BlogThursday, October 29 2020

After years of warnings that the Florida property insurance market was heading towards an availability crisis, many in the industry say the moment of reckoning has arrived. They blame unchecked claims litigation from non-catastrophe water losses and rising reinsurance rates that have severely strained the financials of Florida insurers. The situation has gone from bad to worse for Florida domestic insurance carriers this year, which together cover most of the state’s homeowners market. Nearly 60 carriers suffered a combined $701 million in losses and $351 million in negative income for all of 2019, according to Guy Carpenter. In just the first half of 2020, the companies lost more than a half billion ($501 million) in underwriting losses and $227 million of negative net income. Third quarter results are expected to show further deterioration. Guy Carpenter’s data cited an average net combined ratio for 2019 of 111 percent that climbed to 129 percent in the second quarter of 2020 for these companies. “If we’re not in a crisis, I don’t know what we’re in,” said Kyle Ulrich, president and CEO of the Florida Association of Insurance Agents. “Those numbers … just simply are not sustainable.” As a result, carriers have been steadily raising rates this year and this trend isn’t expected to slow down any time soon. Companies are requesting and the Florida regulator is approving substantial rate increases – some over 30% – along with taking steps to limit their exposures and protect their books of business. The vast majority of Florida insurers have filed multiple rate increases this year for just under the 15% threshold that requires a rate hearing by the Florida Office of Insurance Regulation. Since August, four companies – Capitol Preferred Insurance Co., Southern Fidelity Insurance Co., First Community Insurance Co. and Centauri Specialty Insurance Co. – have participated in rate hearings for rate increase requests ranging from 25% to just below 40%. John Rollins, former principal and consulting actuary with Milliman and now chief financial officer at Olympus Insurance, told the Colodny Fass/Aon Florida Insurance Summit in September that Florida homeowners insurers filed at least 79 rate increases through the second and third quarter of 2020. The cumulative impact of these filings averages a 9.3% increase equaling $7.4 billion in homeowners premium, not including dwelling fire, Rollins said. The total premium base in Florida is about $11 billion, Rollins noted, “so essentially you’ve had 70 percent of the market go to the well in the last five and a half months and take a rate increase of 9.3%.” How did the market get to this point? Over the last several years, insurers have consistently cited evidence of excessive first- and third-party litigation from non-catastrophe water damage losses across the state. While the state also experienced a number of major catastrophes, the industry says the frequency and severity of lawsuits on non-cat losses has been unprecedented. Barry Gilway, president and CEO of Florida’s Citizens Property Insurance Corp., said litigation for the state-run insurer of last resort has increased in some parts of Florida by 500% in the last four years. “Litigation is out of control in the state and until we do something about the overall litigation issues and the firms drumming up litigation, then rates are not going to stabilize,” Gilway said at the Colodny Fass/Aon event. Overall litigation rates for third party assignment of benefits (AOB) lawsuits have dropped from what they were a few years ago thanks to reforms passed in 2019, but carriers say they are still being hit by a considerable amount of first party litigation and excessive attorney fees. They point the finger at the state’s one-way attorney fee statute and the contingency fee multiplier for incentivizing inflated lawsuits against insurers. “We have seen a continued increase in litigation whereas specific AOB claims have decreased slightly,” Jesse Rehburg, actuarial manager for Capitol Preferred, told OIR regulators at an August rate hearing for its filing for a 26.2% increase on nearly 30,000 policies. It also sought a 31.1% increase on more than 46,000 policies for its Southern Fidelity Insurance affiliate. Capitol Preferred said non-catastrophe water loss claims and litigation show no signs of slowing. Rehberg noted 30% of its filed claims are represented by attorneys, and costs of represented claims are more than 100% higher than non-represented claims.

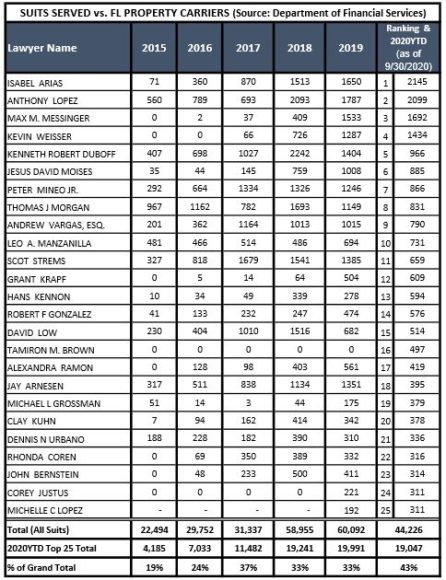

In analyzing data from the Florida Department of Financial Services, industry consultant and president of Johnson Strategies Scott Johnson noted in a recent blog that 25 attorneys have filed nearly 20,000 lawsuits against insurers through the first six months of 2020, accounting for 43% of the state’s total property lawsuits so far this year. The total number of suits filed against 56 property carriers since 2015 totals 246,856. Florida-based litigation management and analytics software company CaseGlide’s data showed that around 4,000 lawsuits per month were filed against the top 15 to 20 Florida property carriers during June, July and August of this year. The company attributed some of that to the rush to get claims in before the September three-year deadline for Hurricane Irma. Litigated claims increased again in September to nearly 5,000, up 7% from August and 28% from September 2019. Reinsurers have responded to the Florida market’s increasing losses and exposure with the highest spike in renewal rates since 2006, Rollins said. Reinsurance rate increases on this year’s renewals averaged 25% to 30% with some companies seeing as much as a 50% increase. The reinsurance increases have put Florida insurers in the position where they simply can’t take on more risk, Ulrich said. “Given what their re-insurance allows them to do and write, based on some storms this summer and the exposure that they have seen in claims, they just don’t have the ability to write any more business,” he said. Agents have reported “pretty restrictive” new underwriting guidelines by carriers, including limits on new business to homes 2010 and newer, Ulrich said. Several carriers have told their agents that they will no longer accept any new business and instead will just quote renewals. “They will be renewing the business that’s on the books, and agents can buy business that has already been quoted,” Ulrich said. “But, going forward, they’re not writing any new business.” At Citizens June board of governors meeting, Gilway said decreased reinsurance capacity has forced companies to restructure their portfolios. Six major companies publicly announced they were shutting down of all new business in Tri-County, Central Western Counties, and more recently, the SOLO counties of Seminole, Orange, Lake and Osceola. “These measures are harmful and significantly impactful to consumers in the form of higher insurance rates, reduced coverage and lack of availability,” Florida Insurance Consumer Advocate Tasha Carter said in an e-mail to Insurance Journal. “As policies are restructured to include tighter underwriting measures, consumers are paying higher insurance premiums for reduced coverage. Essentially, consumers are paying more for less and that’s problematic.” Losses so far in 2020 are not going to help the situation, noted Robert Warren, client services manager for Demotech, at the Colodny Fass/Aon event. Demotech, which rates more than 40 Florida domestics and threatened downgrades to a dozen early this year before affirming them, projects a $730 million underwriting loss for those companies – almost double the amount of 2019 – based on data it has seen of weather losses, reinsurance costs and the investment in the replacement of capital the companies will need to make before the end of the year. That figure does not include losses to carriers from Hurricane Delta, he said, which despite being a mainly Louisiana event could still impact Florida insurers that have diversified and expanded into other states. “It’s been a significant year for storm events – this is a frequency issue as well as severity,” Warren said. Companies are already taking steps to replace lost capital, Warren said, but doing so could be problematic for those that do so by taking on debt. “[Demotech] need[s] to be very aware of what that capital source is,” he said. Warren said Demotech believes carriers are “doing the right things at the right time for the right reasons,” and expects those that need capital to keep their financial stability rating (FSR) from Demotech will be able to get it. “Right now, Demotech’s expectation is they will meet our requirements to maintain or be considered to maintain the current FSR,” Warren said. Ulrich warned, however, that outside capital that has consistently invested in Florida-based carriers, may be close to the end of financing Florida’s domestic homeowners’ market. “When we get to that point where folks that have invested in this market make the decision that they’re no longer willing to invest in this market, and it becomes more difficult for companies to find and attract capital, and their surplus is going down at the rate that it is now, that becomes a crisis situation,” he said. Market Impact – The Growth of CitizensWith rates spiking statewide and companies pulling back capacity, many insureds have had no other choice but to turn to the insurer of last resort, Citizens. Its rates are capped on a glide path of 10% per year, meaning the company cannot raise them more than that, thus making the residual insurer a competitive alternative to the current private market. Citizens’ policyholder count stood at approximately 443,000 policies earlier this year with about $110 billion in exposure. At the September Citizens Board of Governors meeting, Gilway said Citizens is growing by 2,500 to 3,000 new customers per week on a net basis. Its new business increased from 7,770 policyholders to 17,691 per month over the past 12 months. Gilway said the increase in new business, combined with a significantly higher renewal rate of 90% this year compared to 83% last year, puts the company at an estimated policy count of 540,000 for year end 2020 and up to well over 640,000 next year. “We grow and we shrink depending upon the overall profitability of the private market,” Gilway said at the Florida Insurance Summit. “When the private market is doing extremely well then Citizens shrinks. When the private market is really succumbing to some of the problems that we’re seeing … obviously we start to grow.” The repopulation of Citizens could mean added costs for all Florida consumers. Florida law requires that Citizens levy assessments on most Florida policyholders if it experiences a deficit in its reserves in the wake of a major storm or series of storms. At its peak in 2011, Citizens had 1.5 million policies on its books – 23 percent of the Florida market – with exposure that topped $512 billion. In the event of a 1-in-100-year storm, Floridians were on the hook for $11.6 billion in assessments. Thanks to depopulation efforts, the reinsurance market and catastrophe bonds, Citizens was able to eliminate assessments for Florida consumers in 2015. “The growth of Citizens impacts the private market and shifts Citizens farther away from being the residual market carrier it was intended to be,” said Insurance Consumer Advocate Carter. Florida State Senator Jeff Brandes, who sits on the Banking & Insurance Committee, said one of his primary legislative goals over the next two years “is to put the Florida insurance market on a sustainable path.” To that end, Brandes worked with Citizens to commission an exposure reduction study on how the insurer could reduce its overall exposure and financial impact on the state. That study is currently being performed by analysts at Florida State University and is expected to be complete by December. Brandes said he requested the study because “the writing was on the wall.” “Anybody who is shocked that Citizens is starting to grow hasn’t been paying attention because we’ve been telling them for frankly months, likely years,” Brandes said in an interview. “We recognize that Citizens is required to only raise rates 10% a year. And often they’re losing money in certain markets and they’re being subsidized, those homeowners are being subsidized by taxpayers.” Gilway said Citizens hopes the FSU Study will provide insight as to why litigation is increasing, why severity is increasing, and into the roles of public adjusters and loss consultants, and more. He said he expects there will also be legislative recommendations along with changes in the Citizens plan of operations. Brandes has other ideas for how to keep Citizens a residual market, including transitioning its rate structure to what he calls a “vintage model.” That would involve bringing in new policies at an actuarially indicated rate while allowing existing customers to stay at the current rate cap. When policyholders renew, they would stay at the 10% glide path and new policyholders would reset for that vintage, he said. Brandes asked Gilway in June to request the board consider implementing this change. “Application of actuarially sound rates for new Citizens customers will bring Citizens into compliance with the statutory directive that its rates be actuarially sound and maintain Citizens as the insurer of last resort,” he wrote in a letter to Gilway. The action is slated to be discussed at the December board meeting, Brandes said. A Citizens spokesperson said actuaries will present information to the board in response to Brandes’ letter but it is unclear if any action will be taken at that time. “That seems to be the only sustainable model that will work for Citizens for the long term, given the challenge of adjusting the rate cap in the political environment,” Brandes said. Gilway said he thinks much of the business coming into Citizens right now has more to do with capacity in the market than rates. “No one’s quoting. Period,” he said at the Colodny Fass/Aon event. But in studies comparing Citizens to the private market, Citizens rate cap makes it too competitive with the private market, and that’s a problem long term, Gilway said. “The more we get out of whack with the private market … I believe it will be the reason more growth comes into Citizens and that’s not what we want,” he said. “Our goal is to find a policyholder the best coverage at the best price in the private marketplace and get Citizens back down to the point where we have a reasonable residual market position.” Wednesday, October 28 2020

Florida-based Tower Hill Insurance and national carrier Safeco, two non-affiliated carriers, have formed a marketing partnership in the state of Florida to offer a multi-policy discount to customers. Beginning in November, policyholders will have access to a multi-policy discount when they add a Tower Hill home to an account with a Safeco auto policy – or add a Safeco auto policy to an account with a Tower Hill home policy. The company said with market disruption commonplace in Florida, “this is an opportunity for both companies to reach more customers through their multi-policy marketing partnership.” The multi-policy discounts are applied to both the auto and home insurance policies. Tower Hill’s President, Don Matz, and Debra Pooley, Southeast Region Field Executive at Safeco, jointly announced the new partnership to agents recently, saying the marketing partnership is a natural way for each company “to better serve our independent agents and policyholders.” Tower Hill currently insurers more than 2 million customers. Both teams worked over the last year to bring the partnership to light, according to the companies. Safeco Insurance currently offers several programs in Florida – including the RightTrack Mobile program, which provides discounts for safe drivers. After a 90-day driving period, eligible customers receive a premium discount, up to 30%, for the life of the policy. The new multi-policy discount is applied in addition to the home and auto discounts that Tower Hill and Safeco customers already receive. Founded in 1972, Tower Hill Insurance offers residential and commercial property insurance in the Southeast. In business since 1923, Safeco Insurance sells personal automobile, homeowners and specialty products through a network of more than 10,000 independent insurance agencies throughout the United States. Safeco is a Liberty Mutual Insurance company, based in Boston, Mass. Thursday, September 17 2020

As Hurricane Sally bears down on the Gulf Coast, a new survey is highlighting the concerns many Florida residents have about the impact of catastrophic storms on their communities and everyday lives, as well as if they are adequately insured against these events. The survey of 1,582 Florida voters conducted August 31 to September 2 by “Get Ready, Florida!” – a statewide public education initiative produced by the nonprofit FAIR Foundation, follows one conducted by the organization at the start of this year’s hurricane season. The new survey indicates a slight shift in Floridians concerns about hurricane season at its halfway mark compared with the start of the season in June, during the height of the pandemic. The most recent survey looked at Floridians recovery expectations for catastrophic storms. Most respondents (68%) said they would find it difficult to pay the average $5,000 hurricane deductible if needed, with only 32% indicating that the $5,000 deductible would be “very manageable” or “no problem” at all to pay following a storm. More than six in 10 (62%) of Floridians with homeowners or renters insurance said they are unsure what their policies would cover following a storm. And, despite the fact that most hurricane policies do not cover tree and debris removal from yards, 16% of survey respondents said they believed this benefit is covered in their policy. Almost one-third of those surveyed say they would be willing to pay something extra each month in order to have their policies cover these services. Twenty-seven percent of respondents said they’ve experienced problems relating to yard debris or fallen trees following a storm. This includes 19% who say they have been blocked from their home or driveway, 11% who say they were stuck with large bills for debris removal, and 4% who say that they or a member of their household have been injured trying to remove debris out of the way. More than two-thirds would like their local governments to plan ahead and line up debris removal services in advance so life can return to normal as quickly as possible following a disaster. FAIR said the survey serves to help Floridians plan, prepare, and respond to the threat of the annual six-month-long “mean season” of hurricanes and tropical storms. “In the most hurricane-vulnerable state in the nation, millions of Floridians roll the dice by going without adequate insurance to help them through the ordeal,” said Jay Neal, president of the FAIR Foundation. “This survey shows that while many Floridians lack a clear understanding of what their insurance policy covers, they recognize the wisdom of having their cities and counties prepared to clean up the mess after a storm.” The survey found that more than two-thirds of respondents (68%) would support their city or county acting before a disaster strikes to invest tax dollars in advance for contracted cleanup services, if and when needed, in order to ensure that resources are available to deploy immediately to clear massive debris and help a return to normal. “This would mean contracting with a disaster recovery or debris removal business in advance – to be treated as a priority, by providers with the resources and expertise to do the job quickly and efficiently. Since Hurricane Katrina in 2005, many communities in impact zones have adopted this practice,” Get Ready, Florida! said in a statement. The same number of respondents (51%) as the previous survey say they are “more” or “much more” concerned about this year’s hurricane season than in previous years due to COVID-19 when compared with the previous survey. However, the percentage of those with one specific concern dropped from 91% to 84%, with the top concerns listed in the survey including: more strains on first responders (46%); business closures or more hits to the economy (46%); uncertainty about where would be safe to evacuate to (32%); fewer shelters open due to social distancing (32%); the ability to care for elderly or special needs relatives (29%); and being able to afford supplies (24%). “One of the great challenges Florida faces is that it adds enough people each year to fill an entire city, and those newcomers – and many who have lived here for years – don’t really know what they have and what they need when it comes to hurricane insurance,” said Craig Fugate, a Florida native who served as the top administrator of the Federal Emergency Management Agency. “Flooding is not covered by your homeowners insurance and requires a flood policy for protection, and flood risk is growing due to more extreme rainfall events during hurricane threats. It’s a good idea for everyone to check their insurance policies now, add flood coverage, and for local governments to get themselves as prepared as they can.” Get Ready, Florida! is an annual statewide public education campaign working to educate Floridians about hurricane preparedness and safety as part of the National Hurricane Survival Initiative. The survey of 1,582 Florida voters was conducted by Sachs Media Group, with an average margin of error +/- 2.5% at the 95% confidence level. Results Thursday, September 10 2020

It’s been 3 years since Hurricane Irma made landfall in Florida as a Category 4 storm, and the trail of damage left in its wake is still being felt across the state today, particularly by the insurance industry as it continues to see thousands of claims per month and costly litigation from the catastrophic event. But with the storm’s 3-year anniversary comes a deadline that much of the industry hopes will put an end to the many purported frivolous and fraudulent Irma-related claims that have taken a significant toll on the state’s insurance market. In what is an unlikely coincidence, experts say, the run-up to this deadline – when the first notice of loss related to Irma must be filed with insurers – has also brought a new onslaught of claims. “There’s been one last gasp to get the claims in prior to the September 13th deadline,” said Barry Gilway, president & CEO of Citizens Property Insurance Corp., referring to the statutory requirement that specifies policyholders must notify their insurer of a claim within 3 years of when a hurricane makes landfall and causes covered damage. In the case of Irma claims, that deadline falls on Sept. 13, when the storm warning officially ended, Gilway said. Florida approved the three-year insurer notice of windstorm or hurricane loss requirement in 2011 as part of sinkhole reform. Claims can be reopened or supplemental claims related to the original claim can still be filed as long as the insurer received the first notice of loss ahead of the corresponding storm’s deadline. Now, nine years later, that filing deadline is officially being put to the test for claims from Hurricane Irma, the first major storm to hit the state in over a decade when it made landfall in the Florida Keys on Sept. 10, 2017 as a Category 4 hurricane with 130-mile per hour winds. The storm then spread north over Florida’s east and west coasts causing widespread damage and losses statewide. Loss estimates when the storm first hit ranged from $25 billion to $65 billion by catastrophe modelers. According to the most recent Hurricane Irma claims data from the Florida Office of Insurance Regulation in January of this year, more than 1 million Irma claims have been filed – 909,321 of those being residential property and 61,518 commercial – totaling almost $17.5 billion in insured losses. For Florida insurers and Citizens, the state-run insurer of last resort, Irma was and continues to be a very significant event, Gilway said. Citizens received about 76,500 claims and that number keeps growing. Citizens is one of many insurers today, Gilway said, receiving hundreds of Irma cases per month, with the number of claims spiking as the first notice deadline neared. “There really is this push the closer you get to the deadline date for new claims to come in. You get this push to put in more and more and more claims,” Gilway said. “Here we are three years out from the storm, and we’re still getting between 450 and 600 claims per month. From a size standpoint, most companies are seeing that uptick in claims.”

“The claims that we received, initially started out as being legitimate, solid claims. It’s very, very clear that when it comes to hurricane claims, people want to put the claim in, they want to put it in now because it is very real damage and they need a response to the damage,” Gilway said. “As time goes on, what you find is you’re getting more and more claims that are extremely questionable.” The majority of the claims coming in now tend to be declined because they are fraudulent, Gilway said, calling them “door knocker” claims from people out there promising insurance payouts for damage unrelated to Irma. “This is common across the industry and the vast majority of companies are seeing these late reported claims particularly in the southeast, Tri-County area,” Gilway said. CaseGlide, a Florida-based litigation management and analytics software company that monitors Florida carrier claims and works with about 15 to 20 of Florida’s domestic companies, said an influx in claims came right after Irma, as would be expected, as well as for several months after. “But then you’re also seeing a lot that are being filed for the first time this year … And I don’t think there’s really anything unique about Irma as far as why you would see that,” said Wesley Todd, CEO and founder. Not everyone agrees, however, that the all of the Irma claims still coming in are fraudulent or inflated. Florida attorney Gina Clausen Lozier, member of law firm Berger Singerman’s Dispute Resolution team, said in a recent survey conducted by her law firm of 2,000 business owners in Florida, 75% were unaware of the first notice of loss deadline for Irma. That is concerning, she said, especially given the COVID-19 situation that could be preventing people from having inspections done on their home or business. “There’s no reason that anyone would be aware of it if you’re just a regular business owner and consumer,” she said. Larger commercial claims, in particular, can take longer to go through the claims adjustment process and many claims are just in the last six months getting resolved in litigation or in the alternative dispute resolution process, she said. Additionally, more repairs or a more thorough overview of damage can require a supplemental claim because the scope of damages is larger than originally thought. Or “there’s some people who are just now being made aware that they had significant damages to their roof from a wind event, which a lot of times seems to be Irma,” she said. The timing of Irma may have played a role in these delays, Clausen Lozier noted, as it came right after Hurricane Harvey and was then followed by Maria, and the industry was stretched thin in terms of the availability of claims adjusters and other resources. “Sometimes there’s a turnaround and reassignment and it just goes through the process and unfortunately it takes some time,” she said. Condominium associations in particular, Clausen Lozier noted, is where she has seen a lot of additional claims as they continue to experience interior leaks through windows or roofs caused by Irma and end up requiring additional repairs. While acknowledging there are definitely those who take advantage of the system, she disputes the idea that many Irma claims are fraudulent because “the opportunity for fraud is lower in a hurricane claim because we all know the hurricane hit. It’s not like someone created a hurricane to put in an insurance claim.” Her firm’s team, specifically, recovered $95 million just in the last year for clients “that insurance companies said they didn’t have to pay.” “And it’s not because the claims were fraud, they paid them voluntarily or through some other alternative dispute resolution,” she said. Gilway noted that Citizens’ attitude is to absolutely reopen legitimate claims to pay final or differentiated costs and the insurer encourages insureds to reach out for additional payment if more damage is found. “Those are good claims. What is problematic are the new claims coming in,” he said, and every single one is investigated. The blip the company has seen, most notably in July, for Irma claims was “like the attorneys came back out of their hiding place and starting filing new cases again,” he said. “You had a shift, because of the deadline. You had a shift. And you had a slight blip. And again, it was almost totally consistent across the industry.” Irma Impact on Florida MarketBut it hasn’t just been the number of Irma claims that have hurt Florida insurers. The severity of these claims, thanks to corresponding litigation, has left a major mark on the books of carriers, their reinsurers and ultimately the state’s insurance market. Ratings agencies and analysts forecasted immediately after Irma that Florida domestics were well-prepared financially to handle the expected losses after Florida’s 11-year hurricane drought, though AM Best warned that Hurricane Irma had the potential to amplify the AOB issue that was leading to an increase in frequency and severity of litigated water claims. “A.M. Best expects that Hurricane Irma and AOB losses will have a much greater impact on operating results for the concentrated insurers,” a Sept. 2017 report stated. That prediction came to fruition, albeit later than expected, as significant loss creep from Irma in the form of reopened claims, AOB and first-party litigation related to the storm started pouring in months after. The impact of Irma litigation on Florida carriers, which Gilway largely attributes to the “bad actors” filing frivolous claims and lawsuits, can’t be understated, he said, calling it “unlike anything we have seen before.” “The reality is, loss development has just been ridiculous for Irma,” he said, citing numbers as high as 200 to 250% for some companies. Carriers were not expecting such loss development as the litigation rate during prior storms was typically around 4 or 5% and for Irma it was 25%, Gilway said. The negative effect of those numbers on the market has been substantial, particularly for the reinsurance market which mostly absorbed the losses for the Florida domestic companies. But that “basically shut down the retrocession market” and led to huge pricing increases on reinsurance this year, Gilway said. Carriers have responded with their own pricing increases and a pullback in Florida market capacity. “Irma has been an unprecedented event as far as what many characterize as loss creep,” said Kyle Ulrich, president and CEO of the Florida Association of Insurance Agents (FAIA). “If you talk to any insurer or reinsurer and they talk about what happened post Irma, it has been something that I don’t know that they’ve seen anywhere in the world ever. The number of claims that have been filed so far out from the actual event happening – it’s had a significant impact on reinsurance pricing and loss adjustment expense for many carriers, and has, frankly, changed the way that reinsurers look at Florida.” The good news, Gilway says, is that litigation has finally dropped off for Florida carriers, particularly Citizens. The number of litigated cases during the first six months of this year fell from an average of 902 new lawsuits per month for the same period last year to 589 new lawsuits per month this year – a 35% reduction. Part of that is thanks to AOB reforms passed in 2019 and “part of it is that we’re starting to see the beginning of the end of the Irma impact,” Gilway said. He expects carriers will be able to weather any future financial impact that could come from additional Irma claims. “Frankly, I don’t think it’s a financial issue again, because for the vast majority of these carriers, that coverage is well into their reinsurance layers. Any additional Irma claims coming in is covered by their reinsurers, and any additional dollars associated with those claims are covered by the reinsurers,” he said. CaseGlide data showed that Florida litigation against the top 15 to 20 property carriers, including suits related to Irma, peaked in May 2019, right before the AOB law kicked in. Litigation dropped after that but ticked up again this summer between June, July and August to around 4,000 lawsuits per month. “There’s been increases throughout the summer, it’s a little bit elevated, with a significant share of those new lawsuits being Irma, a rising from Irma claims,” Todd said. Many in the Florida insurance industry are now breathing a sigh of relief that the deadline is finally here. “Everybody has seen loss creep in their books over the last three years that no one expected,” said Ulrich. “I don’t want to say that people are looking forward to a point in time when people can’t file claims, but at some point, there does have to be some finality. There is always that option for people to reopen a supplemental claim from a previous claim that was valid.” Todd says, the deadline will at least “close the universe on the potential amount of claims,” and expects that will make a difference for Florida carriers in assessing the extent of their Irma liability. “This marks a bookend to, or at least part of a bookend, to re-insurance obligations, and carry obligations for the storms. It’s a very important time for the industry to start evaluating and analyzing what happened and what it means for their business model,” he said. “In several months, toward the end of the year, towards the beginning of next year, you should start seeing decreases in litigation in Florida, because the Irma claims are such a significant share of the Florida litigation.” Gilway said he wouldn’t be surprised to see the industry push for a reduction in the first notice of loss deadline from three years to two years during the next legislative session, and fully expects another push for reform to first-party litigation. Without reform, these last-ditch efforts to file frivolous claims will be the norm. “We’ll see the same thing in [Hurricane] Michael – as the deadline approaches, you’re going to see a last opportunity for public adjusters and attorneys to take advantage of the system,” he said. Tuesday, September 08 2020

The downward trend for Florida workers’ compensation rates is set to continue next year thanks to favorable loss experiences from policy years 2017 and 2018. The latest filing from the National Council on Compensation Insurance (NCCI) proposes an average statewide rate decrease of 5.7% in the voluntary market. It will take effect Jan. 1, 2021 if approved by the Florida Office of Insurance Regulation, which is currently reviewing the proposed rates. NCCI is a licensed rating organization authorized to make recommended rate filings on behalf of workers compensation insurance companies in Florida. “As always, OIR will review the filing to ensure the proposed changes are not excessive, inadequate or unfairly discriminatory and evaluate its potential effects on the insurance marketplace and employers, who are required by law to carry this insurance on their employees,” the Florida Office of Insurance Regulation said in a statement. The filing is based on experience data as of year-end 2019 from policy years 2017 and 2018. “Favorable experience has been observed in each of these years. Florida’s lost-time claim frequency continues its decline while the state’s average indemnity and medical costs per lost-time claim have exhibited relatively more year-to-year volatility,” NCCI said. If approved, it would be the fifth rate decrease for Florida since 2016, when two separate Florida Supreme Court decisions led to a significant rate increase and much anticipation that rates would continue rising in the near future. Those decisions – Westphal v. City of St. Petersburg and Castellanos v. Next Door Company “resulted in changes to the Florida workers compensation landscape” by undoing a primary cost-reduction component of reforms passed by Florida lawmakers in 2003. The initial response from NCCI and regulators was a steep rate increase of 14.5 percent for 2017. NCCI was ordered by OIR in 2017 to begin assessing the market impact of Castellanos, which has been considered the main driver of concern and accounted for most of the 2017 rate increase. In that case the Florida Supreme Court found the state’s mandatory attorney fee schedule unconstitutional as a violation of due process under both the Florida and United States Constitutions. However, other factors now appear to be impacting rates positively. NCCI’s rate explanation for 2021 noted that carrier loss ratio results are improving over time, which is consistent with the “very favorable WC industry results countrywide over this period.” Nationally, the workers compensation system is experiencing unprecedented results, NCCI said. The combination of underwriting discipline, moderating severity, declining frequency, and adequate reserves has resulted in six straight years of combined ratios under 100%. Claims frequency has been on a downward path thanks to technology, safer workplaces, improved risk management, and a long-term shift from manufacturing to service sectors, NCCI said. Last year, OIR disapproved NCCI’s statewide average premium decrease of 5.4% and instead required NCCI resubmit the filing for a 7.5% rate decrease for new and renewal policies taking effect Jan. 1, 2020. The regulator said then that given NCCI’s assertion that claim frequency is declining for workers’ compensation in Florida and nationwide and that is expected to continue, NCCI’s ranges appeared to be “unreasonable.” OIR also said at that time that more quantitative analysis needed to be conducted “to determine the effect the Castellanos decision is having on the Florida workers’ compensation market and the data used to support future rate filings.” NCCI’s assessment on the Florida’s workers compensation marketplace for the 2021 rate filing included reviewing insurance company feedback from the state’s largest workers’ comp writers that report financial data to NCCI, the change in claimant attorney fees and the change in loss ratios that have occurred since the Castellanos decision. Carrier feedback was largely unchanged from last year, NCCI noted, with most carriers saying they experienced cost increases after the 2016 decision, particularly for claimant attorney fees. Carriers reported that litigated claims generally take longer to close and are costlier when compared to non-litigated claims. “Some carriers reported that litigated claims now represent a relatively larger portion of their book of business versus their experience prior to the Castellanos decision,” NCCI said. At the same time, NCCI said there has been a marked increase in valuation dates for attorney fees from before and after Castellanos, which is supported by data from the Florida Division of Administrative Hearings (DOAH). That data shows claimant attorney fee percentages through June 2020 have increased from 13% prior to the decision to more than 20% in recent years. NCCI noted carrier indemnity paid loss ratios are worsening over time when looking at a single year, with Castellanos likely contributing to this pattern. However, when looking across years, results are improving over time. “The combination of two counteracting impacts has contributed to the current state of the Florida WC system. To date, the especially-favorable WC industry results observed across the country have more than offset the observed cost increases associated with the Castellanos decision,” NCCI said. COVID-19 ImpactOne area that could greatly impact workers’ comp results but is still mostly unknown at this time is the impact of COVID-19. The data underlying in the NCCI filing does not include COVID-19 claims. “Due to the lack of this COVID-19-related ratemaking data and the current level of uncertainty, NCCI has not yet assessed the potential impact on future rate levels. As such, no explicit adjustments have been made in this filing for COVID-19,” NCCI said. “While it is possible that COVID-19 may result in significant adverse loss development and deteriorating loss ratios, the impact on overall system costs could be small.” COVID-19 could actually offset impacts on system costs by causing an increase in the number of compensable claims for frontline, COVID-19 related occupations, NCCI noted, while at the same time there could be a decrease in general claims due to the increased number of employees teleworking. NCCI is currently gathering and researching information to preliminarily gauge the pandemic’s direct and indirect impacts on claim frequency, severity, and duration. “More in-depth analyses related to COVID-19’s impact on frequency and severity will be conducted over time as additional aggregate data becomes available,” NCCI said, though the actual assessment of the pandemic’s impact on claim durations will take longer because claim-specific data is required. Tuesday, September 01 2020

With hurricane season barreling down on Florida, the state is seizing on low interest rates to borrow $2.25 billion for its catastrophe insurance fund. The State Board of Administration Finance Corp. is joining state and local governments that have rushed to sell bonds since yields tumbled this year to the lowest in decades. While rates have edged up over the past three weeks, benchmark 10-year debt is still yielding only about 0.8%, matching the lows seen before the pandemic upended financial markets in March. “The market has been extraordinarily strong on the demand side and interest rates are very low — those two things don’t normally go hand and glove,” Ben Watkins, Florida’s director of bond finance, said in an interview. “From an historical perspective, this is an extraordinary opportunity.” The pace of debt sales surged as rates tumbled in July, with the volume of new municipal bond offerings jumping 58% from a year earlier to about $46 billion that month, according to data compiled by Bloomberg. Even with the uptick in rates since then, sales have stayed strong, with another $41 billion issued this month. The offering will be the first since 2016 by the Florida Hurricane Catastrophe Fund, which acts as a backstop for the state’s insurance market. Tuesday, July 28 2020

Florida’s state-run insurer Citizens Property Insurance Corp. will extend its moratorium on cancellations and nonrenewals until the end of 2020 despite saying earlier this month it would resume processing them on Aug. 15. The decision comes after Florida CFO Jimmy Patronis urged the insurer not to cancel customer policies during hurricane season and the ongoing COVID-19 pandemic. “Hurricane season is just beginning to heat up and we are in the middle of an unprecedented health and economic crisis. This is not the time to cancel Citizens’ home insurance policies,” Patronis said in a public statement released by his office, the Florida Department of Financial Services, on July 24. The insurer originally announced in an agent bulletin July 9 that it would resume the processing of cancellations and nonrenewals beginning Aug. 15, 2020, after imposing a moratorium in March to address a significant uptick in the percentage of premiums not paid by the due date. Citizens reported that figure has since fallen to pre-COVID-19 levels, and now stands at 7.5%. Patronis noted that what policyholders owe must still be paid, “but cancelling their policies during hurricane season should not be an option.” “Faced with the uncertainty of COVID-19, Citizens in March took steps we believed were in the best financial interest of our policyholders. Likewise, the decision to end the temporary moratorium on August 15 was made with our policyholders’ best financial interests in mind,” Gilway said on Friday in response to Patronis’ statement. Gilway added that the insurer would work with its board and other stakeholders to “do what’s best for our customers in these challenging times,” and on July 25 announced it would extend the moratorium on cancellations and nonrenewals until the end of 2020. Citizens Board of Governors’ Chairman Bo Rivard said the rapidly changing Florida landscape warranted a re-evaluation of plans made in early July to end the moratorium August 15. “COVID-19 has been a moving target and I agree that at this time it makes good sense to extend the moratorium until the end of the year,” Rivard said. Gilway said since it enacted the moratorium, Citizens has put together special payment arrangements to assist customers still affected by COVID-19, including allowing policyholders who typically pay premiums on a quarterly or annual basis the option of breaking up payments into smaller installments. “Our top priority has been and will continue to be our policyholders,” Gilway said. “This extension will provide our customers with further assurances that we have their backs during hurricane season and beyond.” Monday, June 22 2020

Even though the six-month Atlantic hurricane season lasts as long as a typical Major League Baseball season, a Florida congresswoman thinks it needs to be longer. Democratic U.S. Rep. Stephanie Murphy sent a letter to the National Oceanic and Atmospheric Administration June 17 requesting that the start of the official hurricane season be in mid-May. The current season goes from June through November, but Murphy said there has been at least one named storm before June 1 in each of the past six years. In 2020, three tropical storms – Arthur, Bertha and Cristobal – formed in mid-May and the beginning of June, she said. “This presents a practical problem, because government officials and residents in hurricane-prone states use this season to inform their funding choices, public awareness campaigns, and preparation decisions,” Murphy said in the letter. “Accordingly, an official season that does not accurately predict major storm activity could result in readiness being compromised and people and property being harmed.” NOAA has received the congresswoman’s letter and the agency looks forward to discussing the topic with her, spokesman Christopher Vaccaro said. Although several tropical storms have formed in the Atlantic before June 1 in recent years, most of them have been “marginal in their structure” and improved satellite monitoring has likely led to an increase in short-lived, weak storms being named by the National Hurricane Center in recent years, said Phil Klotzbach, a research scientist at Colorado State University. There has been only one named hurricane before June since the satellite era started in 1966 – Hurricane Alma in 1970. “I don’t think there is any reason to lengthen the hurricane season, since we haven’t had a hurricane in May in 50 years,” Klotzbach said in an email. Even though Bertha almost flooded Brian McNoldy’s home last May a day before it became a tropical storm, the University of Miami senior research associate does not think the season needs to be extended. “Hurricane season was also never intended to include … all of the activity, just the majority of it,” said McNoldy, who works for the Rosenstiel School of Marine & Atmospheric Science. “Having some outliers is fine.” Wednesday, June 10 2020

Water Damage: A homeowner’s policy typically covers damage caused by water, but with very specific exceptions. It generally does not cover damage from water coming into the home from the ground, but rather water damage that comes into the home from another source, such as a leaking roof or from a burst pipe. Water coming into a home from the ground is called flooding and is not covered by a typical homeowner’s policy. A separate flood policy must be purchased to cover this peril. It would include water that seeps into the home from a heavy rainfall or as the result of a lake, ocean or river overflowing onto the property. However, flood is a covered peril in most auto insurance policies where comprehensive coverage has been purchased. Wind Damage: Yes, wind damage is covered by the most popular and comprehensive form of homeowner’s insurance called an HO-3 policy. It will insure the home and personal property of the policyholder against a number of perils. Some examples include fire, lightning, theft, windstorm or hail. Wind damage may include such things as a fallen tree, which damages a roof or windows of a home. Although windstorm coverage is included in an HO-3 policy, Florida law requires insurers to provide policyholders with the option to exclude coverage for windstorm in specified situations. If a policyholder excludes this coverage, they will not be covered for wind damage. Alternatively, some policyholders may also opt to purchase a separate policy that provides coverage only for the peril of windstorm damage. This policy would not cover any other perils that would affect the home or property. This general coverage description is intended only as a guide. Please refer to the provisions of your insurance policy for additional information. Thursday, June 04 2020

The number of traffic crashes in Florida dropped by 50% in April compared to the same time last year, according to highway officials. With residents holed up at home, working remotely and running fewer errands, rush hour traffic has dipped considerably. Shuttered bars and restaurants has meant fewer drunk drivers on the roads. Florida drivers were involved in 16,191 crashes last month compared to 33,692 in April 2019, according to data from the Department of Highway Safety and Motor Vehicles. The Tampa Bay Times reports the dip started in March as the pandemic spread. Florida’s crash data showed a 25 percent decrease in March compared to last year. “The fewer people out driving, the less vehicle miles traveled, the less opportunity for people to do bad things,” said Whit Blanton, executive director of Forward Pinellas, the county’s transportation planning agency. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.