarters with ornaments listing an item requested by the kids. Goodman said typically 75 to 85 percent of American Integrity’s 200 employees participate in purchasing hundreds of items to fulfill the kids’ Christmas wishes. In addition to participating in the John Hopkins radiothon, the company also holds a Lego drive to replace those the kids play with year-round at the hospital. Goodman said the three organizations all have different needs at different times of year, so employees can participate in giving back at any time. Employees can also have personal donations of up to $500, or in some cases more, matched by the company should they choose to support a different organization. “From an insurance standpoint, our role is to serve, and it just goes hand-in-hand that we would serve our communities as well,” Goodman said. Goodman said that culture of giving back has also been a successful recruiting tool for the company in attracting new, young talent to the firm. Young people just entering the work force want to work for companies that they see making a positive impact on society, he said. “We are drawing an incredibly rich, younger generation of people because they are seeing us out in the community giving back,” he said. American Integrity announced to employees at the beginning of December that the company’s charitable efforts will benefit the same three organizations next year, making it the third year in a row it will support these groups. “We are very proud to be a part of these charities and look forward to continuing to give back to the Florida communities we serve,” the company said in a statement. Wednesday, January 10 2018

Carmakers and tech companies have fallen over one another in recent weeks to show the strides they’ve made with self-driving cars. At CES — usually a stage for bragging about futuristic bona fides — top executives are instead tamping down expectations about the arrival of autonomy. Truly driverless vehicles are years away, executives from auto giants Toyota Motor Corp. and Hyundai Motor Co., mega supplier Robert Bosch GmbH and ride-hailing service Lyft Inc. said this week. While each of those companies showed off the progress they’re making in the form of concept models or Las Vegas test drives, they’re quick to admit that plenty of major hurdles remain. “It’s a mistake to say that the finish line is coming up very soon,” said Gill Pratt, chief executive officer of Toyota Research Institute, the carmaker’s $1 billion unit working on artificial intelligence and robotics. “Things are changing rapidly, but this will be a long journey.” Here are the most interesting things we learned about driverless cars after the first full day of the show sponsored by the Consumer Technology Association. Bettering BrainsToyota President Akio Toyoda introduced an electric-vehicle concept called e-Palette, a box on wheels engineered to drive itself on set routes. In 2020, Toyota will demonstrate the vehicle at the Tokyo Olympics, but even then the car may need as many as two engineers or test drivers to ensure customer safety. Pratt said the technology may not be ready to go it alone — and even if it can, the laws may not allow it yet. One of the major challenges is replicating the human brain, Pratt said. People can sense gestures and the movements of pedestrians and other drivers and predict where they’re going. AI scientists are working on this, Pratt said, but it’ll take years to get autonomous-vehicle systems to be capable of complete robotic driving. Hyundai’s HopesSouth Korea’s largest automaker is projecting an even longer time frame than Toyota for when it’ll be able to deliver almost fully self-driving vehicles. After announcing a deal to collaborate on the technology with U.S. startup Aurora Innovation, whose founders hail from Tesla Inc. and Alphabet Inc.’s Waymo, Hyundai said it’s targeting so-called Level 4 capability by 2021. The fuel-cell vehicle the company debuted at the show, called Nexo, can autonomously park itself into a space and back — with or without a driver. “We take very conservative steps,” Lee Jinwoo, vice president of Hyundai’s Intelligent Safety Technology Center in Namyang, South Korea, said in an interview at CES. “We want to test and validate the technology first. It will not be for sale in 2021, only testing in city use.” Drivers (Still) WantedLyft and Aptiv Plc, the self-driving software company spun off by Delphi Automotive, gave reporters rides in semi-autonomous BMWs, and will demonstrate their wares to CES attendees this week by offering trips to more than 20 destinations around Las Vegas. But the day that costly drivers can be completely removed from the ride-sharing equation — a future teased by General Motors Co. recently — isn’t close, according to Raj Kapoor, Lyft’s chief strategy officer. “You’re going to need human drivers for a very long time,” Kapoor said. “In the next 10 years there will be more drivers than there are today, because the demand for our service is growing so much, and only so many AVs are coming on line.” Seeing the LightCompanies pursuing automated driving are appealing to cities to build infrastructure that will aid the functioning of their autonomous vehicles. For Aptiv and Lyft’s demo in Las Vegas, traffic lights along the route are equipped with sensors that give the cars extra directive on whether to stop or go. This will be the norm in the near term, according to Kay Stepper, vice president of advanced driver-assistance systems and automated driving at Bosch. Pilots like the one GM plans for New York City this year will be restricted to validated routes. “We know we will get to true Level 5 autonomy,” Pratt said, referring to when automated-driving systems will be able to handle all aspects of piloting vehicles, no matter the roadway or environmental condition. “But we don’t know when.” Wednesday, January 03 2018

Florida Highway Patrol Sgt. Mark Wysocky says it is hard to separate texting drivers from drunken drivers as he cruises down a suburban interstate highway. Both weave. They speed up and slow down for no obvious reason and get too close to other cars. They endanger their lives and others. “There’s one,” he says, as a woman zips past. But even though he could see her texting, he couldn’t ticket her – Florida statutes wouldn’t allow it because she wasn’t breaking any other traffic laws. Florida, with some of the nation’s deadliest roads, is one of the last states to not fully ban texting while driving, but the Legislature will soon consider a bill that would. However, studies conflict over whether such bans have any effect. Currently, Florida law says texting by noncommercial drivers is a secondary offense – law enforcement officers must see another violation like speeding or an illegal lane change before they cite a driver for texting. The bill would make texting a primary offense. The fine for a first offense would remain $30 plus court costs and add no points to the driver’s record. Previous attempts have failed, but this bill has support from legislative leaders. Forty-three states already make texting while driving a primary offense. Three besides Florida list it as a secondary offense – Nebraska, Ohio and South Dakota. There is no state law against texting in Arizona, Montana and, for noncommercial drivers 22 and older, in Missouri. The federal government estimates that in 2015 accidents involving texting and other distracted driving killed almost 3,500 people nationally – more than nine per day – and injured almost 400,000. A Florida trooper, Carlos Rosario, was seriously injured in March when investigators say a texting driver struck him as he worked along a Miami highway shoulder. Rosario spent two months in the hospital undergoing several surgeries to repair injuries to his face, spine and legs. He will remain off duty until at least late 2018. Driver Hugo Olivares received five years’ probation on Dec. 20. “You see it every day when you are out driving – people texting. It has become part of our culture,” said Democratic state Rep. Emily Slosberg, one of the bill’s sponsors. She was seriously injured in a 1996 traffic accident caused by a reckless driver that killed her twin sister, Dori, and four other teens. Her father, former state Rep. Irv Slosberg, long pushed traffic safety bills including the state’s mandatory seat belt law, and she has picked up the mantle. “It is time for the Legislature to send a message that we will no longer accept this deadly behavior on our roads,” she said. The state says Florida car crashes killed almost 2,700 this year, but the number killed in texting-related accidents is unknown. Under the current law, only about three drivers a day are cited statewide for texting while driving. According to Insurance Institute for Highway Safety statistics, five of the seven states without a primary offense law had 2016 highway death rates above the national average. Ohio and Nebraska were below; South Dakota and Missouri were just above. Florida, Montana and Arizona tied for the ninth-highest fatality rate. Counterintuitively, the IIHS says its studies also show that states enacting bans experience no decrease in accidents even though surveillance shows the number of drivers texting drops substantially. Vice President of Research Jessica Cicchino said the reasons aren’t known – perhaps texting drivers hold their phones lower so they won’t be seen. That takes their eyes further off the road for longer, increasing the risk. A 2014 University of Alabama at Birmingham study, however, showed a 3 percent drop in fatalities in states after a full texting ban with the best results among young drivers. Opponents of a texting ban generally fall into two camps. First, libertarians, who say current law is sufficient if texting leads to swerving, tailgating or other dangers. Issue tickets for that, they say. Minorities fear texting bans lead to racial profiling. State Sen. Perry Thurston, a Fort Lauderdale Democrat, said the law would save lives but he is concerned some officers would stop mostly black drivers. If the law is adopted, he wants statistics collected to make sure minorities aren’t disproportionately ticketed. An American Civil Liberties Union study showed that after Florida made driving without a fastened seat belt a primary offense in 2009, black drivers were significantly more likely to receive tickets than white drivers even though studies showed blacks were only slightly less likely to buckle up. “It’s disappointing but the reality in some communities is that this is an issue,” said Thurston, an African-American. At a turnpike rest stop near Fort Lauderdale, retired insurance salesman Steve Josephson said he supports the bill because too many distracted drivers have almost hit him and he’s tired of being stuck behind people who are watching their phones when traffic lights turn green. He says he doesn’t text and drive. Landscaper Francisco Martinez wasn’t sure whether he likes the ban, but said he stopped texting and driving 11 months ago after his first child was born. “But it is tempting, particularly when someone is trying to reach you,” he said. Wednesday, December 20 2017

Citizens Property Insurance Corp., the Florida state-run insurer of last resort, is anticipating its policyholder count will increase in 2018 for the first time since its efforts to shed policies through depopulation began several years ago. As it moves on from a tumultuous 2017 that included a major hurricane and ongoing assignment of benefits (AOB) abuse, Citizens executives said at its board of governors meeting last week that it anticipates more than 60,000 policyholders from private insurance companies will return to the state-run insurer of last resort. Citizens President, CEO and Executive Director Barry Gilway told the board at the Dec. 13 meeting that the Florida domestic insurance market’s combined ratio and surplus have declined, and the majority of Florida insurers experienced negative net income for the first time in five years. While the active 2017 storm season is one factor contributing to deteriorating insurer results, the biggest factor is increasing costs from nonweather-related losses and AOB abuse fueled by attorneys and contractors. The industry has started taking steps to limit losses from AOB, with some insurers not writing in certain areas of the state where it is the rampant. Citizens, which is statutorily obligated to offer coverage when the private market will not, will have to pick up these policies. Gilway said he expects Citizens will see significantly less depopulation next year. “When the market is healthy, and companies are making money, depopulation soars; when it becomes negative, depopulation drops. We are not expecting a lot of depopulation next year,” Gilway said. Instead, Gilway said, Citizens is expecting its overall policy count of 442,000 – the lowest it has been since the company was formed in 2002 – to climb back up to around 500,000. Citizens policy count reached a high of 1.4 million before the depopulation program began in 2012. Gilway said the insurer’s personal lines accounts (PLA), where AOB is having the biggest impact, will grow by about 66,000 policies. The company expects its commercial lines policy count to continue to decline because the commercial market is so competitive. Gilway said Citizens overall premium will likely grow by about $100 million primarily because of the growth in PLA, but he added that “the unfortunate thing is we are growing in unprofitable lines and losing business in profitable lines. It’s the nature of the beast.” Gilway said that brings more pressure to focus on finding solutions for the personal lines account segment. Citizens took several steps in 2017 to mitigate nonweather-related losses and AOB abuse, in addition to an unsuccessful push for legislative reform. Over the summer, Florida regulators approved Citizens request for a $10,000 sublimit on nonweather-related water claims for policyholders who opt not to use the new Citizens managed repair and preferred vendor program. Citizens will also require that contractors and other third parties adhere to the same disclosure responsibilities as policyholders when they accept an assignment of benefit. The policy changes go into effect for new and renewal policies on May 1, 2018, to coincide with the implementation of Citizens 2018 rates. Gilway said Citizens’ other efforts to curb AOB abuse have been successful at stabilizing the overall cost of water damage claims, but added nonweather-related water claims remain double the cost of a non-litigated water damage claim in the Tri-County region of Miami-Dade, Palm Beach and Broward. “The last couple years, at least we are maintaining the same level of severity,” he said. Still, Citizens’ percentage of operating expenses relative to claims and litigation is increasing. The company expects AOB and litigation costs will account for about 23 percent of its 2018 operating expenses, up from 16 percent in 2017 – an increase of $17 million. “The scam – and that’s what it is – continues. And until legislative changes are made, it will continue,” Gilway said. Christine Ashburn, chief Communications, Legislative & External Affairs officer, told the board that the bill the industry supported last year to address AOB abuse and reform the one-way attorney statute blamed for the abuse was reintroduced by Florida Sen. Dorothy Hukill for the upcoming 2018 Florida legislative session, but she is not optimistic it will be passed next session as it has yet to have a hearing. The same bill passed by the Florida House in 2017 was also filed again this year. “Our legislative priority remains unchanged from 2017 with our primary focus being meaningful assignment of benefits reform,” she said. Hurricane Irma Response, New Claims System Citizens has closed nearly 80 percent of the 63,600 Hurricane Irma claims and the company said it is continuing to work with policyholders whose claims remain open or whose closed claims need to be adjusted further. It reported about 1,476 of its total claims filed had an AOB attached, and 6,312 claims had representation. The total number of claims in the tri-county region was 58.4 percent. Despite a projected $1.1 billion in Irma losses, Chris Gardner, chairman of Citizens Board of Governors, said the company maintains a $6.4 billion surplus and substantial reinsurance coverage following the payout of Irma claims. Gilway told the board that Citizens is making improvements to its claims processing in the aftermath of Irma to help with efficiency and communication with its policyholders. “There are lessons learned with every event, and we what we learned very quickly with Irma is that we did not have an online claims capability,” he said. Gilway said Citizens was not prepared for the magnitude of calls that came in for Irma and the subsequent follow-up calls from customers requesting status updates on their claims. To meet this need after future events, Citizens is upgrading its claims system and implementing a customer portal. The new system will allow insureds and claimants to view the progress of their claims and, once fully implemented, report them online. “From a consumer standpoint, it clearly will be a huge benefit,” he said. Citizens will also upgrade its existing Guidewire software and storage platform, the first update since the system was implemented five years ago. Thursday, December 07 2017

The Florida Office of Insurance Regulation (OIR) has approved statewide rate increases on 2018 personal and commercial property insurance rates for Citizens Property Insurance Corp. OIR approved a statewide increase of 6.6 percent for homeowners multi-peril policies, but held rates steady for Monroe County policyholders until Citizens completes analyses and review of Hurricane Irma, which devastated the Florida Keys in September. Citizens’ 2018 request called for homeowners wind-only rates in the Keys to climb by 3.9 percent. Chris Gardner, chairman of Citizens Board of Governors, said OIR’s rate order “balances the needs of policyholders facing challenges from Irma with its responsibility to maintain a healthy property insurance market.” Under the approved rates, homeowners along the coast would see wind-only rates climb by an average of 0.9 percent. Rates for condominium unit owners would rise by a statewide average of 4.6 percent. The effective date for both new and renewal rates is no earlier than May 1, 2018. Still, despite statewide increases, thousands of Citizens customers will see rate reductions. OIR said the rate decision was as a result of its review of Citizens filings and the 200 comments and testimony received from policyholders and other interested parties, both by email and during a public rate hearing held on August 23, 2017, in Miami. State insurance regulators postponed the rate filing review process, usually reached in September, on Citizens 2018 rate request to focus attention on response efforts following Hurricane Irma, a Category 4 hurricane that made landfall in the Keys on September 10, 2017. OIR issued an emergency order to assist consumers recovering from this storm. That order expired on Dec. 3, 2017. Industry-wide as of December 4, Hurricane Irma had resulted in more than 850,000 claims with insured losses of nearly $6.3 billion. Citizens said it expects to receive about 70,000 claims, including more than 9,000 from Monroe County. Statewide Citizens losses are expected to exceed $1.2 billion. OIR’s new order calls on Citizens to review rating territories throughout Monroe County and analyze wind mitigation credits while working with local officials to review building codes for possible revision. “The residents of the Florida Keys have withstood challenges and will continue to do so as they rebuild in the wake of Hurricane Irma,” said Barry Gilway, Citizens president, CEO and executive director. “We look forward to working with all stakeholders going forward to address issues discovered as a result of the storm.” Thursday, November 30 2017

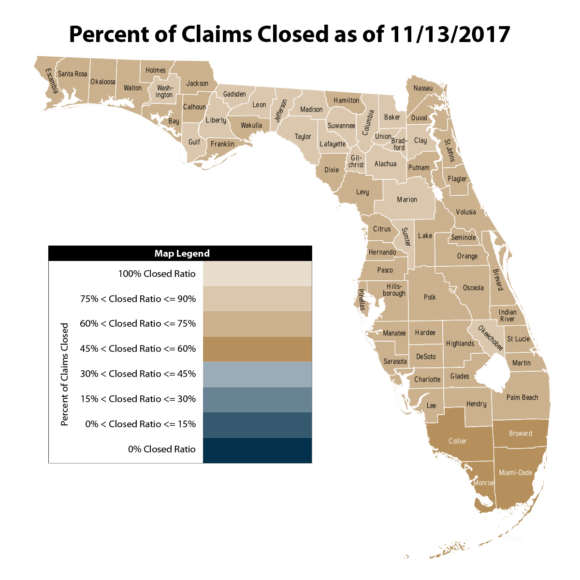

The hurricane season is officially over, but it didn’t go by without leaving a major mark on Florida and its insurance industry. Hurricane Irma, a name most in the state won’t soon forget, first hit the Florida Keys as a category 4 storm on Sunday, Sept. 10, with 130-mile per hour winds. It then worked its way north passing over the east and west coasts. Loss estimates from Hurricane Irma have ranged between $25 billion to $65 billion by catastrophe modelers. The Florida Office of Insurance Regulation (OIR) reported total estimated insured losses at more than $5.8 billion as of Nov. 13, with more than 689,000 residential property claims and 51,396 commercial property claims. Business interruption claims reached more than 3,700 as of Nov. 3. In the immediate aftermath of the storm, 6.7 million homes and businesses — about 65 percent of the state — were without power. The Florida Hurricane Catastrophe Fund said the state fund that provides backing to private insurers would pay about $5.1 billion in claims. Florida estimated it had spent nearly $650 million on emergency resources and clean up from the storm. Florida’s state-run insurer of last resort, Citizens, expects $1.2 billion in insured losses and 70,000 Hurricane Irma claims over the next 18-24 months. The carrier said Nov. 29 it had closed nearly two-thirds of the 62,000 claims it had seen so far, including more than 42,400 claims in Miami-Dade, Broward and Monroe counties. The damage to Florida crops was also epic. According to The Associated Press, Florida Agriculture Commissioner Adam Putnam said Irma’s path couldn’t have been “more lethal” for Florida agriculture, with few crops spared. More than half of the state’s iconic orange crop is estimated to be lost. Could Have Been WorseHurricane Irma will go down as one of the top hurricanes in Florida history, but experts say it could have been worse. As the storm tracked towards Florida in early September, some estimates put the cost of damage from Irma as high as $200 billion. But something called the “Bermuda High,” threw the hurricane slightly off course, sparing the most populated area of South Florida from the brunt of the storm. Bloomberg reported that the circular system hovering over Bermuda “jostled Irma onto Northern Cuba … where being over land sapped it of some power.” Florida escaped the worst because “Irma’s powerful eye shifted westward, away from the biggest population center of Miami-Dade County,” Bloomberg said. “The fact that it took a left turn at the last minute and didn’t give Miami a punch in the nose was a blessing,” said Marsh US Property Practice Leader Duncan Ellis. Recovery OngoingStill, Irma did pack a powerful punch and the recovery will go on for some time. Companies are now working on getting insureds back on their feet. One of the biggest issues in the aftermath of Irma has been a shortage of claims adjusters. The storm came just two weeks after Hurricane Harvey hit Texas and the industry has scrambled to bring in adjusters, leading to delays in resolving claims. OIR reported in its Nov. 13 claims data that about 235,759 residential property claims reported to insurers remained open. The percentage of commercial property claims closed was 29.5 percent. “The biggest challenge is you get a backlog when catastrophes hit like this. [Hurricane Harvey] was so close to what happened in Florida,” said Bobby Raymond, owner of Jacksonville, Fla.-based Brightway, The Fort Caroline Agency. “There’s a limited pool of claims adjusters in the universe. We’ve warned clients carriers are doing the best they can, but they [could] take a while to get back to you.” Raymond himself couldn’t get a claims adjuster out for almost a month after Irma caused two trees to fall on homes he owns. “That’s just typical,” he said. Carriers have turned to technology, such as drones, to help with assessing claims. EagleView, an aerial imagery provider, does inspections for insurance companies, including roof and structure damage, and property damage measurements. Kenneth Cook, SVP of EagleView OnSite Solutions, said its drone technology has handled thousands of Irma claims for insurers. “It’s a new method for them to get their work done. After any kind of a storm event — especially with two major events back to back — insurance adjusters are busy around the country, and insurance companies are always looking for faster more efficient ways to help customers,” Cook said. EagleView contracts with drone hobbyists and provides them with insurance certification training, including how to inspect a home for claims purposes. In some areas of Florida that were impacted by Irma, Cook said drones were not a good solution because of structural damage, but in other areas drones can capture detailed images of damage like missing shingles, fences blown down, or missing roof tiles. “There are thousands of claims that drones are perfect for because in just 25 minutes the pictures are taken and uploaded, saving the carrier a lot of time,” he said. New hurricane policies were also put to the test in the aftermath of Hurricane Irma. Policyholders of the new StormPeace product from Assured Risk Concepts (ARC) and California-based Topa Insurance Co. were reimbursed right away for hurricane expenses ranging from $1,000 to $15,000. Alok Jha, CEO and founder of ARC, said as of mid-October about 90 percent of its customers had been paid for Irma losses. The StormPeace product uses mobile technology to alert costumers in declared storm areas so they be paid right away for evacuation costs or damage to their homes. “This product has no exclusions and pays promptly after a hurricane,” Jha said. A contractor shortage has also delayed recovery efforts. Jake Morin, president of Construction for ProSight Specialty Insurance, said demand has surged for contractors in hurricane-hit areas, and so has demand for coverage. The company is working quickly to get contractors insured so they can help with rebuilding. “Homeowners and businesses want to make sure they are working with a licensed and reputable contractor,” he said. “There is a flood of contractors trying to capitalize; make sure the work they are doing is the work they need to be doing.” Lessons LearnedExperts are already looking at whether the state was adequately prepared for Irma and what should be done differently next time. “Much hard work and preparation over the last few years has paid off during Citizens initial response to Hurricane Irma,” said Chris Gardner, chairman of Citizens’ board of governors, shortly after the storm. “However, given the magnitude of reported claims, we are sure to encounter unforeseen challenges. We will continue to learn, prepare and improve our response capabilities with each storm situation.” Agency owner Raymond said despite the adjuster shortage, he’s been impressed with how carriers have improved their cat response and capabilities to process large claims volumes since Hurricane Matthew. “We had less complaints from customers this year about not being able to get through to their carrier,” he said. Marsh’s Ellis says Irma is a reminder of the importance of adequate insurance coverage, and that agents should take the time now to sit down with their clients and evaluate their coverage needs. “People forget how significant these events are. It’s an eyeopener for people, especially in the residential space where flood isn’t covered,” Ellis said. ProSight’s Morin agrees. “Insurance is one of those items that you buy, but you don’t know what you have until you need it. Customers truly rely on their insurance agent to be their counsel and point them in the right direction and make sure they are covered,” he said. Doug Wiles, president of Herbie Wiles Insurance Agency in St. Augustine, Fla., said Irma’s aftermath has highlighted the important work that insurance agents do. For instance, he has spent countless hours keeping information flowing between carriers and customers since the storm. “It can be tough to get through to insurance companies and you are speaking to a different representative each time — it’s not like talking to an old friend or neighbor. The value of an agent at a time like this is incredible,” he said. He added that the increasing frequency of catastrophes should not be overlooked. “With the change in our climate, I am concerned we are going to see more of this activity and I am concerned about what that is going to do to the insurance industry, especially for those companies who have focused their business in Florida,” he said. “I think we need to take a careful look at how we spread that risk — and whatever that means to the companies involved.” Wednesday, November 22 2017

A Florida nursing home under investigation for the deaths of 13 patients after Hurricane Irma says in a letter to Congress that staff members did everything possible but couldn’t overcome a lack of power to the central air conditioner. In a letter released Monday, Rehabilitation Center at Hollywood Hills attorney Geoffrey D. Smith told the House Energy and Commerce Committee that employees followed proper procedures between the air conditioner losing power on Sept. 10 and when the deaths began Sept. 13. The committee is investigating the deaths as are local police detectives and the state. Smith said managers made repeated calls to Florida Power & Light, the state health care administration and Gov. Rick Scott in an effort to get the air conditioning power restored but got nowhere. Meanwhile, he says the facility’s main power never went out and employees used portable air conditioners and fans to cool the patients and kept them hydrated. There was no state law requiring nursing homes to have backup generators for their central air conditioners. He said staff had been closely monitoring patients for two days when the deaths began without warning. He said the temperature inside the facility never exceeded 81 degrees, which would be within standards. “We believe that there were multiple system failures that need to be considered and investigated before casting blame on persons who risked their own well-being to care for others during this natural disaster,” Smith wrote. Scott’s office issued a statement Monday saying, “This facility had a responsibility to its patients to protect life during emergencies. We must learn why this facility chose not to evacuate their patients to the hospital across the street or call 911.” Florida Power & Light says it followed the priority list for restoration as agreed to by Broward County. Smith wrote in his letter that from Sept. 10 to 12, the staff monitored the facility’s 150 patients and none exhibited any sign of heat exhaustion. He said about 3 a.m. on Sept. 13, several patients began showing signs of respiratory and cardiac distress. He said the staff summoned paramedics for each patient and followed proper protocols. “The onset of heat stroke is impossible to predict and can occur in 10 to 15 minutes,” he said. He said the elderly are susceptible at 81 degrees (27 degrees Celsius). He said about 6 a.m., Hollywood police officers and staff from Memorial Regional Hospital, the trauma center across the street, declared a mass casualty situation. Officers and hospital staff members have said the facility seemed excessively hot. Detectives took a temperature reading but that has not been released. All patients were evacuated to Memorial over the next three hours. Three patients died at the nursing home, five later that day at Memorial and five in subsequent days at the hospital. A 14th death was later determined not to be related. The dead ranged in age from 57 to 99, with most from their 70s to 90s. Smith rejected criticism that the center should have evacuated its patients to Memorial earlier, saying that would violate established emergency procedures. “Hospitals are critical facilities that are supposed to be used for individual cases,” not as mass evacuation centers, he wrote. Shortly after the evacuation, an FPL crew arrived and restored the air conditioning’s power in 20 minutes, he wrote. He said 242 other Florida nursing homes lost power. He said he is seeking information on deaths at other facilities to see if they spiked during the blackout. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.