BlogThursday, December 01 2022

Florida’s homeowners shell out thousands, even tens of thousands, for property insurance to protect themselves from fierce storms like Hurricane Ian. But tens of thousands of people walloped by the Category 4 storm in September are now discovering that they didn’t have the coverage they needed for one of the biggest impacts of the storm — flood insurance. It’s one of the hardest — and most expensive — lessons from hurricane season 2022, which officially draws to a close Wednesday. Florida’s home insurance market has been troubled for decades, but experts worry that the back-to-back strikes from hurricanes Ian and Nicole could be enough to tilt the teetering market for wind damage insurance into another collapse. Gov. Ron DeSantis has hinted at holding another special session on the topic soon, but it’s not clear if legislators will even try to address the already skyrocketing costs of private insurance and increasing risk load of the state-run option, the Citizens Property Insurance Co. And even if they do, coverage for Florida’s most common risk — flooding — won’t be on the table for discussion. Flood insurance is almost entirely run by the federal government, which sets strict rules and price caps on who needs to have it and how much it costs. Experts say that despite the government’s efforts to make flood insurance cheap and available, Florida faces a massive coverage gap that could grow even larger as the state’s population — and flood risks — grow and the number of policies slowly declines. By one estimate, flood damage could make up half of the total Hurricane Ian losses in Florida. The Category 4 storm tore into Southwest Florida in late September, battering Fort Myers and other areas with two-story storm surge and fierce winds. But it was the slow creep north through the rest of the state, when the much weaker storm dumped more than a foot of rain, that shocked inland residents. Low-lying areas quickly flooded, leaving some apartment complexes with an entire story underwater. Officials had to rescue more than a hundred residents trapped in their homes and cars. The Peace River, in Southwest Florida, swelled from 130 feet wide to nearly a mile wide. And when the floodwaters eventually receded, many Floridians in the path of Ian — and then Nicole — found they weren’t covered for the damages. Only about 18% of homes in Florida counties that were under evacuation orders from Hurricane Ian had a federal flood insurance policy, according to an analysis by risk management firm Milliman. In inland counties, those figures drop even further. Compare Lee County, where Ian made landfall, to Seminole County, north of Orlando. In Lee, about 51% of properties inside flood zones have flood insurance. In Seminole, only 37% do. In either case, that leaves thousands uninsured for flooding damage outside the coverage of most homeowner and windstorm policies. Claims will likely be rejected. “People just expect to be protected and it’s very distressing and upsetting for them to find out they paid the premiums and don’t have the coverage they need,” said Nancy Watkins, a principal and consulting actuary with Milliman. “Often the reason they don’t have a flood insurance policy is they mistakenly think that their homeowner policy would cover that.” Few home insurance policies cover flood damage. Instead, almost all flood insurance policies in the nation are through the FEMA-run National Flood Insurance Program, which insures 1.7 million Floridians. The state actually has the highest number of flood policies under the federal program, but hurricane season 2022 was a sobering reminder of how many people don’t have it. An early estimate by CoreLogic, a property information and analytics firm, suggested that half of the flood damage Florida saw from Ian could be uninsured. Tom Larsen, CoreLogic’s vice president of hazard and risk mitigation, said his firm also found Ian’s damage in Florida extended outside FEMA’s flood zones. “We saw more damage outside those zones than in,” Larsen said. “It doesn’t take much water to cause a lot of damage.”

How much damage did the hurricanes do?Florida’s Office of Insurance Regulation has tallied nearly $10 billion in total losses from Hurricane Ian so far. That includes losses to homes, commercial properties and private flood insurance claims. Initial estimates from FEMA suggest the federal flood insurance program, which insures the vast majority of Floridians with flood policies, could see $3.5 billion to $5.3 billion in losses from all five states hit by Ian, with the majority of those claims coming from Florida. Florida’s relatively small private flood insurance market, with just under 100,000 policies as of late 2021, also took a hit. Trevor Burgess, CEO of Neptune Flood, said his firm has about a third of Florida’s private flood insurance policies. He ranked Ian as the most expensive storm the firm has dealt with since it started five years ago but didn’t offer a dollar figure estimate. “Ian will be our largest claim event after Ida last year,” he said. “Having them year after year is consequential.” For Hurricane Nicole, Florida’s total property losses are slimmer but still significant at just under $400 million. What does flood insurance cover?For the lucky few that had the proper insurance to match their hurricane-borne flood damage, there’s cash from FEMA on the line in at least a few ways. As of mid-November, FEMA said more than 40,000 Floridians have filed Ian-related flood damage claims. They’re likely to get some help patching up their homes, but it likely won’t cover a full replacement. The NFIP, like many of the private flood offerings, is capped at $250,000 of coverage. The picture is worse for those without flood insurance. “An inch of water in your house can easily be a $25,000 expense,” said Watkins. Uninsured people will have to raid their savings or hope for help from charities or state and county grants. Federal grants are not an option. FEMA reserves its grant programs for fixes like home elevation or floodproofing for those with active flood insurance policies. FEMA disaster relief for uninsured properties is usually capped at around $10,000, Watkins said, and it can take a very long time to materialize in people’s bank accounts. Flood insurance numbers droppingYet despite the growing risk of flooding — which Watkins says is the most common disaster facing Floridians — the Sunshine State has fewer and fewer residents with flood insurance every year. Burgess, with Neptune, said his firm produced data showing that 18% of Florida buildings had flood insurance five years ago, and today that figure stands at 15%. “That’s going in the wrong direction. We need many many more people to buy flood insurance to be protected from this peril,” he said. That’s a tough sell in Florida, even considering that sea level rise is making nuisance flooding more common and more intense. The biggest reason is likely that flood insurance, unlike property insurance, isn’t mandatory for most homes. Any home purchased with a mortgage is required to have property insurance, but mortgage-purchased homes are only required to have flood insurance if they’re within a designated FEMA flood zone. And even then, research shows that many of the properties required by their lenders to hold flood insurance policies drop them with no consequences. A recent revamp of the federal flood program, known as Risk Rating 2.0, aims to get more people insured at market rate premiums, a move that could help the NFIP dig itself out of its $20 billion debt hole. For Joel Scata, an attorney with the Natural Resources Defense Council’s water and climate team, the flood damage from Hurricane Ian is another indication that the federal program needs to be reformed to encourage people to live farther away from risky areas. “Floods, in general, are becoming more frequent, both inland and on the coast, because of sea level rise and intense rainstorms,” he said. “The NFIP has the opportunity to be a linchpin in the U.S. approach to mitigating flood risk in regards to climate change.” Average flood insurance premiums are around $600 a year in Florida, according to data collected by Forbes. That makes Florida one of the cheapest states in the nation for flood insurance, despite home and windstorm insurance premiums that are some of the highest in the nation at more than $4,000 a year. “People don’t want to pay more money to buy more coverage that they don’t have now,” Watkins said. “But you don’t find out you need it until it’s too late.” Monday, November 14 2022

As the Florida Legislature prepares for its 2nd Special Session on property insurance in 2022, it’s time we examine why our market sputtered out of control and discuss the necessary solutions to fix it. Many Floridians are wondering:

Media outlets across the state have done a decent job of highlighting the failing insurance market. However, there are many misconceptions associated with these reports. The first, that storms are to blame, and the second, that reinsurance rates are exploding due to climate change. In truth, many factors have contributed to the crisis and the insolvent companies failed or were failing long before the 2022 Hurricane season even began. Reinsurance rates have risen, but the cost that can be passed onto the consumer is statutorily capped at 15% per year. While considerable, that only accounts for 60% of the 300% in rate increases since 2018. In short, this crisis starts and ends with litigation. Most have likely seen the headlines that Florida accounts for 80% of our nation’s property insurance lawsuits, while only accounting for 8% of the claims. Breaking that data down further shows that every other state averages less than 1,000 lawsuits annually, while Florida averages 100,000. This leads us to the multi-billion-dollar question: How? This question merits a complex answer, for sure, but can be boiled down to this: The combination of assignment-of-benefits (AOB) proliferation, an obscure, 2016 decision by the Florida Supreme Court (Sebo vs. American Home Assurance), and the 100-year-old one-way attorney fee statute (627.428), created a perfect legal storm so great that it brought our state’s insurance market to its knees. A layman’s attempt to describe each is as follows…

AOBs have been often utilized in healthcare. You go to the doctor, and you assign your benefits to them so they can work with your insurance company for billing purposes. One day a few Florida attorneys figured out they could apply this practice to a homeowner in need of a fast repair, and assume complete control of a claim, including the ability to file a lawsuit. And, Voila! A massive incentive was created from thin air and a cottage industry was born. Prior to 2010, the state saw about 400 lawsuits annually, but once the AOB scheme was unleashed, that number ballooned to 30,000 in 2016. It took strong words from Gov. Ron DeSantis, in his very first State of the State address in 2019, to move the needle on moderate reform when he declared that AOB’s “had degenerated into a racket.” Unfortunately, by then, this racket had already metastasized out of control. This then brings us to the 2016 Sebo decision by the state Supreme Court, which replaced the long-standing and efficient proximate cause doctrine with the concurrent causation doctrine. In practical terms, this enabled contractors to find very minimal damage on already deteriorating roofs or buildings and claim that the small damage, combined with the crummy condition of the structure, necessitated a full replacement at insurers’ expense. So, one windblown shingle on a 20-year-old roof was artfully used to get someone a new roof for “free”. Now, let us factor in the holy grail — one-way attorney fees, courtesy of Florida Statute 627.428. The way this statute works is relatively simple: If you sue your insurance company and the case goes to trial, you only need to win $1 more than their last pretrial offer, regardless of the amount for which you were suing. If successful, the homeowner will be compensated for all attorney fees at the insurance company’s expense. This fee structure, hailed as the David vs Goliath statute, was created to level the playing field so the Smith Family (David) could fight back against Big Insurance Co. (Goliath). For decades, it was considered to be a fair and reasonable concept.

Essentially, nothing prevents a contractor from coming to your home and assuming your rights, finding minimal damage yet filing a large claim; and then working with a lawyer to inflate the claim higher to garner a huge settlement. Financially, it works like this: They sue an insurer for $100,000 for a new roof that, if legitimately damaged, costs $25,000. But it has only two shingles missing that should cost $150 to replace. The insurance company must meet in the middle and settles for $65,000 because it would cost more to go to trial. Now multiply by 130,000, which is the number of lawsuits filed last year, according to state Department of Financial Services data. That equates to more than $8 billion and a healthy dose of eyeball emojis. Now you might find yourself saying: “How can these insurance companies claim poverty and any of this be true when 4 out of 5 television commercials is an advertisement for an insurance company?” The answer is that those “national” carriers combine for only 10% of the market share in Florida. This has been the case since the 2004-2005 hurricane seasons when Mother Nature alone was cause for concern. Citizens Insurance is now the largest provider in the state with more than 15% of the market share. “Domestic” (Florida-only or predominant) carriers are the primary source of homeowners insurance in the state. These insurers, national and domestic, are not without blame, either. Despite the ongoing multibillion dollar racket being committed against them, many carriers that went belly up did so because they ignored the most fundamental aspect of insurance, risk management. The few companies that have weathered this market responsibly did so because they chose to sacrifice growth to protect solvency. The now-defunct carriers were 2-3 years too late when it came to tightening their underwriting practices. It is also unfathomable that some companies would pay not just normal, but increased, dividends or investor bonuses at a time when their company surpluses were being depleted by the tens of millions annually. Even worse, some took on debt to do so. Regardless of the reforms enacted in December, there will be more insolvencies and the number of existing companies on stable ground moving forward can be counted on one hand. The topic of insurance can seem boring, but it is essential state infrastructure. It is the oil that keeps a free-market engine running, and it is safe to say Florida’s property insurance market needs an oil change! What should the new synthetic blend look like? Thus far, the state has tried three times since 2019 to halt abusive practices: AOBs were first regulated to allow for a 14-day rescission period and a new fee-shifting measure for third-party lawsuits was put in place. Then in 2021, a hybrid version of that fee structure was enacted for first-party lawsuits and the amount of time to file a claim was lowered from 5 years to 2 years. Finally, in the May 2022 Special Session, one-way attorney fees were eliminated altogether for AOBs, attorney fee multipliers were prohibited, and building-codes for roofs were updated to combat the loophole being exploited post-2016 and the Sebo case. Has it worked? Some, but not quick enough. Thankfully, Hurricane Ian did not deliver a death blow to the insurance industry partly because these previous reforms had been enacted. Each reform was a tough battle brought forth by good legislators and none made it across the finish line without the governor’s vocal support. However, just surviving Ian is not good enough because Floridians know there will always be more hurricanes on the horizon. To stabilize the marketplace for the foreseeable future, the one-way attorney fee must be abolished across the board, just as it is in most other states. Other changes: Price and scope arguments can be resolved through arbitration or independent appraisals. The time frame to file a claim should be lowered to one year and any assignment of rights, benefits, etc. should be banned completely. Litigating when an insurance company has truly engaged in bad-faith practices should be allowed to continue. If these measures happen, we will slowly get back to normal — or as normal as Florida can be. The better in-class carriers will begin to grow again, pressure on Citizens will be relieved, and new capital will form to enter the state and fill the void left by insolvencies. Reinsurance pricing will also stabilize. Their world-class modeling can project storm losses down to the decimal, but no model can predict how legal rackets create hurricane-esque losses in years with no hurricanes. With the right public policy, the insurance market will fire on all cylinders again. The oil change is long overdue. Kevin Comerer is a consultant and registered lobbyist with Rubin, Turnbull & Associates, in Tallahassee. He was previously legislative director for American Integrity Insurance Co. Monday, October 10 2022

Following Governor DeSantis' Emergency Orders 22-218 and 22-219, and pursuant to sections 252.63(1) and 627.4133(2)(d)1., Florida Statutes, the Florida Office of Insurance Regulation has issued an Emergency Order for Hurricane Ian regarding the extension of grace periods, limitations on cancellations and nonrenewals, deemers and limitations on "use and file" filings, along with other miscellaneous provisions. From September 28 – November 28, no insurer or other regulated entity may cancel, non-renew or issue a notice of cancellation or nonrenewal of a policy or contract except at the written request of the policyholder. For policies that would have been cancelled during this period, the insurer will extend coverage through November 28 or any later date identified by the insurer and the premium for the extended term will be pro rated for that specific term. This Emergency Order is issued to protect the public health, safety and welfare of all Florida policyholders. A copy of the order is available here. Answers to frequently asked questions regarding the Emergency Order is available here. Monday, October 10 2022

What’s making it so hard for Florida insurers to survive? Florida’s insurance rates have almost doubled in the past five years, yet insurance companies are still losing money for three main reasons. One is the rising hurricane risk. Hurricanes Matthew (2016), Irma (2017) and Michael (2018) were all destructive. But a lot of Florida’s hurricane damage is from water, which is covered by the National Flood Insurance Program, rather than by private property insurance. Another reason is that reinsurance pricing is going up – that’s insurance for insurance companies to help when claims spike. But the biggest single reason is the “assignment of benefits” problem, involving contractors after a storm. It’s partly fraud and partly taking advantage of loose regulation and court decisions that have affected insurance companies. It generally looks like this: Contractors will knock on doors and say they can get the homeowner a new roof. The cost of a new roof is maybe $20,000-$30,000. So, the contractor inspects the roof. Often, there isn’t really that much damage. The contractor promises to take care of everything if the homeowner assigns over their insurance benefit. The contractors can then claim whatever they want from the insurance company without needing the homeowner’s consent. If the insurance company determines the damage wasn’t actually covered, the contractor sues. So insurance companies are stuck either fighting the lawsuit or settling. Either way, it’s costly. Other lawsuits may involve homeowners who don’t have flood insurance. Only about 14% of Florida homeowners pay for flood insurance, which is mostly available through the federal National Flood Insurance Program. Some without flood insurance will file damage claims with their property insurance company, arguing that wind caused the problem. How widespread of a problem are these lawsuits? Overall, the numbers are pretty striking. About 9% of homeowner property claims nationwide are filed in Florida, yet 79% of lawsuits related to property claims are filed there. The legal cost in 2019 was over $3 billion for insurance companies just fighting these lawsuits, and that’s all going to be passed on to homeowners in higher costs. Insurance companies had a more than $1 billion underwriting loss in 2020 and again in 2021. Even with premiums going up so much, they’re still losing money in Florida because of this. And that’s part of the reason so many companies are deciding to leave. Assignment of benefits is likely more prevalent in Florida than most other states because there is more opportunity from all the roof damage from hurricanes. The state’s regulation is also relatively weak. This may eventually be fixed by the legislature, but that takes time and groups are lobbying against change. It took a long time to pass a law saying the attorney fee has to be capped. How bad is the situation for insurers? We’ve seen about a dozen companies be declared insolvent or leave since early 2020. At least six dropped out this year alone. Thirty more are on the Florida Office of Insurance Regulation’s watch list. About 17 of those are likely to be or have been downgraded from A rating, meaning they’re no longer considered to be in good financial health. The ratings downgrades have consequences for the real-estate market. To get a loan from the federal mortgage lenders Freddie Mac and Fannie Mae, you have to have insurance. But if an insurance company is downgraded to below A, Freddie Mac and Fannie Mae won’t accept it. Florida established a $2 billion reinsurance fund in May that can help smaller insurance companies in situations like this. If they get downgraded, the reinsurance can act like co-signing the loan so the mortgage lenders will accept it. But it’s a very fragile market. Ian could be one of the costliest hurricanes in Florida history. I’ve seen estimates of $40 billion to $60 billion in losses. I wouldn’t be surprised if some of those companies on the watch list leave after this storm. That will put more pressure on Citizens Property Insurance, the state’s insurer of last resort. Some headlines suggest that Florida’s insurer of last resort is also in trouble. Is it really at risk, and what would that mean for residents? Citizens is not facing collapse, per se. The problem with Citizens is that its policy numbers typically swell after a crisis because as other insurers go out of business, their policies shift to Citizens. It sells off those policies to smaller companies, then another crisis comes along and its policy numbers rise again. Three years ago, Citizens had half a million policies. Now, it has twice that. All these insurance companies that left in the last two years, their policies have been migrated to Citizens. Ian will be costly, but Citizens is flush with cash right now because it had a lot of premium increases and built up its reserves. Citizens also has a lot of backstops. It has the Florida Hurricane Catastrophe Fund, established in the 1990s after Hurricane Andrew. It’s like reinsurance, but it’s tax-exempt so it can build reserves faster. Once a trigger is reached, Citizens can go to the catastrophe fund and get reimbursed. More importantly, if Citizens runs out of money, it has the authority to impose a surcharge on everyone’s policies – not just its own policies, but insurance policies across Florida. It can also impose surcharges on some other types of insurance, such as life insurance and auto insurance. After Hurricane Wilma in 2005, Citizens imposed a 1% surcharge on all homeowner policies. Those surcharges can bail Citizens out to some degree. But if payouts are in the tens of billions of dollars in losses, it will probably also get a bailout from the state. So, I’m not as worried for Citizens. Homeowners will need help, though, especially if they’re uninsured. I expect Congress will approve some special funding, as it did in the past for hurricanes like Katrina and Sandy, to provide financial aid for residents and communities. Monday, October 10 2022

Hurricane Ian is going to affect commercial and personal property rates “significantly” – not just in Florida, predicted MarketScout. The Dallas-based insurance distribution and underwriting company released its quarterly Market Barometer of rate conditions in personal and commercial insurance lines. Overall, MarketScout reported an uptick of about 5.3% in the commercial market composite rate during the third quarter 2022, and an increase of about 4.6% for personal lines during the same period. n the second quarter, MarketScout said commercial rates increased just over 5.9%, virtually matching the rate increases of the first quarter. The focus of both reports was Hurricane Ian. MarketScout CEO Richard Kerr said the storm will “be a huge loss for insurers covering properties in Florida.” “Rates will be up dramatically in Florida for the foreseeable future,” he added in the personal lines Market Barometer. For commercial, Kerr said, “Losses from Hurricane Ian will significantly impact [property] rates in Florida and other wind exposed coastal states.” Commercial property rates were up nearly 7.7% in Q3. Rates for homeowners insurance in Q3 were up 4% for home under $1 million in value and 6% for home over $1 million. Kerr said high-value homes were already seeing more aggressive in Q3 because they are typically located in catastrophe-prone areas. Elsewhere in commercial lines, Kerr said MarketScout is seeing a softening in D&O and professional lines, but cyber insurance rates are “still increasing significantly” – up 23% in Q3.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States. Friday, September 30 2022

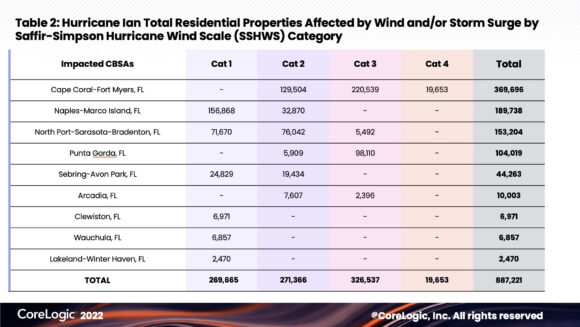

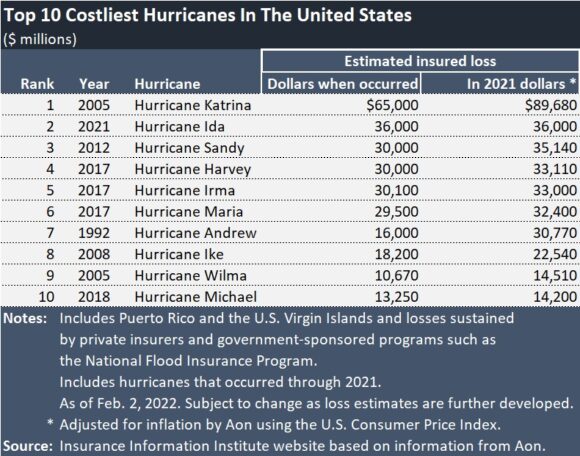

Wind and storm-surge losses from Hurricane Ian could reach as $47 billion in Florida alone, a figure made larger by inflation and rising interest rates, the property analytics firm CoreLogic said in a new analysis. “This is the costliest Florida storm since Hurricane Andrew made landfall in 1992 and a record number of homes and properties were lost due to Hurricane Ian’s intense and destructive characteristics,” said Tom Larsen, associate vice president for hazard and risk management at CoreLogic. Wind-damage losses in Florida, where Ian made landfall Wednesday afternoon near Fort Myers, are expected to be between $22 billion to $32 billion for residential and commercial properties. Storm-surge damage could add another $6-$15 billion, CoreLogic calculated. The analysis was based on high-resolution imaging and storm-surge computer modeling, the firm said. CoreLogic said its calculations include insured and uninsured losses, and Hurricane Ian has yet to make another predicted landfall in South Carolina as a Category 1 storm on Sept. 30, but to begin to put Hurricane Ian into a historical perspective, below is a list of the costliest U.S. hurricanes to the insurance industry. With inflation at a 40-year high, interest rates near 7%, and labor and building materials in short supply, recovery will be slow and difficult. “Hurricane Ian will forever change the real estate industry and city infrastructure,” Larsen said in a news release. “Insurers will go into bankruptcy, homeowners will be forced into delinquency and insurance will become less accessible in regions like Florida.” Besides winds and surge on Florida’s southwest coast, Ian also caused widespread flooding inland in Florida. The storm by Friday morning had weakened, then strengthened as it aimed for coastal South Carolina with 85-mph winds, the National Weather Service reported. Larsen said the storm will likely be a wake-up call, spurring stronger building codes and more resilient infrastructure. ICEYE, the satellite imagery firm, reported that almost 84,000 properties in coastal southwest Florida were affected by storm surge and flooding during Ian, as of Thursday afternoon. Most of those felt less than two feet of water, but 284 were hit by floodwaters above eight feet, the company reported. Thursday, September 29 2022

Hurricane Ian continued to churn through central Florida Thursday morning, leaving widespread flooding and wind damage in its wake. It was too early to know the extent of property insurance claims from the storm, although a few analysts and officials offered some preliminary estimates. Some in the industry are now worried that extensive losses from the storm, which made landfall north of Fort Myers with an estimated 12-foot storm surge, could be devastating for Florida’s largest and fastest-growing property insurer – the state-created Citizens Property Insurance Corp. Citizens’ CEO Barry Gilway said Wednesday that preliminary estimates have put claims at about 225,000 and potential exposure at about $3.8 billion, a spokesman for the insurer said. That’s likely not enough to force an assessment on policyholders, he said, in response to a reporter’s question. A former deputy Florida insurance commissioner, Lisa Miller, warned that if losses exceed the corporation’s reinsurance coverage, Citizen policyholders could see a 15% surcharge for all three of Citizens’ accounts – as much as 45% per property. If Gilway’s estimate holds true, it would mean Citizens avoided a worst-case scenario with the powerful storm. The Office of Insurance Regulation’s quarterly reports, based on insurer data, shows that for the five coastal counties most affected by Ian, Citizens holds more than 60,000 policies with a total exposure of at least $17.5 billion. The OIR’s Quarterly and Supplemental Report, known as QUASR, shows that another insurer, the Palm Beach Gardens-based Olympus Insurance Co., has significant exposure. For the hard-hit coastal counties of Manatee, Sarasota, Desoto, Charlotte and Lee, Olympus had some 13,800 policies in the second quarter of this year, with $11.3 billion in exposure. The report does not give a complete picture of the market. A number of Florida-based insurers do not report their data or allow them to be made public, calling the information “trade secrets.” But the Olympus numbers are notable. Statewide, the firm had some 79,000 policies and $233 million in total written premium. Olympus CEO Steve Bitar could not be reached for comment about the Ian exposure. Other insurers with billions in exposure in the five coastal counties include:

Insurance industry insiders said it’s difficult to judge which carriers are most vulnerable without knowing the extent of their reinsurance programs, information that is not usually made public. Statewide, claims from Hurricane Ian could total as much as $30 billion, a Wells Fargo analyst told Barron’s financial news site. Another analyst told Barron’s that the storm could also lead to higher reinsurance premiums, a tough call for some insurers already struggling with reinsurance costs that spiked as much as 50% this year. Meanwhile, the Florida OIR said that insurers should begin daily reporting of catastrophe claims as early as Friday, Sept. 30, through Friday, Oct. 7. The data should be reported each day before noon Eastern time, through the simplified 2022 catatastrophe reporting form, or CRF, OIR said in a bulletin Wednesday. Insurance Commissioner David Altmaier also issued an emergency order that requires insurance companies to extend deadlines for insureds. For any policy or other notice that requires policyholders to provide information by Sept. 28, the time has been extended to Nov. 28. Insurers also are barred from cancelling or non-renewing policies until after Nov. 28, the order reads. All notices that were mailed after Sep. 18 must be withdrawn and reissued to insureds after the November date. In addition, insurers should not cancel residential policies on damaged homes in Florida until 90 days after the dwelling has been repaired. Rate and form filings known as “use and file,” which are not reviewed by OIR until later, are suspended for now. Hurricane victims that utilize premium financing and have lost their homes or jobs should contact the OIR. “Victims of Hurricane Ian will receive an automatic extension of time to and including November 28, 2022, to bring their accounts up to date,” the order noted. “No late charges will be applied to any late payments received which were due on their accounts between September 28, 2022 and November 28, 2022.” The OIR also said it expects claims to be paid in a timely manner. “Given the strength and size of Hurricane Ian, its expected catastrophic effect on Florida, and its potential impact on hundreds of thousands of policyholders, the Office expects all insurers and regulated entities to implement processes and procedures to facilitate the efficient payment of claims,” the order reads. “This includes critically analyzing current procedures and streamlining claim payment processes as well as using the latest technological advances to provide prompt and efficient claims service to policyholders.” Tuesday, August 16 2022

Florida’s crumbling homeowners insurance market is exposing one of the state’s long-running flaws: its reliance on a single company to certify the majority of the state’s insurers. For the last few weeks, state regulators and Gov. Ron DeSantis’ administration have been scrambling to contain the fallout after the state’s primary ratings agency, Ohio-based Demotech Inc., warned of downgrades to roughly two dozen insurance companies, according to the state. The downgrades would have triggered a meltdown of the state’s housing market, a pillar of Florida’s $1.2 trillion economy. Without the ratings, a million Floridians could be left scrambling to seek new insurance policies, possibly triggering a housing crisis in the middle of hurricane season and months before the November election. State regulators believe they’ve staved off a disaster, at least temporarily, but the episode has observers questioning how it was handled and how the state could be so reliant on a single company few have ever heard of. “If this was a movie title, it would be ‘The Sum of all Fears,’ ” said Sen. Jeff Brandes, R-St. Petersburg, who has been warning for years that the state’s property insurance market was heading toward collapse. The DeSantis administration cobbled together a short-term fix to allow insurers to stay afloat by using state-run agencies to back them up. And it went after the ratings agency, Demotech, and its president and co-founder, Joe Petrelli, calling it a “rogue ratings agency” and urging federal officials to disregard the company’s actions. GHOSTS OF HURRICANE ANDREW The drama is just the latest problem as the state experiences its biggest insurance crisis since 1992′s Hurricane Andrew. In the last two years, insurance policies for more than 400,000 Floridians have been dropped or not renewed. Fourteen companies have stopped writing new policies in Florida. Five have gone belly-up in 2022 alone. The record, set after Hurricane Andrew’s devastation, is eight in one year. The latest was Coral Gables-based Weston Property & Casualty, which leaves 22,000 policyholders — about 9,400 in South Florida — scrambling to find new insurance companies. Costs have also skyrocketed. In 2019, when DeSantis was sworn in, Floridians paid an average premium of $1,988. This year, it’s $4,231, triple the national average, according to an Insurance Information Institute analysis. In several ways, today’s problems have their roots in the decisions lawmakers and regulators made after Andrew, experts say. The storm reshaped Florida’s insurance landscape, forcing several companies out of business and others to flee the state. With homeowners struggling to find coverage, the Legislature created the state-backed Residential Joint Underwriting Association — essentially a precursor to today’s Citizens Property Insurance — to insure homes that couldn’t be covered by private carriers. The program quickly became one of the largest insurers in the state, and concerns grew that it was taking on too much risk. State officials provided incentives for companies to take over its policies, and a number of new, smaller insurers got in line. The new insurers faced a problem, however: They were unable to get a financial stability rating from a qualified ratings agency. Homeowners with federally backed mortgages, such as Fannie Mae and Freddie Mac, are required to have highly rated property insurance companies protecting them. State insurance and banking regulators, plus Fannie and Freddie, looked to various ratings agencies for help. Only Demotech was willing to rate the new insurers. The company, based in Columbus, Ohio, was founded in 1985 by Petrelli and his wife, Sharon Romano Petrelli. Its “A” rating was approved by both Fannie and Freddie. Since then, Demotech has been the primary ratings agency for Florida-based insurers, which dominate Florida’s market and which pay Demotech to rate their financial strength. Although other ratings agencies, such as New Jersey-based AM Best, provide ratings for some insurers, no one has stepped in to compete with Demotech. Without Demotech, Florida would not have an insurance market, said Kevin McCarty, the state’s insurance commissioner from 2003 to 2016. “Regardless of whether you agree with them, they serve an invaluable service to the state of Florida and across the wider economy,” McCarty said. ‘WE NEVER GOT A PHONE CALL’ Florida’s reliance on smaller insurers has caused homeowners to ride out a series of booms and busts ever since. Smaller insurers are mostly able to survive Florida’s hurricanes because of reinsurance — essentially, insurance for insurance companies. When a storm hits, an insurer might be on the hook for a few million dollars, while the reinsurer pays the rest. But the smaller companies in particular are vulnerable to increases in the cost of reinsurance. A series of storms in 2004 and 2005 wiped out a number of insurers and drove up the cost of reinsurance, putting firms in a pinch. Several have also gone out of business because of mismanagement or incompetence. In the last few years, insurers and state regulators have blamed excessive lawsuits for their woes, and Petrelli has been an outspoken critic of the Legislature’s inaction to curb litigation. He has cited statistics from Florida’s insurance commissioner that from 2016 to 2019, Florida accounted for between 7.75% and 16% of the nation’s homeowners’ claims but between 64% and 76% of the nation’s litigated homeowners’ claims. Critics say insurers’ problems are more complicated. DeSantis called a special session of the Legislature in May to pass insurance reforms focused on stabilizing the market and reducing lawsuits, but Petrelli said it wasn’t enough. On July 18 and 19, Demotech sent private notices to at least 17 Florida insurers, according to state officials — almost half of the companies it rates in Florida — warning that the insurance environment was worsening and that without corrective action, the companies faced a ratings downgrade. (Demotech has not said how many companies received the warnings.) A ratings downgrade of that magnitude would create shock waves. Fannie and Freddie back about 62% of all residential mortgages, according to the Florida Association of Insurance Agents. Demotech’s “A” rating and above, which indicates a 97% certainty a company could afford all the claims from a 1-in-130 year hurricane, is approved by Fannie and Freddie, while its “S” rating, the next step down, is not. A reduction from an “A” rating would force homeowners to find a new insurance company — and fast. Otherwise, the bank holding the mortgage could “force place” a homeowner with whatever insurance company they can find, which is usually far more expensive and offers less protection. That could include placing a homeowner with what’s known as a “surplus lines” insurer, which doesn’t need state approval for their rates. They can charge whatever they want. “Getting force-placed insurance is terrible for a homeowner. You’re paying double the premium and getting half the coverage,” said Paul Handerhan, president of the consumer-oriented Federal Association for Insurance Reform, based in Fort Lauderdale. Many homeowners would likely end up with Citizens, placing more risk with the state-run insurer that already covers nearly 1 million policies. (Its peak was 1.4 million, in 2011.) Demotech, in large part, blamed the Legislature’s inaction for the changes. “In Florida, the unwillingness or inability of the Legislature to address longstanding disparate, disproportionate levels of litigation, and increasing claims frequency has resulted in a level of dysfunction that renders our previous accommodation inapplicable,” several of the letters state. DeSantis’ office coordinated a swift and public attack on Demotech. In letters to federal housing authorities on July 21, Chief Financial Officer Jimmy Patronis called Demotech a “rogue ratings agency.” Florida Insurance Commissioner David Altmaier wrote that it was an example of “inconsistent, monopolistic power of a select rating agency and is trying to exert coercive influence over Floridians and policymakers in an effort to thwart public policy according to its own opinions.” Even U.S. Sen. Marco Rubio waded into the fray, asking the Federal Housing Finance Agency to reexamine its dependence on Demotech. Petrelli said he had no warning and no conversations with state officials before the letters were sent to federal officials and the news media. He said the correspondence with the companies was the normal course of business, part of regular, ongoing conversations with companies about their financial status that they’ve been doing every quarter since 1996. The level of rancor was “unprecedented,” Petrelli said, but it did not change how it rates companies. In recent weeks ratings were downgraded for four companies and ratings were withdrawn from four more, including Weston. “It did not deter us,” Petrelli said. Mark Friedlander, communications director for the industry-backed Insurance Information Institute, said the response was unlike anything he’d ever seen. Ratings agencies are supposed to be neutral third parties that rate companies without influence, he said. “It was definitely, in our opinion, stepping over the line,” Friedlander said of the state’s response. On the other hand, Petrelli “has pushed himself further into the limelight by publicly engaging in political theater,” the Florida Association of Insurance Agents said in a memo distributed by the Office of Insurance Regulation. The association’s memo wondered whether the state’s insurers should move on from Demotech. It also raised longtime criticisms that Demotech often downgrades a company just days before it goes insolvent. “That often begs the question, ‘Does a Demotech rating mean anything or provide the intended peace of mind to agents, consumers, and lenders?’ ” the memo stated. Petrelli said companies keep their “A” rating as long as possible precisely because the “S” rating is not accepted by Fannie and Freddie, despite Demotech’s numerous attempts to get them to accept it. When a company gets an “S,” he said, “unfortunately, they drop off the edge of the cliff.” A ‘VERY ELEGANT’ SOLUTION Notably, the Office of Insurance Regulation’s letter did not dispute that Florida insurers were failing. The office has its own watch list of 27 companies under “enhanced monitoring.” Patronis’ letter also suggested insurance companies needed to find a new rating agency, but Friedlander said that likely wouldn’t help. The New Jersey firm AM Best has stricter requirements than Demotech, he noted. Six days later, the state announced a solution should the companies’ ratings be downgraded. Florida’s plan is to let insurance companies that are financially stable but just missing that “A” rating from Demotech, to keep operating and covering people’s policies. If they go under, homeowners’ claims would be covered by the long-running state program known as the Florida Insurance Guaranty Association, which covers the first chunk of claims for any failed insurance companies. Citizens would foot the bill for anything over the limit of $500,000 for homes and $300,000 for condo units. Handerhan called it a “very creative, very elegant, very consumer-centric” solution. But will it satisfy the federal mortgage holders? Despite repeated emails and calls over the last week from the Herald/Times, representatives from Fannie Mae and Freddie Mac didn’t offer an answer. The Florida Housing Finance Agency didn’t respond to Rubio, either, according to his office. An Office of Insurance Regulation spokesperson said they’re “confident” the solution will be acceptable. Friday, August 05 2022

Earlier today, the Florida Office of Insurance Regulation (OIR) announced its plan to establish a temporary reinsurance arrangement through Citizens Property Insurance Corporation (Citizens). This innovative reinsurance program would be available to insurers facing a rating downgrade from Demotech, and it would allow such insurers to meet an exception offered by Fannie Mae and Freddie Mac, thus avoiding a situation where lenders would require policyholders insured by these downgraded insurers to find replacement coverage. Jul 27, 2022 Tallahassee, Fla. - Today, the Florida Office of Insurance Regulation (OIR) announced a plan to establish a temporary reinsurance arrangement through Citizens Property Insurance Corporation (Citizens) in the event of disruptive financial rating downgrades from Demotech, Inc. This unprecedented solution would allow insurers to meet an exception offered by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) and ensures Floridians can maintain coverage during hurricane season. “OIR’s greatest priority is ensuring consumers have access to insurance, especially during hurricane season; and because of the uncertainty with the status of Demotech's ratings, we’ve been forced to take extraordinary steps to protect millions of consumers,” said Insurance Commissioner David Altmaier. “This innovative arrangement satisfies requirements set by the secondary mortgage market. In the event we need to implement this temporary solution, consumers will not need to seek coverage elsewhere, agents will not need to move policies, and lenders can have confidence that these insurers continue to meet the mortgage qualifications.” Fannie Mae and Freddie Mac require that property insurance policies for properties with a mortgage backed by Fannie Mae or Freddie Mac must be written by an insurer meeting financial rating requirements. As a result, OIR, in conjunction with Citizens, has formed a program that meets the exceptions to the Fannie Mae or Freddie Mac guidelines. Therefore, there should be no reason for lenders to require a replacement policy, or force place coverage based solely on the ratings downgrades. This temporary arrangement would allow insurers to remain viable, to continue providing coverage for Floridians and helps keep policies out of Citizens. Last week, OIR requested that Demotech provide additional information regarding their rating methodology to justify these downgrades. OIR received a response from Demotech, however, the response did not provide a timeline for ratings. The sudden loss of an acceptable Financial Strength Rating would have a significant and adverse impact on Florida’s insurance consumers, insurers, agents and property insurance market. OIR is remaining committed to protecting Floridians and the property insurance market under this plan. Wednesday, August 03 2022

By order of the Office of Insurance Regulation (OIR), with support from the Governor’s Office and the Chief Financial Officer's office, Citizens is ready to assist carriers in the event of a rating downgrade by Demotech. Carriers that are in compliance with all provisions of the Florida Insurance Code may enter into an arrangement by endorsement with Citizens. |

Personal Service at Internet Prices!

|

© Olson & DiNunzio Insurance Agency, Inc., 2008

2536 Northbrooke Plaza Drive; Naples, FL 34119

Doing Business in the State of Florida

P: 239-596-6226; F: 239-596-1620; E: info@olsondinunzio.com

Featuring the cities of Naples, Bonita Springs, Marco Island and Estero Florida. Providing them the highest quality insurance and unbeatable rates.