BlogMonday, June 07 2021

A bill passed by the Florida Legislature to address the state’s property insurance crisis has created optimism among some stakeholders, while others say it will not reduce rates over the next 18 to 24 months or stop the state’s out-of-control claims litigation. This year’s effort to pass property insurance reforms came down to the wire with the passage of Senate Bill 76 on the last day of session. The bill attempts to solve some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion last year. Consumers are facing double-digit rate increases, restricted coverage, or having to turn to the state’s insurer of last resort, Citizens Property Insurance. Shortly after the bill passed, the state regulator approved three Florida insurers’ requests to drop more than 50,000 homeowners policies as the state heads into hurricane season. The passed bill includes changes to the state’s one-way attorney fee statute, the eligibility and glidepath of Citizens, and the deadline to file claims. It also places new requirements and restrictions on roofing contractors. But two pieces the industry and experts identified as critical to addressing cost drivers and stabilizing the market were left out of the final bill — the elimination of the state’s attorney fee multiplier and a provision allowing insurers to implement policy language to mitigate roof replacement costs. The provisions were sticking points in both legislative chambers. “It’s a watered-down bill that won’t restore market stability. It will not curb rate increases,” said American Integrity CEO Robert Ritchie. “Everybody is set up for these expectations and everybody’s going to be mad at each other.” “In my view, the most important provisions are the ones that didn’t get in it,” said Joseph Petrelli, president and founder of ratings analysis firm Demotech, which rates more than 40 Florida domestic insurers. Petrelli previously warned that it will be harder for several companies to enhance their financial results, and sustain their ‘A’ ratings, if the Florida Legislature did not pass “meaningful” reform this year. Sen. Jim Boyd, also an insurance broker and owner of Boyd Insurance & Investments in Bradenton, Fla., acknowledged that what passed didn’t have everything he — or the industry — wanted, but he is confident what did pass will make a difference in stabilizing the market, encourage the return of insurance investment capital into the state, and cut down on contractor and litigation abuse in the system. “Rates aren’t going to go down tomorrow, of course,” Boyd said. “But I firmly believe this will have a definite downward impact on what has been continually rising homeowners rates in Florida … I really, truly believe we have done a lot of good toward getting at the root causes of the problem.” Sen. Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve.” “Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his Senate colleagues. If signed by the governor, the legislation would take effect July 1 and includes:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation, including making it illegal for roofing contractors or any person acting on their behalf to make a “prohibited advertisement,” including an electronic communication, phone call or document that solicits a claim. Offering anything of value for performing a roof inspection, an offer to interpret an insurance policy or file a claim or adjust the claim on the insured’s behalf will also be prohibited. Additionally, contractors are prohibited from providing repairs for an insured without a contract that includes a detailed cost estimate of the labor and materials required to complete the repairs. Violations could result in fines of $10,000. Florida’s insurance regulator is optimistic the new reforms will have a positive effect on the state’s marketplace over the longer term. “I think it’s a pretty meaningful step forward, in terms of stabilization, but certainly as with most things, there’s no quick fix, and this is going to take some time to implement,” said Insurance Commissioner David Altmaier. “We’re going to be very carefully monitoring a lot of different data points — most importantly, the impact to consumer rates.” Locke Burt, chairman and CEO of Florida-based insurance company Security First, said the bill will ultimately change “the way that roofers do business, the way public adjusters do business, the way plaintiff’s attorneys do business, and the way that insurance companies do business,” which is “significant.” But “it is not going to cause rates to go down [now]; the best that can happen is it will flatten the curve in 2023 or 2024,” he said. “It’s not going to make agents’ life easier in the foreseeable future.” Litigation Reform Altmaier called the reforms to the one-way attorney fee statute one of the more impactful features of the bill. The new statute stipulates that if a claimant recovers at least 50% of the disputed amount (the difference between the pre-suit demand excluding attorney fees and costs and the indemnity award obtained at trial), full attorney fees would be awarded to the plaintiff attorney. If the indemnity award obtained is less than 20% of the amount in dispute, then no attorney fees are awarded to the plaintiff attorney. Indemnity awards between 20% and 50% of the disputed amount would merit the same proportional award of attorney fee and costs as the percentage of the disputed amount obtained at trial. The fee reforms were modeled after the assignment of benefit legislation that passed in 2019, Altmaier said, which appears to be having a “meaningful impact in reducing the incentive for some of the excessive litigation that we were seeing with AOB.” The Florida Office of Insurance Regulation sent a report to lawmakers during session that found while Florida homeowners insurance claims accounted for just over 8% of all homeowners claims opened by U.S. insurers in 2019, homeowners insurance lawsuits in Florida accounted for more than 76% of all litigation against insurers nationwide. “Litigation trends in Florida have been consistently many times higher than any other state,” the report stated, citing data from the National Association of Insurance Commissioners (NAIC) showing that Florida lawsuits rose steadily from 64.4% of all nationwide homeowners lawsuits in 2016, to 68% in 2017, to 79.9% in 2018 and 76.4% in 2019. “I really think that [attorney fee reform] is going to go a long way in helping to disincentivize some of the excessive litigation, while still allowing the opportunity for consumers to pursue civil remedies against their insurance companies if they feel as if they’ve run out of other options,” Altmaier said. Burt said changes to the one-way attorney fee statute, which has been in place for 125 years, are a “big deal,” but noted it is hard to quantify at this point what litigation savings companies will see. The pre-suit demand requirement will also be “very significant” for insurers. “It is usually very difficult to extract that information from plaintiff attorneys,” he said. “Now we will know what we are dealing with in terms of a demand.” Roofing Claims Abuse Many in the industry, like American Integrity’s Ritchie, said addressing roofing claims was a critical element left out. “Seventy percent of my lawsuits are for uncovered roof claims. Will this curb the lawsuits for roofs? I say no,” Ritchie said. Sen. Boyd said roofing claims are “one of the biggest drivers of rate increases” for Florida homeowners, but the House rejected provisions in the passed Senate bill aimed at stemming these losses by allowing insurers to only offer homeowners policies that adjust roof claims to actual cash value if the roof is older than 10 years. Also rejected was allowing property insurers to offer homeowners to purchase a stated value limit for roof coverage and implement a reimbursement schedule for total losses to a primary structure. OIR did not support the roof ACV provisions, Altmaier said. He expects carriers will see positive results from the combination of curbing roof claims solicitations and the one-way attorney fee reforms. “I think those two things combined are going to make the absence of those other two items much less significant in the overall impact of the bill,” he said. State agencies will be responsible for enforcement of the roofing provisions in the law. The Florida Department of Professional Regulation will handle licensing and the Florida Department of Financial Services will investigate and work to prosecute insurance fraud related to roofing solicitations and claims. “As we await the Governor’s signature on consumer protection legislation passed this session, the Department is preparing to implement measures to curb unlicensed adjusting by holding anyone accountable who looks to profit off of a business model of improperly soliciting insurance consumers and coming between them and their insurance claims,” DFS Communications Director Devin Galetta said in a statement to Insurance Journal. Today’s Market For the insurers that are struggling now, there isn’t time to wait and see if the bill goes far enough. Demotech’s Petrelli said Florida companies are taking action to nonrenew and cancel policies to lower their exposure in particular geographic areas and their reinsurance costs. Southern Fidelity Insurance, Universal Insurance Co. of North America and Gulfstream Property & Casualty were recently approved by OIR to drop more than 50,000 policies because of hazardous financial conditions. “Between the geographical issues and the disproportionate reinsurance cost issues, we think that’s a smart move on behalf of companies,” Petrelli said. Without addressing the other major cost drivers for insurers going forward, Petrelli said the passed legislation is merely “nibbling around the edges.” He does not expect more investment capital or competition in the state and said there soon could be less. Demotech is waiting to review the first quarter results and final reinsurance programs of the companies it rates, but Petrelli noted about five companies could be downgraded. The ratings firm would have been more lenient if Florida had passed “meaningful” reforms, and “there was a true light at end of a litigation tunnel,” Petrelli said. “What would have saved companies, in terms of their rating, is reforms that had immediate teeth. I don’t see these as being immediate nor having the sharpest of teeth.” Florida Association of Insurance Agents (FAIA) President and CEO Kyle Ulrich said while the association is encouraged and supportive of the reforms that passed and thinks it will have a positive impact on the market, significant changes aren’t likely for at least 18 to 24 months. FAIA is advising agents to become comfortable with placing business with Citizens, if they aren’t already, as it is likely more policies are headed that way. “Unfortunately, as much as agents don’t want to have to do it, there are going to be some relying on Citizens in ways that they either never have, or haven’t had to in probably 10 years,” Ulrich said. “The good news is, at least from our perspective, is that Citizens is in a much better place right now to handle that and are easier to do business with than they have been in the past.” Monday, May 24 2021

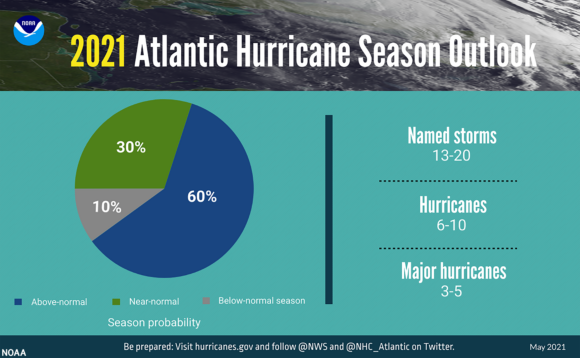

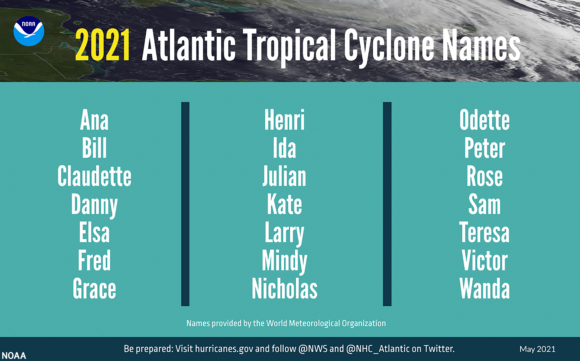

Just days after weather forecasters predicted another above-normal Atlantic hurricane season in 2021, Ana launched the season by forming off of Bermuda. Ana reached Tropical Storm status early on Sunday northeast of Bermuda, but then weakened to a Tropical Depression. The National Weather Service said Ana is expected to dissipate by Monday. The National Oceanic and Atmospheric Administration’ (NOAA) Climate Prediction Center is predicting a 60% chance of an above-normal season this year, a 30% chance of a near-normal season, and a 10% chance of a below-normal season. However, NOAA does not anticipate the historic level of storm activity seen in 2020. Ana was the first “named storm” in the Atlantic this year even though the hurricane season does not officially start until June 1. The season runs through November 30. For 2021, a likely range of 13 to 20 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 5 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher) is expected. NOAA provides these ranges with a 70% confidence. Last month, NOAA updated the statistics used to determine when hurricane seasons are above-, near-, or below-average relative to the latest climate record. Based on this update an average hurricane season produces 14 named storms, of which 7 become hurricanes, including 3 major hurricanes. El Nino Southern Oscillation (ENSO) conditions are currently in the neutral phase, with the possibility of the return of La Nina later in the hurricane season. However, these phases support the conditions associated with the ongoing high-activity era, according to Matthew Rosencrans, lead seasonal hurricane forecaster at NOAA’s Climate Prediction Center.

Forecasters at the National Hurricane Center are now using an upgraded probabilistic storm surge model — known as P-Surge — which includes improved tropical cyclone wind structure and storm size information that offers better predictability and accuracy. This upgrade extends the lead time of P-Surge forecast guidance from 48 to 60 hours in situations where there is high confidence.

Thursday, May 13 2021

Make sure your home is insured before hurricane seasonPublished:May 12, 2021 2:50 PM EDT Updated:May 12, 2021 9:18 PM EDT Insuring your home against a hurricane is more expensive than ever. We look into what you can do to make sure you have enough coverage for a worst-case scenario and save some money on your policy. Summertime in Southwest Florida just isn’t the same for Hope Daley and her husband Matthew Dykes. Hurricane Irma changed everything, damaging their Naples home so much it had to be torn down. “Hurricane season definitely raises our level of anxiety,” Daley said. “I grew up here and never worried about them, and it just takes one really bad one to kind of trash your life and turn everything upside down, and then you’re never the same.” And the full payout of their insurance policy didn’t cover the cost to rebuild, so they had to start over. “My advice, from having gone through it, is to absolutely… do not take any shortcuts on insurance, do not do it, it’s not worth it,” Daley said. But homeowners take shortcuts to save money because policy renewals are at an all-time high. “I heard the other day in a meeting that the average hurricane premium is headed towards $5,000,” said insurance agent Kagen Cookesly. “If we don’t make some meaningful change to help the industry, the rates are going to continue to climb.” Cookesly says the rate increases are out-of-control for homeowners. “At the end of the day, a lot of folks that had these increases, there’s not another market for them—they have to pay,” Cookesly said. “And some of them I’m even telling, ‘You’re lucky to get a policy right now.'” While there’s not a magic bullet to significantly cut your insurance price, there are some simple things you can do around your home to help cut those costs and keep you safer during storm season. To qualify for discounts, you have to hire a licensed home inspector. Home inspector Coty Lawrence walked Hope Daley and Matthew Dykes around their house and checked every opening from the garage door to the windows to see if they are impact-rated. Many of their windows are not impact-rated; if they don’t want to replace them, they can get shutters. “If you don’t have hurricane shutters, you can call your insurance agent and say ‘How much is it going to save me to get hurricane shutters installed?'” Cookesly said. “If it’s a 2002 or newer home, you may already be getting the credit because of the year built. But if your home is built in 2001 or older, those discounts are a lot more meaningful than they were five, six years ago.” And if you have an older home, you could get significant savings with a simple fix in your attic: Install a third nail into the hurricane clips on your roof trusses. And if you got your roof replaced recently, let your insurance company know. “So if you have a roof that’s five years [old] or newer, you’re going to have a gamut of options,” Cookesly said. More options make it easier to shop for a better rate and better coverage. “Get every possible coverage you can and get as much as you can, because you don’t need it until you absolutely need it,” Daley said. Monday, May 03 2021

Florida lawmakers passed two bills on the last day of their 2021 legislative session that make major changes to the state’s auto and property insurance markets. The actions follow weeks of back-and-forth debate on the proposals between the House and Senate chambers. Stakeholders say neither of the potential new laws will do enough to accomplish lawmakers’ goals of reducing rates or weeding out fraud in their respective insurance industries. Both bills are now headed to Governor Ron DeSantis, who will have to sign them before they can become law. Senate Bill 76The bill attempts to address some of the issues plaguing the state’s homeowners insurance market in which insurers lost more than $1.5 billion in last year. It passed Friday in the Senate by a vote of 35 to 5 and 75 to 41 in the House. The legislation was revised significantly from its original form at the start of the session and includes:

The bill also makes several changes to tackle what insurers claim has been an explosion of roofing claims and litigation. Specifically, SB 76:

Removed from the final legislation was the elimination of the state’s attorney fee multiplier and allowing insurers to include policy language that offers actual cash value instead of full replacement cost on roofs. The industry had urged lawmakers to include these provisions to address cost drivers, but it became a sticking point in both chambers. An amendment passed Friday also eliminated offers of judgment for the insured or the insurer. Senator Jeff Brandes, who co-sponsored the legislation, voted to pass the bill but said it was only a “40% solution for what is needed in Florida to bend the cost curve.” “Hopefully, it stabilizes rates, but really will ultimately do nothing to actually lower them,” he told his colleagues. Locke Burt, chairman and CEO of Florida-based insurance company Security First, said he was disappointed lawmakers didn’t take up reforms to the effects of two Florida Supreme Court cases – Joyce vs. FedNat (2017), and Sebo vs. American Home Assurance (2016) – that are said to be partly to blame for perpetuating litigation in the state, as noted in a recent report from Florida Insurance Commissioner David Altmaier. But, Burt said, the legislation that passed makes some much needed changes and is a “step in the right direction.” “I would characterize this a single step,” he told Insurance Journal. “But I would also tell consumers that their rates are going to continue to go up.” Senator Jim Boyd, who is also an insurance broker, acknowledged that the bill is far from perfect and that no one, including the insurance industry and the trial bar, are happy with the result. However, he noted, “we have got to do something. We cannot wait until next year to solve what is an incredibly large problem for our constituents.” Representative Bob Rommel, who worked on the House version of the bill, said the legislation would provide oversight on insurance companies, help attract new carriers to the state of Florida and “make sure homeowners will have a competitive market and have the right to choose the right insurance for themselves.” The Florida Office of Insurance Regulation (OIR) said in a statement that it “appreciates the tireless work of the Florida Legislature to pass meaningful property insurance reform. SB 76 protects consumer’s rights and addresses the current challenges in the property insurance market.” If signed by DeSantis, the new law will take effect July 1, 2021. Senate Bill 54Florida’s passage of this bill will repeal the state’s no-fault personal injury protection (PIP) system and instead require mandatory bodily injury coverage starting at $25,000 for all drivers in the state of Florida. Earlier versions of the legislation required insurers to offer medical payments coverage (MedPay) in the amount of $5,000 or $10,000, but the passed version makes the offering optional and includes an optional $5,000 MedPay death benefit. The bill will also create a new framework to govern motor vehicle claims handling and third-party bad faith failure to settle actions against motor vehicle insurance carriers. A House amendment passed this week added a statement that the statute governing these bad faith actions is not intended to expand or diminish any cause of action currently available against insurance agents who sell motor vehicle liability insurance policies in this state. Brandes, one of three senators to vote against the bill, said its sponsors had not done enough to study how the bill would affect rates. “Florida already has some of the highest rates in the country and unfortunately if you are just struggling to make it… [and] buying just PIP today, rates will go up 40%,” Brandes said. But bill sponsor Danny Burgess, a Republican, argued that a 2016 study from OIR showed rates would go down if the state repealed PIP. He said the provisions addressing bad faith will also help stop fraud that has been rampant with PIP and lead to further rate reductions. “It’s hard to predict market forces, but overwhelmingly the data shows we will see a [rate] reduction,” he said. “Certainly not a steep reduction, but I do believe we will see a reduction.” However, many in the industry and stakeholders have countered that assessment. Insurer trade group the American Property Casualty Insurance Association (APCIA) opposed the bill’s passage, saying it could increase rates on Florida drivers and increase the state’s current uninsured rate of 20%. It worked on an actuarial study to assess the impact of the bill and said its analysis shows it could increase the cost of the average auto insurance policy by as much as 23% or $344. Drivers who carry the lowest levels of coverage could see increases as high as $805 a year. APCIA said more than 28,000 letters from Floridians were sent to lawmakers opposing the bill. The group is encouraging the governor to veto the legislation. “As SB 54 heads to Governor DeSantis’ desk, he has the opportunity to protect Florida drivers from higher auto insurance costs and help keep our roads safer by vetoing this legislation,” APCIA said. Also encouraging the governor to veto the bill is the Personal Insurance Federation of Florida (PIFF) and the Consumer Protection Coalition (CPC). “We are extremely concerned that this bill would substantially increase rates for our customers and Florida residents who can least afford an increase, while forcing hundreds of thousands of Floridians already struggling to pay current premiums to drive without insurance,” said Michael Carlson, president and CEO of PIFF. “On behalf of Florida consumers, the CPC urges Governor Ron DeSantis to examine the potential cost impact this legislation will pose on Florida consumers and consider vetoing the bill if it is found to raise rates and not decrease litigation,” the group said. If signed by DeSantis, the new law will take effect Jan. 1, 2022. Monday, April 26 2021

Florida’s property-insurance market is headed toward a crisis, as mounting carrier losses and rising premiums threaten the state’s booming real-estate market, according to insurance executives and industry analysts. Longtime homeowners are getting socked with double-digit rate increases or notices that their policies won’t be renewed. Out-of-state home buyers who have flocked to Florida during the pandemic are experiencing sticker shock. Insurers that are swimming in red ink are cutting back coverage in certain geographic areas to shore up their finances. Various factors are at play, insurance executives and analysts say. Two hurricanes that slammed the state—Irma in 2017 and Michael in 2018—generated claims with an estimated cost of about $30 billion. The cost of reinsurance, which insurers take out to cover some of the risk in the policies they sell, is swelling. Of particular concern, executives say, are excessive litigation over insurance claims and a proliferation of what insurers see as sham roof-related claims. A large group of Florida homeowner insurers tracked by Marsh McLennan’s Guy Carpenter business had $1.58 billion in underwriting losses in 2020, more than double the $664 million loss in 2019. “The industry is in a panic because it is losing so much,” said Barry Gilway, chief executive of Citizens Property Insurance Corp., a state-backed insurer of last resort that is growing rapidly as private-sector insurers retrench. Barring changes, he said, “rates will continue to skyrocket and it absolutely will have an impact on the real-estate market.” Eric Firestone, a 37-year-old teacher who lives with his wife in the Miami area, received a letter from their insurance company in February saying their policy wouldn’t be renewed because the carrier was no longer servicing their area. When their insurance agent shopped for an alternative, the cheapest one she could find had a $9,644 annual premium—an 85% increase over their most recent premium of $5,205. “Where am I going to get the extra $4,000?” Mr. Firestone said. “Worst-case scenario, I will have to go into credit-card debt.” Florida is the most expensive state in the U.S. for home insurance. Residents are projected to pay on average $2,380 in premiums this year, a 21% increase over the $1,960 paid in 2018, according to estimates by trade group Insurance Information Institute. By contrast, the average American homeowner is expected to pay $1,297 this year, up 4% from $1,249 in 2018. Out of 105 rate increases for multi-peril homeowners policies approved by the Florida Office of Insurance Regulation last year, more than half exceeded 10%, compared with six of 64 in 2016, state Insurance Commissioner David Altmaier informed lawmakers. Ana Regina Myrrha, an insurance agent in the Orlando area, said she hired three more employees because clients’ policies that used to automatically renew now require “re-quoting,” or finding cheaper alternatives. Her office used to tell clients to expect a single-digit rate increase upon renewal, she said, but “we now tell them that a 20% increase is a gift.” Florida lawmakers are considering bills that supporters say would help curb premium increases. Among the provisions of a Senate measure backed by the insurance industry and passed by the Republican-led chamber are limits on attorney fees and roof coverage that proponents say would reduce incentives for frivolous lawsuits and claims. A measure in the GOP-led House that industry representatives consider weaker is expected to come up for a vote in the next few days. If it passes, lawmakers will have until the end of the session on April 30 to negotiate a compromise. Many Democrats and plaintiff lawyers oppose the bills, saying they would hurt consumers by limiting legal recourse against insurance companies. Opponents say the insurance industry is exaggerating the role of fraud in its deteriorating finances and playing down the significance of losses from natural disasters and rising reinsurance rates. While Florida made up 8% of all homeowner insurance claims in the U.S. in 2019, it accounted for 76% of homeowners’ insurance lawsuits, according to an analysis by Mr. Altmaier’s office. A survey by his office of Florida insurers representing about 60% of the market showed they received 90,950 roof claims in 2020, up from 56,657 in 2019. Questionable claims often involve alleged roof damage from hail or wind that the carriers’ adjusters and engineers conclude was due instead to normal wear and tear, which isn’t insured, according to industry executives. In Florida, as in other states, policyholders with disputed claims can sue their insurers. Critics say that Florida law currently allows too-easy access to insurer-paid legal fees, encouraging contractors to drum up business and lawyers to file frivolous lawsuits over claims, seeking the legal fees. “Let me help you get a new roof through insurance!” reads one door hanger that Mr. Altmaier shared with lawmakers. Mandy Wells, 40, a real-estate agent in Cape Coral, met with a representative of roofing company Marlin Construction in 2019 regarding storm damage. The representative guided her on filing a claim and said she would get a new roof, according to Ms. Wells. She signed an agreement authorizing Marlin to receive payment directly from the insurer. But Ms. Wells said Marlin, which has generated numerous complaints to the Better Business Bureau, never performed any work, and broke off contact when she refused to sign additional documents. Scott Hertz, a Marlin attorney, said Ms. Wells cut off Marlin after receiving an insurance payment, and the parties are now locked in litigation, partly over that money. He said the complaints against Marlin are mostly tied to the employee who met with Ms. Wells, who is no longer at the company. Though Florida’s real-estate market remains strong, spiraling insurance premiums could hobble it, real-estate agents say. Some out-of-state buyers streaming into Florida say they are stunned by their insurance bills. Ricardo Calina, 45, a former Wisconsin resident who closed on a house in Winter Garden, near Orlando, in January, said he was upset to learn he and his wife would pay roughly 25% more in homeowners insurance, even though the 4,500-square-foot Florida property is 500 square feet smaller than their Wisconsin residence. “It is frustrating that we are paying more for less,” Mr. Calina said. Meanwhile, in Davie, near Fort Lauderdale, Alexander Barr is worried about getting priced out of the house where he grew up and is now raising his two children with his wife. Earlier this month, they received a renewal notice from their insurance company advising that their premium was increasing to $4,006, a 63% jump from the $2,451 they paid last year. “I can only imagine what’s going to happen next year,” Mr. Barr said. Monday, April 26 2021

After many years of trying, Florida is closer than ever to repealing its 50-year-old motor vehicle no-fault law. However, many industry stakeholders have expressed opposition to the legislation passed by the Florida Senate last week and its companion bill approved by the House Judiciary Committee Monday, saying the proposals will actually raise rates for many Florida drivers and be ineffective at weeding out fraud. Florida’s current no fault law requires drivers to carry personal injury protection coverage of $10,000. If passed, the new law would instead require that drivers carry bodily injury liability coverage with limits starting at $25,000 per person. Senate Bill 54 and House Bill 719 would also create a new framework to govern motor vehicle claims handling and third-party bad faith failure to settle actions against motor vehicle insurance carriers. The bills also require policies include a medical payments option of $5,000, though under the House version insureds can opt out of purchasing the coverage. SB 54’s minimum liability requirements for motor vehicle ownership or operation include:

Insurers may also offer medical payments coverage with limits of $10,000, without a deductible, to cover medical expenses of the insured. Insurers can offer other policy limits that exceed $5,000 and may offer deductibles of up to $500. SB 54 requires that insurers must reserve the first $5,000 of MedPay benefits for 30 days to pay providers of emergency services or hospital inpatient care. The exclusion of a specifically named individual from specified insurance coverages under a private passenger motor vehicle policy, with the written consent of the policyholder, is also authorized under the bill. “Florida is one of only two states in the country that does not currently require drivers to carry liability coverage that would immediately kick in if they cause harm to another person while operating a motor vehicle,” said Senate President Wilton Simpson in a statement. “For everyone’s protection, drivers must be insured at sufficient levels. PIP coverage levels are clearly insufficient. It’s the right time for Florida to move to mandatory coverage for bodily injury liability.” Included in the Senate version of the bill and added Monday to the House version is the creation of a new framework for motor vehicle insurance bad faith actions. The bill requires insurers to follow claims handling best practices standards based on “long-established good faith duties related to claims handling, claim investigations, defense of the insured and settlement negotiations,” a Senate statement said. But industry groups say the proposed bad faith reforms will not reduce lawsuits, which is a primary driver of costs for the state’s insurers. “Meaningful reforms to Florida’s deeply unfair bad faith system should be included to help reduce lawsuits,” said Michael Carlson, president and CEO of the Personal Insurance Federation of Florida. “While the Senate bill includes an attempt at bad faith reform, it has been weakened by the trial bar to the point that it may not help reduce lawsuits.” The American Property Casualty Insurance Association’s (APCIA) Assistant Vice President of State Government Relations Logan McFaddin said the proposals lack “any meaningful reforms to Florida’s bad faith laws, which will only serve to fuel the current cycle of lawsuit abuse, worsen Florida’s legal environment, and could lead to even higher costs for consumers.” Specifically, McFaddin said HB 719 is a “considerable step backward and [will] do nothing to alleviate the current abuses of Florida’s bad faith laws.” PIFF and APCIA said the passage of the proposed PIP repeals would likely raise costs for Florida drivers, particularly those who buy the minimum required insurance or who currently buy bodily injury coverage at amounts below what the proposed law requires. Florida’s uninsured motorist rate would likely increase from its current 20%, the groups said, as more low-income and underinsured drivers will be unable to purchase higher amounts of coverage. Florida drivers currently pay the highest premiums in the nation, according to MarketWatch data. “In Florida, approximately 40% of drivers carry minimum limits that are below what would be required under SB 54. Under the current proposal, these drivers could see their auto insurance costs rise by $165 to as much as $876 a year,” said McFaddin. “Florida cannot afford the higher insurance rates generated by HB 719 and SB 54,” Carlson said. Senator Jeff Brandes was the lone vote in the Senate against SB 54. Brandes supported a previous version that did not include a mandatory MedPay option, and said there was insufficient time to gather data on if the amended bill would lower rates for Florida drivers. Brandes voiced concern the new version would increase the number of uninsured drivers in the state and harm low-income policyholders. “We have no basis for making claims that rates will go down,” he said. “Twenty percent of Floridians are driving around without auto insurance and if we raise prices, more Floridians will drive around without insurance – that is a huge problem for me.” APCIA’s McFaddin said lawmakers are attempting to eliminate the major public policy “through a rushed process without an objective study on the cost impact to consumers.” However, Senator Danny Burgess, SB 54 sponsor, asserted his bill would eliminate fraud in the system that would lower costs and would offer an overall reduction in rates. The bill, he said, is trying to right a “very broken system.” “The goal of this legislation is to lower the number of uninsured and underinsured drivers and provide a greater safety net in the event of an accident. Replacing our current no-fault system with a bodily injury liability system more appropriately places liability where it should be – with the party that caused the accident,” said Burgess. He added the new framework for handling bad faith litigation, “will lead to better outcomes for both insured Floridians and their insurance companies.” A report from the Office of Insurance Regulation in February noted that overall loss trends for automobile insurance losses in Florida are continuing to increase for the most significant coverages such as BI liability, PIP, and comprehensive coverage. The increases are a result of cost drivers such as a higher rate of fatal crashes in Florida than the rest of the country, higher loss trends for BI and PIP, and the costs of services associated with auto insurance such as medical care, hospital care and motor vehicle body work. “These trends in auto insurance rates will likely continue, regardless of whether PIP remains or is replaced by BI,” the report stated. “If PIP is repealed and replaced with mandatory BI and MedPay, without addressing bad faith and litigation trends, increased litigation and claims costs associated with the new mandatory coverages could increase premiums dramatically.” HB 719 now goes to the full House for a vote. If passed and signed by the governor, the new system would take effect Jan. 1, 2022. Wednesday, April 07 2021

WASHINGTON— FEMA is updating the National Flood Insurance Program’s pricing methodology to communicate flood risk more clearly, so policyholders can make more informed decisions on the purchase of adequate insurance and on mitigation actions to protect against the perils of flooding. The 21st century rating system, Risk Rating 2.0—Equity in Action, provides actuarially sound rates that are equitable and easy to understand. It transforms a pricing methodology that has not been updated in 50 years by leveraging improved technology and FEMA’s enhanced understanding of flood risk. “The new pricing methodology is the right thing to do. It mitigates risk, delivers equitable rates and advances the Agency’s goal to reduce suffering after flooding disasters,” said David Maurstad, senior executive of FEMA’s National Flood Insurance Program. “Equity in Action is the generational change we need to spur action now in the face of changing climate conditions, build individual and community resilience, and deliver on the Biden Administration’s priority of providing equitable programs for all.” The National Flood Insurance Program provides about $1.3 trillion in coverage for more than 5 million policyholders in 22,500 communities across the nation. Understanding the magnitude of even the smallest changes of a program of this scale, FEMA devoted thousands of hours to develop the new pricing methodology to ensure equity and accuracy. In developing the new rates, FEMA coordinated with subject matter experts from the U.S. Army Corps of Engineers, U.S. Geological Survey and the National Oceanic and Atmospheric Administration along with experts from across the insurance industry and actuarial science to ensure alignment with federal regulations, systems, guidance and policies. The new methodology allows FEMA to equitably distribute premiums across all policyholders based on the value of their home and the unique flood risk of their property. Currently, many policyholders with lower-value homes are paying more than they should and policyholders with higher-value homes are paying less than they should. To provide more equity, FEMA now has the capability and tools to address rating disparities by incorporating more flood risk variables. These include flood frequency, multiple flood types—river overflow, storm surge, coastal erosion and heavy rainfall—distance to a water source and property characteristics such as elevation and the cost to rebuild. The cost to rebuild is key to an equitable distribution of premiums across all policyholders because it is based on the value of their home and the unique flood risk of their property. This has been an industry standard for years. FEMA is conscious of the far-reaching economic impacts COVID-19 has had on the nation and existing policyholders and is taking a phased approach to rolling out the new rates.

FEMA continues to engage with Congress, its industry partners and state, local, tribal and territorial agencies to ensure clear understanding of these changes. Monday, April 05 2021

More than a million Floridians will see their flood insurance premium rise next year, FEMA said Thursday. The good news is, most will see increases of less than $120 a year. The bad news is that homeowners will likely see annual rate hikes like that for the foreseeable future. The National Flood Insurance Program, which underwrites most flood insurance policies in the U.S., is changing the way it calculates what each property has to pay. The new strategy, called Risk Rating 2.0, is meant to help pull the program out of its $20 billion debt and encourage people to live in safer, less flood-prone homes. The new program will stop charging flood insurance premiums based solely on whether a home is within or outside of a flood zone and instead consider a range of factors like distance from the ocean, rainfall flooding and the cost to rebuild a home. “It allows us to set accurately sound rates and communicate flood risk better than we ever have before,” David Maurstad, senior executive of FEMA’s National Flood Insurance Program, said in a press conference to announce the changes, the most dramatic change to the program in 50 years. Starting April 2022, this pricing revamp will lead to higher prices for a majority of Florida’s 1.7 million policyholders — the most of any state — as well as a decrease for about 20% of policies, more than 340,000 policyholders. For the million-plus who will see increases, about 68% of policyholders will see their premiums rise less than $120 a year. Eight percent, about 134,000 policyholders, will see increases as high as $240 a year. About 73,000 policyholders will see their annual rates rise higher than that, but still within the congress-set cap of 18% a year. And that’s just year one. Rates will continue to rise every year at that 18% level until the annual insurance premium reflects the real cost of protecting the home, a figure that will be provided to homeowners along with the annual cost increases. Andy Neal, chief actuary of the NFIP, said in the press conference that they expect half of the policies to be at their full, proper price in five years, with 90% of policies at full risk in 10 years. “That last 10% takes us a good five years to get to a majority of it, and some will take even more of that,” he said. This reflects one of the major findings of the Risk Rating 2.0 revamp: higher-value homes are generally underpaying for flood insurance and lower-value homes are generally overpaying.The riskiest (and therefore most expensive) properties to insure are more likely to be homes that are expensive to rebuild, Neal said. That price, known as the replacement cost, is the same figure home insurers use to come up with premiums. Now flood insurance will do the same, which is likely to raise the cost of insurance for those homes. “Larger increases are highly correlated with high replacement cost, but there are some exceptions,” Neal said. “This is an effort that’s about equity in pricing.” Although most current policyholders won’t see a change in their rates until next year, on October 1 policyholders that are up for renewal can choose to switch to the new premium if it’s lower than their current one. October 1 is also the date that this new method of pricing applies to new flood insurance policies. Because FEMA hasn’t released much information about what that change might look like, advocates for affordable flood insurance are worried about the potential impact for the real estate market. “We’re leery of how that’s going to touch us, because it’s never touched us in a good way,” said Mel Montagne, head of Fair Insurance Rates in Monroe, an advocacy group that aims to keep flood and home insurance affordable for residents of the Florida Keys. Last time the NFIP was reformed, it sent premiums skyrocketing and ground real estate transactions to a halt in the Keys for months, before the changes were rolled back. Montagne recalled one $200,000 ground level home in the Keys that saw its premium jump to $20,000 a year. “It was absolutely ludicrous,” he said. However, the new Risk Rating 2.0 strategy appears to have some new protections to prevent the sins of the past. For one, congress’s 18% annual cap keeps premiums from rising overnight. Under Risk Rating 2.0, the maximum for a single-family home’s annual premium would be about $12,000 a year, a number that could change going forward. Currently, there is no cap for a maximum policy, and Maurstad said the maximum annual policy price tops $45,000. The NFIP is also maintaining most of its discounts, like the ones for properties newly mapped into flood zones. That will likely be important in Miami-Dade, where new draft flood maps will be released in May. In a county webinar last week, one snapshot of the draft maps revealed plenty of properties in the Little River area will soon be considered in flood zones, which means that flood insurance will be mandatory. There will also be new discounts for homeowners who protect their homes by elevating them, install flood panels or elevate important outdoor equipment like their AC units. Other NFIP discounts for homes built before FEMA’s building standards existed will also apply, as will discounts for cities and counties that participate in FEMA’s Community Rating Service, which offers big discounts on flood insurance to communities that guard against flood damage. Miami Beach residents get a 25% discount under CRS. That used to only apply in full to residents in flood zones, which cover 93% of buildings in Miami Beach, but under Risk Rating 2.0 it will extend to every property in the city. Amy Knowles, Miami Beach’s chief resilience officer, said that discount saves residents about $8.2 million. “We do want flood insurance to be accurate, but as a coastal city we’ve got to be able to afford it,” she said. “We’re doing everything we can as a city to offset the cost of federal flood insurance.” Making flood insurance more expensive is unpopular on either side of the political aisle, and Congress could step in to lower the 18% cap or force the NFIP to make more changes to lessen the impact of the suggested price hikes. In 2019, all of South Florida’s U.S. House members from both parties, with the exception of Democratic Rep. Frederica Wilson, signed a letter to House leaders expressing concern with the proposed flood insurance rate changes. “While FEMA intends Risk Rating 2.0 to provide more accurate and transparent flood insurance pricing, this untested proposal could lead to increased premiums, forcing homeowners to drop coverage, or even worse, lose their home,” the lawmakers wrote. Reps. Mario Diaz-Balart, Debbie Wasserman Schultz, Ted Deutch, Lois Frankel and Alcee Hastings all signed the letter, along with former Reps. Donna Shalala and Debbie Mucarsel-Powell. The letter also stated, “our constituents cannot suffer from a double-digit rate increase in addition to the fees and surcharges FEMA could impose on policy holders under Risk Rating 2.0.” Diaz-Balart’s office said Thursday his position on NFIP rate changes is unchanged from the 2019 letter he signed. “I worked with my colleagues across the country to push FEMA to lower the cap on annual premium increases and take into account how rate increases will impact regions like South Florida that are extremely vulnerable to climate change and hurricanes,” Rep. Debbie Wasserman Schultz said in a statement. “FEMA should be assessing flood insurance affordability for our region, especially during COVID.” But risk experts say those high prices serve a purpose: pushing people away from vulnerable spots, a process that will only get more important as sea levels rise. Del Schwalls, the immediate past chair of the Florida Floodplain Managers Association, praised FEMA for joining the private flood insurance market by charging customers the proper amount for their policies. “I think this is exactly what we’ve been asking for, and at times begging for,” he said. “Now people aren’t subsidized into a false sense of security. If you tell them their risk is insanely high but they’re paying $1,200 a year, their gut tells them you’re wrong.” As that $1,200 premium balloons to a $5,000 premium a decade down the line, Schwalls said homeowners might be more likely to consider elevating their home or other floodproofing improvements as a way of saving money. Or, they might decide the risk is too great and move inland. “When you get a policy premium that is equal to your risk, it informs your decisions,” he said. Monday, March 29 2021

Florida’s insurer of last resort, Citizens Property Insurance Corp., has become the insurer of first resort as thousands of new policies flood into it each week and the private homeowners insurance market continues its downward spiral. “The reality is the marketplace in Florida is shutting down,” Citizens President and CEO Barry Gilway said at a rate hearing before the Florida Office of Insurance Regulation this week. Gilway painted a dire picture of the Florida domestic market to state regulators at the March 15 hearing, noting that five years of sustained losses from excessive litigation, contractor schemes, major catastrophes and the increasing cost of reinsurance has led to diminished insurance capacity and higher costs for consumers. Florida carriers’ net underwriting losses for 2020 are expected to reach a combined $1.6 billion, Gilway said, with income losses totaling nearly $840 million. “Companies that are operating in the market are not profitable, have not been profitable, and frankly some of them are having to pay high rates of return just to get the capital in order to continue writing the level of business that they are writing today,” he said. Florida insurers are taking significant steps to reduce their exposure in areas where there is high litigation rates or high reinsurance costs, he said. The result is four companies in Florida are now closed for new business; at least 12 companies have strict underwriting restrictions such as limits on new business/renewals based on location, age of home, age of roof; required minimum Coverage A limits and policy cancellations. In addition to coverage restrictions, carriers are offsetting their losses with rate increases. The Florida Office of Insurance Regulation has approved 105 rate changes, 90 of which were for rate increases, over the last year, with 55 of those for rate increases of more than 10%. Ratings agency Demotech, which rates 66% of the Florida market, is also requiring the companies it rates to restrict their writings geographically and the types of homes they write in order to retain their FSR rating. “They are doing that basically to improve the overall profitability of these companies and make sure that when the insured does get insurance there is sufficient financial wherewithal on the part of the company to support any anticipated claims volume,” he said. “There’s a lot of restrictions on the market.” Gilway told regulators Citizens is growing by 5,000 new policies per week and is expected to reach a policy count of 700,000 by the end of the year as carriers continue to raise rates and cut back on capacity. Citizens’ rate of growth is further exacerbated by the competitiveness of its rates, Gilway said, noting that its homeowners policies are priced lower than the average private market rate 91% of the time. “The capacity in the marketplace has shrunk to the point where unfortunately Citizens is becoming not the market of last resort but, in many cases, the market of first resort,” he said, adding that is never the intention for a residual market mechanism. The concern is that Citizens could return to its 2011 policy count level where there was an assessment risk of $11.6 billion to all Florida policyholders in the event of a 1-in-100 year event. Gilway said at that point, the insurer wrote 23% of the Florida market. Its top priority is protecting the company’s surplus so it can pay claims and keep all Floridians from being stuck with paying assessments. “As we grow, then the potential for assessment grows,” Gilway said. Citizens’ has its own share of litigation troubles as well. Gilway told regulators that 800 lawsuits were filed against the insurer in February and 78% of the claims it receives are from nonweather water losses. While assignment of benefits reforms passed two years ago have cut its AOB litigation in half, litigated claims are still a significant driver of its rate need. The Citizens Board of Governors approved 2021 rate recommendations in January that call for a statewide average increase of 7.2% for personal lines policyholders – homeowners, condominium unit owners, mobile homeowners, dwelling, and renters. Homeowner policies would increase by an average 6.1%; condo owners would see an average 9.4% increase; and renters rates would increase 4% on average. The proposed commercial lines increase is 9.5%. Citizens is required by law to recommend actuarially sound rates, while complying with a legislative glide path that caps individual rate increases at 10%. The insurer’s uncapped rate indication is 25.9% for homeowners and 85.6% for commercial lines. The proposed rate recommendations came after Citizens Board deferred action on a slate of rates that called for an average 3.7% increase in personal lines coverage, including a 2.2% increase in homeowners coverage. The board directed Citizens actuarial staff to work with OIR to address the growing disparity between Citizens rates and those charged by private insurance companies in many areas of the state. Citizens is also seeking approval by OIR to charge new policyholders actuarially sound rates instead of allowing them to join the insurer with capped premiums that existing Citizens policyholders receive, as is the case now. The exception would be in Monroe County where rates would be capped at 20% because Citizens is essentially the only insurer option. If approved by OIR, the recommendation would increase rates for new business by an average of 21%, Citizens said previously. OIR will accept public comments on the proposed rates through March 26. If approved, the 2021 rates would go into effect for policies renewed after August 1. Friday, March 26 2021

Florida homeowners already have been slammed with rising windstorm insurance rates this year but they’re likely to get an unexpected reprieve on protection against the other major hurricane threat. Federal flood insurance rates were poised to spike dramatically this year in Florida and other coastal states but that appears on hold for most homeowners because of push back — at least for this year. The Federal Emergency Management Agency, which controls the National Flood Insurance Program, has been telling flood insurance brokers for weeks that the planned rollout of new (and for Floridians, potentially much higher) rates won’t happen all at once in October as originally planned. FEMA now plans that only new policies will be subject to the new rate structure, known as Risk Rating 2.0, on October 1. Everyone who already has a flood insurance policy won’t see a rate change until April 2022. Del Schwalls, immediate past chair of Florida Floodplain Managers Association, confirmed to the Herald that FEMA has told his members of this change in the scheduled rollout. “That is the only delay I’m aware of,” he said. FEMA declined to confirm or deny that the agency was considering a delay, which was first reported in Politico this month. “FEMA currently is finalizing its planned release of Risk Rating 2.0. Once that process is complete we will announce specifics related to the National Flood Insurance Program’s new rating system. At this time, any information would be pre-decisional, and as such, it would be inappropriate to comment further,” David Maurstad, senior executive of FEMA’s National Flood Insurance Program, said in a statement. Risk Rating 2.0, the biggest revamp of the federal flood insurance program in decades, is meant to set new prices that actually align with the risk of flooding homeowners face. That could mean lower rates for some homeowners, but experts say it will likely lead to higher rates for coastal homeowners. Florida, which holds about a third of all flood policies nationwide, could see some of the biggest impacts. The overhaul has been in the works for years for a federal system that has run billions in the red because of the massive losses from a string of storms, starting with Hurricane Katrina in 2005, which cause more than $125 billion in damage, much of it in badly flooded New Orleans. The new system is expected to be a more accurate view of flood risk, one that takes rainfall and sea-rise-driven tidal flooding into account and doesn’t set rates solely on whether or not a building is in a flood zone. The program was initially set to debut in October 2020 but was delayed a year under political pressure. Politico reported that political pressure, this time from the Biden administration, was yet again the reason for a delay. On April 1, FEMA is supposed to release the new rates it plans to charge homeowners, as well as the math behind their decision. But that too could be pushed back. The New York Times reported this week that Senate Democratic Majority Leader Chuck Schumer is pressing FEMA to put off the release over concerns that the new rates will be more expensive for his New York constituents. Neither FEMA nor Sen. Schumer’s office responded to a request for comment, but a spokesperson for Schumer told the Times that the agency should focus on “affordable protection” for communities nationwide. “FEMA shouldn’t be rushing to overhaul their process and risk dramatically increasing premiums on middle-class and working-class families without first consulting with Congress and the communities at greatest risk to the effects of climate change,” Alex Nguyen said in a statement. Raising rates is politically unpopular on both sides of the aisle, although experts say it’s needed to help the nation adapt to climate change. Currently, any changes to premium prices are capped at 18% a year. Florida’s two Republican senators have a history of objecting to any reforms to the NFIP that would drastically raise rates for Floridians. As governor, Rick Scott openly opposed the major flood reform act of the day — the 2012 Biggert-Waters Act — arguing a dramatic rate hike would hurt the real estate industry. As a senator, spokesperson McKinley Lewis said in a statement that Scott still supports keeping rates from rising quickly. “Senator Scott supports a long-term, stable solution to the NFIP that is fair to Floridians. He continues to work with his colleagues on a permanent fix to the NFIP that will keep rates stable and remove the unfair burden on Floridians, as well as reforms to the private market that would strengthen the overall flood insurance market and give consumers more choice,” he said. Sen. Marco Rubio has co-sponsored several bills to sustain or reform the National Flood Insurance Program, including a major bipartisan bill in 2019 that didn’t succeed. “Flood insurance is a necessity in Florida, and as the private insurance market responds to increased flooding we must make sure the federal backstop remains an accessible and sustainable option for Floridians. Rates changes are unfortunately unavoidable, but they should happen alongside fundamental reforms that focus on much-needed mitigation efforts and guided by new mapping that allows the federal government, local communities, and homeowners to make informed decisions,” Rubio said in a statement. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.