BlogFriday, March 12 2021

The Florida Office of Insurance Regulation will conduct a rate hearing on Monday, March 15 on proposed rate increases from Citizens Property Insurance Corp. The hearing will be held virtually at 9 am EST and will include testimony and public comment on the insurer’s proposed rate filings. The Citizens Board of Governors approved 2021 rate recommendations in January that call for a statewide average increase of 7.2% for personal lines policyholders – homeowners, condominium unit owners, mobile homeowners, dwelling, and renters. Homeowner policies would increase by an average 6.1%. Condo owners would see an average 9.4% increase. Renters rates would increase 4% on average. If approved by OIR, the 2021 rates would go into effect for policies renewed after August 1. The approved rate recommendations came after Citizens Board deferred action on a slate of rates that called for an average 3.7% increase in personal lines coverage, including a 2.2% increase in homeowners coverage. The board directed Citizens actuarial staff to work with OIR to address the growing disparity between Citizens rates and those charged by private insurance companies in many areas of the state. The insurer said the higher rates would make it more competitive with the private market and slow the flow of policyholders returning to Florida’s insurer of last resort. Since March 2020, Citizens’ policy count has grown from 443,444 to 551,613, an increase of 26.4%. Citizens is now receiving more than 3,000 new customers per week, the company said at its March 3 board meeting. It is preparing for 150,000 additional policyholders by the end of the year as private insurers continue to raise rates, limit coverage and exit particular markets to stem rising losses. Citizens is required by law to recommend actuarially sound rates, while complying with a legislative glide path that caps individual rate increases at 10%, excluding coverage changes and surcharges. However, private insurers are implementing rate increases far in excess of the 10% cap, widening the premium gap between private insurer and Citizens policies. The board also approved in January a recommendation that new policyholders pay actuarially sound rates instead of joining the insurer with capped premiums that existing Citizens policyholders receive. If approved by OIR, the recommendation would increase rates for new business by an average of 21%. A recent report commissioned by Citizens identified the need for the insurer to make changes to the Citizens’ glide path for rate increases. Thursday, March 04 2021

It’s the start of another Florida Legislative Session with a familiar theme — insurers pushing for reforms they say are needed to help the state’s distressed insurance market. Only this year the need is more urgent than ever, according to industry experts and stakeholders, as consumers face unprecedent rate increases and constrictions in coverage availability. “We’re advocating that the legislature take a good look at some of the issues that are plaguing the Florida property insurance market right now to see if we can make some reforms to stabilize not only the performance of the carriers, but also the impact that has on the consumers,” said Florida Insurance Commissioner David Altmaier in an interview with Insurance Journal. “One of the major — if not the major focal point for our office … is working on this very challenging time.” Altamier is one of many sounding the alarm about the Florida insurance market that has been described as in a state of crisis. Consumer advocates, insurance agents, insurers and realtor groups are all urging Florida lawmakers to enact reforms that stem excessive litigation and insurance costs now hitting the pockets of Florida consumers. In January hearings before the start of the 2021 session, Altmaier told lawmakers that Florida’s domestic marketplace had lost $1 billion during the first three quarters of 2020, more than double its underwriting losses in 2019. That has translated into steep rate increases for policyholders and there appears to be no sign of relief. The Floirda Office of Insurance Regulation has approved 105 rate changes, 90 of which were for rate increases, over the last year, Altmaier said, with 55 of those for rate increases of more than 10%. “Clearly, these losses have negative outcomes for our consumers,” he said. The deteriorating financial condition of Florida’s domestic companies is blamed on several factors: excessive litigation, contractor schemes, several years in a row of major catastrophes and the increasing cost of reinsurance. Barry Gilway, president and CEO of Citizens Property Insurance Corp., which is seeing an increase of about 3,000 new policies per week as private market conditions tighten, said litigated cases for insurance companies increased from 27,000 in 2013 to 85,000 in 2020. “That is the primary driver of unprofitability,” Gilway told lawmakers at a Florida House of Representatives committee hearing in January. The industry is supporting several bills that they say will help stem the abuse, but these bills are competing for attention in an unusual legislative session thanks to a lingering pandemic.

“AOB reform helped significantly,” Gilway told lawmakers. “[But] the reality is, while AOB is going down, first party litigation is going up. The increase in first party litigation is really overshadowing any benefits we have got from AOB — it’s shifting from third party over to first party.” Litigation costs have helped fuel adverse loss development for companies of $418 million in 2018 and $682 million in 2019, Altmaier told lawmakers. While there is compelling evidence that shows the AOB law has been effective in curbing the use of AOBs, “we also think that there is compelling evidence that demonstrates first party litigation continues to increase, and we have equally compelling information that shows … the disparity in cost of claims between a litigated claim and a non-litigated claim, and so I think that it’s a critical conversation for us to be having,” Altmaier said. He added, “I can certainly understand how after working on AOB for several sessions in a row and finally getting some reform it can be frustrating when the very next session people come back and say, ‘litigation is still a problem.’ So that really underscores [OIR’s] role in being very data-driven.” Stakeholders outside the industry are also coming out in support of reforms. “Consumers are being faced with dire circumstances and options centered around homeowners insurance coverage,” said Insurance Consumer Advocate Tasha Carter, who noted she hears daily from policyholders receiving large rate increases or who are unable to find coverage at all. Most consumers are not aware of why their rates are going up and are particularly frustrated because they have never filed a claim. Carter said she explains the issues in the market and “they have a better understanding of what’s happening, but ultimately they’re still looking at it from a personal and individual perspective and how these things will ultimately affect them,” she said. Groups like Florida Realtors and the Florida Chamber of Commerce have urged the legislature to act this year as the insurance market’s problems trickle into other industries. “Florida’s economy is the envy of the nation, but we must address persistent home and auto insurance fraud and abuse that hurts consumers and threatens our state’s overall competitiveness,” said Mark Wilson, president of the Florida Chamber. Trey Goldman, legislative counsel for Florida Realtors, a real estate association in the state representing 200,000 realtors, said he’s heard many concerns from members about rates, availability and underwriting guidelines and how real estate transactions could be affected. “We sell property, and we can’t sell property without property insurance,” he said. “Many members are reaching out … insurance is not important until it’s very, very important.” Proposed LegislationThe main bill supported by the insurance industry is Senate Bill 76, introduced by Senator Jim Boyd, chair of the Florida Senate Committee on Banking and Insurance and an insurance broker. SB 76 seeks to tackle roofing claims abuse and attorney fee multipliers, and would shorten the current deadline for new, supplemental and reopened property claims from three years to two. The bill would allow property insurers to offer homeowners policies that adjust roof claims at actual cash value if the roof is older than 10 years old. Further, it requires a 60-day notice of a property insurance claim before a suit can be filed against an insurer and gives insurers 30 days to inspect the property. The bill would mandate that attorney fees in property lawsuits be awarded based on how successful the insured was in recovering the amount demanded in the lawsuit rather than using the current fee multiplier. Boyd said the legislation would benefit both parties by encouraging insurers not to underpay valid claims while also encouraging claimants to make reasonable demands and would provide “fair access and reasonable guidelines” for both insurers and insureds during the claims process. The changes to roofing policies would prevent the abuse of claims by predatory attorneys and contractors, he told the Senate Committee on Banking and Insurance at its Feb. 2 meeting. “Property insurance rates are going up and this is driven in large part by an extraordinary number of roofing claims in Florida,” he said. Florida is facing a litigation crisis, he said, noting that from October 2020 to December 2020 there were almost 21,000 lawsuits reported to the Department of Financial Services. Thirty-four attorneys filed more than 100 cases, with one attorney filing 1,234 cases in that 90-day period. “That’s 13.4 claims a day, including holidays and weekends,” he said. Claims data shows that just 8% of damages are paid to insureds in property suits and 21% goes to defense costs, while plaintiff attorneys receive about 71% of the pot. “We are not saying attorneys can’t be paid but they should be paid fairly, and the claimants should be the main ones that receive the compensation in the event of a claim,” Boyd said. Attorney and adjuster groups disagree about the bill’s fairness, however, saying it would make it harder for policyholders to sue their insurer and gives more power to carriers. “If this bill passes, this will substantially restrict policyholders’ and homeowners’ access to the courts,” Attorney Matthew Collett told lawmakers at the Feb. 2 Senate Committee on Banking and Insurance hearing. Florida Association of Insurance Agents President Kyle Ulrich disagreed with that assessment. “Nothing in this legislation would prohibit any homeowner from filing suit against their company in the event of a dispute,” he said. Insurance Consumer Advocate Carter said she supports the reduction of the claims filing deadline in the bill but only as it relates to new claims, not the limitations on limiting supplemental and reopened claims. She is still reviewing data on the attorney fee provisions. Pandemic PrioritiesThere is concern from the industry that reforms may be hard to accomplish during a session that is overshadowed by the pandemic and Florida’s budget, which the legislature is required to pass. More than 2,500 bills have reportedly been filed so far and passing COVID-19 liability reforms for businesses and healthcare organizations is a clear priority by top lawmakers, including Governor Ron DeSantis. But stakeholders say reform cannot wait another year. “I think it’s beyond just urgent, it’s desperate, frankly,” said Florida Property Casualty Association President Roger Desjadon. “If you were to look at the rate increases that have been going in for the industry, there’s a reason for that. And that reason is because all of these cases, the lawsuits, the overinflation of claims have gotten totally out of hand. So, the rates have to reflect that, and the rates that you see are rates that are reflecting that.” Without a change, Desjadon said rates will continue to escalate, reinsurers will become more reluctant to write Florida companies and provide aggregate coverages, which means companies are going to have to take more losses on their surplus. “It’s a vicious cycle and I think it’s gotten to a point now where if something isn’t done, I think you’re going to see a contraction of the market. You’re going to see Citizens grow a lot, and you’re going to see rates going up dramatically,” he said. “Time is of the essence,” Gilway agreed. “Because you can’t wait for another year or two years. You are going to have more and more companies that just decide that Florida is not an economic reality for them, and they can apply their capital elsewhere.” Personal Insurance Federation of Florida President Michael Carlson said without law changes that will quickly impact the market, Citizens will continue to increase its policy count and some insurance companies will not survive. As of right now, “that’s where we’re headed,” he said. Legislative reform is critical to helping consumers, ICA Carter said. She also supports legislation that would clarify and prohibit unlicensed adjusting, protects consumers when they sign a contract with a public adjuster, and would improve company communications with policyholders going through the claims process. She said targeted legislative changes could have a “significant and positive impact on the market.” “I am very concerned about the affordability and availability as it relates to homeowners insurance in the state,” she said. “I anticipate that if legislation is not passed this session … we’re going to see the situation for policyholders continue to deteriorate and to become more dire, and that’s my biggest concern.” Commissioner Altmaier said that though there are a variety of stakeholders with different viewpoints, OIR plans to tell the story of what is happening through data and that ensures the consumer is top of mind. “I think if we can continue to do that, we can make some meaningful progress this session,” he said. Wednesday, February 24 2021

Three bills currently working their way through the Florida Legislature are designed to tackle the rising costs of homeowner roof claims, the costs of attorney fees in homeowner’s claims and issues surrounding notice to insurance carriers. The proposed legislations come less than two years after Florida enacted an assignment of benefits law for homeowners’ property claims. But these latest efforts are meant to address the increasing costs of homeowners insurance due to market forces that were not addressed by the 2019 AOB bill. While these bills are preliminary and not law yet, it shows a shift in the legislature to reel in the liberal rules of lawsuits relating to property insurance claims. Among the bills currently being considered is Senate Bill 76, which amends Florida statute (627.428) to award attorney’s fees for claims arising under the lodestar fee. Deviation from this method would be reserved for only rare and exceptional circumstances that competent counsel could not be retained in a reasonable manner. The lodestar method determines what a reasonable fee for an attorney would be and requires the following determinations:

Further, SB 76 would allow insurance carriers to limit coverage on roof claims. Under the provision, a carrier can include a roof surface reimbursement schedule endorsement to the insurance policy, which allows for reimbursement for repairs, replacement and installation based on the annual age of a roof surface type, unless the roof is less than 10 years old. The schedule also would provide reimbursement amounts of no less than 70% for metal roofs, 40% for concrete, clay tile, wood shaker, and shingle roofs, and 25% for any remaining roof types. SB 76 also extends certain statutes to cover all property insurance claims instead of just a windstorm or hurricane claim, which would bar property claims if the insurer is not provided notice of claim or supplemental claim within two years of the date of the loss. The bill, if passed, would add a statute (627.70152), which would affect all property insurance policy lawsuits. Specifically, the statute would require any claimant(s) to provide at least 60 days’ notice of their intention of initiating litigation against their insurance carrier prior to filing the lawsuit. The notice must include:

The new provision would give carriers the ability to inspect and evaluate the demand and allow the carrier to abate any lawsuit if said notice was not provided in compliance with the proposed statute. Attorney’s fees under this statute would provide a similar sliding scale structure as the assignee of an assignment of benefits related to property insurance claims and would be based on a demand to judgment quotient. SB 76 was approved by the Senate Banking and Insurance Committee and is awaiting a hearing by the Judiciary Committee. The Florida House of Representatives’ companion bill to SB76 – House Bill 305 – would amend the same statutes as SB 76, except it does not involve adding the claimant’s requirement to provide notice of intent to initiate litigation proposed in SB76. This bill is currently awaiting a hearing by the House Banking and Insurance Subcommittee. The Florida Senate also introduced Senate Bill 212 as a standalone bill addressing just the attorney’s fees issue of reasonableness and multipliers. SB 212 would only entail adopting the lodestar fee for property insurance policy lawsuits. SB 212 is currently awaiting a hearing by the Florida Senate Banking and Insurance Subcommittee. These bills would provide insurers the ability to address the growing number of roof claims that were either not damaged by wind or hail or could be repaired yet facing litigation due to insureds, or their representatives, demand full replacement. Further, SB 76 would force claimants to provide notice to a carrier of their intent to file their lawsuit, giving the carrier an opportunity to re-evaluate the claim. All three of these bills would go into effect on July 1, 2021 if passed and signed by Governor Ron DeSantis. Monday, February 22 2021

If the nearly 4.3 million residential homes (1-4 units) across the country with substantial flood risk were to be insured through the National Flood Insurance Program (NFIP), the NFIP rates would need to increase 4.5 times to cover the risk today. New research, The Cost of Climate, from First Street Foundation, a nonprofit research and technology group working on flood risk, quantifies the financial impacts of flood risk carried by American homeowners, and how those impacts are growing as flood risks worsen due to a rapidly changing climate. First Street Foundation researchers calculated average annual loss (AAL) statistics for each residential property in the contiguous United States, which is the dollar value of damage associated with flood risk each year. The foundation found that while the total expected annual loss for the estimated 4.3 million properties with substantial risk is $20 billion this year, it grows to nearly $32.2 billion a year in 30 years – an increase of 61% – due to the impact of a changing climate. These estimates suggest the NFIP, which has lost more than $36 billion since its inception, will face growing losses in the years ahead without reform. “Quantifying flood risk in economic terms creates a new context for homeowners to understand their risk, and for buyers to consider when evaluating a property,” said Matthew Eby, founder and executive director of First Street Foundation. “Flood risk brings with it real and potentially devastating financial impacts that aren’t being priced into the market. We’re providing key insights into how flooding can impact the financial bottom line of property owners along with solutions that can protect their largest investment.” The Foundation’s analysis was conducted in part with home value data acquired from ComeHome by HouseCanary. The Federal Emergency Management Agency (FEMA), which runs the NFIP, is working to change the pricing of flood risk at the individual property level to more accurately reflect the risk of today’s climate through the forthcoming “Risk Rating 2.0” initiative. The FEMA rating change will set new premiums for properties both inside and outside of Special Flood Hazard Areas (SFHA) based on their individual flood risk. However, that risk-based pricing has been delayed. FEMA had initially announced that new rates for all single-family homes would go into effect nationwide on October 1, 2020, but decided it needed additional time to broaden its analyses of the proposed rating structure across its entire book of business, so that it included communities behind levees. FEMA delayed implementation of Risk Rating 2.0 by one year to October 1, 2021. The FEMA extension means all NFIP policies – including, single-family homes, multi-unit and commercial properties – could change over to the new rating system at one time instead of a phased approach as originally proposed. Private flood insurers approach risk assessment and pricing differently and offer different limits and endorsements than the NFIP. Climate Impact First Street Foundation’s new report highlights the impact that climate change and a risk-based approach could have on individual homeowners. The 2.7 million properties at risk outside the SFHA would require a 5.2 times price increase to roughly $2,484 a year to cover their current risk. The 1.5 million properties within SFHAs, which are mandated to buy flood insurance if they hold a federally backed mortgage, would require an increase of 4.2 times, to $7,895 a year. “If the necessary adjustments to premiums were put in place to accurately reflect property level risk, those homes which previously benefited most from group based subsidized rates would see a reduction in their underlying value,” said Dr. Jeremy Porter, head of Research and Development at First Street Foundation. First Street Foundation has added dollar estimates of flood damage for individual residential homes to its flood risk assessment tool Flood Factor. The new feature provides homeowners with flood damage cost estimates based on depth of flooding, demonstrate how these costs will change from today to 30 years from now due to a changing climate, and offer a cumulative projection of flood damage costs over the typical life of home ownership, or a 30-year mortgage. In earlier research, First Street Foundation found that government-produced maps showing 8.7 million homes and properties at significant flood risk may have underestimated the amount of real estate at risk by 67%. Or, in other words, an additional 6 million properties face a significant risk of flood. The nonprofit is making accurate climate change-adjusted flood scores available for every property in the U.S. today. NFIP Unchanged The NFIP’s current rating structure has not fundamentally changed since the 1970s. It evaluates structures using their flood zone on a Flood Insurance Rate Map (FIRM), occupancy type, and the elevation of the structure. FEMA’s nationwide rating system combines flood zones across many geographic areas, and calculates expected losses for groups of structures that are similar in flood risk and key structural aspects, assigning the same rate to all policies in a group. Under Risk Rating 2.0, according to FEMA, flood zones will no longer be used in calculating the premium. Instead, the premium will be calculated based on the specific features of an individual property, including structural variables such as the foundation type of the structure, the height of the lowest floor of the structure relative to base flood elevation, and the replacement cost value of the structure. Risk Rating 2.0 will also incorporate a broader range of flood frequencies and sources than the current system, as well as geographical variables such as the distance to water, the type and size of nearest bodies of water, and the elevation of the property relative to the flooding source. Given the threat of sea-level rise, NFIP policymakers should rethink policies that encourage development in flood-prone regions, according to the Washington, D.C. think tank R Street. R Street has proposed that the NFIP cease writing coverage for new construction in 100-year floodplains and that NFIP rates for any new construction should be adjusted to reflect future changes in assessments of flood risk. The study, Do No Harm: Managing Retreat By Ending New Subsidies, says that climate change will exacerbate the financial problem, as sea-level rise turns what once were 1-in-100-year floods into 1-in-10-year or even annual floods. Wednesday, January 20 2021

Florida’s property insurance market is “spiraling towards collapse” and requires immediate attention if there is any chance of protecting the market, consumers, and ultimately, the state’s economy, according to an analysis about to be presented to the Florida Legislature. The report points a finger at the state’s “litigation economy” as the main contributor to insurance market woes— seeing it as more of a direct cause than the many weather events Florida has suffered. Among its findings:

The report, “Florida’s P&C Insurance Market: Spiraling Towards Collapse,” was authored by Guy Fraker of Cre8tfutures Innovation System & Consultancy. Fraker has worked with the insurance industry for 30 years, including on auto insurance and autonomous vehicles, and with primary carriers, reinsurers and related sectors. In tracing how the market got to the crisis point, the report identifies four Florida laws passed between 2011 and 2019 as fostering the litigation crisis. They are statutes governing assignment agreements, mandatory replacement cost coverage for residential roofs, multi-year statute of limitations to file a first notice of loss and the one-way attorney fee. Also, two state Supreme Court rulings have exacerbated matters. This litigation environment has carriers steadily hemorrhaging capital and surplus. Fraker’s report says the roughly 6% of homeowners insurance claims being litigated are equal to the cost of a “good solid Cat 3 hurricane” every 12 months. “This market is at a critical inflection point. The longer and broader these trends continue, the more likely the state will face a recovery measured in generational time horizons,” the report warns. “The time for hoping some theoretical break point doesn’t materialize is over.” Fraker was commissioned last year to do the Florida market analysis by insurers, lawsuit reform groups, and others. Florida State Senator Jeff Brandes, a member of the Senate Banking and Insurance Committee who has been sounding alarms about the Florida property insurance market, helped spearhead the effort. Fraker’s study argues that the state’s residential P/C insurance marketplace “faces a convergence of existential threats in the form of increasingly unpredictable claims litigation, from rising costs of risk capital and from its persistently high exposure to natural catastrophe risks.” The report argues that “targeted legislative reforms are needed in order to preserve the insurance industry’s viability while serving property owning Floridians and Florida’s economy,” while adding that “without intervening public policy solutions, the residential property insurance marketplace will experience failure.” Fraker said in an interview with Insurance Journal that he agreed to do the report on “behalf of Florida’s economy and Florida’s consumers, not the industry [or] any other stakeholder groups.” Florida Property Market Report Recommendations There is no panacea to fix the Florida market, according to the Fraker report. “For those seeking a single reform to turn this market around, such an answer does not exist,” Fraker writes. Instead, he says, Florida legislators in the 2021 and 2022 sessions must take multiple actions to get this crisis under control. The best reforms would include terminating any attorney contingency fee statutes that create arrangements unique to the insurance industry, followed by eliminating fee enhancements, particularly from litigation reliant upon the Concurrent Causation in order to prevail, the report states. “Despite rhetoric lacking in facts to the contrary, those statutes included in this analysis have not evened the playing field for the consumers who dispute their insurers,” it claims. His other recommendations include:

“Multiple legislative reforms are the only lock capable of closing Pandora’s box,” the report states, and the worst-case scenario without reform will be devastating to Florida’s economy and take a generation to fix. In a statement to Insurance Journal on the report, Florida State Senator Jeff Brandes, a member of the Senate Banking and Insurance Committee, said, “Mr. Fraker’s report presents a new and objective voice and greater transparency than ever before for much needed legislative action.” Brandes, who sits on the Banking & Insurance Committee, has said one of his primary legislative goals over the next two years “is to put the Florida insurance market on a sustainable path.” In compiling the report, Fraker said he interviewed insurance executives from companies, regulators, lobbyists/advocates, plaintiff counsel firms, defense counsel firms, building and roofing contractors, consumer advocates, reinsurers, ratings agencies, as well as investors and a climate scientist. He also analyzed litigation records and reviewed thousands of documents from regulators. While Florida has faced three consecutive years of major hurricanes from 2017 to 2019, insurers have insisted that the insurance problems are tied to an exponential increase in litigation. Florida domestic carrier results showed a continuous drop in surplus over the last five years that culminated in a single year underwriting loss of more than $1 billion through the third quarter of 2020. Florida Insurance Commissioner David Altmaier told the Senate Banking and Insurance Committee on Jan. 12 that carriers were on pace to nearly double their losses in 2020 compared with 2019, as their surpluses fell from $6.7 billion to $6.1 billion in just the first three quarters of the year. The combined ratio for Florida domestics was over 100% in the third quarter of 2020 and has been “trending upward for several years.” Carriers writing property risks in the state have been responding by pulling back capacity in certain areas including south Florida and more recently central Florida, along with filing for rate increases. Altmaier said insurers submitted 105 rate filings in 2020 for increases of 10% or more and 55 of those filings were approved; in 2016 only six rate increases were approved. Florida’s insurer of last resort, Citizens Property Insurance Corp., has received a flood of new policyholders over the last year as consumers struggle to find coverage in the private market. The problems are also starting to impact Florida insurers’ ability to get reinsurance capital in the catastrophe prone state. “These losses are having a direct impact on the surplus position of our industry,” Altmaier said. “As capital and surplus deteriorates, companies lose the flexibility to be able to write additional business … that has consequences for the consumer.” Litigation Explosion Fraker blames a convergence of several events that have “moved the market from stabilizing towards total collapse.” Fraker said four individual Florida statutes governing assignment agreements, mandatory replacement cost coverage for residential roofs, multi-year statute of limitations to file a first notice of loss and the one-way attorney fee statute were passed between 2011 and 2019 “individually and in an isolated form without real consideration for how they might someday form a relationship.” Additionally, two Florida Supreme Court decisions – Joyce vs. FedNat (2017) that found a contingency fee multiplier does not need to be reserved for rare and exceptional circumstances; and Sebo vs. American Home Assurance (2016) where the court shifted to using the Concurrent Causation Doctrine that permits a covered cause of loss (such as wind) to combine with damage caused by non-covered cause of loss – helped propel the market towards crisis. “The combination of these policies and court decisions represents an ideal combination for significant financial exploitation,” the report states. “The volume of claims following each major storm became the fuel and the architecture for an economic engine distinct to Florida generally referred to as ‘Litigation.'” Insurers have racked up more than 200,000 lawsuits since 2013, many of them stemming from non-catastrophe water damage and roofing claims, and many of them with assignment of benefits agreements attached. After reforms were passed in 2019, there was a dip in AOB lawsuits, particularly for Citizens, Fraker notes. However, by the third quarter of 2020 plaintiff attorneys had established a work around to AOB with a “Demand to Pay,” instead filing first party suits against carriers. According to Fraker, the cost of this litigation cannot be understated. He found that while there has been an obvious influence of catastrophic storms on claim frequency, non-catastrophe claims have accounted for approximately 60% of all litigation filed against Florida’s domestic companies while 40% of the litigation is associated with cat losses. In analyzing more than 3,000 insurance cases, Fraker found that litigation costs are 17% higher for Florida insurers than in other catastrophe-prone states. The fees paid to attorneys by Florida carriers for this litigation are on average more than 750% of the damages paid to the plaintiffs/insureds. In one case Fraker examined, the plaintiff attorney was awarded 21,041% of the damages in fees. Insurers have paid out more than $12 billion in fees to attorneys since 2013 and were engaged in more than 221,000 suits between 2014 and 2020, according to the report. The costs of all this litigation equals approximately $3 billion in expenses “being forced upon Florida property owners,” the report states. In 2019 alone, Florida insureds paid between $2 billion and $2.7 billion in costs allocated to suits in the form of increased premiums. Fraker said just 8% of damages are paid to insureds while plaintiff attorneys receive about 71% of the insurance litigation cash flow “because they are allowed to, not because plaintiff attorneys are motivated to do harm.” Insurer defense costs range from 237% to 307% of damages, or 21% of total litigation. “Florida’s P&C litigation economy may be rooted in hurricane recovery. However, like every emergent economy, the state’s litigation economy required nurturing and protections in order to become established,” the report says. “Yet, unlike an economic system balanced by governance relevant to all stakeholders, Florida’s litigation economy operates almost entirely at the expense of insurers, then ultimately the State’s economy and resident consumers. As a result, the value of corporations, the value of jobs, and spendable consumer income is either destroyed or greatly degraded.” Forecasting Litigation It isn’t just Florida insurers paying the price of the litigation. Reinsurers and investors are paying close attention to the Florida market because it is no longer profitable, and they are now seeing a negative return on their investments. Fraker quoted one executive he spoke with for the report as saying, “I’d rather invest in time shares on the West Bank than to invest in the Florida insurance industry.” “Understand this proxy for an additional tax generates zero community, county, or state benefits because these billions are diverted away from Florida’s economy,” the report notes. There isn’t likely to be relief from rate increases for consumers either, as reinsurance rates increase for carriers and uncertainty about future litigation costs make it difficult for the industry to reliably model for litigation, the report notes. Florida carriers already pay 30% to 35% more on reinsurance premiums than other hurricane prone states and soaring litigation costs creates more concern. Fraker said insurers have underestimated preliminary damage assessments immediately following a hurricane by an average of 300% because of unforeseen litigation costs and that is also influencing reinsurance rates. For reinsurers as well as domestic carriers reflecting upon 212,000 litigated cases since 2015, the inability to reliably model litigation “is the final push off the cliff for Florida’s P&C market.” Fraker said because “there’s no way to reliably forecast the dollars and cents of this litigation storm,” he created a new financial construct called the litigation probable maximum loss (LPML). It is similar to the probable maximum loss (PML) model companies use in modeling catastrophic storm damage, but the LPML forecasts the range of litigation frequency and severity from thousands of insurance litigation data points extracted between 2016 to 2020. “Output from forecasting litigation costs through this construct is an assessment of litigation frequency and severity uncertainty, which is significantly influencing reinsurance rates in Florida which then becomes a cost burden affecting Florida’s domestic carriers, and ultimately for Florida consumers,” the study notes. Florida consumers are the ultimate victims of what is happening Fraker says, as they are essentially paying a “hidden tax” to fund the litigation. This hidden tax averaged $487 per family in 2019, and is growing annually by 25.6%, totaling about $680 per family in 2020. That “tax” is being paid to less than 2,500 attorneys and contractors in the state. Meanwhile, the narrative by plaintiffs’ attorneys that insurance companies created this crisis because of poor claims’ handling practices is a “catastrophic PR failure” on the part of the industry, Fraker said. “The reality is whether it’s a catastrophe claim or not, 92.5% of all claims are closed within a year; 80% of the claims that require more than one year involve representation by a third party,” he said. The carriers in the marketplace have between a 95.2 and a 98.3 policy holder retention rate, he noted. Thursday, January 14 2021

After extending the moratorium on cancellations and nonrenewals put into place at the start of the pandemic, Citizens Property Insurance Corp. has announced it will resume processing these as of Feb. 1, 2021. The Florida insurer of last resort said in a bulletin to agents that the board of governors at its December meeting approved lifting the temporary moratorium established in March 2020 to ease the burden on policyholders due to the COVID-19 health risk. Cancellations and nonrenewals for policies that had exceptions made due to the COVID-19 health risk will be processed on Feb. 1. After that date, Citizens will only make hardship exceptions to those policyholders who continue to be affected by loss of employment, diminished wages or business income, or other monetary loss realized during the state of emergency and directly impacting the ability of the policyholder to make payments.

The company said this is a standard similar to that used in Gov. Ron DeSantis’ executive order that narrows criteria in prior orders for relief from foreclosures and evictions. Citizens will continue to offer temporary payment arrangements to impacted policyholders to select by Jan. 31, 2021. Quarterly payment plans will continue to be available to policyholders as of Feb. 1. After Jan. 31, new payment arrangements would be offered only to policyholders who continue to experience a loss of employment, diminished wages or business income, or other monetary loss. Citizens has begun mailing invoices for each policy term to list-bill (mortgagee-billed) and direct-billed policyholders with a past due premium of $5 or more. The total past-due premium is due on Jan. 31, 2021. Citizens said it would email affected agents a list of their past-due policies that are direct-billed and list-billed before Jan. 31, 2021, with more information. Citizens said that as of Nov. 30, 2020, payment exceptions had been made on 30,799 policies (6.04% of policies) for a total of more than $24 million. The insurer also made 25,857 underwriting exceptions for 10,678 new business policies and 15,179 existing policies. Citizens had originally planned to end its moratorium last summer but reversed its decision after Florida CFO Jimmy Patronis urged the insurer not to cancel customer policies during hurricane season and the ongoing COVID-19 pandemic. “Hurricane season is just beginning to heat up and we are in the middle of an unprecedented health and economic crisis. This is not the time to cancel Citizens’ home insurance policies,” Patronis said on July 24. Citizens’ program for alternate documents and deferrals, as outlined in the April 3 Update on Response to the Coronavirus Health Risk, also will end on February 1. Monday, January 04 2021

Former Secretary of the Florida Department of Corrections Julie Jones has been appointed Deputy Chief Financial Officer within the Office of Chief Financial Officer, according to a statement from the Florida Department of Financial Services. As Deputy CFO, Jones will be responsible for divisions encompassing sworn law enforcement, including Investigative and Forensic Services, Public Assistance Fraud and Workers’ Compensation, which all work to prosecute insurance fraud. Jones will replace Jay Etheridge who is retiring following his completion of the Deferred Retirement Option Program (DROP). Jones, who was appointed by CFO Jimmy Patronis, most recently served as secretary of the Florida Department of Corrections from 2015 to 2019. During Jones’ tenure, the Department of Corrections added over 200 more correctional officer positions and worked to increase the agency’s budget to bolster safety and improve recidivism rates, DFS said. Prior to that role, Jones served as executive director of the Florida Department of Highway Safety and Motor Vehicles from 2009 to 2014. Additionally, from 2002 to 2009, then-Colonel Jones served as director of Law Enforcement of the Florida Fish and Wildlife Conservation Commission. Patronis said with increasing insurance rates resulting from fraud, he’s directed Jones to coordinate with all of DFS’ divisions to “crack down on fraud, waste and abuse.” “Through her decades of executive-level leadership, coupled with her experience in law enforcement, we’ll need her out-of-the-box thinking, and her relationships with local prosecutors and law enforcement agencies, to take the fight against the criminal elements that are stealing from hardworking Floridians,” Patronis said. Patronis also praised the retiring Etheridge for his work with the department since 2012, including:

Thursday, October 29 2020

After years of warnings that the Florida property insurance market was heading towards an availability crisis, many in the industry say the moment of reckoning has arrived. They blame unchecked claims litigation from non-catastrophe water losses and rising reinsurance rates that have severely strained the financials of Florida insurers. The situation has gone from bad to worse for Florida domestic insurance carriers this year, which together cover most of the state’s homeowners market. Nearly 60 carriers suffered a combined $701 million in losses and $351 million in negative income for all of 2019, according to Guy Carpenter. In just the first half of 2020, the companies lost more than a half billion ($501 million) in underwriting losses and $227 million of negative net income. Third quarter results are expected to show further deterioration. Guy Carpenter’s data cited an average net combined ratio for 2019 of 111 percent that climbed to 129 percent in the second quarter of 2020 for these companies. “If we’re not in a crisis, I don’t know what we’re in,” said Kyle Ulrich, president and CEO of the Florida Association of Insurance Agents. “Those numbers … just simply are not sustainable.” As a result, carriers have been steadily raising rates this year and this trend isn’t expected to slow down any time soon. Companies are requesting and the Florida regulator is approving substantial rate increases – some over 30% – along with taking steps to limit their exposures and protect their books of business. The vast majority of Florida insurers have filed multiple rate increases this year for just under the 15% threshold that requires a rate hearing by the Florida Office of Insurance Regulation. Since August, four companies – Capitol Preferred Insurance Co., Southern Fidelity Insurance Co., First Community Insurance Co. and Centauri Specialty Insurance Co. – have participated in rate hearings for rate increase requests ranging from 25% to just below 40%. John Rollins, former principal and consulting actuary with Milliman and now chief financial officer at Olympus Insurance, told the Colodny Fass/Aon Florida Insurance Summit in September that Florida homeowners insurers filed at least 79 rate increases through the second and third quarter of 2020. The cumulative impact of these filings averages a 9.3% increase equaling $7.4 billion in homeowners premium, not including dwelling fire, Rollins said. The total premium base in Florida is about $11 billion, Rollins noted, “so essentially you’ve had 70 percent of the market go to the well in the last five and a half months and take a rate increase of 9.3%.” How did the market get to this point? Over the last several years, insurers have consistently cited evidence of excessive first- and third-party litigation from non-catastrophe water damage losses across the state. While the state also experienced a number of major catastrophes, the industry says the frequency and severity of lawsuits on non-cat losses has been unprecedented. Barry Gilway, president and CEO of Florida’s Citizens Property Insurance Corp., said litigation for the state-run insurer of last resort has increased in some parts of Florida by 500% in the last four years. “Litigation is out of control in the state and until we do something about the overall litigation issues and the firms drumming up litigation, then rates are not going to stabilize,” Gilway said at the Colodny Fass/Aon event. Overall litigation rates for third party assignment of benefits (AOB) lawsuits have dropped from what they were a few years ago thanks to reforms passed in 2019, but carriers say they are still being hit by a considerable amount of first party litigation and excessive attorney fees. They point the finger at the state’s one-way attorney fee statute and the contingency fee multiplier for incentivizing inflated lawsuits against insurers. “We have seen a continued increase in litigation whereas specific AOB claims have decreased slightly,” Jesse Rehburg, actuarial manager for Capitol Preferred, told OIR regulators at an August rate hearing for its filing for a 26.2% increase on nearly 30,000 policies. It also sought a 31.1% increase on more than 46,000 policies for its Southern Fidelity Insurance affiliate. Capitol Preferred said non-catastrophe water loss claims and litigation show no signs of slowing. Rehberg noted 30% of its filed claims are represented by attorneys, and costs of represented claims are more than 100% higher than non-represented claims.

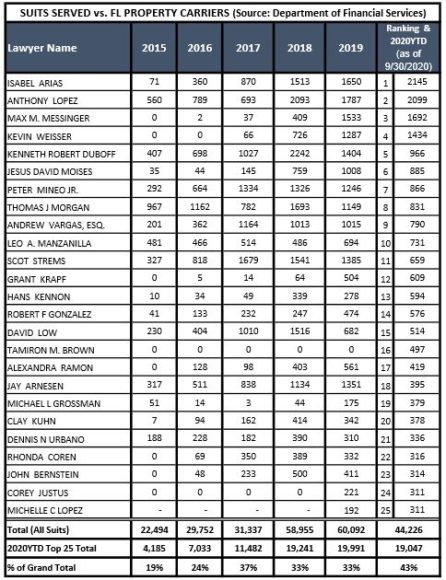

In analyzing data from the Florida Department of Financial Services, industry consultant and president of Johnson Strategies Scott Johnson noted in a recent blog that 25 attorneys have filed nearly 20,000 lawsuits against insurers through the first six months of 2020, accounting for 43% of the state’s total property lawsuits so far this year. The total number of suits filed against 56 property carriers since 2015 totals 246,856. Florida-based litigation management and analytics software company CaseGlide’s data showed that around 4,000 lawsuits per month were filed against the top 15 to 20 Florida property carriers during June, July and August of this year. The company attributed some of that to the rush to get claims in before the September three-year deadline for Hurricane Irma. Litigated claims increased again in September to nearly 5,000, up 7% from August and 28% from September 2019. Reinsurers have responded to the Florida market’s increasing losses and exposure with the highest spike in renewal rates since 2006, Rollins said. Reinsurance rate increases on this year’s renewals averaged 25% to 30% with some companies seeing as much as a 50% increase. The reinsurance increases have put Florida insurers in the position where they simply can’t take on more risk, Ulrich said. “Given what their re-insurance allows them to do and write, based on some storms this summer and the exposure that they have seen in claims, they just don’t have the ability to write any more business,” he said. Agents have reported “pretty restrictive” new underwriting guidelines by carriers, including limits on new business to homes 2010 and newer, Ulrich said. Several carriers have told their agents that they will no longer accept any new business and instead will just quote renewals. “They will be renewing the business that’s on the books, and agents can buy business that has already been quoted,” Ulrich said. “But, going forward, they’re not writing any new business.” At Citizens June board of governors meeting, Gilway said decreased reinsurance capacity has forced companies to restructure their portfolios. Six major companies publicly announced they were shutting down of all new business in Tri-County, Central Western Counties, and more recently, the SOLO counties of Seminole, Orange, Lake and Osceola. “These measures are harmful and significantly impactful to consumers in the form of higher insurance rates, reduced coverage and lack of availability,” Florida Insurance Consumer Advocate Tasha Carter said in an e-mail to Insurance Journal. “As policies are restructured to include tighter underwriting measures, consumers are paying higher insurance premiums for reduced coverage. Essentially, consumers are paying more for less and that’s problematic.” Losses so far in 2020 are not going to help the situation, noted Robert Warren, client services manager for Demotech, at the Colodny Fass/Aon event. Demotech, which rates more than 40 Florida domestics and threatened downgrades to a dozen early this year before affirming them, projects a $730 million underwriting loss for those companies – almost double the amount of 2019 – based on data it has seen of weather losses, reinsurance costs and the investment in the replacement of capital the companies will need to make before the end of the year. That figure does not include losses to carriers from Hurricane Delta, he said, which despite being a mainly Louisiana event could still impact Florida insurers that have diversified and expanded into other states. “It’s been a significant year for storm events – this is a frequency issue as well as severity,” Warren said. Companies are already taking steps to replace lost capital, Warren said, but doing so could be problematic for those that do so by taking on debt. “[Demotech] need[s] to be very aware of what that capital source is,” he said. Warren said Demotech believes carriers are “doing the right things at the right time for the right reasons,” and expects those that need capital to keep their financial stability rating (FSR) from Demotech will be able to get it. “Right now, Demotech’s expectation is they will meet our requirements to maintain or be considered to maintain the current FSR,” Warren said. Ulrich warned, however, that outside capital that has consistently invested in Florida-based carriers, may be close to the end of financing Florida’s domestic homeowners’ market. “When we get to that point where folks that have invested in this market make the decision that they’re no longer willing to invest in this market, and it becomes more difficult for companies to find and attract capital, and their surplus is going down at the rate that it is now, that becomes a crisis situation,” he said. Market Impact – The Growth of CitizensWith rates spiking statewide and companies pulling back capacity, many insureds have had no other choice but to turn to the insurer of last resort, Citizens. Its rates are capped on a glide path of 10% per year, meaning the company cannot raise them more than that, thus making the residual insurer a competitive alternative to the current private market. Citizens’ policyholder count stood at approximately 443,000 policies earlier this year with about $110 billion in exposure. At the September Citizens Board of Governors meeting, Gilway said Citizens is growing by 2,500 to 3,000 new customers per week on a net basis. Its new business increased from 7,770 policyholders to 17,691 per month over the past 12 months. Gilway said the increase in new business, combined with a significantly higher renewal rate of 90% this year compared to 83% last year, puts the company at an estimated policy count of 540,000 for year end 2020 and up to well over 640,000 next year. “We grow and we shrink depending upon the overall profitability of the private market,” Gilway said at the Florida Insurance Summit. “When the private market is doing extremely well then Citizens shrinks. When the private market is really succumbing to some of the problems that we’re seeing … obviously we start to grow.” The repopulation of Citizens could mean added costs for all Florida consumers. Florida law requires that Citizens levy assessments on most Florida policyholders if it experiences a deficit in its reserves in the wake of a major storm or series of storms. At its peak in 2011, Citizens had 1.5 million policies on its books – 23 percent of the Florida market – with exposure that topped $512 billion. In the event of a 1-in-100-year storm, Floridians were on the hook for $11.6 billion in assessments. Thanks to depopulation efforts, the reinsurance market and catastrophe bonds, Citizens was able to eliminate assessments for Florida consumers in 2015. “The growth of Citizens impacts the private market and shifts Citizens farther away from being the residual market carrier it was intended to be,” said Insurance Consumer Advocate Carter. Florida State Senator Jeff Brandes, who sits on the Banking & Insurance Committee, said one of his primary legislative goals over the next two years “is to put the Florida insurance market on a sustainable path.” To that end, Brandes worked with Citizens to commission an exposure reduction study on how the insurer could reduce its overall exposure and financial impact on the state. That study is currently being performed by analysts at Florida State University and is expected to be complete by December. Brandes said he requested the study because “the writing was on the wall.” “Anybody who is shocked that Citizens is starting to grow hasn’t been paying attention because we’ve been telling them for frankly months, likely years,” Brandes said in an interview. “We recognize that Citizens is required to only raise rates 10% a year. And often they’re losing money in certain markets and they’re being subsidized, those homeowners are being subsidized by taxpayers.” Gilway said Citizens hopes the FSU Study will provide insight as to why litigation is increasing, why severity is increasing, and into the roles of public adjusters and loss consultants, and more. He said he expects there will also be legislative recommendations along with changes in the Citizens plan of operations. Brandes has other ideas for how to keep Citizens a residual market, including transitioning its rate structure to what he calls a “vintage model.” That would involve bringing in new policies at an actuarially indicated rate while allowing existing customers to stay at the current rate cap. When policyholders renew, they would stay at the 10% glide path and new policyholders would reset for that vintage, he said. Brandes asked Gilway in June to request the board consider implementing this change. “Application of actuarially sound rates for new Citizens customers will bring Citizens into compliance with the statutory directive that its rates be actuarially sound and maintain Citizens as the insurer of last resort,” he wrote in a letter to Gilway. The action is slated to be discussed at the December board meeting, Brandes said. A Citizens spokesperson said actuaries will present information to the board in response to Brandes’ letter but it is unclear if any action will be taken at that time. “That seems to be the only sustainable model that will work for Citizens for the long term, given the challenge of adjusting the rate cap in the political environment,” Brandes said. Gilway said he thinks much of the business coming into Citizens right now has more to do with capacity in the market than rates. “No one’s quoting. Period,” he said at the Colodny Fass/Aon event. But in studies comparing Citizens to the private market, Citizens rate cap makes it too competitive with the private market, and that’s a problem long term, Gilway said. “The more we get out of whack with the private market … I believe it will be the reason more growth comes into Citizens and that’s not what we want,” he said. “Our goal is to find a policyholder the best coverage at the best price in the private marketplace and get Citizens back down to the point where we have a reasonable residual market position.” Wednesday, October 28 2020

Florida-based Tower Hill Insurance and national carrier Safeco, two non-affiliated carriers, have formed a marketing partnership in the state of Florida to offer a multi-policy discount to customers. Beginning in November, policyholders will have access to a multi-policy discount when they add a Tower Hill home to an account with a Safeco auto policy – or add a Safeco auto policy to an account with a Tower Hill home policy. The company said with market disruption commonplace in Florida, “this is an opportunity for both companies to reach more customers through their multi-policy marketing partnership.” The multi-policy discounts are applied to both the auto and home insurance policies. Tower Hill’s President, Don Matz, and Debra Pooley, Southeast Region Field Executive at Safeco, jointly announced the new partnership to agents recently, saying the marketing partnership is a natural way for each company “to better serve our independent agents and policyholders.” Tower Hill currently insurers more than 2 million customers. Both teams worked over the last year to bring the partnership to light, according to the companies. Safeco Insurance currently offers several programs in Florida – including the RightTrack Mobile program, which provides discounts for safe drivers. After a 90-day driving period, eligible customers receive a premium discount, up to 30%, for the life of the policy. The new multi-policy discount is applied in addition to the home and auto discounts that Tower Hill and Safeco customers already receive. Founded in 1972, Tower Hill Insurance offers residential and commercial property insurance in the Southeast. In business since 1923, Safeco Insurance sells personal automobile, homeowners and specialty products through a network of more than 10,000 independent insurance agencies throughout the United States. Safeco is a Liberty Mutual Insurance company, based in Boston, Mass. Thursday, September 17 2020

As Hurricane Sally bears down on the Gulf Coast, a new survey is highlighting the concerns many Florida residents have about the impact of catastrophic storms on their communities and everyday lives, as well as if they are adequately insured against these events. The survey of 1,582 Florida voters conducted August 31 to September 2 by “Get Ready, Florida!” – a statewide public education initiative produced by the nonprofit FAIR Foundation, follows one conducted by the organization at the start of this year’s hurricane season. The new survey indicates a slight shift in Floridians concerns about hurricane season at its halfway mark compared with the start of the season in June, during the height of the pandemic. The most recent survey looked at Floridians recovery expectations for catastrophic storms. Most respondents (68%) said they would find it difficult to pay the average $5,000 hurricane deductible if needed, with only 32% indicating that the $5,000 deductible would be “very manageable” or “no problem” at all to pay following a storm. More than six in 10 (62%) of Floridians with homeowners or renters insurance said they are unsure what their policies would cover following a storm. And, despite the fact that most hurricane policies do not cover tree and debris removal from yards, 16% of survey respondents said they believed this benefit is covered in their policy. Almost one-third of those surveyed say they would be willing to pay something extra each month in order to have their policies cover these services. Twenty-seven percent of respondents said they’ve experienced problems relating to yard debris or fallen trees following a storm. This includes 19% who say they have been blocked from their home or driveway, 11% who say they were stuck with large bills for debris removal, and 4% who say that they or a member of their household have been injured trying to remove debris out of the way. More than two-thirds would like their local governments to plan ahead and line up debris removal services in advance so life can return to normal as quickly as possible following a disaster. FAIR said the survey serves to help Floridians plan, prepare, and respond to the threat of the annual six-month-long “mean season” of hurricanes and tropical storms. “In the most hurricane-vulnerable state in the nation, millions of Floridians roll the dice by going without adequate insurance to help them through the ordeal,” said Jay Neal, president of the FAIR Foundation. “This survey shows that while many Floridians lack a clear understanding of what their insurance policy covers, they recognize the wisdom of having their cities and counties prepared to clean up the mess after a storm.” The survey found that more than two-thirds of respondents (68%) would support their city or county acting before a disaster strikes to invest tax dollars in advance for contracted cleanup services, if and when needed, in order to ensure that resources are available to deploy immediately to clear massive debris and help a return to normal. “This would mean contracting with a disaster recovery or debris removal business in advance – to be treated as a priority, by providers with the resources and expertise to do the job quickly and efficiently. Since Hurricane Katrina in 2005, many communities in impact zones have adopted this practice,” Get Ready, Florida! said in a statement. The same number of respondents (51%) as the previous survey say they are “more” or “much more” concerned about this year’s hurricane season than in previous years due to COVID-19 when compared with the previous survey. However, the percentage of those with one specific concern dropped from 91% to 84%, with the top concerns listed in the survey including: more strains on first responders (46%); business closures or more hits to the economy (46%); uncertainty about where would be safe to evacuate to (32%); fewer shelters open due to social distancing (32%); the ability to care for elderly or special needs relatives (29%); and being able to afford supplies (24%). “One of the great challenges Florida faces is that it adds enough people each year to fill an entire city, and those newcomers – and many who have lived here for years – don’t really know what they have and what they need when it comes to hurricane insurance,” said Craig Fugate, a Florida native who served as the top administrator of the Federal Emergency Management Agency. “Flooding is not covered by your homeowners insurance and requires a flood policy for protection, and flood risk is growing due to more extreme rainfall events during hurricane threats. It’s a good idea for everyone to check their insurance policies now, add flood coverage, and for local governments to get themselves as prepared as they can.” Get Ready, Florida! is an annual statewide public education campaign working to educate Floridians about hurricane preparedness and safety as part of the National Hurricane Survival Initiative. The survey of 1,582 Florida voters was conducted by Sachs Media Group, with an average margin of error +/- 2.5% at the 95% confidence level. Results |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.